India Stout Market Size, Share, Trends and Forecast by Distribution Channel, and Region, 2026-2034

India Stout Market Size and Share:

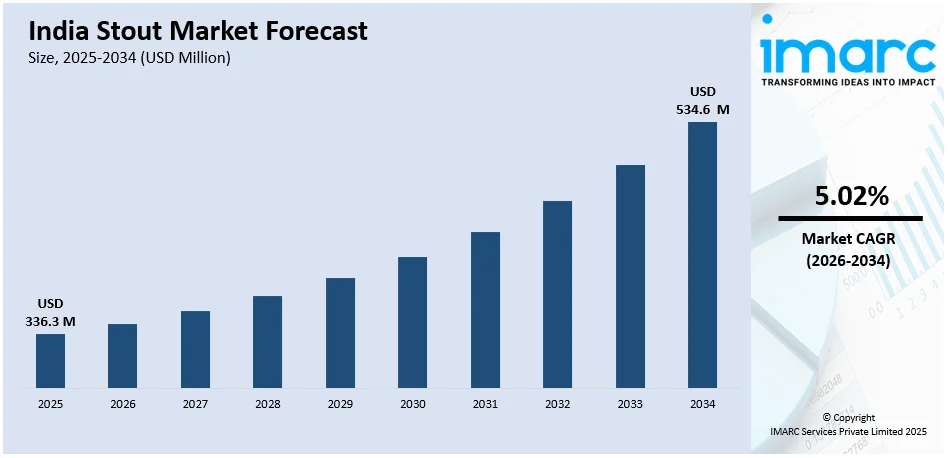

The India stout market size reached USD 336.3 Million in 2025. The market is expected to reach USD 534.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.02% during 2026-2034. The market growth can be attributed to the growing preferences and interest in craft and specialty beers, the aggressive marketing and promotion efforts by breweries and beer brands, rapid urbanization and rising disposable incomes of individuals.

Market Insights:

- On the basis of region, the market has been divided into South India, East India, West and Central India, and North India.

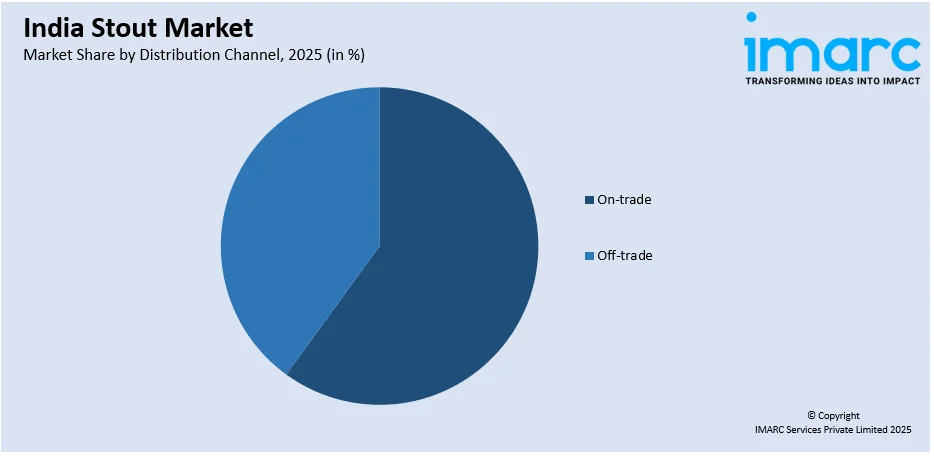

- On the basis of distribution channel, the market has been divided into on-trade and off-trade.

