India Tea Market Size, Share, Trends and Forecast by Product Type, Packaging, Distribution Channel, Application, and Region, 2026-2034

India Tea Market Summary:

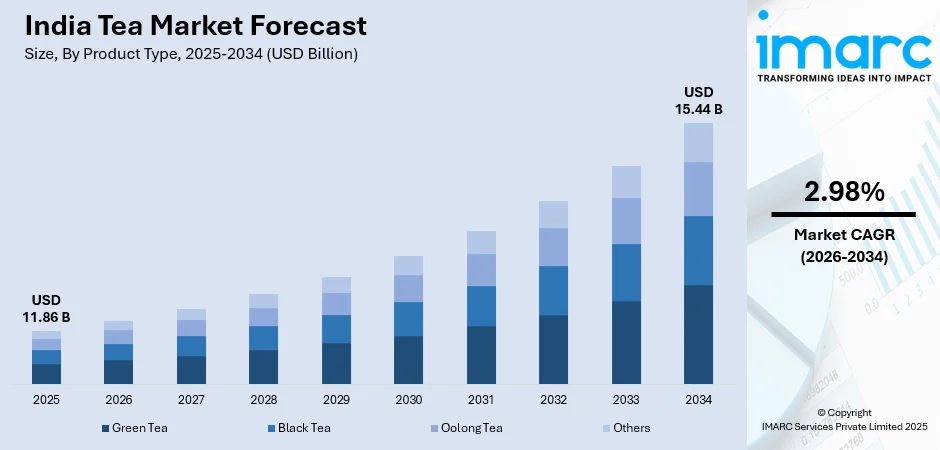

The India tea market size was valued at USD 11.86 Billion in 2025 and is projected to reach USD 15.44 Billion by 2034, growing at a compound annual growth rate of 2.98% from 2026-2034.

The India tea market is experiencing sustained expansion driven by rising health consciousness, growing demand for premium and specialty teas, and expanding retail distribution networks. Cultural integration of tea consumption across diverse demographics, increasing disposable incomes, and the proliferation of organized retail channels are propelling market growth. The industry's position in the world is still being strengthened by strong domestic demand and export possibilities.

Key Takeaways and Insights:

- By Product Type: Black tea dominates the market with a share of 68% in 2025, as it is widely consumed in homes and businesses, has significant cultural importance, and is reasonably priced, making it available to a variety of consumer groups. This market is being strengthened by the growing demand for high-end Assam and Darjeeling varietals.

- By Packaging: Loose tea leads the market with a share of 44% in 2025. This dominance is driven by traditional consumer preferences, cost-effectiveness for bulk household consumption, and the ability to customize brewing strength according to regional taste preferences across different Indian states.

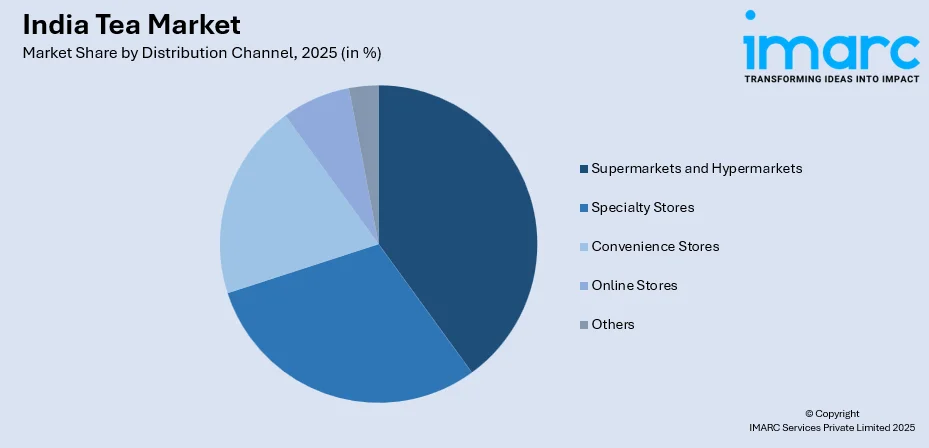

- By Distribution Channel: Supermarkets and hypermarkets hold the largest segment with a market share of 36% in 2025, representing the growth of organized retail networks that provide urban consumers with a wide range of products, competitive pricing, special deals, and easy one-stop shopping experiences.

