India Thermal Power Plant Equipment Market Size, Share, Trends and Forecast by Equipment Type, Fuel Type, Capacity, Technology, and Region, 2025-2033

India Thermal Power Plant Equipment Market Overview:

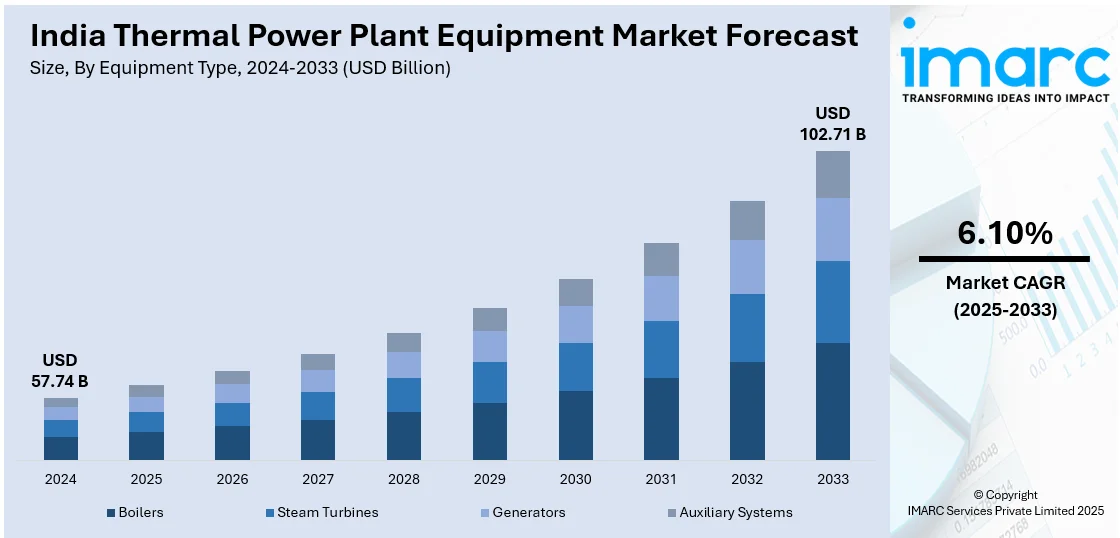

The India thermal power plant equipment market size reached USD 57.74 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 102.71 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The rising electricity demand, ongoing industrialization, expansion of urban infrastructure, increasing investments in coal-based and hybrid thermal projects, government support through schemes and growing replacement needs for aging equipment are some of the major factors augmenting India thermal power plant equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57.74 Billion |

| Market Forecast in 2033 | USD 102.71 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

India Thermal Power Plant Equipment Market Trends:

Shift Toward Supercritical and Ultra-Supercritical Technology

The transition from subcritical to supercritical and ultra-supercritical technologies is positively impacting the India thermal power plant equipment market outlook. Advanced ultra-supercritical plants (AUSC) operate at higher temperatures and pressures, which significantly increases thermal efficiency, allowing more electricity generation with less coal. According to an industry report, thermal power plants utilizing AUSC technology will attain a plant efficiency of 46%, in contrast to subcritical power plants' approximate efficiency of 38%. This will reduce carbon dioxide emissions and coal usage by 11% as compared to supercritical facilities. This shift is critical for India's climate commitments under the Paris Agreement, as it helps reduce carbon dioxide per unit of electricity produced. In addition to this, supportive government policies, such as the mandatory adoption of supercritical technology for new plants above a certain capacity threshold and incentives for higher efficiency projects, are accelerating market expansion. Furthermore, leading equipment manufacturers, including Bharat Heavy Electricals Limited (BHEL) and L&T-MHPS, are investing in advanced turbine and boiler manufacturing capabilities to meet market demand. In line with this, states such as Tamil Nadu, Maharashtra, and Chhattisgarh are leading in commissioning supercritical units, contributing to localized demand for upgraded equipment. This trend is also increasing the domestic manufacturing ecosystem, with greater emphasis on indigenization under the "Make in India" initiative.

To get more information on this market, Request Sample

Rising Electricity Demand Across Urban and Rural India

Electricity consumption in India has been climbing steadily, driven by residential growth, rising middle-class incomes, and increasing penetration of electric appliances across both urban and rural areas. According to an industry report, India's per capita electricity consumption increased by 45.8% (438 kWh) from 957 kWh in 2013–14 to 1,395 kWh in 2023–24. Additionally, the implementation of supportive government initiatives to provide last-mile electricity access, including Saubhagya and DDUGJY, is expanding the consumer base significantly. This further place pressure on utilities to ramp up generation capacity, pushing investment into thermal infrastructure despite the policy focus on renewables. In line with this, peak load demand, especially in summer months, continues to exceed forecasts, highlighting the reliance on thermal plants for base load stability. The increasing requirement for flexible thermal systems and equipment upgrades to meet grid reliability standards is facilitating the India thermal power plant equipment market growth. Also, distribution companies prefer thermal due to predictability in output. Manufacturers are responding with high-efficiency boilers, turbines, and pollution control equipment designed to meet emission norms without compromising power output. This rising demand environment is encouraging life extension and modernization of older plants, creating ongoing opportunities for equipment suppliers.

