India Textile Auxiliaries Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Textile Auxiliaries Market Overview:

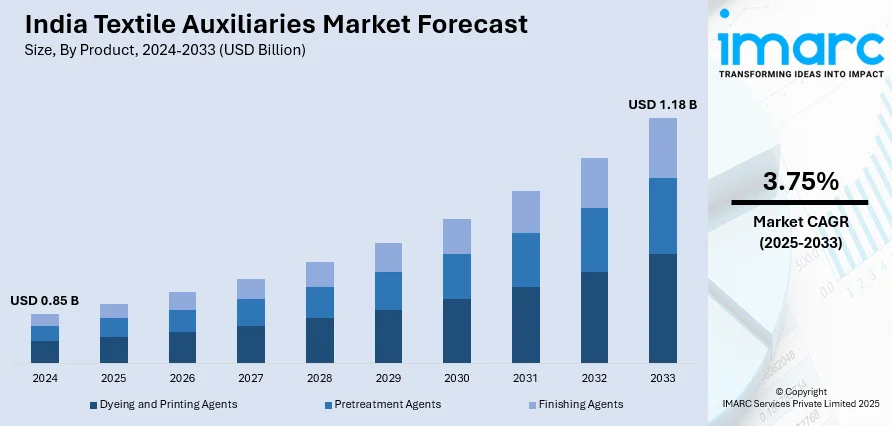

The India textile auxiliaries market size reached USD 0.85 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.18 Billion by 2033, exhibiting a growth rate (CAGR) of 3.75% during 2025-2033. The market is driven by expanding textile production, rising demand for eco-friendly chemicals, and favorable government initiatives, such as Production-Linked Incentive (PLI) schemes. Moreover, increasing exports, advancements in fabric processing technologies, and growing consumer preference for high-quality apparel are further fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.85 Billion |

| Market Forecast in 2033 | USD 1.18 Billion |

| Market Growth Rate 2025-2033 | 3.75% |

India Textile Auxiliaries Market Trends:

Rising Demand for Sustainable and Eco-Friendly Textile Auxiliaries

India's textile sector is undergoing significant transformation, propelled by the growing emphasis on sustainability and the implementation of stronger environmental legislation. Eco-friendly textile auxiliaries, such as dyeing agents, finishing chemicals, and washing solutions, are gaining popularity as they help reduce water pollution, cut energy consumption, and improve biodegradability in accordance with green chemistry principles. Moreover, the implementation of stringent regulations, such as the Zero Liquid Discharge (ZLD) mandate, are propelling textile manufacturing facilities to adopt cleaner technologies. Additionally, the shifting consumer preferences towards sustainable fashion are catalyzing the market growth, with a 2023 Nielsen survey revealing that 73% of Indian consumers are willing to pay a premium for eco-friendly products. This, in turn, is pushing brands to source sustainable textile auxiliaries that align with their environmental commitments. The availability of relevant certifications, such as OEKO-TEX®, GOTS (Global Organic Textile Standard), and ZDHC (Zero Discharge of Hazardous Chemicals), is further driving manufacturers to develop biodegradable and non-toxic solutions. As a result, leading players, such as Archroma, Huntsman, and Indian firms like Rossari Biotech, are heavily investing in R&D to innovate bio-based textile auxiliaries, shaping the industry's sustainable future.

To get more information on this market, Request Sample

Increasing Adoption of Smart and Functional Finishing Auxiliaries

The Indian textile industry is witnessing a surge in the adoption of smart and functional textile auxiliaries that enhance fabric properties, offering features, such as antimicrobial protection, moisture-wicking capabilities, UV resistance, and wrinkle-free finishes. The surging emphasis on hygiene has significantly increased the demand for antibacterial and antiviral textile treatments, with a 2023 study by the Textile Association of India reporting a 35% rise in antimicrobial auxiliaries for medical textiles and athleisure. Additionally, the booming athleisure and performance wear segment is fueling demand for high-performance textile auxiliaries, with the Indian sportswear market projected to grow at a CAGR of 5.10% between 2025 and 2033 from USD 10.2 million to USD 16.6 million. Besides this, the advent of smart textiles in fashion and home furnishings, which incorporate breakthroughs, such as phase-change materials (PCMs) for temperature management and self-cleaning fabrics, is acting as another significant growth-inducing factor. Consumers are increasingly seeking long-lasting and pleasant textiles, driving major manufacturers, such as Huntsman, BASF, and India's Fineotex Chemical, to invest in intelligent auxiliaries. This trend toward sophisticated textile solutions is redefining the industry by meeting changing customer expectations for functionality and sustainability.

India Textile Auxiliaries Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Dyeing and Printing Agents

- Pretreatment Agents

- Finishing Agents

The report has provided a detailed breakup and analysis of the market based on the product. This includes dyeing and printing agents, pretreatment agents, and finishing agents.

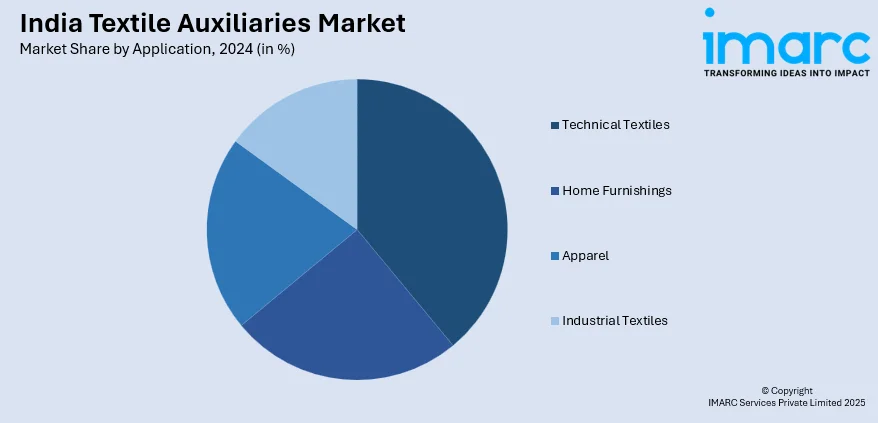

Application Insights:

- Technical Textiles

- Home Furnishings

- Apparel

- Industrial Textiles

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes technical textiles, home furnishings, apparel, and industrial textiles.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Textile Auxiliaries Market News:

- December 2024: Ministry of Textiles approved grants of approximately INR 50 lakh each to two start-ups under the National Technical Textiles Mission (NTTM). These start-ups focus on sustainable textiles and medical textiles, which will drive the demand for textile auxiliaries.

- October 2024: U.S.-based textile recycling start-up Circ partnered with India's Aditya Birla Group's Birla Cellulose to scale Circ's recycling technology. Birla Cellulose committed to purchasing at least 5,000 metric tons of pulp annually from Circ's first large-scale commercial plant over five years, converting the pulp into lyocell fibre for clothing production, thereby boosting textile auxiliaries demand.

India Textile Auxiliaries Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dyeing and Printing Agents, Pretreatment Agents, Finishing Agents |

| Applications Covered | Technical Textiles, Home Furnishings, Apparel, Industrial Textiles |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India textile auxiliaries market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India textile auxiliaries market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India textile auxiliaries industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The textile auxiliaries market in India reached USD 0.85 Billion in 2024.

The market is forecast to grow at a CAGR of 3.75% from 2025-2033, reaching USD 1.18 Billion by 2033.

Rising demand for eco-friendly chemicals, increased textile production, and government incentives like the PLI scheme are key drivers. Sustainability regulations and functional textile innovations also support India textile auxiliaries market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)