India Television Market Size, Share, Trends and Forecast by Technology, Screen Size, Features, End User, and Region, 2026-2034

India Television Market Summary:

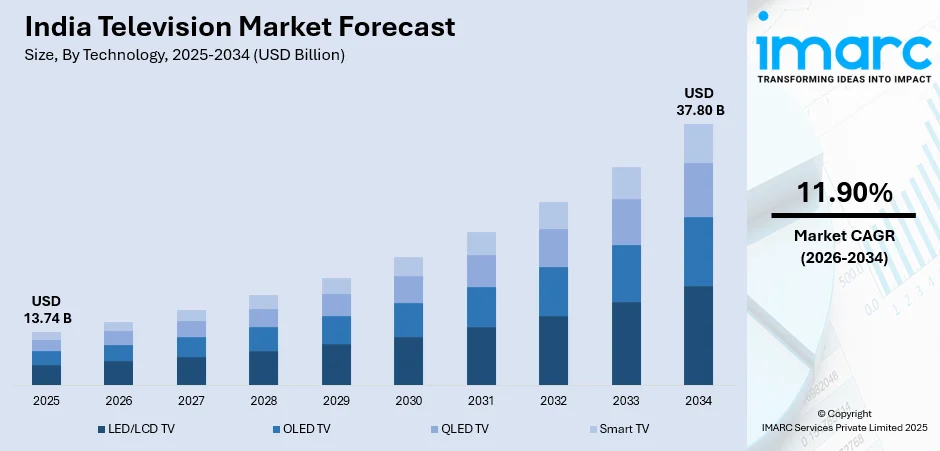

The India television market size was valued at USD 13.74 Billion in 2025 and is projected to reach USD 37.80 Billion by 2034, growing at a compound annual growth rate of 11.90% from 2026-2034.

The India television market is experiencing robust growth driven by increasing consumer demand for smart features, expanding regional content availability, and widespread low-cost internet connectivity. Technological advancements and higher television penetration in non-metropolitan areas are propelling market expansion. Changing lifestyle preferences and accelerating digitalization are fundamentally transforming viewing patterns among both urban and rural audiences, positioning television as a central digital entertainment hub within Indian households.

Key Takeaways and Insights:

-

By Technology: LED/LCD TV dominate the market with a share of 46% in 2025, driven by their widespread affordability, energy efficiency, and availability across diverse price segments catering to India's heterogeneous consumer base from entry-level to mid-range preferences.

-

By Screen Size: Medium screen (32 to 50 inches) leads the market with a share of 49% in 2025, attributed to their optimal balance between viewing experience and space requirements, making them ideal for typical Indian household living room configurations and viewing distances.

-

By Features: High-resolution displays dominate the market with a share of 42% in 2025, reflecting growing consumer preference for 4K and emerging 8K technologies that deliver superior picture quality essential for streaming OTT content and immersive gaming experiences.

-

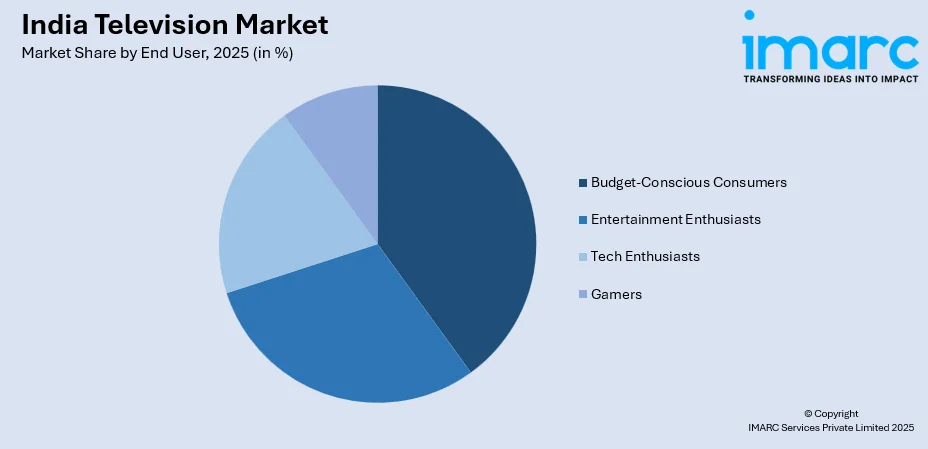

By End User: Budget-conscious consumers leads the market with a share of 35% in 2025, driven by India's price-sensitive consumer landscape where value-for-money propositions and affordable smart TV options determine purchasing decisions across urban and semi-urban markets.

-

By Region: North India dominate the market with a share of 31% in 2025, owing to the concentration of population in states like Uttar Pradesh, Delhi NCR, Punjab, and Haryana with rising disposable incomes and increasing urbanization driving television adoption.

