India Thin Film Battery Market Size, Share, Trends and Forecast by Technology, Battery Type, Voltage Type, Application, and Region, 2026-2034

India Thin Film Battery Market Overview:

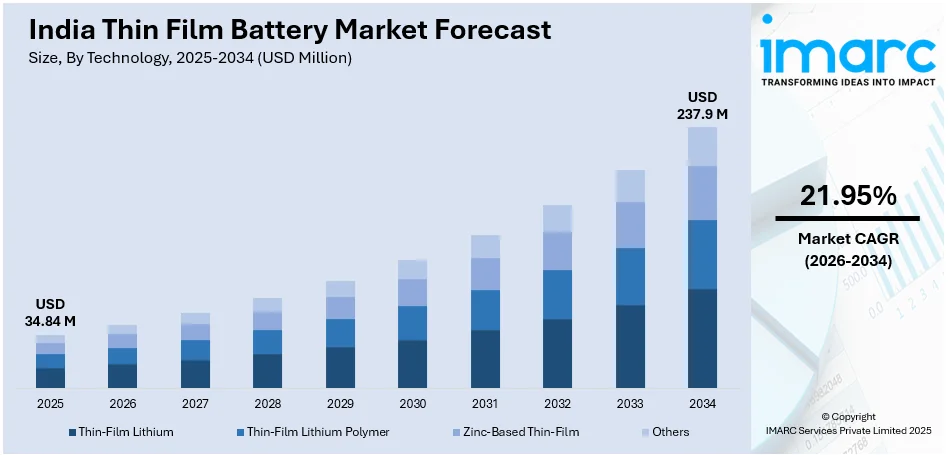

The India thin film battery market size reached USD 34.84 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 237.9 Million by 2034, exhibiting a growth rate (CAGR) of 21.95% during 2026-2034. The increasing adoption in IoT devices, wearables, and medical implants, government initiatives supporting clean energy technologies, advancements in flexible battery designs, and growing investments in research and development (R&D) activities for enhanced battery efficiency and lifespan are some of the major factors positively impacting India thin film battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 34.84 Million |

| Market Forecast in 2034 | USD 237.9 Million |

| Market Growth Rate (2026-2034) | 21.95% |

India Thin Film Battery Market Trends:

Increasing Adoption of Thin Film Batteries in IoT and Wearable Devices

The demand for thin film batteries in India is growing as IoT devices and wearable technologies become more widespread. According to an industry report, India ranks among the biggest wearables markets by 2023. By the end of 2023, India supplied 130–135 million of the 504.1 million devices that are exported. In addition, the Indian wearables market expanded by 121% in the first quarter of 2023 compared to the same period in 2022. This rapid growth is fueling innovation in battery technology, with compact, lightweight, and flexible thin-film batteries becoming essential for powering advanced wearable devices. The proliferation of IoT in industries such as healthcare, consumer electronics, and industrial automation is driving the need for power sources that can provide stable performance with a small form factor. Additionally, continual advancements in sensor technology and wireless communication protocols, including 5G, are accelerating the deployment of IoT devices in India. Thin film batteries support this trend by providing efficient, long-lasting power with a lower risk of overheating or leakage, unlike conventional lithium-ion batteries. Moreover, the implementation of supportive government initiatives promoting digitalization and smart infrastructure is further strengthening the India thin film battery market growth.

To get more information on this market Request Sample

Expansion of Consumer Electronics Manufacturing

India’s consumer electronics sector is witnessing unprecedented growth, driven by inflating disposable incomes, digital penetration, and government initiatives promoting domestic production. India wants to produce USD 300 Billion worth of electronics by 2026, according to a report from the Ministry of Electronics and IT. Also, government schemes is encouraging multinational companies and local manufacturers to establish production facilities in the country. As a result, India emerges as a significant hub for smartphones, laptops, and other portable devices. With this expansion, there is a heightened demand for advanced, compact, and efficient battery solutions that can power increasingly miniaturized and high-performance devices. Thin film batteries, with their ultra-thin design, high energy density, and flexibility, have become a preferred choice for next-generation electronics. Their ability to be integrated into flexible displays, wireless sensors, and smart cards further enhances their appeal. The transition toward 5G-enabled devices and AI-driven electronics is also influencing battery requirements, making thin film technology more relevant. As India continues to strengthen its local manufacturing ecosystem, the demand for innovative energy storage solutions will accelerate, positioning thin film batteries as a key component of the country’s electronics revolution, thereby enhancing the India thin film battery market outlook.

