India Tankless Toilet Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

India Tankless Toilet Market Overview:

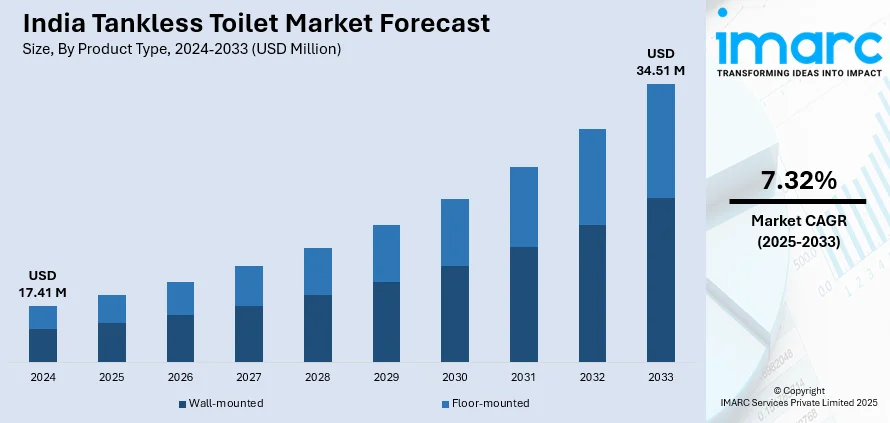

The India tankless toilet market size reached USD 17.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 34.51 Million by 2033, exhibiting a growth rate (CAGR) of 7.32% during 2025-2033. The increasing demand for space-saving and water-efficient sanitation solutions, the expansion of premium residential and commercial projects, government support for smart city development, and the growing consumer awareness regarding hygiene and modern bathroom aesthetics are propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.41 Million |

| Market Forecast in 2033 | USD 34.51 Million |

| Market Growth Rate 2025-2033 | 7.32% |

India Tankless Toilet Market Trends:

Surge in Smart Bathroom Adoption in Urban Housing and Hospitality Projects

India is witnessing a surge in the adoption of smart bathroom fixtures, with tankless toilets emerging as a preferred choice for their sleek aesthetics, advanced features, and efficient space utilization. These modern units are becoming increasingly common in high-rise apartments, luxury hotels, and premium office spaces across metros and Tier-1 cities, where compact, space-optimized designs are in high demand. The country’s smart bathroom segment is poised for significant growth, fueled by rising consumer interest in hygiene and tech-enabled comfort. Tankless toilets equipped with automatic flushing, integrated bidets, heated seats, and motion sensors are perfectly aligned with these evolving preferences. Notably, over 58% of premium hotels under construction in 2024 featured smart bathroom fittings, including tankless toilets, reflecting the hospitality sector’s push toward ultra-modern guest experiences. Builders and architects are favoring these models not only for their minimalist design but also for their eco-friendly edge, reducing water consumption by up to 30% compared to traditional toilets.

To get more information on this market, Request Sample

Rising Focus on Water Conservation and Green Building Certification

India, home to 16% of the global population but with access to only 4% of the world’s freshwater resources, faces a mounting water crisis—further highlighted by the 210 million Indians still lacking improved sanitation. As urban water scarcity intensifies in cities like Bengaluru and Chennai, the demand for water-saving sanitation solutions has grown, positioning tankless toilets as a key innovation. These systems, which connect directly to the supply line, eliminate the need for bulky water storage tanks and significantly reduce water waste. The Ministry of Housing and Urban Affairs notes that toilet flushing accounts for 25–30% of a household's daily water use. Tankless toilets with sensor-based or dual-flush features can cut that usage by up to 35%, making them crucial in advancing water-efficient urban infrastructure. This aligns with green certification systems, such as IGBC and GRIHA, which incentivize low-flow fixtures. Additionally, India's Smart Cities Mission promotes tankless toilet adoption in public and institutional projects, with a 2023 National Real Estate Development Council (NAREDCO) report revealing that 40% of new commercial green buildings integrating these systems, driven by regulatory backing and sustainability targets.

India Tankless Toilet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Wall-mounted

- Floor-mounted

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wall-mounted and floor-mounted.

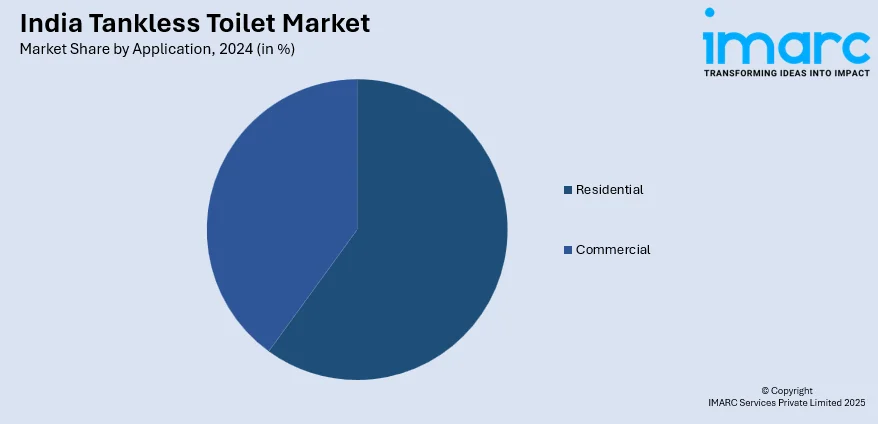

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tankless Toilet Market News:

- October 2024: Nagpur Municipal Corporation inaugurated a smart toilet at Walkers Street in Civil Lines. The facility features air conditioning, sensor-based automatic doors, and solar panels for energy efficiency.

- September 2024: Hindware’s Italian Collection introduced the Automate Imperial Smart Toilet, a tankless model that eliminates the need for a traditional cistern, optimizing bathroom space. This smart toilet features a presence-sensing lid and seat, pre- and post-flush functions to prevent stains, an oscillating water spray for thorough cleansing, a self-cleaning mechanism, and a warm air dryer.

India Tankless Toilet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wall-mounted, Floor-mounted |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India tankless toilet market performed so far and how will it perform in the coming years?

- What is the breakup of the India tankless toilet market on the basis of product type?

- What is the breakup of the India tankless toilet market on the basis of application?

- What is the breakup of the India tankless toilet market on the basis of distribution channel?

- What are the various stages in the value chain of the India tankless toilet market?

- What are the key driving factors and challenges in the India tankless toilet market?

- What is the structure of the India tankless toilet market and who are the key players?

- What is the degree of competition in the India tankless toilet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tankless toilet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tankless toilet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tankless toilet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)