-

Key Players: The India television market is highly competitive, with multinational, domestic, and Chinese brands vying for market share, driving innovation, diverse product offerings, and aggressive pricing strategies to attract consumers across urban and rural segments.

To get more information on this market Request Sample

The India television market is witnessing rapid technological evolution, driven by growing consumer preference for smart, connected entertainment solutions. According to reports, smart TV shipments surged around 8.6 % in 2024, with Samsung and LG leading the market, reflecting strong demand for larger, feature-rich connected TVs. These shipments now account for the overwhelming majority of total TV sales, signaling a near-complete shift from conventional television sets. Expanding population and a rising middle class continue to fuel television penetration, offering substantial growth opportunities. Simultaneously, the rise of OTT platforms such as Netflix, Amazon Prime Video, Disney+ Hotstar, and regional content providers is reshaping content consumption, boosting demand for high-resolution displays and advanced audio-visual technologies, and redefining the overall entertainment experience for Indian viewers.

India Television Market Trends:

Artificial Intelligence Integration and Smart Home Connectivity

The Indian TV market is embracing AI to enhance user experiences with content recommendations, adaptive picture optimization, and voice controls. Samsung India’s 2025 premium lineup, including Neo QLED, OLED, QLED, and The Frame, features Vision AI for real-time picture and sound enhancement, personalized content, and multi-device connectivity. Televisions are becoming central hubs for smart homes, connecting with IoT devices, lighting, and security systems, driving premiumization as consumers seek advanced functionality alongside high-quality displays.

Proliferation of Affordable Smart Television Options

Affordable smart TVs are transforming India’s television market, bringing advanced home entertainment to mass‑market consumers. Following a government GST cut on smart TV displays, prices now start around ₹5,799, with brands like Thomson and Sony announcing reductions in 2025. Feature-rich Android TVs, direct online sales, easy financing, and festive promotions are driving adoption among first-time buyers and upgrading households, bridging urban and rural markets, and intensifying competition across brands.

Shift Toward Large Screen and Premium Display Technologies

Indian consumers are increasingly favoring large-screen TVs with premium displays such as QLED, OLED, and Mini‑LED for immersive home entertainment. Croma’s Year‑End Consumer Trends 2025 report highlights strong sales growth for 65‑inch models in cities like Bengaluru, reflecting rising demand. Higher incomes, urban apartment growth, and a desire for cinematic experiences are driving this trend, with larger screens gaining market share over smaller models, especially in metropolitan and tier‑1 cities.

Market Outlook 2026-2034:

The India television market outlook remains highly favorable, supported by sustained consumer demand for connected entertainment solutions, expanding internet infrastructure, and continuous product innovation across all price segments. Rising disposable incomes among India's rapidly expanding middle class are driving transition from basic television sets to advanced smart TV variants featuring larger screens and premium display technologies. Government initiatives promoting digital India and manufacturing under Production Linked Incentive schemes are attracting investment in domestic television production capabilities. The market generated a revenue of USD 13.74 Billion in 2025 and is projected to reach a revenue of USD 37.80 Billion by 2034, growing at a compound annual growth rate of 11.90% from 2026-2034.

India Television Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | LED/LCD TV | 46% |

| Screen Size | Medium Screen (32 to 50 inches) | 49% |

| Features | High-Resolution Displays | 42% |

| End User | Budget-Conscious Consumers | 35% |

| Region | North India | 31% |

Technology Insights:

- LED/LCD TV

- OLED TV

- QLED TV

- Smart TV

The LED/LCD TV dominates with a market share of 46% of the total India television market in 2025.

LED and LCD TVs continue to dominate the Indian market, offering affordability and reliable performance for price-sensitive consumers. After the GST Council cut the tax on TVs larger than 32 inches from 28 % to 18 % in September 2025, brands like Sony, LG, and Panasonic reduced prices by up to ₹85,000, boosting demand for large sets. These TVs appeal to entry-level and middle-income households, benefiting from lower production costs and domestic manufacturing scale.

The segment's dominance reflects India's market structure where value-for-money considerations significantly influence purchasing decisions across urban, semi-urban, and rural geographies. Manufacturers have successfully positioned LED/LCD televisions as accessible gateways to smart television functionality, incorporating Android TV operating systems and connectivity features at competitive price points. The widespread availability of these products through both online and offline retail channels, combined with attractive financing options, sustains strong consumer adoption particularly among first-time television buyers and households replacing legacy CRT sets.

Screen Size Insights:

- Small Screen (Below 32 inches)

- Medium Screen (32 to 50 inches)

- Large Screen (Above 50 inches)

The medium screen televisions (32 to 50 inches) leads with a share of 49% of the total India television market in 2025.