India Thin Film Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on technology, battery type, voltage type, and application.

Technology Insights:

- Thin-Film Lithium

- Thin-Film Lithium Polymer

- Zinc-Based Thin-Film

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes thin-film lithium, thin-film lithium polymer, zinc-based thin-film, and others.

Battery Type Insights:

- Rechargeable

- Disposable

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes rechargeable and disposable.

Voltage Type Insights:

- Below 1.5V

- 1.5V to 3V

- Above 3V

The report has provided a detailed breakup and analysis of the market based on the voltage type. This includes below 1.5V, 1.5V to 3V, and above 3V.

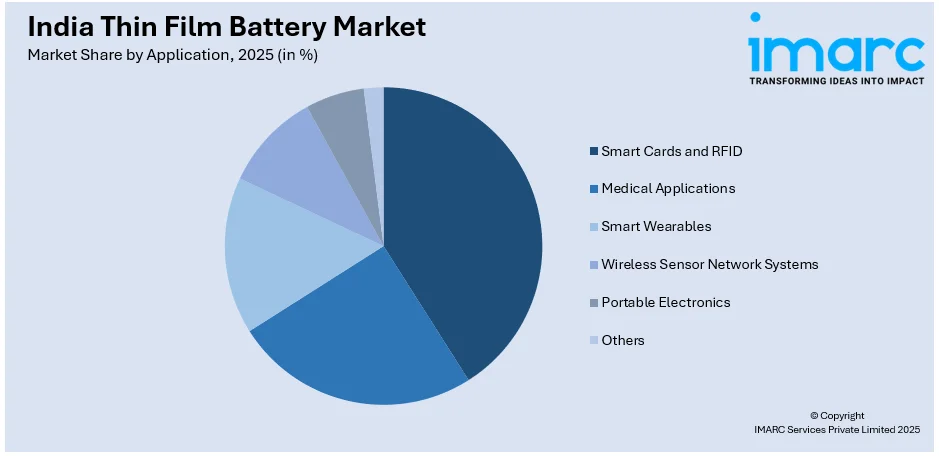

Application Insights:

Access the comprehensive market breakdown Request Sample

- Smart Cards and RFID

- Medical Applications

- Smart Wearables

- Wireless Sensor Network Systems

- Portable Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes smart cards and RFID, medical applications, smart wearables, wireless sensor network systems, portable electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Thin Film Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Thin-Film Lithium, Thin-Film Lithium Polymer, Zinc-Based Thin-Film, Others |

| Battery Types Covered | Rechargeable, Disposable |

| Voltage Types Covered | Below 1.5V, 1.5V to 3V, Above 3V |

| Applications Covered | Smart Cards and RFID, Medical Applications, Smart Wearables, Wireless Sensor Network Systems, Portable Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India thin film battery market performed so far and how will it perform in the coming years?

- What is the breakup of the India thin film battery market on the basis of technology?

- What is the breakup of the India thin film battery market on the basis of battery type?

- What is the breakup of the India thin film battery market on the basis of voltage type?

- What is the breakup of the India thin film battery market on the basis of application?

- What is the breakup of the India thin film battery market on the basis of region?

- What are the various stages in the value chain of the India thin film battery market?

- What are the key driving factors and challenges in the India thin film battery market?

- What is the structure of the India thin film battery market and who are the key players?

- What is the degree of competition in the India thin film battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India thin film battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India thin film battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India thin film battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)