Market Size and Forecast:

- 2025 Market Size: USD 336.3 Million

- 2034 Projected Market Size: USD 534.6 Million

- CAGR (2026-2034): 5.02%

A stout is a type of beer known for its rich, full-bodied flavor and deep, opaque color. It is a member of the ale family and is typically brewed using roasted barley or other dark, roasted malts, which give it its characteristic and robust taste. It also has a deep, dark color that ranges from dark brown to black, giving them their distinct and visually appealing appearance. This darkness is achieved through the use of roasted barley or dark malts during the brewing process. It often has notes of coffee, chocolate, caramel, and sometimes even hints of dried fruit or smokiness. The complex flavors and hearty nature of stouts make them versatile when it comes to food pairing. They complement a wide range of dishes, including roasted meats, stews, barbecued foods, chocolate desserts, and even oysters. Moreover, stouts offer a wide array of specialty variations, such as coffee stouts, chocolate stouts, milk stouts, and barrel-aged stouts. These unique variations cater to different taste preferences and provide an opportunity for beer aficionados to explore and appreciate the diversity within the stout category.

To get more information on this market Request Sample

Indian consumers are increasingly exploring and embracing different styles of beer beyond the traditional lagers. The evolving taste preferences and growing interest in craft and specialty beers have driven the demand for stouts, which offer a distinct and rich flavor profile. In addition, India has witnessed a craft beer revolution in recent years, with a surge in microbreweries and brewpubs. Craft brewers often experiment with various beer styles, including stouts, to cater to a more discerning consumer base seeking unique and locally crafted beverages. Besides, urbanization and the rise in disposable income have contributed to the India stout market growth significantly. As more people move to urban areas and experience a change in lifestyle, they are exploring a wider range of alcoholic beverages, including stouts. Moreover, the marketing and promotion efforts by breweries and beer brands have played a significant role in popularizing stouts in India. Through effective branding and targeted campaigns, breweries have educated consumers about the unique characteristics and flavors of stouts, attracting new enthusiasts to the category. This, coupled with the India's exposure to international beer styles and trends, including stouts from various beer-producing regions, has influenced consumer preferences and contributed to the demand for stouts. Furthermore, breweries in India are continually introducing new and innovative stout variants, such as coffee stouts, chocolate stouts, and barrel-aged stouts, to cater to diverse tastes and preferences which is also creating a favorable market outlook.

India Stout Market Trends:

Premium Craft Beer Culture and Experiential Consumption

The emergence of a sophisticated craft beer culture is significantly reshaping the market landscape, as per the India stout market analysis, with consumers increasingly seeking premium, artisanal experiences over mass-produced alternatives. Urban millennials and Gen-Z consumers, comprising over 60% of the beer-drinking demographic, are driving demand for complex, nuanced flavors that stouts uniquely provide through their rich maltiness and diverse flavor profiles. The proliferation of beer festivals, tasting events, and brewing workshops across major cities like Bangalore, Mumbai, and Delhi is creating awareness and appreciation for stout varieties among discerning consumers. Microbreweries and brewpubs are capitalizing on this trend by offering exclusive, limited-edition stout variants that incorporate local ingredients such as Indian spices, regional coffee beans, and indigenous malts, creating distinctive flavor experiences, augmenting the India stout market share. The social media influence and food blogging culture are amplifying stout consumption as consumers share their craft beer experiences, creating viral marketing effects. Premium pricing strategies for craft stouts, often 2-3 times higher than regular beers, are being readily accepted by the affluent urban consumers who view craft beer consumption as a lifestyle statement and social experience rather than mere alcohol consumption.

