India Travel Insurance Market Size, Share, Trends and Forecast by Insurance Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

India Travel Insurance Market Overview:

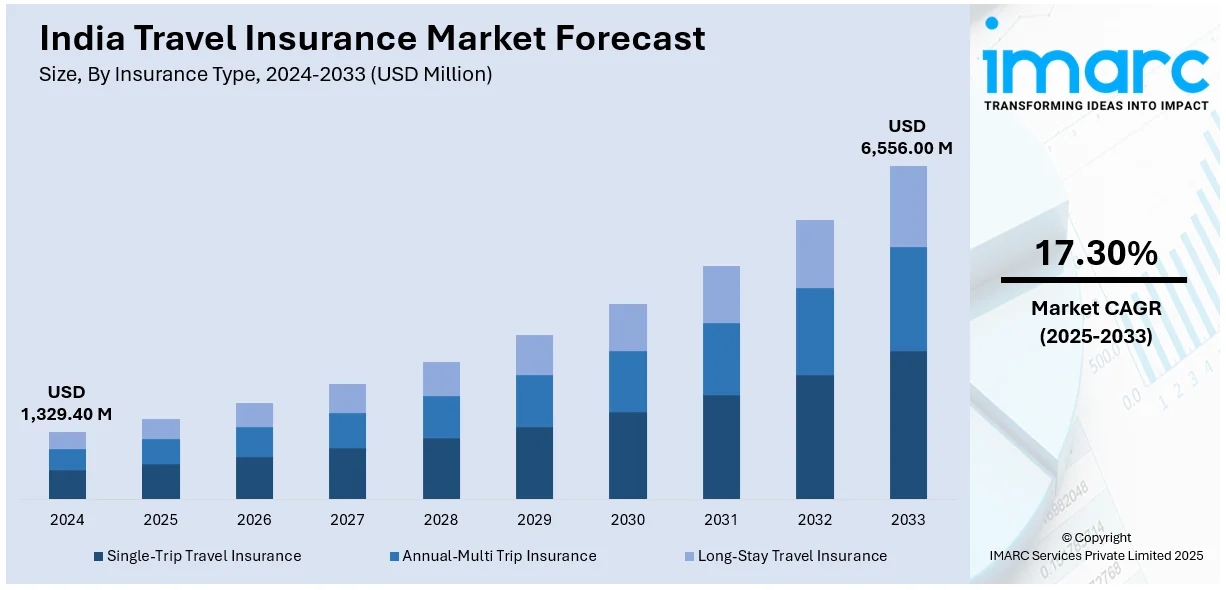

The India travel insurance market size reached USD 1,329.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,556.00 Million by 2033, exhibiting a growth rate (CAGR) of 17.30% during 2025-2033. The market is driven by rising outbound and domestic tourism, increasing awareness of travel risks, growing disposable income, expanding regulatory mandates, widespread digital adoption, evolving consumer preferences for comprehensive coverage, and expanding partnerships between insurers and travel service providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,329.40 Million |

| Market Forecast in 2033 | USD 6,556.00 Million |

| Market Growth Rate 2025-2033 | 17.30% |

India Travel Insurance Market Trends:

Growing Demand for Comprehensive Coverage

The India travel insurance market outlook is witnessing a shift from basic policies to comprehensive coverage, driven by increased awareness of travel-related risks. In line with this, travelers currently look for insurance policies that extend past medical emergencies as they need coverage for trip cancellations, baggage loss, flight delays, and adventure sports. Travelers from millennial age groups along with frequent travelers also show strong interest in financial protection when they travel because they value security during their trips. Moreover, the insurance industry provides custom policy solutions that meet the requirements of different traveler groups including students and senior citizens with corporate policy options. Besides this, the increasing expense of medical treatment abroad has motivated international visitors to choose insurance with elevated medical coverage benefits. According to reports, in 2024, 62% of Indian travelers' travel insurance purchases covered Asia and the UAE, highlighting the growing demand for coverage in popular destinations like Thailand, Vietnam, Malaysia, and the UAE. Furthermore, the increase in the adoption of digital platforms enables travelers to easily search compare and buy insurance policies while making claims with ease. As a result, the ongoing evolution of the insurance sector allows providers to develop customized plans through AI and data analytics which is boosting the India travel insurance market growth.

To get more information on this market, Request Sample

Digitalization and Instant Policy Issuance

The rapid digital transformation is significantly boosting the India travel insurance market share and is revolutionizing the way policies are purchased and managed. In addition to this, the fintech revolution enables insurers to provide customers with fully paperless issuance of policies through mobile platforms and website portals as well as integrated booking systems. Moreover, travel insurance policy approvals now occur in real-time through AI-driven chatbots along with automated underwriting procedures thus expanding the accessibility of travel insurance to immediate travelers. For instance, in October 2024, ICICI Lombard introduced 'TripSecure+', an AI-driven travel insurance solution offering personalized coverage options, including visa fee refunds and adventure sports coverage, enhancing customer experience and policy customization. In confluence with this, instant digital policies that use the Electronic Know Your Customer (e-KYC) verification now eliminate traditional delay problems from long document submissions and approval waiting times. Furthermore, the application of blockchain technology aims to improve both transparency and prevent fraud during the process of claim settlement. Apart from this, travel insurance adoption increases because booking platforms for airlines and hotels now provide users with the option to purchase coverage during their reservation process. As a result, Indian travelers are benefiting from progressive insurance innovation which creates flexible on-demand policies as digitalization keeps advancing.

