India Two-Wheeler Helmets Market Size, Share, Trends and Forecast by Helmet Type, Distribution Channel, and Region, 2026-2034

India Two-Wheeler Helmets Market Summary:

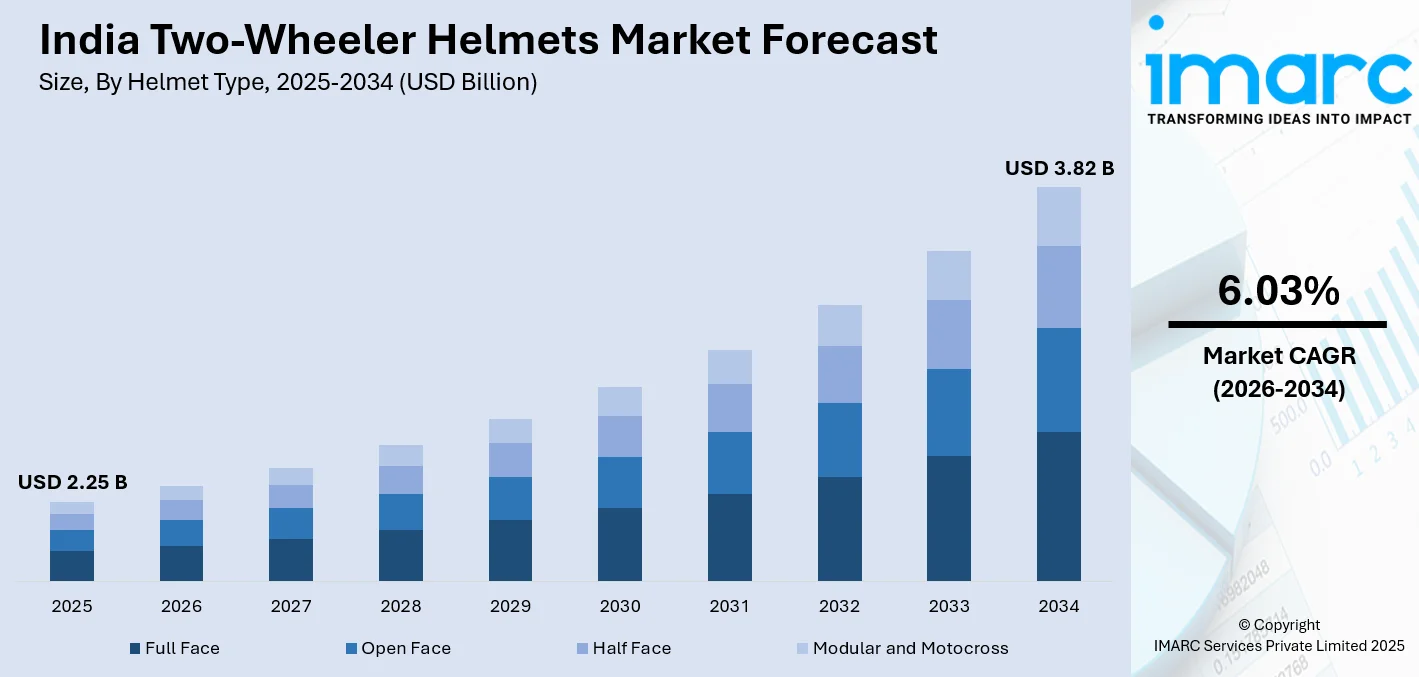

The India two-wheeler helmets market size was valued at USD 2.25 Billion in 2025 and is projected to reach USD 3.82 Billion by 2034, growing at a compound annual growth rate of 6.03% from 2026-2034.

The India two-wheeler helmets market is experiencing sustained momentum driven by heightened road safety consciousness, expanding two-wheeler penetration across urban and rural regions, and stringent government enforcement of helmet usage mandates and BIS certification requirements. Growing urbanization, rising disposable incomes, and increasing consumer preference for stylish and feature-rich helmets are further propelling market expansion. The proliferation of e-commerce platforms and evolving consumer purchasing patterns are reshaping distribution dynamics, enabling broader market accessibility and driving India two-wheeler helmets market share.

