India Textile Dyes Market Size, Share, Trends and Forecast by Dye Type, Fiber Type, Application, and Region, 2025-2033

India Textile Dyes Market Overview:

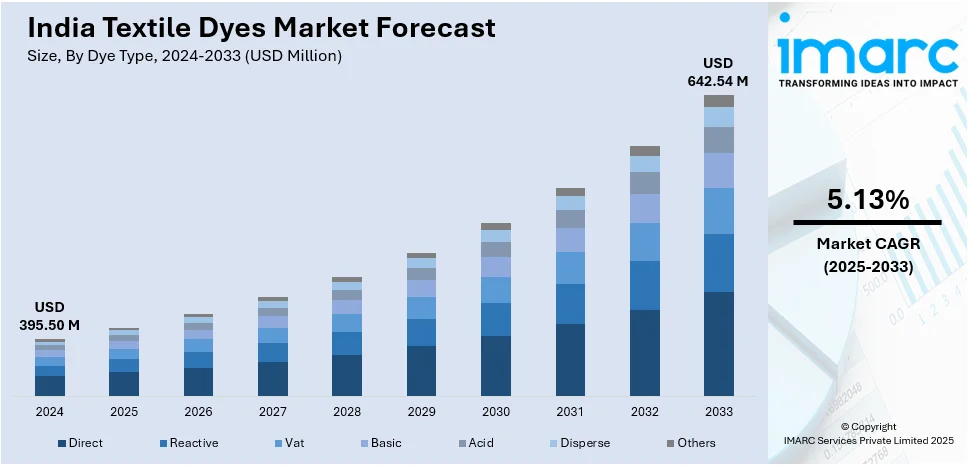

The India textile dyes market size reached USD 395.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 642.54 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The rising demand for sustainable and eco-friendly dyes, increasing textile production fueled by exports and domestic consumption, government initiatives promoting natural dyes, advancements in dyeing technology, and a growing preference for high-performance synthetic dyes in apparel and home textiles are positively impacting India textile dyes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 395.50 Million |

| Market Forecast in 2033 | USD 642.54 Million |

| Market Growth Rate (2025-2033) | 5.13% |

India Textile Dyes Market Trends:

Growing Demand for High-Performance Synthetic Dyes

The rising demand for high-performance synthetic dyes in technical textiles, sportswear, and home furnishings is positively influencing the India textile dyes market outlook. Polyester and nylon-based fabrics require dispersed dyes with superior wash, light, and perspiration fastness, making them ideal for high-end applications. According to IBEF, by 2030, the Indian textile and apparel market will reach USD 350 Billion at a 10% compound annual growth rate (CAGR), with USD 100 Billion in anticipated exports. This expansion of India's textile sector is driving the need for specialty dye formulations. Reactive and vat dyes, known for their superior durability and colorfastness, are widely used in cotton and cellulosic fiber processing. With global brands sourcing from India, dye manufacturers are focusing on high-quality, precision-engineered dyes that offer enhanced resistance to fading, friction, and harsh laundering conditions. Additionally, advancements in dye chemistry, such as nanotechnology-based coatings and microencapsulation techniques, are improving dye performance and meeting stringent international quality standards.

To get more information on this market, Request Sample

Technological Advancements in Digital Textile Printing

The adoption of digital textile printing technology is propelling the India textile dyes market growth, reducing water consumption, chemical waste, and production time. Unlike conventional dyeing processes, which require large dye baths and excess rinsing, digital printing uses precision inkjet technology to apply dyes directly onto the fabric, enhancing efficiency and sustainability. Reactive, acid and dispersed inks are formulated specifically for digital applications, catering to cotton, silk, and polyester textiles. On February 8, 2025, a high-volume digital textile printer with a daily production capability of up to 13,000 square meters, the Fab Jet Pro was introduced by ColorJet India Ltd. Together with its sticky belt technology and 32 Kyocera or 48 Konica Minolta print heads, this 3.2-meter-wide machine produces prints with remarkable clarity. The Fab Jet Pro's sustainable design lowers energy and water usage, which is consistent with environmentally friendly manufacturing methods. The growing penetration of e-commerce and personalized fashion further supports digital printing adoption. Major textile hubs, including Surat and Tiruppur, are investing in digital printing infrastructure, leveraging advancements such as pigment-based inks that require minimal post-processing while offering high color vibrancy and durability.

