India Thoracic Surgical Devices Market Size, Share, Trends and Forecast by Product, Indication, End User, and Region, 2025-2033

India Thoracic Surgical Devices Market Overview:

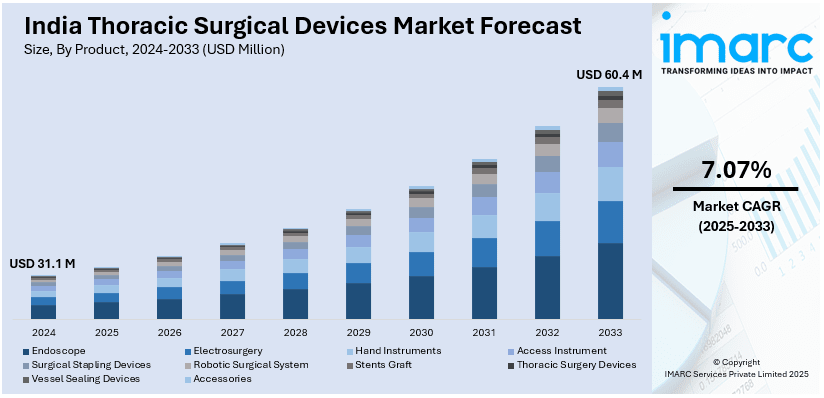

The India thoracic surgical devices market size reached USD 31.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 60.4 Million by 2033, exhibiting a growth rate (CAGR) of 7.07% during 2025-2033. The rising cardiothoracic surgeries, increasing prevalence of lung diseases, growing adoption of minimally invasive procedures, advancements in robotic-assisted surgery, expanding healthcare infrastructure, favorable government initiatives, increasing medical tourism, and higher investments in R&D for innovative surgical technologies are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 31.1 Million |

| Market Forecast in 2033 | USD 60.4 Million |

| Market Growth Rate (2025-2033) | 7.07% |

India Thoracic Surgical Devices Market Trends:

Rising Adoption of Robotic-Assisted Thoracic Procedures

Hospitals across India are increasingly integrating robotic-assisted systems to enhance precision in thoracic surgeries. Advanced surgical platforms enable minimally invasive procedures, reducing recovery time, post-operative pain, and complications for patients with lung and chest wall conditions. The availability of such technology in regional medical centers is improving access to specialized care, eliminating the need for patients to seek treatment in distant cities. This shift reflects a growing emphasis on technological advancements in surgical interventions, ensuring better patient outcomes. As more healthcare institutions invest in robotic-assisted capabilities, the adoption of minimally invasive thoracic procedures is expanding, catering to the rising demand for efficient and less traumatic surgical solutions in both metropolitan and tier-2 cities. For example, in July 2024, Pune's DPU Super Specialty Hospital inaugurated a dedicated robotic thoracic surgery department. Equipped with the advanced Da Vinci Xi system, the department offers minimally invasive surgeries for conditions like lung tumors and chest wall tumors. This initiative provides patients from Pune and neighboring regions access to cutting-edge thoracic care without the need to travel to distant cities.

To get more information on this market, Request Sample

Expansion of Telesurgery in Thoracic Procedures

India is witnessing rapid advancements in robotic-assisted surgeries, with telesurgery emerging as a key innovation in thoracic procedures. The successful deployment of indigenously developed surgical robotic systems highlights the increasing focus on enhancing accessibility to specialized care. By enabling surgeons to operate remotely with high precision, this technology can bridge geographical gaps, allowing expert intervention even in underserved regions. The integration of telesurgery is expected to improve patient outcomes by reducing dependency on physical proximity to advanced healthcare facilities. As more medical institutions explore robotic-assisted capabilities, the adoption of remote surgical solutions is gaining momentum, driving efficiency and precision in thoracic procedures. This shift signals a move toward a more technologically advanced and widely accessible surgical landscape. For instance, in June 2024, SS Innovations (SSI) achieved a significant milestone in India's thoracic surgical devices market by successfully conducting a human telesurgery trial using the indigenously developed SSi Mantra surgical robotic system. This advancement underscores India's growing capabilities in medical technology, potentially enhancing the accessibility and precision of thoracic surgeries nationwide.