Key Takeaways and Insights:

- By Helmet Type: Full face dominates the market with a share of 33% in 2025, driven by superior protection features, mandatory safety requirements, and growing consumer preference for comprehensive head coverage during both urban commuting and highway riding.

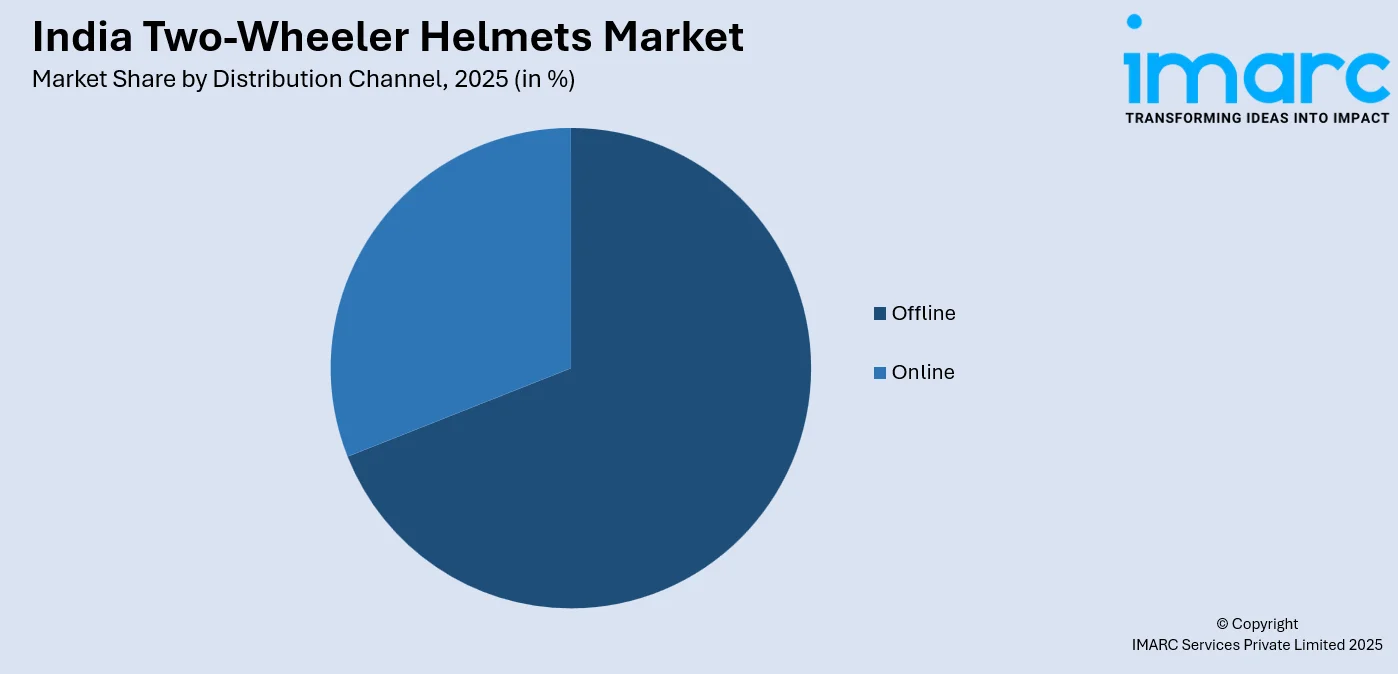

- By Distribution Channel: Offline leads the market with a share of 69% in 2025, owing to consumer preference for physical inspection and trial before purchase, established dealer networks across urban and semi-urban areas, and immediate product availability through retail outlets.

- By Region: North India represents the largest segment with a market share of 31% in 2025, attributed to high two-wheeler density in states like Uttar Pradesh and Delhi, robust urbanization trends, and stringent traffic enforcement driving helmet adoption rates.

- Key Players: The India two-wheeler helmets market exhibits a moderately consolidated competitive landscape, with domestic manufacturers holding significant market presence through extensive distribution networks, localized production capabilities, competitive pricing strategies, and continuous product innovation in safety features and design aesthetics.