- By Application: Residential exhibits a clear dominance in the market with 80% share in 2025, driven by tea's integral role in daily Indian household routines, cultural significance in social gatherings, morning rituals, and evening refreshment traditions entrenched across all demographic segments.

- By Region: North India represents the largest region with 30% share in 2025, driven by high per-capita tea consumption patterns, concentration of population in major metropolitan areas, and strong preference for CTC and masala chai varieties among consumers in this region.

- Key Players: Key players drive the India tea market by expanding product portfolios, improving quality and sourcing practices, and strengthening nationwide distribution networks. Their investments in marketing, premiumization, and partnerships with retail chains boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments. Some of the key players operating in the tea industry in India are Duncans Tea, Hindustan Unilever Limited, Organic India Pvt. Ltd., Pataka Group of Companies, Society Tea, Taj Mahal Tea House, Tata Consumer Products Limited and Wagh Bakri Tea Group.

To get more information on this market Request Sample

The India tea market continues its upward trajectory as the nation strengthens its position as the world's second-largest tea producer and consumer. Growing health consciousness among urban and semi-urban populations has catalyzed demand for green, herbal, and organic tea varieties that offer functional health benefits including antioxidant properties and immunity support. According to the Tea Board of India, India's tea exported 254.67 Million Kilograms in 2024, highlighting the industry's expanding global footprint. The proliferation of modern retail channels and e-commerce platforms has revolutionized tea distribution, enabling brands to reach previously untapped consumer segments while offering convenience and product variety. Premium and specialty teas are witnessing accelerated adoption among affluent urban consumers seeking artisanal and single-origin varieties. Government initiatives including the Tea Development and Promotion Scheme continue fostering industry modernization and export competitiveness. The integration of sustainable sourcing practices and innovative packaging solutions further strengthens the India tea market growth trajectory.

India Tea Market Trends:

Rising Demand for Health and Wellness Teas

The India tea market is witnessing a significant shift toward health-oriented tea varieties as consumers increasingly prioritize wellness-focused beverages. Among health-conscious urban millennials, green tea, herbal infusions, and functional mixes with Ayurvedic components like tulsi, turmeric, ginger, and ashwagandha are becoming increasingly popular. In June 2024, TeaFit launched Saffron, Lemongrass, and Matcha Latte instant teas emphasizing Ayurvedic formulations and zero-sugar premixes. This trend reflects broader consumer migration from traditional caffeinated beverages toward natural alternatives offering therapeutic benefits including immunity support, stress reduction, and digestive health enhancement.

Growing Popularity of Ready-to-Drink Tea Beverages

The India tea market is witnessing accelerating demand for ready-to-drink tea beverages as urban millennials and Generation Z consumers seek convenient, on-the-go refreshment options that align with their fast-paced lifestyles and busy schedules. RTD formats including iced teas, cold brews, and bottled tea beverages are gaining substantial traction in metropolitan areas across the country. This trend reflects broader consumer migration toward portable beverage solutions offering convenience, innovative flavor profiles, and refreshing experiences without compromising on taste and quality preferences.

Premiumization and Specialty Tea Adoption

The India tea market is experiencing accelerated premiumization as affluent urban consumers increasingly seek high-quality, artisanal, and single-origin tea varieties that offer distinctive flavor profiles and superior quality. Specialty teas including orthodox, white, and oolong varieties are commanding premium prices as discerning consumers appreciate craftsmanship and provenance. In March 2024, Pansari Group introduced TVOY Green Tea sourced from the Nilgiris at 1,900 meters elevation, featuring Fair Trade certification and biodegradable pyramid tea bag packaging. This trend reflects evolving consumer aspirations toward authentic tea experiences and sustainable consumption practices.

