India UPS Battery Market Size, Share, Trends and Forecast by Type, Mode, Application, Size, and Region, 2025-2033

India UPS Battery Market Overview:

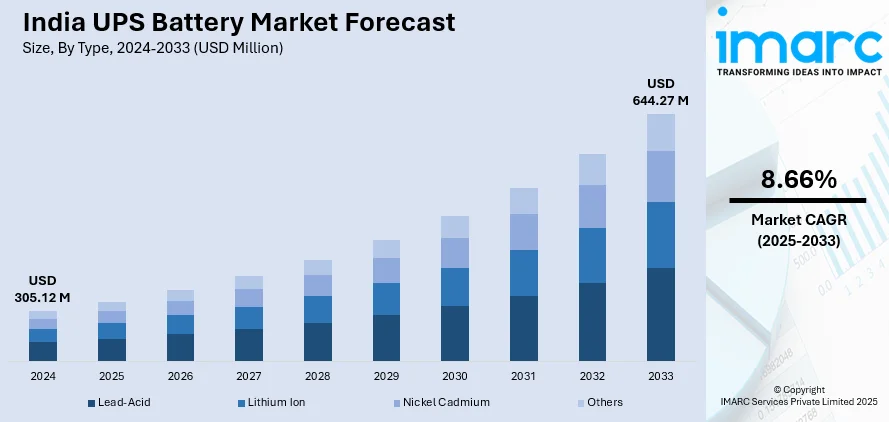

The India UPS battery market size reached USD 305.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 644.27 Million by 2033, exhibiting a growth rate (CAGR) of 8.66% during 2025-2033. The market is driven by factors such as increasing power outages, propelling demand for uninterrupted power supply in sectors like IT, healthcare, and retail, rising adoption of home automation systems, expanding e-commerce, and the shift toward energy-efficient, eco-friendly lithium-ion batteries for both residential and commercial utilization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 305.12 Million |

| Market Forecast in 2033 | USD 644.27 Million |

| Market Growth Rate 2025-2033 | 8.66% |

India UPS Battery Market Trends:

Growth of Data Centers and Digital Infrastructure

India is witnessing rapid growth in its digital economy, with the spread of data centers being the driving force behind demand for Uninterruptible Power Supply (UPS) batteries. As businesses across sectors shift toward cloud computing, big data analytics, and artificial intelligence, the requirement for constant and reliable power supply has become greater. The Indian government's push toward data localization, where it mandates companies to store data within the country, has further accelerated the setting up of hyperscale data centers. Data centers are huge energy-guzzlers, and even a temporary loss of power can cause heavy financial losses and corruption of data. To avoid disruptions, organizations spend a lot of money on high-capacity UPS batteries that guarantee seamless operations. Lithium-ion batteries are extensively being used in this space as they have a greater lifespan and recharge time compared to conventional lead-acid batteries. Moreover, as companies are focusing on sustainability, high-end UPS systems with energy-efficient battery solutions are high in demand. As India is digitizing at a rapid pace, dependence on UPS battery systems is also likely to increase, so data center development is significant driver for the industry.

To get more information on this market, Request Sample

Expansion of the Electric Vehicle (EV) and Renewable Energy Sectors

The fast pace of progress of India's EV and renewable energy sectors is shaping up to become a major booster for the UPS battery market. The electric vehicle market in India is expected to reach USD 164,420.4 million by 2033, exhibiting a CAGR of 57.23% (2025-2033). Although historically connected with backup power solutions, UPS batteries are becoming more and more involved in EV charging infrastructure as well as in renewable energy storage systems. At the same time, the renewable energy market solar and wind power are fueling demand for UPS batteries as storage solutions. Solar power adoption is elevating in residential and industrial markets, and users widely integrate UPS battery systems to harvest excess energy to be used at night or on cloudy days. The growing emphasis on green energy and carbon footprint reduction is further fueling adoption of energy-efficient UPS battery technologies, cementing their position in India's changing energy landscape. With government policies encouraging sustainable energy solutions, households and industries are increasingly turning to UPS batteries for grid stabilization and energy storage. The move toward green energy and electrification is driving the pace of innovation in battery efficiency, capacity, and sustainability. Consequently, UPS battery systems are becoming an integral part of India's changing energy landscape.