Medium screen televisions encompassing 32 to 50-inch display sizes represent the optimal configuration for typical Indian household requirements, balancing immersive viewing experiences with practical space considerations. These screen dimensions accommodate the standard living room configurations prevalent in Indian homes, including apartments and independent houses, where viewing distances and room layouts favor mid-sized displays. The segment benefits from extensive product variety across all price points, enabling consumers to select televisions matching their specific feature requirements and budget constraints.

The 43-inch screen size has emerged as a particularly popular choice, representing an upgrade path from traditional 32-inch televisions while remaining accessible to mainstream consumers. This segment captures demand from both urban households seeking secondary televisions for bedrooms and dining areas, as well as semi-urban and rural consumers purchasing primary entertainment systems. The proliferation of full HD and 4K resolution options within this size category enhances value perception, driving sustained market leadership amid growing consumer interest in larger premium displays.

Features Insights:

- High-Resolution Displays

- 4K

- 8K

- HDR (High Dynamic Range)

- Audio Enhancement

- Dolby Atmos

- DTS X

- Connectivity Options

- Bluetooth

- Wi-Fi

- HDMI

- Voice Control and AI Integration

The high-resolution displays dominates with a market share of 42% of the total India television market in 2025.

4K Ultra HD displays are emerging as the key driver of television purchases in India, fueled by growing 4K content on streaming platforms like Netflix, Amazon Prime Video, and Disney+ Hotstar. Superior picture quality and significant price reductions, now similar to full HD models, have made premium viewing more accessible. This combination of affordability and enhanced viewing experience is accelerating adoption, making high-resolution displays a defining factor in Indian consumer TV preferences.

The emergence of 8K resolution televisions is establishing new premium tier positioning, targeting affluent consumers and early technology adopters in metropolitan markets. High-resolution displays have become particularly important for gaming enthusiasts leveraging next-generation consoles and for home cinema applications where picture clarity directly impacts viewing satisfaction. Manufacturers are integrating advanced upscaling algorithms and AI-powered image processing to enhance standard definition and HD content appearance on high-resolution panels, further strengthening the value proposition of this feature category.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Entertainment Enthusiasts

- Budget-Conscious Consumers

- Tech Enthusiasts

- Gamers

The budget-conscious consumers lead with a share of 35% of the total India television market in 2025.

Budget‑conscious consumers form the largest segment in India’s television market, reflecting a price‑sensitive population seeking maximum value within constrained budgets. Affordable smart TVs remain the “real screen stars,” with strong demand for budget models from brands like Xiaomi, Vu, and Thomson. Buyers prioritize essential smart features, trusted brands, and competitive pricing, including first‑time buyers, families replacing old sets, and consumers in tier‑2 and tier‑3 cities.

Manufacturers have strategically targeted this segment through aggressive pricing, festive season promotions, and no-cost EMI financing options that reduce immediate financial burden while enabling access to feature-rich smart televisions. The proliferation of domestic and Chinese brands offering competitive specifications at aggressive price points has intensified competition for budget-conscious consumers, driving continuous value enhancement across the segment. Online retail platforms have emerged as preferred channels for this demographic, offering price comparison tools, customer reviews, and promotional discounts that facilitate informed purchasing decisions within budget parameters.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 31% share of the total India television market in 2025.

North India maintains market leadership driven by the region's substantial population concentration across states including Uttar Pradesh, Delhi NCR, Rajasthan, Punjab, Haryana, and Madhya Pradesh. The Delhi National Capital Region serves as a significant consumption hub with high disposable incomes, cosmopolitan demographics, and strong preference for premium television brands and advanced technologies. Urban centers including Lucknow, Jaipur, Chandigarh, and Noida demonstrate robust demand for smart televisions across all price segments.

The region benefits from extensive retail infrastructure encompassing brand exclusive stores, multi-brand electronics retailers, and growing e-commerce penetration that ensures comprehensive market coverage. Agricultural prosperity in Punjab and Haryana contributes to rural television adoption, while industrial growth in Uttar Pradesh supports rising consumer electronics demand. The concentration of corporate offices, educational institutions, and entertainment venues in North India drives both residential and commercial television procurement, reinforcing the region's dominant market positioning.

Market Dynamics:

Growth Drivers:

Why is the India Television Market Growing?

Expanding Media and Entertainment Ecosystem

India’s rapidly growing media and entertainment sector is boosting television market demand, driven by the surge of OTT streaming platforms. According to reports in September 2025, India had an estimated 600 million OTT users, while Connected TV (CTV) viewership surged by 87% year on year to around 129 million households, highlighting a growing consumer preference for streaming content on large-screen televisions. Widespread broadband access, affordable mobile data, and popular live sports broadcasts, including cricket and the Olympics, further boost demand, prompting greater investment in smart TVs with enhanced display, AI features, and connectivity options.

