India Telecom Market to Generate a Revenue of USD 71.3 Billion by 2033, Driven by Rising Smartphone Penetration and 5G Rollout

India Telecom Market Size, Trends and Top Key Players

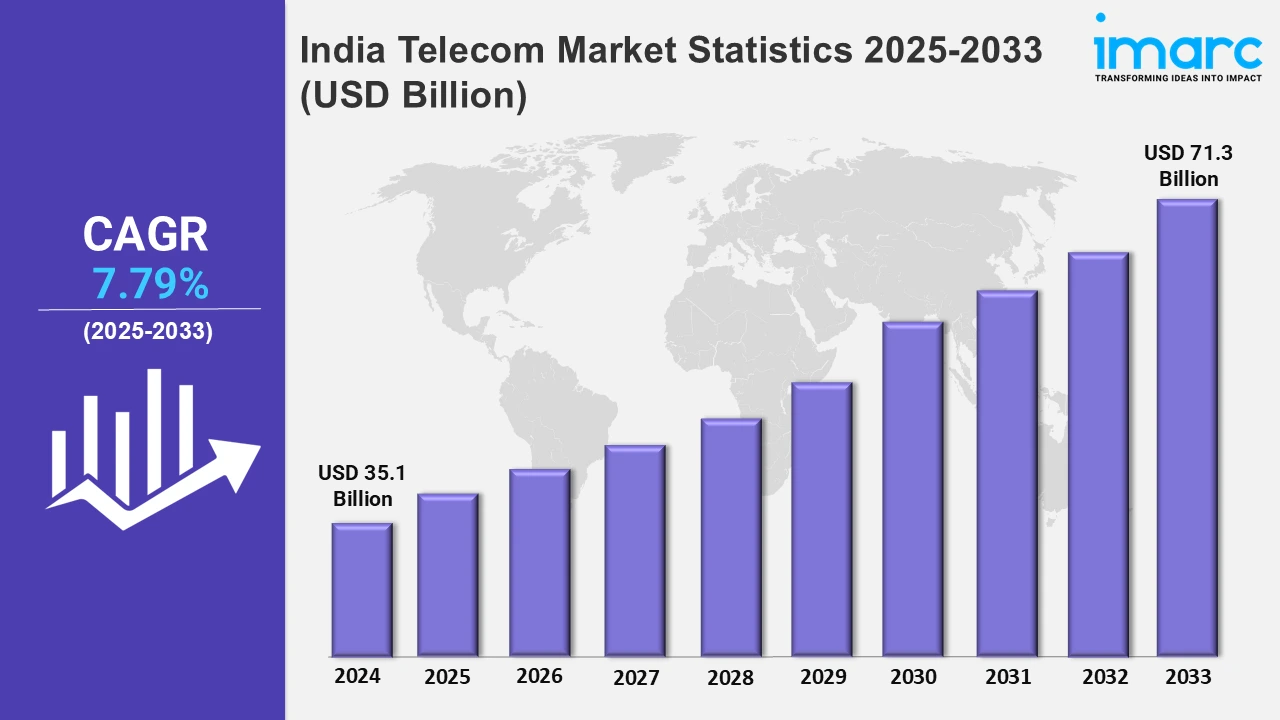

The Indian telecom market is valued at USD 35.1 Billion in 2024 and is projected to grow to USD 71.3 Billion by 2033, registering a compound annual growth rate (CAGR) of 7.79% from 2025 to 2033. This growth is driven by the increasing smartphone penetration, favorable government policies, the rollout of 5G technology, competitive pricing strategies, and growing demand for digital services.

Significant developments such as broader rural network coverage, growing use of digital platforms, and escalating data usage are further accelerating the market's expansion.

To get more information on this market, Request Sample

India Telecom Market Analysis 2025 - 2033

Key Takeaways

- The India telecom market is valued at USD 35.1 Billion in 2024.

- Market projected to hit USD 71.3 Billion by 2033.

- CAGR of 7.79% between 2025 and 2033.

- The increasing demand for 5G and IoT applications is a major trend.

- Fiber-optic networks are improving service delivery across urban and rural areas.

