India Textile Manufacturing Market Size, Share, Trends and Forecast by Process Type, Textile Type, Equipment and Machinery, and Region, 2025-2033

India Textile Manufacturing Market Overview:

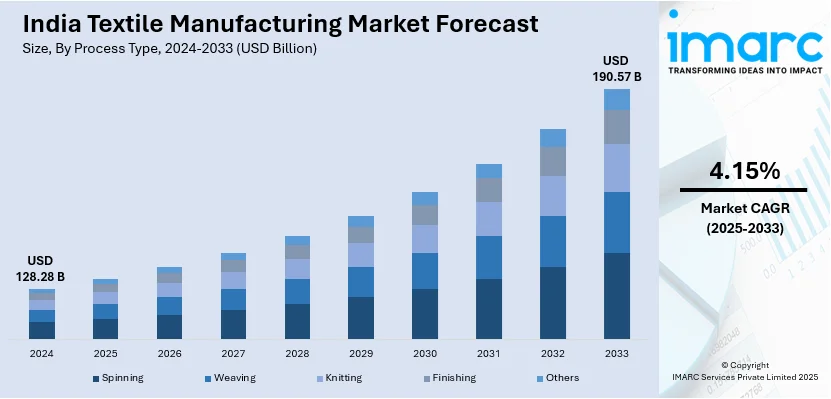

The India textile manufacturing market size reached USD 128.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 190.57 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The market is expanding due to government initiatives like the PLI scheme, rising exports, and increasing domestic demand for apparel and home textiles. The sector benefits from technological advancements, growing synthetic fiber adoption, and sustainability-focused production. Additionally, foreign investments and e-commerce-driven sales growth are accelerating industry expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 128.28 Billion |

| Market Forecast in 2033 | USD 190.57 Billion |

| Market Growth Rate (2025-2033) | 4.15% |

India Textile Manufacturing Market Trends:

Expansion of Sustainable and Eco-Friendly Textiles

Sustainability is becoming a major focus in India’s textile industry, driven by rising consumer awareness, regulatory mandates, and global demand for eco-friendly products. Manufacturers are increasingly investing in organic cotton, recycled fibers, and water-efficient dyeing technologies. Several textile firms are implementing zero-liquid discharge (ZLD) facilities and using plant-based dyes to reduce their environmental footprint. A notable example of this includes the identification of four non-toxic ionic liquids by IASST Guwahati researchers in July 2024 capable of efficiently extracting silk proteins from raw fibers, providing an eco-friendly substitute for conventional toxic chemicals in silk processing. This advancement promotes sustainability in the textile industry by minimizing environmental impact and enhancing resource efficiency. The demand for certified sustainable fabrics, such as those with GOTS (Global Organic Textile Standard) or OEKO-TEX certification, is increasing as international buyers emphasize responsible sourcing. Additionally, the circular economy is gaining traction, with companies exploring fabric recycling and biodegradable materials. Sustainability-focused innovation is expected to shape India’s textile manufacturing landscape, enhancing competitiveness in global markets. For instance, in February 2025, the EU and India’s Ministry of Textiles launched seven projects across nine states to boost the textile and handicraft sector, funded by a €9.5 million (₹85.5 crore) grant. These projects will promote sustainability, circular economy, and economic empowerment, benefiting 35,000 direct participants, including 200,000 women. The initiatives focus on natural dyes, bamboo crafts, handlooms, and traditional textiles, enhancing branding and market access. This aligns with India's Sustainable Bharat Mission for Textiles, reinforcing India-EU cooperation in sustainable manufacturing.

To get more information on this market, Request Sample

Rise of Automation and Digitalization in Manufacturing

Automation and digitalization are transforming India’s textile manufacturing sector, enhancing efficiency, precision, and scalability. For instance, Bharat Tex 2025, India's flagship textile event, saw participation from 250 technical textile firms and 370 foreign buyers, highlighting India's advancements in man-made fiber textiles and the growing $22 billion technical textile sector. With 5,000 exhibitors from 120+ countries, the event showcased innovations across the textile value chain, including fiber, yarn, garments, and home textiles. Organized by MATEXIL, the event emphasized investment opportunities in textile recycling and strategies to expand exports of technical textiles globally. The adoption of AI-powered predictive maintenance, automated fabric cutting, and robotic-assisted garment assembly is optimizing production cycles and reducing waste. Digital printing technologies are replacing traditional water-intensive dyeing methods, offering cost-effective, high-quality designs with minimal environmental impact. Industry 4.0 practices, including IoT-enabled textile mills and cloud-based inventory management, are improving real-time decision-making and supply chain agility. Additionally, blockchain adoption is strengthening traceability and transparency, particularly for export markets that demand ethical sourcing and compliance adherence. As textile firms embrace data-driven manufacturing, operational efficiencies are improving, positioning India as a competitive player in global textile exports.

India Textile Manufacturing Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on process type, textile type, and equipment and machinery.

