India Thermal Energy Storage Market Size, Share, Trends and Forecast by Storage Type, Technology, Material Type, Application, and Region, 2025-2033

India Thermal Energy Storage Market Overview:

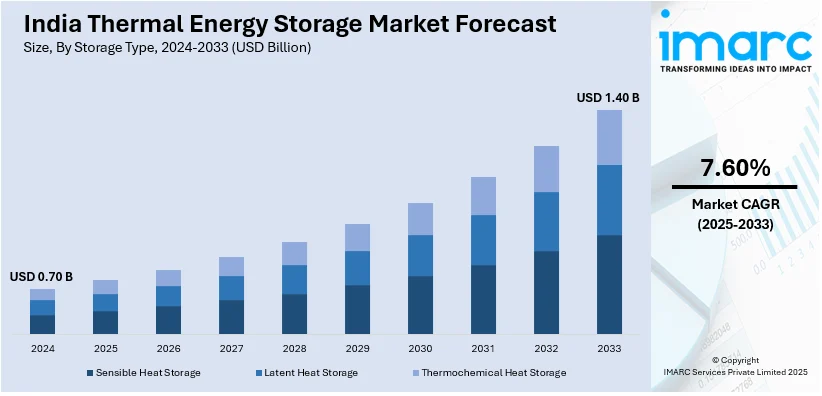

The India thermal energy storage market size reached USD 0.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.40 Billion by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. The India thermal energy storage market share is expanding, driven by the rising installation of district cooling systems in metro cities, particularly in large-scale infrastructure developments, along with the growing adoption of artificial intelligence (AI) to enhance predictive maintenance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.70 Billion |

| Market Forecast in 2033 | USD 1.40 Billion |

| Market Growth Rate 2025-2033 | 7.60% |

India Thermal Energy Storage Market Trends:

Growing investments in infrastructure projects

Rising investments in infrastructure projects are offering a favorable India thermal energy storage market outlook. Increasing construction activities drive the demand for efficient heating, cooling, and energy management solutions. Infrastructure expansion in smart city projects is also accelerating the utilization of thermal storage solutions to regulate peak electricity needs and enhance grid stability. In August 2024, the Cabinet Committee on Economic Affairs (CCEA) of India sanctioned 12 smart city initiatives within the National Industrial Corridor Development Programme (NICDP) with an expenditure of INR 286.02 Billion (USD 3.41 Billion). These proposals were anticipated to draw INR 1.52 Trillion (USD18.12 Billion) in funding from major sectors, generating 1 Million direct and 3 Million indirect employment opportunities. Large commercial complexes, hospitals, and educational institutions are adopting thermal energy storage systems to optimize power usage and ensure uninterrupted energy supply. With rapid urbanization, residential complexes and industrial facilities are integrating thermal energy storage to refine energy efficiency and reduce operational costs. The rising installation of district cooling systems in metro cities is further catalyzing the demand, particularly in large-scale infrastructure developments. Additionally, government initiatives promoting sustainable construction practices are encouraging developers to incorporate eco-friendly systems, where thermal energy storage plays a key role in improving building performance.

To get more information on this market, Request Sample

Advancements in technology

Improvements in technology are impelling the India thermal energy storage market growth. Innovations in molten salt storage systems are enhancing heat retention, making them ideal for concentrated solar power (CSP) plants, which are expanding in India. Enhanced insulation materials and control systems are also increasing storage efficiency by minimizing heat loss and enabling precise temperature management. Advanced software solutions are optimizing the operations of thermal energy storage systems by integrating smart sensors and automation technologies, allowing real-time energy monitoring and improved load management. The integration of AI and machine learning (ML) is further enhancing predictive maintenance, system performance, and energy forecasting, contributing to refined energy management in large-scale projects. Additionally, innovations in modular and scalable designs are making thermal energy storage solutions more adaptable for diverse applications, including industrial heat recovery processes. Apart from this, education institutions and firms are working to come up with modern solutions to cater to the evolving requirements. In January 2025, IIT Kanpur initiated its yearly startup festival, Abhivyakti, highlighting entrepreneurial enthusiasm and innovative accomplishments. IIT Kanpur launched a ‘Thermal Management System’ based on phase change materials, developed by Prof. Sri Sivakumar. This advanced technology aimed to improve cold chain logistics by providing better thermal conductivity and energy storage for applications in food item preservation.