Key Metrics and Overview:

|

Metric

|

Details |

|---|---|

| Market Size in 2024 | USD 35.1 Billion |

| Projected Market Size in 2033 | USD 71.3 Billion |

| CAGR (2025–2033) | 7.79% |

| Market Segmentation | By Services, By Region |

Market Overview:

India's telecom sector offers a diverse range of services, including voice, data, and over-the-top (OTT) platforms. It serves as a vital enabler of nationwide connectivity and plays a pivotal role in advancing digital initiatives such as Digital India. By boosting internet accessibility and leveraging innovations like 5G, the telecom industry is instrumental in enhancing connectivity, increasing productivity, and fostering economic development across both urban centers and rural regions.

Trends in the Market:

- Surge in Cloud Computing Integration: Telecom firms are integrating cloud-based solutions to support 5G infrastructure and improve workplace productivity.

- Progress in 5G Deployment: The continuous expansion of 5G networks is significantly improving connectivity and fueling the need for ultra-fast data services.

- IoT and AI Integration: Innovations in AI and IoT are enabling smarter telecom services and optimized network operations.

- Growth in Data Consumption: With rising smartphone usage, data consumption continues to increase, leading to greater demand for efficient, high-speed internet solutions.

Role of 5G Technology in the Market:

5G technology is a transformative force in the India telecom market, enabling faster data speeds, reduced latency, and enhanced connectivity. It plays a pivotal role in expanding IoT applications and supporting critical sectors like healthcare, transportation, and education, facilitating innovation and improving service delivery.

Market Dynamics:

Driver: Increasing Smartphone Penetration

The surge in smartphone usage across India, coupled with affordable data plans, has significantly contributed to the telecom market's growth. With more consumers relying on smartphones for digital services, telecom operators are expanding their service offerings to meet the growing demand.

Restraint: Limited Rural Connectivity

Despite rapid growth, rural areas still face challenges in terms of internet accessibility and affordability. Although there have been efforts to expand rural connectivity, infrastructural limitations remain a key barrier to faster growth in these regions.

Opportunity: Expansion of 5G Infrastructure

As the 5G rollout progresses, there is significant potential for telecom companies to tap into new customer bases, especially in underserved areas. The technological upgrades and the subsequent demand for high-speed internet services present considerable growth opportunities.

Segmental Insights:

- By Services: Voice services (wired and wireless), data and messaging services, and OTT and pay-tv services represent the key services offered by telecom companies in India. Voice services (both wired and wireless) are driven by continued reliance on mobile phones for communication across both urban and rural India. Data and messaging services are also witnessing rapid growth, driven by the increased use of mobile internet for services such as video streaming, online gaming, and social media consumption. The OTT and Pay-TV services segment is growing as more users turn to streaming platforms for entertainment. The demand for these services is expected to continue rising with the increasing availability of affordable data and smartphones.

Regional Insights:

- South India: The market growth in South India is driven by increasing smartphone penetration, strong adoption of digital services, and robust infrastructure developments supporting 5G.

- North India: North India, particularly in urban centers, continues to see steady growth due to high smartphone penetration and demand for internet services.

- West and Central India: The region is benefiting from government policies aimed at improving internet penetration and providing better rural connectivity.

- East and Northeast India: This region is still in the early stages of telecom development, but with the government’s push for digital inclusion, it is expected to witness significant growth.

Recent Developments:

- Reliance Jio launched JioSpaceFiber in October 2023, offering satellite-based broadband to previously inaccessible areas.

- Bharti Enterprises entered a joint venture with Brookfield Asset Management in May 2023 to enhance its commercial real estate portfolio in India.

Key Benefits of the Report:

- Comprehensive Market Sizing: Historical, current, and forecast data from 2024 to 2033.

- Growth Drivers & Challenges: Insights on what’s shaping the market, including government initiatives and competition.

- Competitive Landscape: Analysis of top players, key strategies, and market share.

- Technological Advancements: Updates on 5G deployment, cloud computing integration, and IoT.

- Regional and Segmental Breakdown: In-depth analysis of regional performance and service segmentation.

- Strategic Recommendations: Actionable insights for telecom operators, investors, and new entrants.

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)