Market Outlook 2026-2034:

The outlook for the India tea market remains positive as it traversed through the ever-changing trends of consumer preference and developments in the country's distribution capacity. An increase in the number of people having disposable incomes and the rising middle-class population is fueling the demand for high-end and health-related tea. Government plans and developments via the Tea Board of India remain helpful. Adoption of technology in the tea manufacturing process and advancements in new and innovative packing materials will aid significantly in the future. An increase in consumer knowledge about the health-related advantages of tea consumption and the premium segment will significantly impact the expansion of the India tea market and make the country a leader globally for tea exports. The market generated a revenue of USD 11.86 Billion in 2025 and is projected to reach a revenue of USD 15.44 Billion by 2034, growing at a compound annual growth rate of 2.98% from 2026-2034.

India Tea Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Black Tea |

68% |

|

Packaging |

Loose Tea |

44% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

36% |

|

Application |

Residential |

80% |

|

Region |

North India |

30% |

Product Type Insights:

- Green Tea

- Black Tea

- Oolong Tea

- Others

Black tea dominates with a market share of 68% of the total India tea market in 2025.

Black tea maintains its dominant position in the India tea market owing to its deep-rooted cultural significance and widespread consumption patterns across all demographic segments. The strong flavor profile and high caffeine content make it the preferred choice for traditional Indian chai preparations enjoyed in households, tea stalls, and commercial establishments. Affordability and accessibility across both urban and rural markets ensure continued mass adoption, while premium varieties from Assam and Darjeeling strengthen consumer loyalty.

The black tea segment benefits from established distribution networks spanning traditional kirana stores, modern retail outlets, and emerging e-commerce platforms. Premium black tea varieties from renowned tea estates in Assam and Darjeeling command significant domestic and international demand. The versatility of black tea in various preparations including masala chai, lemon tea, and milk tea sustains consumer preference. Manufacturers continue investing in quality improvements, innovative blends, and attractive packaging to strengthen brand loyalty while catering to evolving consumer expectations for superior taste experiences.

Packaging Insights:

- Plastic Containers

- Loose Tea

- Paper Boards

- Aluminium Tin

- Tea Bags

- Others

Loose tea leads with a share of 44% of the total India tea market in 2025.

Loose tea maintains market leadership in India owing to traditional consumption practices that favor bulk purchasing and customized brewing according to regional taste preferences across different states. The cost-effectiveness of loose tea makes it accessible to price-sensitive consumers across diverse economic segments in both urban and rural areas. Indian households predominantly prefer loose tea for daily consumption rituals involving family gatherings, morning routines, and social interactions, reinforcing its enduring popularity among consumers.

The loose tea segment enables consumers to assess quality through visual inspection and aroma evaluation before purchase, building trust and ensuring satisfaction. Regional variations in tea strength preferences across different Indian states are better accommodated through loose tea formats. Established supply chain networks connecting tea estates to wholesale markets and retail outlets ensure consistent product availability at competitive prices. Despite growing popularity of tea bags among urban professionals, loose tea continues commanding substantial market presence through its value proposition and cultural alignment with traditional tea preparation methods.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets hold the largest share at 36% of the total India tea market in 2025.

Supermarkets and hypermarkets dominate tea distribution in India through extensive product assortment, competitive pricing strategies, and convenient one-stop shopping experiences that attract diverse consumer segments. The expansion of organized retail networks across urban and semi-urban markets has significantly enhanced consumer access to diverse tea brands and varieties previously unavailable in traditional retail channels. Major retail chains stock comprehensive tea selections ranging from budget-friendly CTC varieties to premium green, herbal, and orthodox blends catering to evolving preferences.

Modern trade channels leverage strategic shelf placement, promotional discounts, and in-store sampling initiatives to enhance consumer engagement and drive tea sales. The ability to physically examine products, compare prices, and access both domestic and international brands attract quality-conscious urban consumers. Data-driven inventory management systems ensure efficient stock replenishment and product freshness. Supermarkets and hypermarkets serve as crucial platforms for tea manufacturers to build brand visibility, launch new products, and capture market share through targeted marketing campaigns and loyalty programs.

Application Insights:

- Residential

- Commercial

Residential represents the leading segment with an 80% share of the total India tea market in 2025.

