India Turbine Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

India Turbine Market Size and Share:

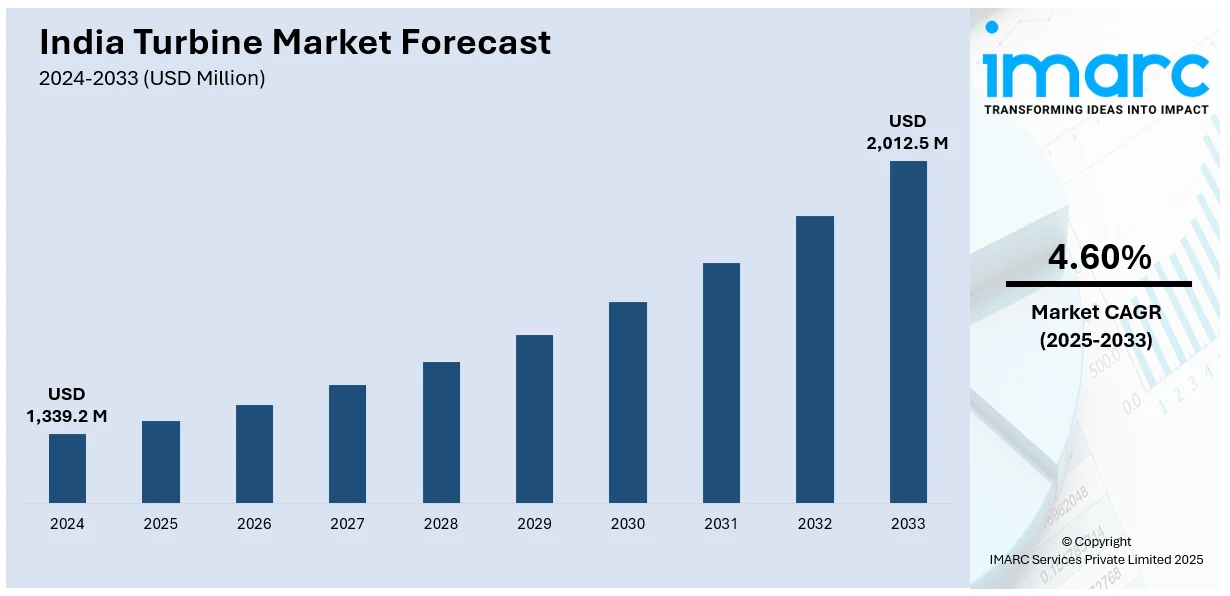

The India turbine market size reached USD 1,339.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,012.5 Million by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. India’s turbine market is growing with strong policy support, increased domestic manufacturing, and better logistics. Rising project execution, blade transport capability, and state-level push are strengthening deployment, improving supply stability, and attracting global partnerships for long-term renewable infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,339.2 Million |

| Market Forecast in 2033 | USD 2,012.5 Million |

| Market Growth Rate (2025-2033) | 4.60% |

India Turbine Market Trends:

Rising Domestic Manufacturing Strengthens Supply Stability

India’s wind turbine market is expanding steadily, driven by long-term policy support and the government’s focus on scaling up domestic manufacturing. States like Gujarat, Karnataka, and Tamil Nadu are pushing wind project development, supported by favorable land allocation, power evacuation infrastructure, and state renewable targets. Central incentives such as the PLI scheme and customs duty exemptions on certain components are encouraging investments in nacelle assembly, blades, and gearboxes. In January 2025, India confirmed the addition of 3.4 GW of wind capacity in 2024. This surge came from coordinated policy rollout, project clearance reforms, and faster execution of state and central auctions. Private players are increasingly localizing their supply chains to cut costs and reduce import dependency. Indian firms are now scaling manufacturing capacities for key turbine parts, aligning with national energy security goals. Developers are also benefiting from streamlined approvals, hybrid project opportunities, and repowering incentives. These trends are making India a key regional hub for wind turbine production and deployment. As installation rates improve and costs decline, the country is becoming better positioned to meet its 2030 renewable targets through wind energy.

