India Three-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Passenger Vehicle, Fuel Type, and Region, 2025-2033

India Three-Wheeler Market Overview:

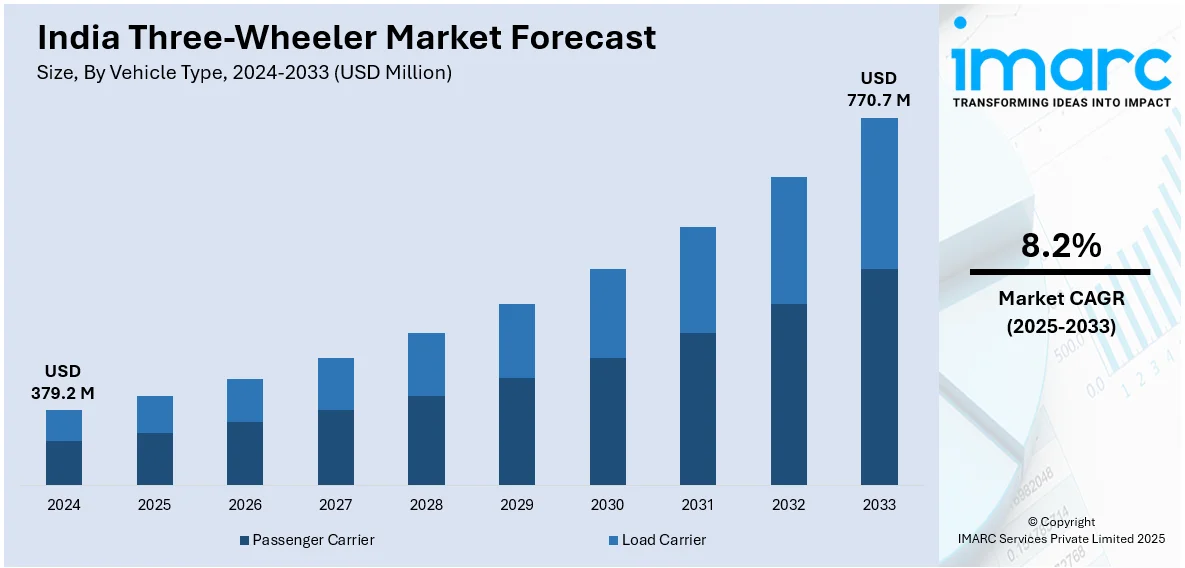

The India three-wheeler market size reached USD 379.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 770.7 Million by 2033, exhibiting a growth rate (CAGR) of 8.2% during 2025-2033. Government incentives promoting electric mobility, rapid urbanization boosting last-mile connectivity, escalating demand for affordable public transport, expanding charging infrastructure, and rising e-commerce logistics adoption are key factors propelling India's three-wheeler market, fostering innovation, sustainability, and widespread accessibility in both passenger and cargo transportation segments across urban and semi-urban regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 379.2 Million |

| Market Forecast in 2033 | USD 770.7 Million |

| Market Growth Rate 2025-2033 | 8.2% |

India Three-Wheeler Market Trends:

Urbanization and the Need for Efficient Urban Mobility

India's urban population has enormously contributed to the progress of the nation's three-wheeler market. With higher congestion in urban areas, the need for affordable, flexible, and effective urban mobility solutions has placed three-wheelers—particularly auto-rickshaws—at the center of mobility needs. Due to their small size, they can conveniently operate on crowded city streets, making them the favored choice for last-mile connectivity and shorter distances. Numerous policies striving for traffic decongestion and public transport enabling have enabled a conducive scenario for the mass usage of three-wheelers. Also, the increasing thrust toward electric mobility has propelled the development of electric three-wheelers, helping match India's sustainable objectives. These vehicles not only lower carbon emissions but are also responsible for cleaner air in urban areas, tackling pollution in cities.

To get more information on this market, Request Sample

Government Initiatives Promoting Electric Three-wheelers

The Indian three-wheeler market is transforming quickly with government policies fueling the transition toward electric mobility. A major driver in this process is the Production Linked Incentive (PLI) scheme initiated in 2021, which is stimulating indigenous production of EVs and EV components. Through the incentive on local production, the scheme is reducing the prices of electric three-wheelers and making them available across the market, compelling both manufacturers and fleet operators to shift from traditional fuel-based variants. Further, government assistance toward charging infrastructure expansion is resolving the significant EV uptake challenge of making three-wheeler drivers benefit from well-developed charging networks. This is especially vital in urban and last-mile applications, where electric three-wheelers are being used as an economical and eco-friendly alternative to conventional auto-rickshaws. With sustained policy support and expanding ecosystem for electric mobility, India's three-wheeler market is on a robust path of electrification, drawing investments and innovation while lessening dependence on fossil fuels.

India Three-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, passenger vehicle, and fuel type.