To get more information on this market Request Sample

The India two-wheeler helmets market continues to demonstrate resilience as safety awareness campaigns gain momentum and regulatory frameworks strengthen across the country. With over 210 million registered two-wheelers on Indian roads and annual sales exceeding 19.6 million units in FY 2024-25 according to SIAM data, the demand for quality helmets remains robust. Manufacturers are responding to evolving consumer preferences by introducing helmets with advanced features including improved ventilation systems, anti-fog visors, and lightweight composite materials. The market is witnessing notable premiumization as consumers increasingly prioritize quality and safety over price considerations, particularly in metropolitan areas where traffic density necessitates enhanced protection measures. In December 2024, Steelbird Hi-tech India announced a new manufacturing facility in Hosur, Tamil Nadu with an initial investment of INR 100 crore and planned total investment of INR 250 crore, targeting production capacity of 20,000 helmets daily to address growing market demand.

India Two-Wheeler Helmets Market Trends:

Rise in Demand for Premium and Smart Helmets

Indian consumers are increasingly gravitating toward technologically advanced helmets that offer features beyond basic protection. Smart helmets equipped with Bluetooth connectivity, integrated speakers, voice navigation systems, and crash detection capabilities are gaining popularity among urban riders and younger demographics. Rising disposable incomes and evolving lifestyle preferences are fueling this shift toward value-based purchasing behavior over price sensitivity. In August 2025, AXOR launched the X Altor Apex Smart Helmet priced under INR 8,000, featuring Bluetooth 5.0 connectivity, smart swipe touch controls for hands-free calling, music playback, and voice assistant integration for navigation.

Enforcement of Stringent Safety Regulations and BIS Certification

The government's mandate making BIS certification compulsory under IS 4151:2015 standards has fundamentally reshaped the helmet market landscape. This regulatory framework targets the elimination of substandard products while enhancing rider safety through rigorous quality compliance. Initiatives under the Motor Vehicles Amendment Act combined with stricter traffic enforcement have significantly elevated public awareness regarding certified helmets. In FY 2024-25, the Bureau of Indian Standards conducted over 30 search-and-seizure operations, testing more than 500 helmet samples and confiscating over 3,000 non-compliant units including 2,500 helmets from nine manufacturers in Delhi operating with expired licenses, demonstrating intensified regulatory oversight driving India two-wheeler helmets market growth.

Growth of E-Commerce and Online Retailing Channels

The rapid expansion of e-commerce platforms has significantly reshaped helmet distribution in India by improving accessibility and purchasing convenience. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034. Online channels allow consumers to explore a wide range of products, compare features, and receive deliveries directly at their homes. This shift is especially impactful in smaller cities, where access to organized retail and branded outlets is limited. Digital platforms also enable helmet manufacturers to connect directly with end users, reduce reliance on intermediaries, strengthen brand presence, and improve control over pricing and customer engagement.

Market Outlook 2026-2034:

The India two-wheeler helmets market is poised for sustained expansion as road safety initiatives intensify and consumer awareness elevates across demographic segments. Technological integration in helmet design, including smart features and advanced safety mechanisms, is expected to drive premiumization trends. Government mandates requiring two BIS-certified helmets with every new two-wheeler from January 2026 will significantly boost baseline demand volumes. Infrastructure development supporting rural connectivity and increasing electric scooter adoption are anticipated to create additional demand avenues. The market generated a revenue of USD 2.25 Billion in 2025 and is projected to reach a revenue of USD 3.82 Billion by 2034, growing at a compound annual growth rate of 6.03% from 2026-2034.

India Two-Wheeler Helmets Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Helmet Type |

Full Face |

33% |

|

Distribution Channel |

Offline |

69% |

|

Region |

North India |

31% |

Helmet Type Insights:

- Full Face

- Open Face

- Half Face

- Modular and Motocross

Full face dominates with a market share of 33% of the total India two-wheeler helmets market in 2025.

Full face helmets have emerged as the dominant segment in the India two-wheeler helmets market, commanding the largest revenue share due to their comprehensive protection capabilities. These helmets provide complete head coverage including chin and face protection, making them the preferred choice among safety-conscious consumers. The segment benefits from mandatory helmet regulations that emphasize adequate protection standards, driving adoption across both urban commuters and highway travelers who prioritize safety during extended rides.