The residential segment dominates the India tea market reflecting tea's integral role in daily household routines and cultural traditions across the country. Tea consumption is deeply embedded in Indian family life, serving as an essential component of morning rituals, afternoon refreshment, and evening social gatherings. The widespread availability of affordable tea options ensures accessibility across all economic segments. In January 2024, Chai Chun introduced its Bagan Bahar CTC tea packets offering classic and masala chai blends specifically targeting household consumers seeking authentic home-brewing experiences.

Regional taste preferences significantly influence residential tea consumption patterns, with North India favoring strong CTC varieties while South India prefers lighter orthodox blends. Growing health awareness among households is driving adoption of green, herbal, and wellness teas alongside traditional black tea consumption. Popular tea brands extensively cater to this segment through affordable packaging options, regional flavor variants, and mass-market distribution strategies. The residential segment's substantial volume contribution ensures its continued prominence in shaping overall market dynamics and influencing product development priorities.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India tea market in 2025.

North India holds a strong position in the Indian tea industry as a whole due to its per-capita Tea consumption rate being the highest in the country, a massive population residing within major metropolitan cities such as Delhi NCR, as well as a preference for CTC and masala Tea varieties. Teas are readily available because of a well-established supply chain that connects Tea estates to the wholesale as well as the retail sectors. Premium as well as wellness Tea varieties are gaining preference from urban customers.

The emergence of new age retail outlets, specialty tea cafes, as well as online shopping portals, in North India is further broadening consumption levels on various tea options as well as high-end varieties in large metropolitan regions. The efforts put forward by the Tea Board of India, a government agency, are further helping in an increased focus on modernization, quality, and sustainable plantation. The increasing disposable incomes, urbanization rates, as well as awareness regarding health among consumers are further fueling high-end segments of tea, along with an impetus to growth.

Market Dynamics:

Growth Drivers:

Why is the India Tea Market Growing?

Rising Health Consciousness and Demand for Functional Beverages

The India tea market is experiencing substantial growth driven by escalating health consciousness among urban and semi-urban consumers who increasingly prioritize wellness-oriented beverage choices. Growing awareness regarding tea's antioxidant properties, metabolism-boosting benefits, and immunity-supporting characteristics is accelerating demand for green, herbal, and functional tea varieties. Consumers are migrating from traditional caffeinated beverages and carbonated drinks toward natural tea alternatives that offer therapeutic benefits without artificial additives. In January 2024, Organic India Private Limited launched its Black Tea range including Assam Black Tea, Masala Black Tea, and Elaichi Black Tea, offering rich flavors combined with antioxidants and organic purity. The integration of Ayurvedic ingredients like Tulsi, turmeric, ginger, and ashwagandha into tea blends aligns with India's traditional wellness heritage while addressing contemporary health priorities. This wellness-driven consumption shift is creating sustained demand across premium and mass-market tea segments.

Expanding Retail Infrastructure and E-Commerce Penetration

The rapid expansion of organized retail networks and e-commerce platforms is significantly propelling the India tea market by enhancing consumer accessibility and product variety. Supermarkets, hypermarkets, and convenience stores are proliferating across urban and semi-urban areas, offering diverse tea assortments ranging from budget-friendly options to premium specialty varieties. The digital commerce revolution has enabled direct-to-consumer engagement, allowing brands to reach previously untapped markets while offering personalized shopping experiences. Online tea sales have witnessed substantial growth as consumers embrace convenient doorstep delivery and access to niche products unavailable in traditional retail channels. Social media marketing and influencer partnerships are amplifying brand visibility and consumer engagement. The integration of subscription models and estate-to-consumer traceability features is building consumer trust and loyalty, particularly among younger demographics seeking authentic and sustainable tea experiences.

Government Support and Export Growth Initiatives

Government initiatives through the Tea Board of India and supportive policy frameworks are fostering substantial growth in the India tea market by modernizing production capabilities and strengthening export competitiveness. The Tea Development and Promotion Scheme (TDPS) provides financial assistance for plantation rehabilitation, quality improvements, and sustainable cultivation practices. Export diversification to key markets including Russia, Iran, UAE, and emerging destinations in West Asia has strengthened international demand. Government emphasis on geographical indication protection for premium varieties like Darjeeling tea enhances brand value and export premiums. Investment incentives for processing technology upgrades and quality certifications are enabling Indian tea producers to meet international standards while expanding market access globally.