India Thermal Power Plant Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on equipment type, fuel type, capacity, and technology.

Equipment Type Insights:

- Boilers

- Steam Turbines

- Generators

- Auxiliary Systems

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes boilers, steam turbines, generators, and auxiliary systems.

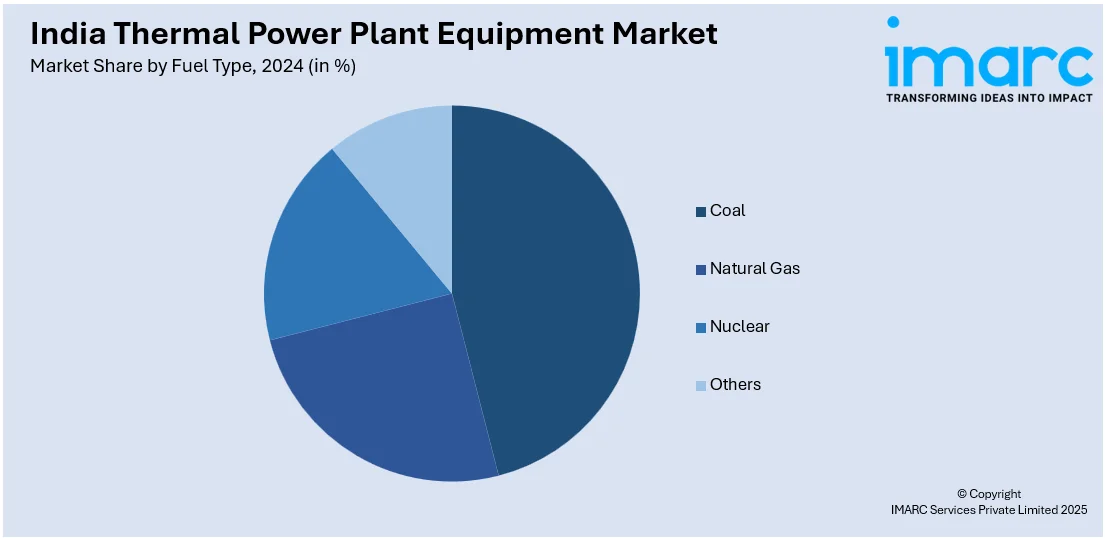

Fuel Type Insights:

- Coal

- Natural Gas

- Nuclear

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes coal, natural gas, nuclear, and others.

Capacity Insights:

- Up to 400 MW

- 400-800 MW

- Above 800 MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes up to 400 MW, 400-800 MW, and above 800 MW.

Technology Insights:

- Conventional

- Supercritical

- Ultra-Supercritical

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes conventional, supercritical, and ultra-supercritical.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Thermal Power Plant Equipment Market News:

- On February 15, 2025, Bharat Heavy Electricals Limited (BHEL) secured a contract from Damodar Valley Corporation (DVC) to supply and install the steam generator (boilers) island package for Phase-II of the 2×660 MW Raghunathpur Thermal Power Station in Purulia district, West Bengal. This contract, awarded through international competitive bidding, encompasses design, engineering, manufacturing, erection, testing, and commissioning of the boiler package, including auxiliaries and emission control equipment.

India Thermal Power Plant Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Boilers, Steam Turbines, Generators, Auxiliary Systems |

| Fuel Types Covered | Coal, Natural Gas, Nuclear, Others |

| Capacities Covered | Up to 400 MW, 400-800 MW, Above 800 MW |

| Technologies Covered | Conventional, Supercritical, Ultra-Supercritical |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India thermal power plant equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India thermal power plant equipment market on the basis of equipment type?

- What is the breakup of the India thermal power plant equipment market on the basis of fuel type?

- What is the breakup of the India thermal power plant equipment market on the basis of capacity?

- What is the breakup of the India thermal power plant equipment market on the basis of technology?

- What is the breakup of the India thermal power plant equipment market on the basis of region?

- What are the various stages in the value chain of the India thermal power plant equipment market?

- What are the key driving factors and challenges in the India thermal power plant equipment?

- What is the structure of the India thermal power plant equipment market and who are the key players?

- What is the degree of competition in the India thermal power plant equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India thermal power plant equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India thermal power plant equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India thermal power plant equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)