India UPS Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, mode, application, and size.

Type Insights:

- Lead-Acid

- Lithium Ion

- Nickel Cadmium

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lead-acid, lithium ion, nickel cadmium, and others.

Mode Insights:

- Installation

- Replacement

- Maintenance and Service

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes installation, replacement, maintenance and service.

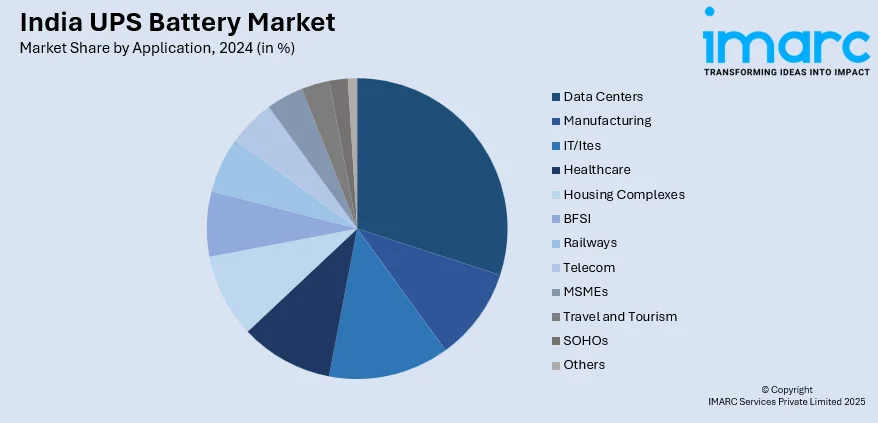

Application Insights:

- Data Centers

- Manufacturing

- IT/Ites

- Healthcare

- Housing Complexes

- BFSI

- Railways

- Telecom

- MSMEs

- Travel and Tourism

- SOHOs

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data centers, manufacturing, IT/Ites, healthcare, housing complexes, BFSI, railways, telecom, MSMEs, travel and tourism, SOHOs, and others.

Size Insights:

- Small Battery

- 7Ah

- 12Ah

- Medium Battery

- 24Ah

- 42Ah

- 65Ah

- 100Ah

- 200Ah

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes small battery (7Ah and 12Ah) and medium battery (24Ah, 42Ah, 65Ah, 100Ah, and 200Ah).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India UPS Battery Market News:

- October 2024: JSW MG Motor India, in collaboration with Vision Mechatronics, launched India's first high-voltage second-life battery powered by an indigenous Battery Management System (BMS), as part of 'Project Revive', marking a significant step in energy storage and circular economy. The second-life battery will be used as an uninterruptible power supply (UPS) backup at an industrial facility in Pune, demonstrating its potential for large-scale energy storage and transforming the industrial power landscape.

- May 2024: Oakter launched the Mini UPS Pro, a compact backup power solution for routers, CCTV cameras, and set-top boxes, featuring a 2600 mAh lithium-ion battery with up to 8 hours of backup. This product increases demand for small-scale UPS batteries, catering to rising power backup needs in homes and offices. The growing adoption of such devices is driving the Indian UPS battery market by expanding consumer awareness and boosting lithium-ion battery sales.

India UPS Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead-Acid, Lithium Ion, Nickel Cadmium, Others |

| Modes Covered | Installation, Replacement, Maintenance and Service |

| Applications Covered | Data Centers, Manufacturing, IT/Ites, Healthcare, Housing Complexes, BFSI, Railways, Telecom, MSMEs, Travel and Tourism, SOHOs, Others |

| Sizes Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India UPS battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India UPS battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India UPS battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India UPS battery market was valued at USD 305.12 Million in 2024.

The UPS battery market in India is projected to exhibit a CAGR of 8.66% during 2025-2033, reaching a value of USD 644.27 Million by 2033.

The UPS battery market in India is driven by increasing grid instability and frequent power outages, rapid growth of data centers and digital infrastructure, expansion of renewable energy and EV charging needs, and rising demand from industries, healthcare, and telecom. Shift toward energy-efficient technologies like lithium-ion batteries further boosts adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)