India Travel Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on insurance type, coverage, distribution channel, and end user.

Insurance Type Insights:

- Single-Trip Travel Insurance

- Annual-Multi Trip Insurance

- Long-Stay Travel Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes single-trip travel insurance, annual-multi trip insurance, and long-stay travel insurance.

Coverage Insights:

- Medical Expenses

- Trip Cancellation

- Trip Delay

- Property Damage

- Others

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes medical expenses, trip cancellation, trip delay, property damage, and others.

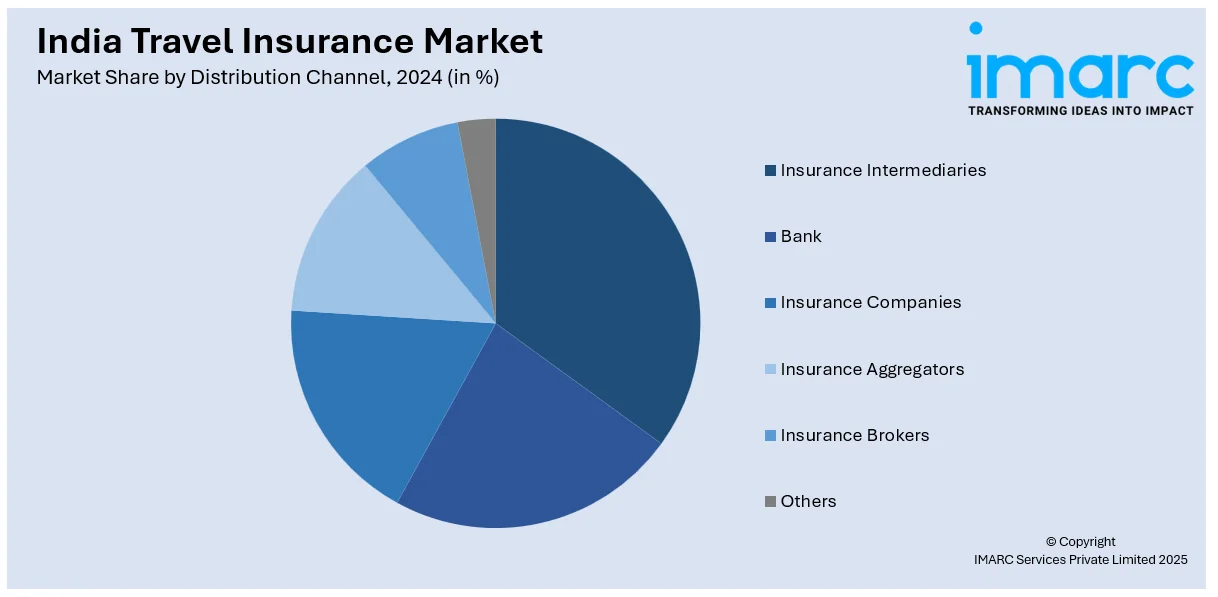

Distribution Channel Insights:

- Insurance Intermediaries

- Bank

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes insurance intermediaries, bank, insurance companies, insurance aggregators, insurance brokers, and others.

End User Insights:

- Senior Citizens

- Educational Travelers

- Business Travelers

- Family Travelers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes senior citizens, educational travelers, business travelers, family travelers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Travel Insurance Market News:

- In June 2024, Zurich Insurance acquired a 70% stake in Kotak Mahindra General Insurance for ₹5,560 crore, marking a significant foreign investment in India's general insurance sector. This partnership is expected to introduce innovative travel insurance products, leveraging Zurich's global expertise.

- In May 2024, the Hinduja Group secured approval from the Insurance Regulatory and Development Authority of India (IRDAI) for its ₹9,650 crore acquisition of Reliance Capital and its insurance subsidiaries, including Reliance General Insurance. This acquisition is poised to strengthen the group's presence in the general insurance sector, potentially leading to more competitive travel insurance offerings.

India Travel Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Single-Trip Travel Insurance, Annual-Multi Trip Insurance, Long-Stay Travel Insurance |

| Coverages Covered | Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others |

| Distribution Channels Covered | Insurance Intermediaries, Bank, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others |

| End Users Covered | Senior Citizens, Educational Travelers, Business Travelers, Family Travelers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India travel insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India travel insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India travel insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The travel insurance market in India was valued at USD 1,329.40 Million in 2024.

The India travel insurance market is projected to exhibit a (CAGR) of 17.30% during 2025-2033, reaching a value of USD 6,556.00 Million by 2033.

Key drivers of the India travel insurance market include growth in international and domestic travel, awareness of travel risks, and demand for financial protection for trip cancellations, medical complications, and delayed or lost baggage. Tourism promotion efforts by the government, growth in online insurance channels, and compulsive acquisition of travel insurance by some countries enhance market growth and consumer penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)