Vehicle Type Insights:

- Passenger Carrier

- Load Carrier

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger carrier and load carrier.

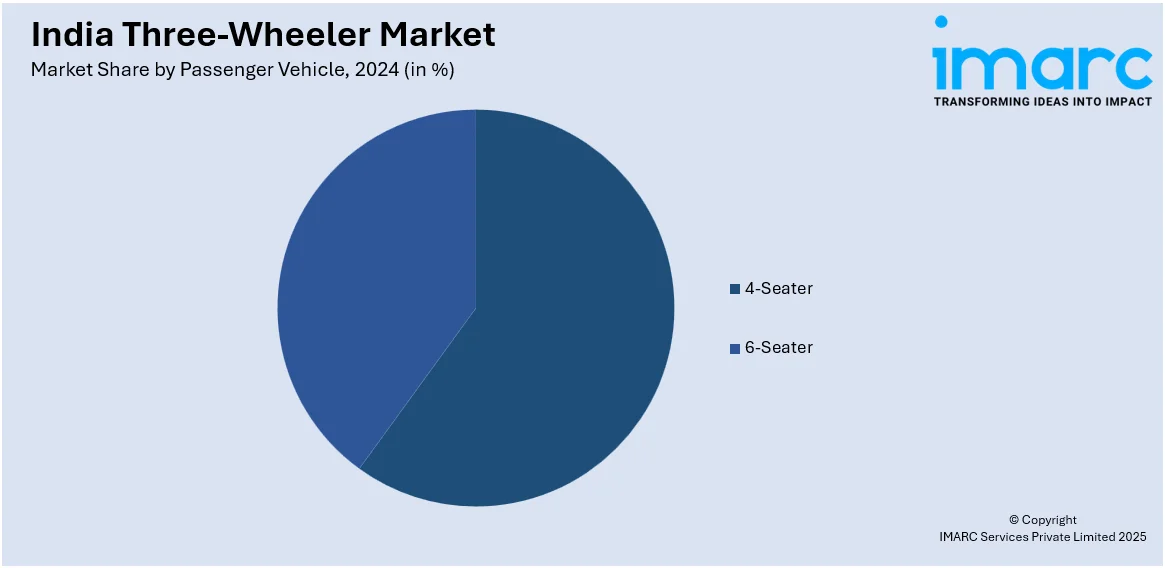

Passenger Vehicle Insights:

- 4-Seater

- 6-Seater

A detailed breakup and analysis of the market based on the passenger vehicle have also been provided in the report. This includes 4-seater and 6-seater.

Fuel Type Insights:

- Petrol/CNG

- Diesel

- Electric

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes petrol/CNG, diesel, and electric.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Three-Wheeler Market News:

- March 2025: Omega Seiki and Clean Electric launched the NRG, an electric three-wheeler with a 300 km range, at Rs 3.55 lakh. The launch broadened alternatives for affordable and long-range electric mobility in India. The vehicle helped the nation transition to sustainable transport, consolidating the three-wheeler segment.

- February 2025: Bajaj Auto Ltd. launched its new electric three-wheeler brand Bajaj GoGo, with a battery life of up to 251 km on a single charge, priced starting at INR 3.26 Lakhs for the P5009 variant. GoGo line comes equipped with sophisticated security features, two-speed automatic transmission, and other technical specialties such as LED lighting, Hill Hold Assist, and a 5-year battery guarantee.

- January 2025: Hyundai revealed a concept electric three-wheeler that will help modernize Indian local transport, with a modular nature for different applications ranging from delivery services to wheelchair accessibility. The three-wheeler electric is the result of collaboration between TVS Motor Company Ltd. and Hyundai, emphasizing small size to drive through tight streets and body height adjustability for monsoons.

- January 2025: TVS Motor Company brought out its initial electric three-wheeler, the TVS King EV MAX, priced at INR 2.95 Lakhs, with an intention of growing sales nationwide in the subsequent four to six months. The TVS King EV MAX, which comes with features such as Bluetooth connectivity and real-time vehicle diagnostics, boasts a certified range of 179 km on a single charge and a fast-charging ability of 0-80% in 2 hours and 15 minutes.

India Three-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Carrier, Load Carrier |

| Passenger Vehicles Covered | 4-Seater, 6-Seater |

| Fuel Types Covered | Petrol/CNG, Diesel, Electric |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India three-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India three-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India three-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India three-wheeler market was valued at USD 379.2 Million in 2024.

The India Three-Wheeler market is projected to exhibit a CAGR of 8.2% during 2025-2033, reaching a value of USD 770.7 Million by 2033.

The market is driven by government incentives promoting electric mobility, rapid urbanization boosting last-mile connectivity, escalating demand for affordable public transport, expanding charging infrastructure, and rising e-commerce logistics adoption, fostering innovation, sustainability, and accessibility in passenger and cargo transportation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)