Process Type Insights:

- Spinning

- Weaving

- Knitting

- Finishing

- Others

The report has provided a detailed breakup and analysis of the market based on the process type. This includes spinning, weaving, knitting, finishing, and others.

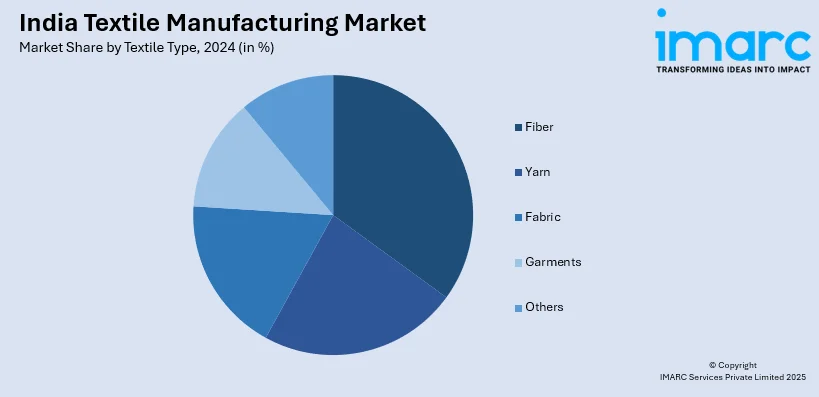

Textile Type Insights:

- Fiber

- Yarn

- Fabric

- Garments

- Others

A detailed breakup and analysis of the market based on the textile type have also been provided in the report. This includes fiber, yarn, fabric, garments, and others.

Equipment and Machinery Insights:

- Simple Machines

- Automated Machines

- Console/Assembly Line Installations

A detailed breakup and analysis of the market based on the equipment and machinery have also been provided in the report. This includes simple machines, automated machines, and console/assembly line installations.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Textile Manufacturing Market News:

- In February 2025, South Eastern Coalfield Limited (SECL) and the Apparel Training & Design Centre (ATDC) signed an MoU to provide skill training to 400 candidates from economically weaker sections in Bishrampur, Sohagpur, Korba, and Chhindwara districts. The initiative includes residential training in Self-employed Tailor and Apparel Manufacturing Technology courses. SECL aims to enhance employment opportunities in the textile sector, supporting both wage and self-employment. ATDC has trained over 400,000 candidates, reinforcing the initiative’s impact on India's garment and textile industry.

- In February 2025, Trident Group is preparing for a greenfield expansion in India's textile manufacturing sector, allocating ₹1,000 crore for FY26 to drive sustainability, modernization, and asset enhancement. The company emphasized India's shift from a low-cost textile producer to a premium quality and brand-driven market. With 85-90% of its revenue from exports, Trident aims to strengthen its domestic home textiles presence, leveraging India’s growing textile industry and increasing demand for high-quality, locally manufactured textile products.

- In March 2025, CottonConnect signed an MoU with the Indian government to promote Kasturi Cotton, India’s premium cotton brand, and will launch a pilot project in Gujarat or Maharashtra. The initiative aims to enhance sustainability, empower farmers, and strengthen India's textile supply chain. The project supports India’s cotton sector modernization, improving quality, traceability, and global market competitiveness, aligning with the government’s sustainability and economic growth goals in the textile industry.

- In February 2025, Primus Partners, in collaboration with the Maharashtra government, launched a roadmap for a zero-waste textile industry by 2047 at Bharat Tex 2025. The report focuses on sustainability, circular economy principles, and resource efficiency across the textile value chain. It recommends financial incentives, policy support, and textile waste collection centers to tackle waste valued at USD 3.5 Billion over five years. Key strategies include eco-friendly fiber production, circular fashion initiatives, and a National Policy for Sustainable Textiles to drive industry transformation.

- In February 2025, Shein re-entered the Indian market through a partnership with Reliance Retail's subsidiary, Nextgen Fast Fashion. The Shein India app offers products manufactured, marketed, and sold exclusively by Nextgen, utilizing a network of Indian manufacturers, predominantly micro, small, and medium enterprises (MSMEs). The platform is developed and hosted entirely in India, ensuring data localization with no access granted to Shein. This initiative aims to boost Indian MSME exports and create local employment opportunities.

India Textile Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Process Types Covered | Spinning, Weaving, Knitting, Finishing, Others |

| Textile Types Covered | Fiber, Yarn, Fabric, Garments, Others |

| Equipment and Machineries Covered | Simple Machines, Automated Machines, Console/Assembly Line Installations |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India textile manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India textile manufacturing market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India textile manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The textile manufacturing market in India was valued at USD 128.28 Billion in 2024.

The India textile manufacturing market is projected to exhibit a CAGR of 4.15% during 2025-2033, reaching a value of USD 190.57 Billion by 2033.

India’s textile manufacturing sector grows on the back of government incentives like PLI and PM MITRA parks, rising domestic consumption, new tech adoption, and a sustainability push. Shifting global sourcing patterns and trade deals open export avenues. Automation, eco-friendly practices, and demand for affordable fashion keep the industry competitive and expanding.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)