India Textile Dyes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on dye type, fiber type, and application.

Dye Type Insights:

- Direct

- Reactive

- Vat

- Basic

- Acid

- Disperse

- Others

The report has provided a detailed breakup and analysis of the market based on the dye type. This includes direct, reactive, vat, basic, acid, disperse, and others.

Fiber Type Insights:

- Wool

- Nylon

- Cotton

- Viscose

- Polyester

- Others

A detailed breakup and analysis of the market based on the fiber type have also been provided in the report. This includes wool, nylon, cotton, viscose, polyester, and others.

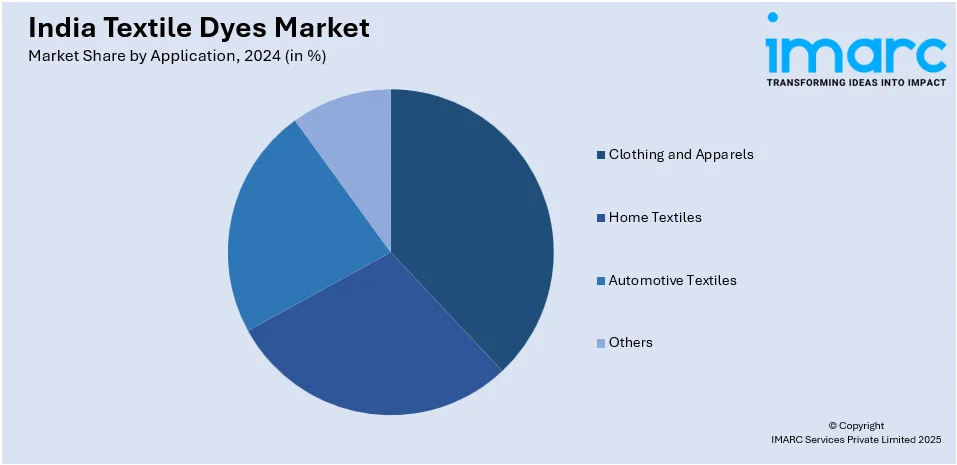

Application Insights:

- Clothing and Apparels

- Home Textiles

- Automotive Textiles

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes clothing and apparels, home textiles, automotive textiles, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Textile Dyes Market News:

- On February 12, 2025, Union Minister of Textiles, Shri Giriraj Singh, inaugurated the Garment Technology Expo, DyeChem World Bharat Tex 2025, and the Indian Handicrafts Pavilion at the India Expo Centre & Mart in Greater Noida. These events, featuring over 1,000 exhibitors, aim to showcase advancements in apparel production technology, sustainable dyes and chemicals, and a diverse range of handcrafted products, respectively.

- On February 16, 2025, India's Ministry of Textiles and the European Union unveiled seven initiatives to develop the country's handicraft and textile industries. These projects, which have a total budget of EUR 9.5 Million (about USD 9.87 Million), would help 35,000 people in nine states, including farmers, artisans, and MSMEs. The initiatives will concentrate on the manufacture and promotion of natural dyes, bamboo crafts, handlooms, shawls, traditional handicrafts, and textiles.

India Textile Dyes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Dye Types Covered | Direct, Reactive, Vat, Basic, Acid, Disperse, Others |

| Fiber Types Covered | Wool, Nylon, Cotton, Viscose, Polyester, Others |

| Applications Covered | Clothing and Apparels, Home Textiles, Automotive Textiles, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India textile dyes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India textile dyes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India textile dyes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The textile dyes market in India was valued at USD 395.50 Million in 2024.

The India textile dyes market is projected to exhibit a CAGR of 5.13% during 2025-2033, reaching a value of USD 642.54 Million by 2033.

The India textile dyes market is driven by rapid textile and apparel growth, increasing synthetic fiber use, and rising domestic fashion demand. Environmental regulations and consumer shifts led to the adoption of sustainable, eco-friendly, and biodegradable dyes. Technological advances, digital printing, advanced dye processes, and government support like PLI and textile parks further bolster market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)