India Vanadium Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

India Vanadium Market Overview:

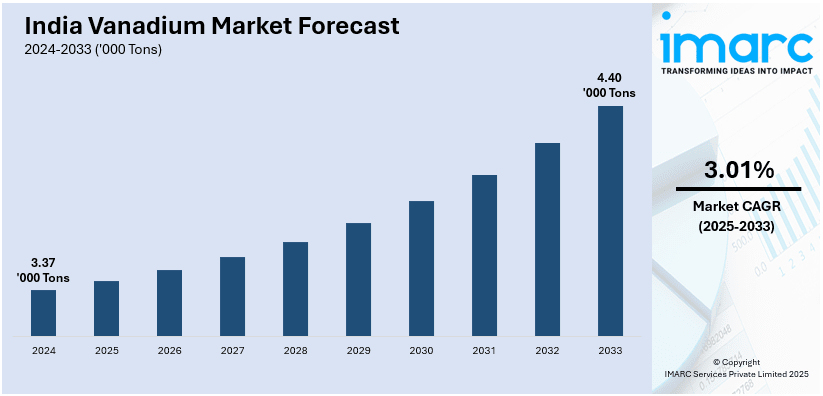

The India vanadium market size reached 3.37 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 4.40 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 3.01% during 2025-2033. The market is being driven by increasing demand from the steel and alloy industries, growth in infrastructure and construction sectors, the push for high-strength low-alloy (HSLA) steels, rising interest in vanadium redox flow batteries for energy storage, and government support for domestic critical mineral exploration and self-reliance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3.37 Thousand Tons |

| Market Forecast in 2033 | 4.40 Thousand Tons |

| Market Growth Rate 2025-2033 | 3.01% |

India Vanadium Market Trends:

Strategic Focus on Domestic Vanadium Recovery from Secondary Sources:

India is increasingly prioritizing vanadium recovery from secondary sources like slag, spent catalysts, and fly ash, given its limited primary reserves. This aligns with national goals of circular economy and resource efficiency. Efforts are underway through pilot projects and investments in hydrometallurgical and solvent extraction technologies to enable scalable, economically viable recovery. A relevant example is Imergy Power Systems, a member of the India Energy Storage Alliance (IESA), which in November 2024 developed a method to utilize 98.5% purity recycled vanadium in flow batteries. This approach reduces battery production costs by bypassing reliance on high-purity, steel-industry-grade vanadium. Imergy’s proprietary electrolyte formulation tolerates impurities, enabling efficient use of vanadium recovered from industrial waste streams like slag and oil sludge for grid-scale applications.

To get more information on this market, Request Sample

Integration of Vanadium Redox Flow Batteries in Renewable Energy Storage

Rising Use of Vanadium Microalloying in Indian Automotive and Construction Sectors

India Vanadium Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application.

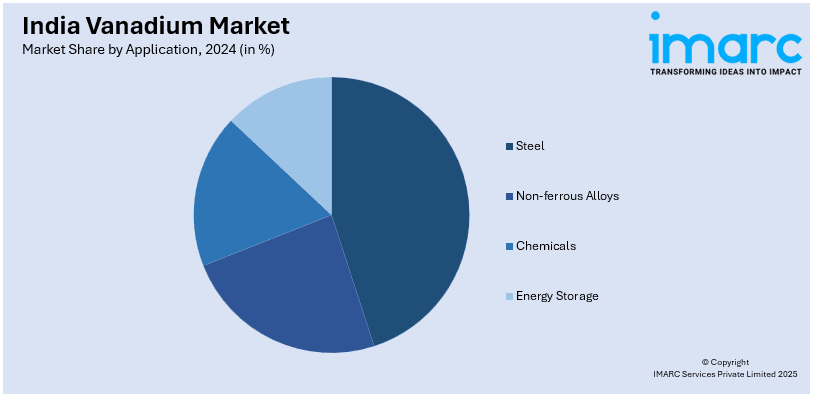

Application Insights:

- Steel

- Non-ferrous Alloys

- Chemicals

- Energy Storage

The report has provided a detailed breakup and analysis of the market based on the application. This includes steel, non-ferrous alloys, chemicals, and energy storage.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vanadium Market News:

- In September 2024, Rays Power Infra secured India's largest Vanadium Redox Flow Battery (VRFB) tender from NTPC's R&D division, NTPC Energy Technology Research Alliance (NETRA), for a 600KW/3000KWh project. This achievement underscores Rays Power Infra's technical expertise and commitment to sustainable energy solutions.

- In June 2024, NTPC, India’s largest power utility, issued a tender for a 600kW/3,000kWh vanadium redox flow battery (VRFB) to be installed at its research facility. The 5-hour duration system aims to support long-duration energy storage (LDES) applications and grid resilience. This initiative marks NTPC’s continued exploration of non-lithium alternatives for energy storage, aligning with India's broader push toward renewable integration and energy security. The tender underscores growing domestic interest in deploying vanadium-based technologies for sustainable, large-scale power infrastructure.

India Vanadium Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Steel, Non-ferrous Alloys, Chemicals, Energy Storage |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India vanadium market performed so far and how will it perform in the coming years?

- What is the breakup of the India vanadium market on the basis of application?

- What are the various stages in the value chain of the India vanadium market?

- What are the key driving factors and challenges in the India vanadium?

- What is the structure of the India vanadium market and who are the key players?

- What is the degree of competition in the India vanadium market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vanadium market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vanadium market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vanadium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)