India Thoracic Surgical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, indication, and end user.

Product Insights:

- Endoscope

- Electrosurgery

- Hand Instruments

- Access Instrument

- Surgical Stapling Devices

- Robotic Surgical System

- Stents Graft

- Thoracic Surgery Devices

- Vessel Sealing Devices

- Accessories

The report has provided a detailed breakup and analysis of the market based on the product. This includes endoscope, electrosurgery, hand instruments, access instrument, surgical stapling devices, robotic surgical system, stents graft, thoracic surgery devices, vessel sealing devices, and accessories.

Indication Insights:

- Lung Cancer

- Lymphoma

- Mediastinal Tumors

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes lung cancer, lymphoma, mediastinal tumors, and others.

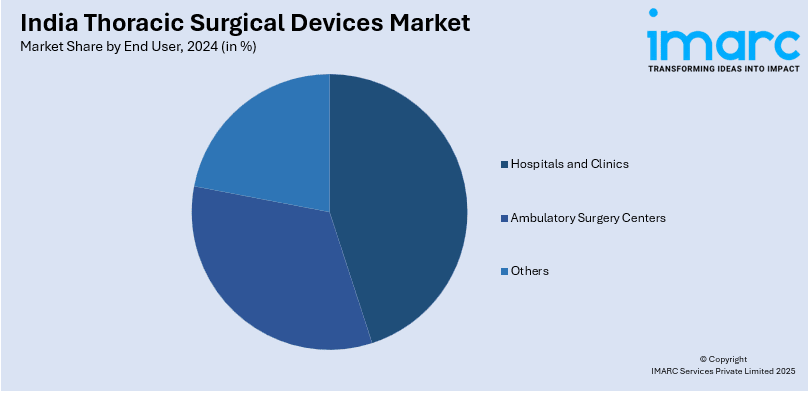

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgery centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Thoracic Surgical Devices Market News:

- In January 2025, Prashanth Hospitals, Chennai, launched an indigenously developed surgical robotic system, enhancing precision in cardiothoracic procedures. The system features tremor filtration, motor scaling, and a head-tracking safety monitor, ensuring patient safety. Equipped with four robotic arms and telesurgery capabilities, it supports minimally invasive thoracic surgeries. This development aligns with India's growing thoracic surgical devices market, driven by technological advancements and a shift toward robotic-assisted procedures.

- In January 2024, a hospital in Visakhapatnam introduced India's first state-of-the-art 4th Generation DaVinci robotic surgical system, enhancing precision in procedures like thoracic surgeries. This advancement aligns with the growing adoption of robotic-assisted surgeries in India, offering benefits such as smaller incisions and faster recovery.

India Thoracic Surgical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Endoscope, Electrosurgery, Hand Instruments, Access Instrument, Surgical Stapling Devices, Robotic Surgical System, Stents Graft, Thoracic Surgery Devices, Vessel Sealing Devices, Accessories |

| Indications Covered | Lung Cancer, Lymphoma, Mediastinal Tumors, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgery Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India thoracic surgical devices market performed so far and how will it perform in the coming years?

- What is the breakup of the India thoracic surgical devices market on the basis of product?

- What is the breakup of the India thoracic surgical devices market on the basis of indication?

- What is the breakup of the India thoracic surgical devices market on the basis of end user?

- What are the various stages in the value chain of the India thoracic surgical devices market?

- What are the key driving factors and challenges in the India thoracic surgical devices?

- What is the structure of the India thoracic surgical devices market and who are the key players?

- What is the degree of competition in the India thoracic surgical devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India thoracic surgical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India thoracic surgical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India thoracic surgical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)