India Supply Chain Risk Management Market Size, Share, Trends and Forecast by Component, Deployment, Enterprise Size, Type, End-Use Industry, and Region, 2025-2033

India Supply Chain Risk Management Market Overview:

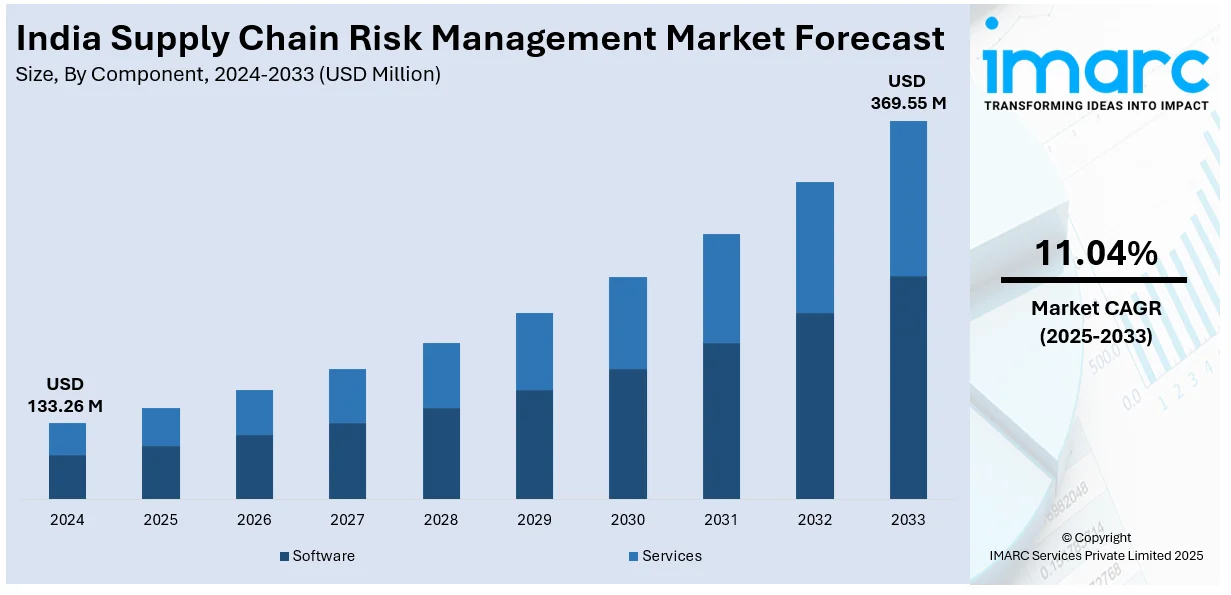

The India supply chain risk management market size reached USD 133.26 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 369.55 Million by 2033, exhibiting a growth rate (CAGR) of 11.04% during 2025-2033. The Indian market for supply chain risk management is growing due to increased digitalization, adoption of AI-driven analytics, and demand for resilient logistics networks. Similarly, rising geopolitical uncertainties, regulatory changes, and cybersecurity threats are driving companies to invest in real-time monitoring and predictive risk mitigation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 133.26 Million |

| Market Forecast in 2033 | USD 369.55 Million |

| Market Growth Rate 2025-2033 | 11.04% |

India Supply Chain Risk Management Market Trends:

Technology Adoption for Supply Chain Resilience

The growing use of cutting-edge technologies is impelling the swift development of India's supply chain risk management industry. Moreover, companies are embracing AI, IoT, blockchain, and cloud analytics to improve visibility, streamline operations, and manage risks. Also, real-time tracking has become indispensable in detecting disruptions beforehand with rising levels of complexity in logistics networks. Organizations are adopting digital twin technology and predictive analytics to deal with the uncertainties created due to geopolitical changes, natural disasters, and varying demand patterns. These innovations improve risk preparedness as well as enable businesses to respond with agility, minimizing potential losses. This shift toward technology-driven risk management was highlighted at India’s Supply Chain and Logistics Summit in June 2024. Minister Bhupathiraju Srinivas Varma emphasized the importance of carbon reduction, resilience, and digital transformation. The push for digital adoption is also aligning with sustainability goals. Businesses are leveraging smart tracking systems to measure carbon footprints, optimize transportation routes, and enhance resource efficiency. By embracing these innovations, India’s logistics sector is strengthening its ability to withstand risks while meeting global regulatory expectations, ultimately improving market competitiveness and long-term resilience.

To get more information on this market, Request Sample

Regulatory Initiatives Enhancing Risk Compliance

Regulatory frameworks are playing a pivotal role in shaping India’s supply chain risk management landscape, compelling businesses to adopt stricter compliance measures. With rising concerns over labor rights, ethical sourcing, and environmental sustainability, organizations are restructuring their supply chain strategies to meet regulatory requirements. Businesses are investing in risk assessment tools and due diligence frameworks to ensure compliance with evolving trade policies and sustainability goals. Strengthened regulations are not only reducing operational uncertainties but also fostering more transparent and resilient supply chain ecosystems. The significance of regulatory compliance was underscored in LRQA’s 2025 Supply Chain ESG Risk Outlook, which highlighted global supply chain vulnerabilities, including labor risks, geopolitical tensions, and nearshoring challenges. The report emphasized the role of data intelligence in strengthening compliance, ethical sourcing, and overall risk management strategies. The Indian government’s infrastructure modernization efforts, including initiatives like Sagar Mala, are further enhancing supply chain security and cost efficiency. By lowering logistics costs and encouraging sustainable practices, these policies are enabling businesses to mitigate risks more effectively. Companies are integrating AI-driven compliance platforms to monitor supplier risks, ensure regulatory alignment, and navigate complex trade policies. The growing emphasis on sustainable procurement and data-driven compliance strategies is fostering operational stability, reducing penalties, and building stronger investor confidence.