India Thermal Energy Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on storage type, technology, material type, and application.

Storage Type Insights:

- Sensible Heat Storage

- Latent Heat Storage

- Thermochemical Heat Storage

The report has provided a detailed breakup and analysis of the market based on the storage types. This includes sensible heat storage, latent heat storage, and thermochemical heat storage.

Technology Insights:

- Molten Salt Technology

- Electric Thermal Storage Heaters

- Solar Energy Storage

- Ice-Based Technology

- Miscibility Gap Alloy Technology (MGA)

- Others

A detailed breakup and analysis of the market based on the technologies have also been provided in the report. This includes molten salt technology, electric thermal storage heaters, solar energy storage, ice-based technology, miscibility gap alloy technology (MGA), and others.

Material Type Insights:

- Water

- Molten Salt

- Phase Change Materials (PCM)

- Others

The report has provided a detailed breakup and analysis of the market based on the material types. This includes water, molten salt, phase change materials (PCM), and others.

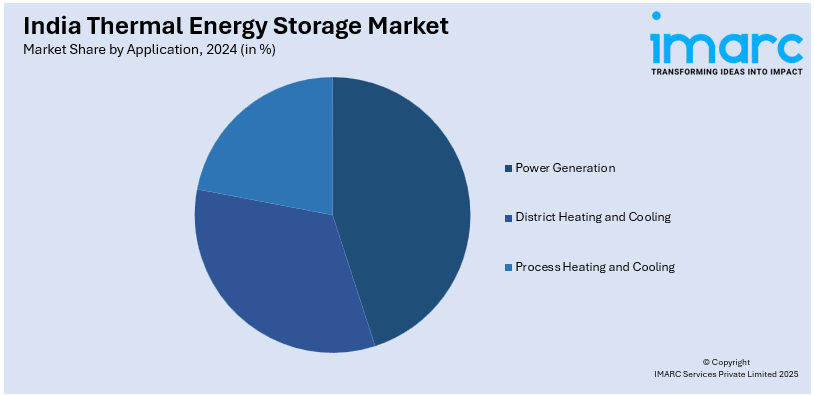

Application Insights:

- Power Generation

- District Heating and Cooling

- Process Heating and Cooling

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes power generation, district heating and cooling, and process heating and cooling.

End-Use Insights:

- Residential and Commercial Sector

- Utility Industry

- Others

A detailed breakup and analysis of the market based on the end-uses have also been provided in the report. This includes residential and commercial sector, utility industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Thermal Energy Storage Market News:

- In March 2025, PURE Energy (PURE) unveiled its new energy storage range, PuREPower, in Hyderabad, India. It is engineered for smooth incorporation across residential areas, commercial enterprises, and large-scale grid systems. PuREPower sought to improve energy efficiency and sustainability.

- In May 2024, India Power Corporation Ltd teamed up with E2S Power to create a 250Kwh TESS for effective energy storage, facilitating the integration of renewable energy and assisting India in achieving its net zero emission goals. The technology provided adaptability in thermal power activities and supported the Make in India initiative.

India Thermal Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Storage Types Covered | Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage |

| Technologies Covered | Molten Salt Technology, Electric Thermal Storage Heaters, Solar Energy Storage, Ice-Based Technology, Miscibility Gap Alloy Technology (MGA), Others |

| Material Types Covered | Water, Molten Salt, Phase Change Materials (PCM), Others |

| Applications Covered | Power Generation, District Heating and Cooling, Process Heating and Cooling |

| End-Uses Covered | Residential and Commercial Sector, Utility Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India thermal energy storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India thermal energy storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India thermal energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The thermal energy storage market in India was valued at USD 0.70 Billion in 2024.

The India thermal energy storage market is projected to exhibit a (CAGR) of 7.60% during 2025-2033, reaching a value of USD 1.40 Billion by 2033.

Key drivers of the India thermal energy storage market are growing integration of solar power plants needing efficient heat retention systems and growing demand for dispatchable and reliable energy. Support of government policies to increase renewable energy capacity and ease grid pressure also favors investment. Growth of industry in sectors such as cement and steel, which demand continuous high-temperature processes, also fuels India thermal energy storage market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)