The growing awareness about head injury prevention and the availability of full face helmets with advanced features such as improved ventilation, anti-fog visors, and lightweight materials are sustaining segment growth. Manufacturers are introducing aerodynamic designs and premium materials including carbon fiber and fiberglass composites to enhance comfort without compromising protection. In December 2025, Studds Accessories Ltd’s premium label, SMK Helmets, introduced an expanded portfolio of helmets and riding apparel at India Bike Week 2025. The launch featured the Cygnus flip-back helmet, additions to the Delta series of demi-jet helmets, and a comprehensive range of riding jackets certified to CE Level A standards.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline leads with a share of 69% of the total India two-wheeler helmets market in 2025.

Offline distribution channels continue to dominate the India two-wheeler helmets market, driven by consumer preference for physical product inspection, trial fitting, and immediate purchase availability. Authorized dealerships, specialized helmet outlets, and multi-brand retail stores form the backbone of offline distribution, offering consumers the opportunity to assess product quality, comfort, and fit before making purchase decisions. This tactile shopping experience remains particularly important for safety gear purchases.

The offline distribution channel is strengthened by well-established dealer networks across major cities, semi-urban areas, and rural markets, providing a wide geographic reach. Authorized service centers of two-wheeler manufacturers also support helmet sales through bundled products and replacement demand. In addition, domestic manufacturers have broadened their presence through exclusive brand outlets, supported by extensive traditional retail networks, ensuring strong visibility and convenient access for consumers across diverse regions.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits clear dominance with a 31% share of the total India two-wheeler helmets market in 2025.

North India has emerged as the largest regional market for two-wheeler helmets, driven by high two-wheeler ownership density, rapid urbanization, and stringent traffic enforcement in major urban centers. States including Uttar Pradesh, Delhi, Haryana, Punjab, and Rajasthan contribute substantially to regional demand owing to their large populations and extensive two-wheeler usage for daily commuting. The region's growing middle-class population with rising disposable incomes is increasingly investing in quality safety equipment.

The clustering of helmet manufacturing units in North India supports cost competitiveness by lowering transportation and distribution expenses. Strong two-wheeler penetration in the region naturally drives higher demand for protective gear, including helmets. In parallel, stricter enforcement of traffic regulations, supported by digital monitoring systems and routine compliance checks, has reinforced helmet usage, further boosting adoption across northern states.

Market Dynamics:

Growth Drivers:

Why is the India Two-Wheeler Helmets Market Growing?

Expanding Two-Wheeler Ownership and Urbanization

The continuous expansion of two-wheeler ownership across India serves as a fundamental growth catalyst for the helmet market. Two-wheelers remain the preferred mode of personal transportation for millions of Indians due to their affordability, fuel efficiency, and maneuverability in congested urban traffic conditions. Rising urbanization rates are driving increased two-wheeler adoption as cities expand and commuting distances grow. The resultant increase in registered two-wheelers directly translates into proportional demand for helmets as essential safety accessories. The India two-wheeler market size reached 28.78 Million Units in 2025 and is projected to reach 101.35 Million Units by 2034, growing at a compound annual growth rate of 15.01% from 2026-2034 driven by improved rural demand and consumer confidence recovery.

Strengthened Road Safety Awareness Campaigns

Intensified road safety awareness initiatives by government agencies, non-governmental organizations, and industry stakeholders are positively influencing helmet adoption rates across India. Public campaigns highlighting the life-saving potential of helmets in preventing head injuries during accidents are reshaping consumer attitudes toward safety gear. Educational programs in schools, colleges, and workplaces are instilling safety-conscious behavior among younger demographics who constitute a significant proportion of two-wheeler riders. Media campaigns emphasizing the correlation between helmet usage and reduced fatality rates are generating widespread public attention. In June 2024, the United Nations collaborated with India to launch the "Helmets for Hope" campaign led by UN Special Envoy Jean Todt and road safety advocate Rajeev Kapur, Managing Director of Steelbird Helmets, targeting reduced road fatalities through enhanced helmet usage awareness among motorcyclists and cyclists as part of broader global road safety improvement efforts.