India Supply Chain Risk Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment, enterprise size, type, and end-use industry.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes on-premises and cloud.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises (SME)

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium enterprises (SME).

Type Insights:

- Operational Risks

- Financial Risks

- Predictive Analysis

- Geopolitical Risks

- Cybersecurity Risks

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes operational risks, financial risks, predictive analysis, geopolitical risks, cybersecurity risks, and others.

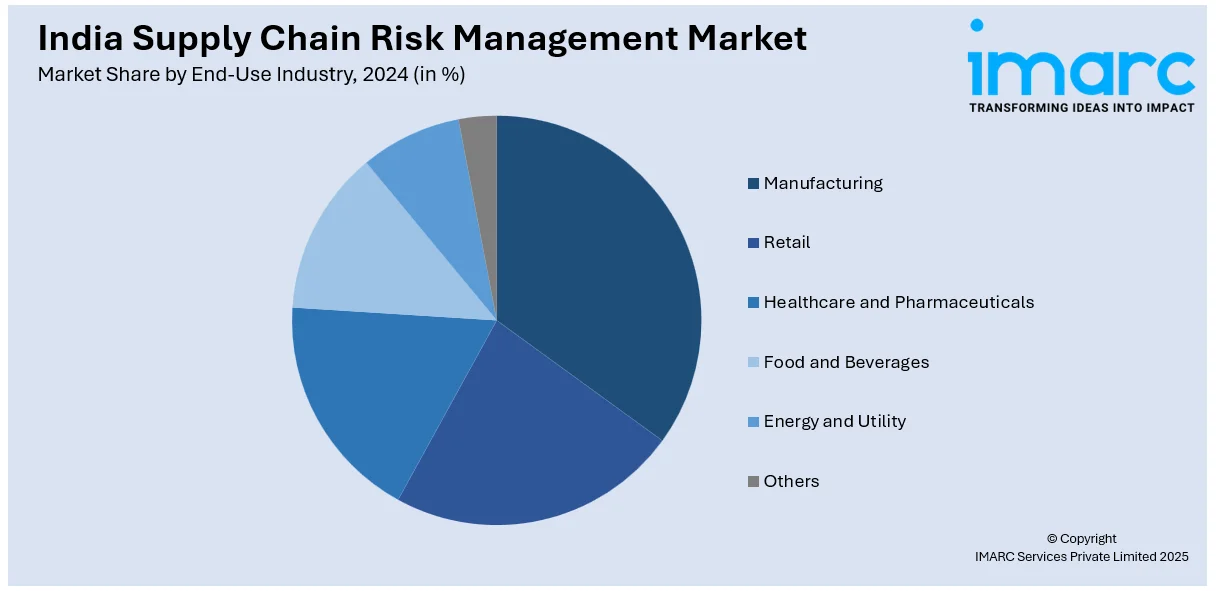

End-Use Industry Insights:

- Manufacturing

- Retail

- Healthcare and Pharmaceuticals

- Food and Beverages

- Energy and Utility

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes manufacturing, retail, healthcare and pharmaceuticals, food and beverages, energy and utility, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Supply Chain Risk Management Market News:

- February 2025: MetricStream’s 2025 GRC and Cyber GRC Predictions emphasize AI-driven automation, continuous cyber risk monitoring, and third-party risk management. Strengthening supply chain resilience amid geopolitical shifts and cyber threats enhances security, compliance, and vendor management, driving the demand for advanced risk management solutions in India’s supply chain sector.

- July 2024: SAP India launched a study with Economist Impact highlighting digitalization and sustainability as key priorities for supply chain resilience. The SAP Sustainability Data Exchange enables businesses to track emissions, enhance transparency, and optimize procurement, strengthening India's supply chain risk management and global trade competitiveness.

India Supply Chain Risk Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployments Covered | On-Premises, Cloud |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises (SME) |

| Types Covered | Operational Risks, Financial Risks, Predictive Analysis, Geopolitical Risks, Cybersecurity Risks, Others |

| End-Use Industries Covered | Manufacturing, Retail, Healthcare and Pharmaceuticals, Food and Beverages, Energy and Utility, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India supply chain risk management market performed so far and how will it perform in the coming years?

- What is the breakup of the India supply chain risk management market on the basis of component?

- What is the breakup of the India supply chain risk management market on the basis of deployment?

- What is the breakup of the India supply chain risk management market on the basis of enterprise size?

- What is the breakup of the India supply chain risk management market on the basis of type?

- What is the breakup of the India supply chain risk management market on the basis of end-use industry?

- What are the various stages in the value chain of the India supply chain risk management market?

- What are the key driving factors and challenges in the India supply chain risk management market?

- What is the structure of the India supply chain risk management market and who are the key players?

- What is the degree of competition in the India supply chain risk management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India supply chain risk management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India supply chain risk management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India supply chain risk management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)