Market Restraints:

What Challenges the India Tea Market is Facing?

Climate Change Impact on Production

Climate change represents a challenge for the tea industry in India as the fluctuating patterns of rainfall and the effects of drought and temperature increase have resulted in the reduction of tea yields and quality. The tea gardens in the regions of Assam are facing a reduction in productivity as a result of unfavorable weather conditions. The fluctuating temperature levels have resulted in the growth and proliferation of pests, thereby increasing the cost of crop protection.

Rising Production Costs and Labor Challenges

Rising production costs, such as increased wages, fertilizer prices, and processing charges, are impeding profitability in the Indian tea market, especially for small and medium-sized companies. The migration of workers with skills and expertise from tea-producing to urban areas has created a talent gap, especially during peak seasons when harvesting takes place. Increasing production charges for agri-inputs and increased production charges due to rising energy prices are also posing operational challenges.

Competition from Alternative Beverages

The Indian tea market is under increasing pressure from other beverages such as coffee, fruit juices, energy drinks, and carbonated drinks, which are stealing consumer attention, particularly among younger populations. Aggressive marketing by global beverage firms and growing coffee culture in urban centers is transforming the consumption patterns. The emergence of specialty coffee chains and ready-to-drink beverages puts enormous competitive pressure on tea producers to become more innovative and diverse in their product portfolios.

Competitive Landscape:

The Indian tea market is found to have a highly competitive environment, with both local and MNC companies competing for their shares in the market through innovations and distribution reach. Market players have vast brand portfolios, reach, and adequate marketing spend, which makes them market dominators. With an increasing number of companies diversifying their product lines into organic and wellness tea, competition becomes tough in the Indian tea market. Acquisitions, retail chain collaborations, and direct-to-consumer models are also changing the dynamics in the competitive environment in the Indian tea market. Several local players in this market use local product lines and pricing strategies, while new brands enter the market using an online reach strategy.

Some of the key players operative in the industry include:

- Duncans Tea

- Hindustan Unilever Limited

- Organic India Pvt. Ltd.

- Pataka Group of Companies

- Society Tea

- Taj Mahal Tea House

- Tata Consumer Products Limited

- Wagh Bakri Tea Group

Recent Developments:

- In May 2024, Society Tea launched its Ready-to-Drink Iced Tea range in four flavors including Ginger Cinnamon Bergamot, Lemon, Chamomile Jasmine, and Peach Apricot. Packaged in 250ml bottles, the new offering blends tradition with innovation, catering to evolving consumer preferences and is available in retail stores, supermarkets, and online platforms across India.

- In January 2024, Tata Consumer Products signed agreements to acquire 100% of Organic India Private Limited's equity shares. This strategic acquisition expands Tata Consumer's wellness-oriented portfolio and creates a platform for health and wellness products, strengthening its position in the premium organic tea segment.

India Tea Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Green Tea, Black Tea, Oolong Tea, Others |

| Packagings Covered | Plastic Containers, Loose Tea, Paper Boards, Aluminium Tin, Tea Bags, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Applications Covered | Residential, Commercial |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Duncans Tea, Hindustan Unilever Limited, Organic India Pvt. Ltd., Pataka Group of Companies, Society Tea, Taj Mahal Tea House, Tata Consumer Products Limited, Wagh Bakri Tea Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India tea market size was valued at USD 11.86 Billion in 2025.

The India tea market is expected to grow at a compound annual growth rate of 2.98% from 2026-2034 to reach USD 15.44 Billion by 2034.

Black tea dominated the market with a share of 68%, driven by its deep-rooted cultural significance, widespread consumption across households and commercial establishments, and affordability that ensures accessibility to diverse consumer segments.

Key factors driving the India tea market include rising health consciousness, expanding retail infrastructure, government support through promotion schemes, increasing demand for premium and specialty teas, and growing e-commerce penetration.

Major challenges include climate change impacts on production, rising production costs and labor shortages, competition from alternative beverages, fluctuating raw material prices, and the need for modernization in small tea plantations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)