India Unified Payments Interface (UPI) Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Unified Payments Interface (UPI) Market Overview:

The India unified payments interface (UPI) market size reached USD 16.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 478.9 Billion by 2033, exhibiting a growth rate (CAGR) of 45% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of UPI for high-value transactions and expansion of UPI beyond bank accounts like wallet integration and credit access.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.9 Billion |

| Market Forecast in 2033 | USD 478.9 Billion |

| Market Growth Rate 2025-2033 | 45% |

India Unified Payments Interface (UPI) Market Trends:

Rising Adoption of UPI for High-Value Transactions

India’s Unified Payments Interface (UPI) market is experiencing a significant shift toward high-value transactions, driven by increasing consumer trust and business adoption. Initially designed for small peer-to-peer (P2P) payments, UPI is now being widely used for merchant transactions, corporate payments, and even government disbursements. The introduction of UPI credit lines, linking transactions to bank overdrafts, is further accelerating high-ticket transactions. For instance, in October 2024, Unified Payments Interface (UPI) set a record by processing 16.58 billion transactions in one month, highlighting its crucial role in India’s digital payments growth and transformation. Merchants, particularly in e-commerce, retail, and service sectors, are integrating UPI with point-of-sale (PoS) systems to streamline digital payments. The Reserve Bank of India’s (RBI) decision to raise the transaction limit for specific categories, such as education and healthcare, is further fueling this trend. Additionally, UPI’s compatibility with international markets is encouraging cross-border payments, strengthening its role in global transactions. As consumers shift from traditional banking to digital platforms, UPI is emerging as a preferred payment method for both daily expenses and large financial transactions. With continued regulatory support, increased adoption by enterprises, and technological advancements like near-field communication (NFC)-based UPI Lite, the platform is expected to handle an even higher volume of large-value transactions, reinforcing its dominance in India’s digital payments ecosystem.

.webp)

To get more information on this market, Request Sample

Expansion of UPI Beyond Bank Accounts: Wallet Integration and Credit Access

The UPI market in India is undergoing a structural transformation with the integration of digital wallets and expanded credit access. Traditionally, UPI transactions were limited to bank-to-bank transfers. However, the Reserve Bank of India has now permitted the use of pre-paid payment instruments (PPIs), allowing customers to link digital wallets like Paytm, PhonePe, and Google Pay to UPI. For instance, in December 2024, The Reserve Bank of India (RBI) enabled interoperability of prepaid payment instruments (PPIs) on UPI via third-party apps, allowing seamless transactions between digital wallets beyond their issuer’s payment system. This shift enhances convenience and accessibility for users without a traditional bank account or those preferring to transact through stored-value wallets. Additionally, UPI is evolving into a credit-driven payment system. The introduction of UPI credit lines, where users can link their accounts to small-ticket credit facilities offered by banks, is expected to drive financial inclusion. This development allows consumers to make transactions on credit, boosting retail and e-commerce spending. Leading fintech firms and banks are launching embedded credit solutions via UPI, catering to the rising demand for short-term, interest-free credit options. The convergence of UPI with digital wallets and credit products is set to reshape India’s payments landscape. By broadening financial access and providing seamless transaction experiences, UPI is reinforcing its position as the backbone of India’s cashless economy.

India Unified Payments Interface (UPI) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- P2P

- P2M

The report has provided a detailed breakup and analysis of the market based on the type. This includes P2P and P2M.

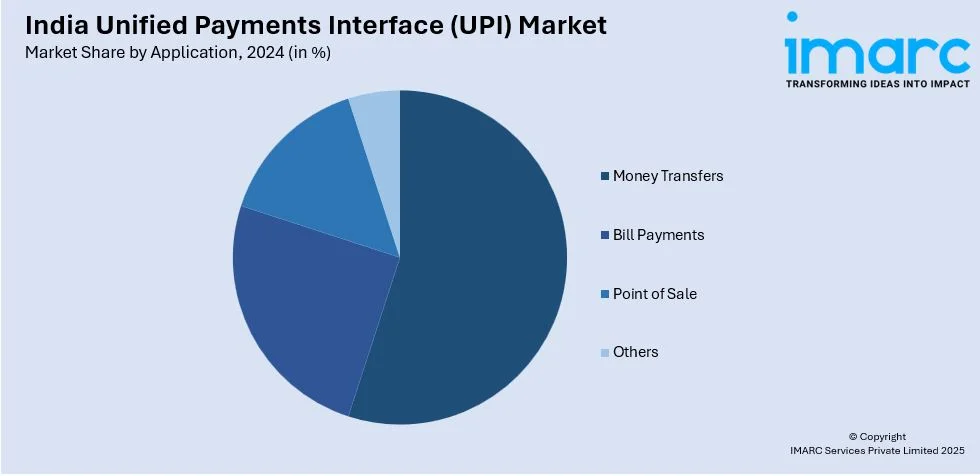

Application Insights:

- Money Transfers

- Bill Payments

- Point of Sale

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes money transfers, bill payments, point of sale, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Unified Payments Interface (UPI) Market News:

- In February 2024, Unified Payments Interface (UPI) announced that their services are now live in Sri Lanka and Mauritius, expanding India's digital payment reach. Prime Minister Narendra Modi attended the launch event, emphasizing strong bilateral ties. Earlier, NPCI International Payments Limited (NIPL) and Lyra introduced UPI in France, enhancing global adoption of India's payment system.

India Unified Payments Interface (UPI) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | P2P, P2M |

| Applications Covered | Money Transfers, Bill Payments, Point of Sale, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India unified payments interface (UPI) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India unified payments interface (UPI) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India unified payments interface (UPI) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UPI market in India was valued at USD 16.9 Billion in 2024.

The UPI market in India is projected to reach USD 478.9 Billion by 2033, exhibiting a CAGR of 45% during 2025-2033.

The India UPI market is driven by widespread digital adoption, increased smartphone penetration, and regulatory support for cashless transactions. High-value usage is accelerating with the rise of merchant payments, credit-linked UPI, and government disbursements. Integration with digital wallets and the introduction of UPI-based credit lines are improving accessibility. Use cases are also expanding beyond domestic transactions, with cross-border interoperability in focus. Additionally, fintech innovations and point-of-sale UPI adoption in retail and services are helping to scale transaction volumes across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)