Government Regulatory Support and Enforcement

Comprehensive regulatory frameworks mandating helmet usage and quality certification are driving sustained market growth. The Motor Vehicles Act requires both riders and pillion passengers to wear ISI-certified helmets, with non-compliance attracting penalties and potential license suspension. State governments are implementing stricter enforcement mechanisms including automated challan systems, increased traffic patrol presence, and periodic compliance drives. Quality control orders mandating BIS certification under IS 4151:2015 standards have effectively marginalized substandard products from the organized market. From January 2026, the Ministry of Road Transport mandates that manufacturers must supply two BIS-certified helmets with every new two-wheeler sold, a regulation expected to significantly boost baseline demand volumes while ensuring both rider and pillion passenger protection. This policy intervention represents a transformative approach to institutionalizing helmet adoption across the country.

Market Restraints:

What Challenges the India Two-Wheeler Helmets Market is Facing?

Prevalence of Substandard and Counterfeit Helmets

The increasing number of sub-standard and fake helmets in the unorganized sector creates obstacles for the legitimate manufacturers and for consumer safety as well. Such non-standard helmets, which are available at significantly lower prices, are not safety-oriented during an accident. The increasing number of fake helmets marked with "ISI" marks creates confusion among consumers regarding the authenticity of certification marks.

Price Sensitivity Among Value-Conscious Consumers

A major constraint in consuming approved helmets is that consumers are sensitive to prices. Most consumers, mostly from lower economic groups, are currently valuing cheap over safe helmets. A massive difference in prices between BIS-certified helmets and inferior ones makes it attractive to consume inferior helmets. This price-driven purchasing behavior creates market opportunities for unorganized manufacturers supplying cheap, non-compliant products.

Low Consumer Awareness in Rural Markets

Limited awareness about helmet quality standards and safety certification requirements in rural and semi-urban areas constrains market expansion. Many consumers in these regions remain uninformed about the differences between certified and non-certified helmets, making them vulnerable to purchasing substandard products. Inadequate access to authorized retail outlets and branded helmet stores in remote areas further limits consumer exposure to quality products, while inconsistent enforcement of helmet laws in rural jurisdictions reduces compliance motivation.

Competitive Landscape:

The India two-wheeler helmets market exhibits a moderately consolidated competitive structure with established domestic manufacturers commanding significant market presence. Leading players compete through extensive distribution networks, continuous product innovation, competitive pricing strategies, and brand-building initiatives. Companies are investing in advanced manufacturing technologies, quality certification expansions, and design enhancements to differentiate their offerings. Strategic focus areas include premiumization through smart helmet development, geographic expansion into underserved markets, and vertical integration to optimize production costs. Partnerships with two-wheeler manufacturers for original equipment supply and aftermarket collaborations provide additional revenue channels. The competitive intensity is driving innovation in safety features, comfort enhancements, and aesthetic designs while simultaneously pressuring pricing structures across market segments.

Recent Developments:

- March 2025: Uber introduced AI-powered helmet selfies and in-app helmet nudges to enhance safety on its two-wheeler service, Uber Moto. The initiative includes distributing 3,000 safety kits nationwide and a new feature allowing female drivers to choose female riders, aiming to boost helmet usage and promote safer commuting across India.

- February 2025: Reise Moto launched Italian-designed Acerbis Profile 4 off-road helmets in India, priced at INR 7,999. Certified by DOT, ECE, and ISI, the helmets feature advanced ventilation, removable padding, and double ring fastening, targeting India's growing adventure and off-road biking segment through international brand partnerships.

India Two-Wheeler Helmets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Helmet Types Covered | Full Face, Open Face, Half Face, Modular Motocross |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India two-wheeler helmets market size was valued at USD 2.25 Billion in 2025.

The India two-wheeler helmets market is expected to grow at a compound annual growth rate of 6.03% from 2026-2034 to reach USD 3.82 Billion by 2034.

Full face, representing the largest revenue share of 33% in 2025, dominates the India two-wheeler helmets market due to their comprehensive protection features, regulatory compliance advantages, and growing consumer preference for complete head coverage during urban and highway riding.

Key factors driving the India two-wheeler helmets market include expanding two-wheeler ownership and urbanization, strengthened road safety awareness campaigns through government and industry initiatives, stringent BIS certification enforcement, and increasing consumer preference for premium and smart helmet features.

Major challenges include the prevalence of substandard and counterfeit helmets in unorganized markets, price sensitivity among value-conscious consumers limiting certified helmet adoption, low awareness about quality standards in rural areas, and inconsistent enforcement of helmet regulations across different states.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)