To get more information on this market, Request Sample

Enhanced Logistics Capabilities Accelerate Project Execution

Efficient logistics and international sourcing are emerging as crucial drivers for India’s wind turbine market. Large components like blades and nacelles demand specialized handling, route planning, and port coordination. With wind project sizes increasing, logistical efficiency is becoming central to timely project execution. In August 2024, DB Schenker transported 240 wind turbine blades each 76.8 meters long for Envision Energy from China to India. These blades supported 80 turbines, significantly strengthening India’s deployment readiness. The movement showcased growing competence in handling supersized components across borders and highlighted the strategic use of Indian ports for renewable energy infrastructure. Indian logistics providers are now investing in modular trailers, reinforced roads near wind sites, and port upgrades to accommodate large turbine equipment. These improvements are reducing downtime, project delays, and cost overruns. Cross-border logistics partnerships are also enhancing delivery precision for international OEMs entering the Indian market. As projects spread to newer wind zones in central and eastern India, logistics reliability is directly impacting turbine market growth. The success of large-scale blade transport operations is now serving as a benchmark for future offshore and hybrid wind ventures.

India Turbine Market Segmentation:

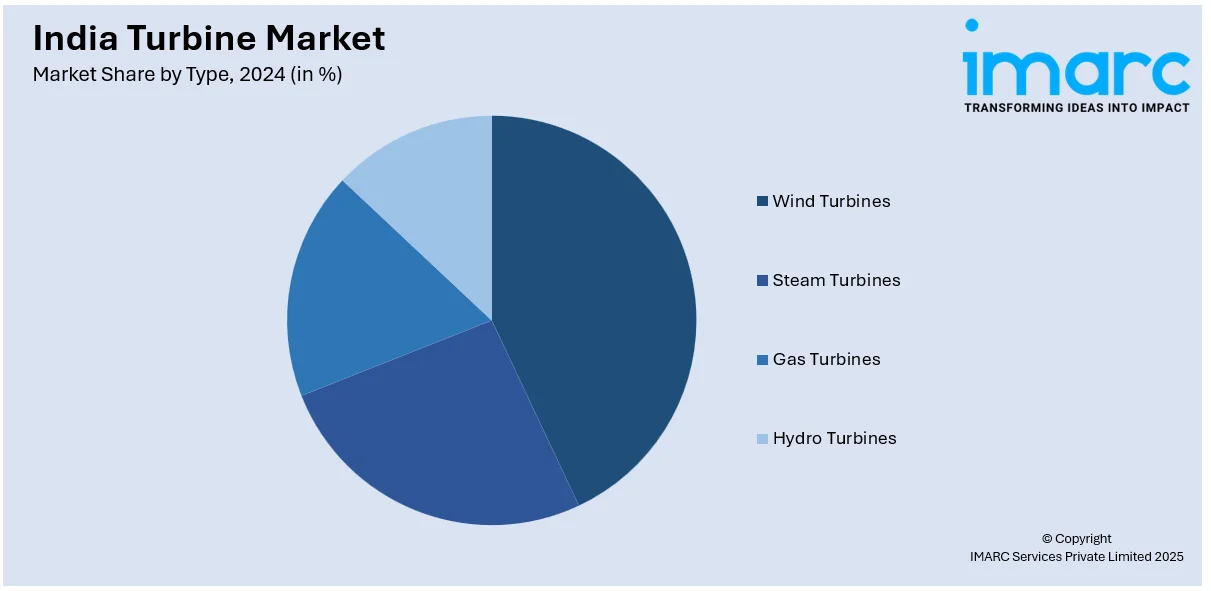

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Wind Turbines

- Onshore

- Offshore

- Steam Turbines

- Combined Cycle

- Steam Cycle

- Gas Turbines

- Combined Cycle

- Open Cycle

- Hydro Turbines

- Reaction

- Impulse

The report has provided a detailed breakup and analysis of the market based on the type. This includes Wind Turbines (Onshore, Offshore), Steam Turbines (Combined Cycle, Steam Cycle), Gas Turbines (Combined Cycle, Open Cycle), Hydro Turbines (Reaction, Impulse).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Turbine Market News:

- January 2025: Suzlon secured a 486 MW order from Torrent Power to supply 162 S144 wind turbines with 3 MW capacity and Hybrid Lattice Towers in Gujarat. This development strengthened India’s turbine industry, boosting domestic manufacturing and enabling power generation for nearly one million homes.

- January 2025: Senvion India secured a 121.5 MW order from Continuum Green Energy to supply 45 units of 2.7M130 wind turbines. This strengthened localized turbine production, improved efficiency for low-wind sites, and supported India's renewable targets with over 85% component localization.

India Turbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India turbine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India turbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India turbine market was valued at USD 1,339.2 Million in 2024.

The India turbine market is projected to exhibit a CAGR of 4.60% during 2025-2033, reaching a value of USD 2,012.5 Million by 2033.

Key factors driving the India turbine market include strong policy support, increased domestic manufacturing, improved logistics, and rising project execution. State-level initiatives, blade transport capability, and the growing renewable infrastructure development are also contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)