Rising Disposable Incomes and Middle Class Expansion

Rising disposable incomes and a growing middle class are driving strong television demand in India. As per the Chief Economic Advisor in August 2025, household disposable income is expected to be “significantly higher” than last year, aided by lower inflation and tax cuts, supporting consumer spending on durables like TVs. Economic growth, employment, and higher female workforce participation boost purchasing power, prompting shifts from basic to premium smart TVs, while urban and rural markets expand adoption, further encouraging brands to introduce innovative features, larger screens, and affordable smart TV options across the country.

Technological Innovation and Product Accessibility

Ongoing technological innovation and competitive pricing are making televisions more accessible across India. In January 2025, Chinese brand TCL plans to nearly double its market share to around 10% in 2025, highlighting rising competition and investment in affordable, innovative TVs. Advanced displays, AI features, and smart home integration are now common in budget models. Government-backed domestic manufacturing and e-commerce platforms enhance affordability, convenience, and reach, driving purchases across urban, semi-urban, and rural areas, expanding the overall television market significantly, while catering to diverse consumer preferences and accelerating adoption of smart, feature-rich TVs nationwide.

Market Restraints:

What Challenges the India Television Market is Facing?

Intense Price Competition and Margin Pressure

The Indian television market experiences significant competitive intensity with numerous brands competing primarily on price positioning, creating sustained margin pressure across the industry value chain. The proliferation of domestic and Chinese manufacturers offering comparable specifications at aggressive price points has compressed profit margins for established brands and new entrants alike. This pricing pressure limits manufacturer investment capacity in research and development, premium product innovation, and brand building activities essential for long-term market sustainability.

Infrastructure Limitations in Rural Markets

Despite improving penetration, infrastructure limitations in rural and semi-urban India continue constraining television market expansion. Inconsistent electricity supply, limited broadband connectivity, and underdeveloped last-mile retail distribution networks restrict both smart TV functionality utilization and product accessibility in significant portions of India's population. Service and warranty support availability in remote areas remains challenging, potentially affecting consumer confidence and post-purchase satisfaction in emerging markets.

Competition from Alternative Entertainment Devices

Televisions face increasing competition from alternative entertainment devices including smartphones, tablets, and laptop computers that capture viewer attention particularly among younger demographics. The ubiquity of mobile devices with improving display quality and content access capabilities diverts entertainment consumption time from traditional television viewing. This behavioral shift potentially impacts television purchase urgency and replacement cycles, particularly in urban households where multiple screen ownership is common.

Competitive Landscape:

The India television market is highly competitive, with multinational, domestic, and Chinese brands vying across all segments. Market leaders leverage premium positioning, diverse product portfolios from entry-level to ultra-premium, and extensive retail networks. Other players compete through value pricing, online-focused distribution, and differentiated offerings such as advanced display technologies and gaming features. The landscape is marked by rapid product innovation, frequent launches, aggressive promotions, and omnichannel strategies, as brands continuously strive to capture consumer attention and adapt to evolving preferences in both performance and pricing.

Recent Developments:

-

In December 2025, Sony Pictures Networks India (SPNI) launched the Indian edition of Wheel of Fortune, aiming to boost primetime viewership and advertising revenue. The popular global game show format has been adapted for Indian audiences, combining entertainment with local appeal.

India Television Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | LED/LCD TV, OLED TV, QLED TV, Smart TV |

| Screen Sizes Covered | Small Screen (Below 32 inches), Medium Screen (32 to 50 inches), Large Screen (Above 50 inches) |

| Features Covered |

|

| End Users Covered | Entertainment Enthusiasts, Budget-Conscious Consumers, Tech Enthusiasts, Gamers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India television market size was valued at USD 13.74 Billion in 2025.

The India television market is expected to grow at a compound annual growth rate of 11.90% from 2026-2034 to reach USD 37.80 Billion by 2034.

LED/LCD TV technology dominated the market with 46% share, driven by widespread affordability, energy efficiency, and extensive availability across diverse price segments catering to India's value-conscious consumer base seeking reliable entertainment solutions.

Key factors driving the India television market include expanding media and entertainment ecosystem with OTT platform proliferation, rising disposable incomes among the growing middle class, technological innovation enhancing product accessibility, increasing internet penetration enabling smart TV functionality, and shifting consumer preference toward larger screens and premium display technologies.

Major challenges include intense price competition creating margin pressure across industry participants, infrastructure limitations constraining smart TV functionality utilization in rural areas, competition from alternative entertainment devices particularly smartphones, and the need for continuous innovation to maintain competitive positioning in a rapidly evolving technology landscape.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)