Health-Conscious Consumption and Functional Beer Trends

Growing health consciousness among Indian consumers is creating new opportunities within the India stout market forecast projections, as stouts naturally align with several wellness trends due to their ingredient composition and brewing methods. Stouts made with organic ingredients, lower alcohol content variants, and those incorporating superfoods like quinoa, oats, and dark chocolate are gaining traction among health-aware consumers who seek indulgence without compromising their wellness goals. The antioxidant properties of dark malts used in stout production are being highlighted by brewers as health benefits, appealing to consumers looking for functional alcoholic beverages. Seasonal and limited-edition stouts featuring ayurvedic herbs, local honey, and traditional Indian spices are creating unique market positioning that combines traditional wellness concepts with modern craft brewing. The rise of mindful drinking culture, where consumers prefer quality over quantity, favors stouts due to their complex flavors and higher satiety factor, encouraging slower, more deliberate consumption patterns. Breweries are responding to this trend by developing lower-calorie stout variants, gluten-free options, and incorporating probiotics, positioning stouts as premium, health-conscious choices within the broader alcoholic beverage category. The stout industry in India is thus evolving beyond traditional beer consumption patterns toward more sophisticated, health-aware drinking preferences that prioritize quality, uniqueness, and functional benefits.

Growth, Opportunities, and Challenges in the India Stout Market:

- Growth Drivers of the India stout market: The market is primarily driven by evolving consumer preferences toward craft and specialty beers, with urban millennials seeking premium, artisanal drinking experiences. Rapid urbanization and rising disposable incomes are enabling broader exploration of diverse alcoholic beverages beyond traditional lagers. Effective marketing campaigns by breweries and increasing exposure to international beer styles are educating consumers and expanding the stout enthusiast base.

- Opportunities in the India stout market: Significant opportunities exist in developing local ingredient-based stout variants that incorporate Indian spices, regional coffee, and traditional flavors for unique market positioning. The growing health-conscious segment presents potential for functional stouts with organic ingredients, lower alcohol content, and wellness-focused formulations. Expansion into tier-II and tier-III cities through targeted distribution strategies and price-point optimization offers substantial untapped market potential.

- Challenges in the India stout market: High taxation and complex regulatory frameworks across different states create pricing pressures and operational challenges for stout manufacturers and distributors. Strong preference for traditional lagers and limited consumer awareness about stout varieties pose adoption barriers in price-sensitive market segments. Competition from established international brands and the need for significant investment in consumer education and brand building create market entry challenges.

India Stout Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India stout market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on distribution channel.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-trade

- Off-trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- South India

- East India

- West and Central India

- North India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, East India, West and Central India, and North India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In August 2025, Simba Beer earned global recognition by winning Silver and Bronze at the World Beer Awards 2025. The awards saw Simba's Belgian Style Witbier take Silver and its Stout claim Bronze in the ‘India Country Winners - Taste’ category. This achievement marks a significant milestone for India’s craft beer industry, proving that homegrown breweries can successfully compete with global beer giants.

- In June 2025, Red Rhino, the craft brewery brand, announced ambitious expansion plans to scale to 100+ locations by December 2025. The company is set to expand to over 50 outlets by August 2025 and will also be launching its bottled beer portfolio in early August. Red Rhino plans to enter the Hyderabad market soon and has devised a partner-first strategy, providing dispensing equipment to outlets without prior draft capabilities, ensuring wider accessibility.

- In April 2024, Indri and Fort City Brewing launched Dhumri, India’s first barrel-aged stout, created by aging Fort City’s Imperial Stout in whisky casks previously used for Indri’s single malt whisky. This unique collaboration aims to blend the flavors of whisky and beer, offering a new experience for both whisky and beer enthusiasts. The limited-edition craft beer, with an ABV of 7.8%, was exclusively launched in March 2024 at Fort City Brewing’s brewery.

India Stout Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Distribution Channels Covered | On-trade, Off-trade |

| Regions Covered | South India, East India, West and Central India, North India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India stout market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India stout market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India stout industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India stout market was valued at USD 336.3 Million in 2025.

The India stout market is projected to exhibit a CAGR of 5.02% during 2026-2034, reaching a value of USD 534.6 Million by 2034.

Increased urbanization and increased disposable incomes are driving the India stout industry and fostering consumer interest in premium and craft beer varieties. Microbreweries are leveraging local tastes by innovating with variants like coffee and chocolate stouts. Effective marketing and exposure to international stout trends further boost demand across urban India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)