India Vegan Chocolate Market Size, Share, Trends and Forecast by Chocolate Type, Nature, Sales Channel, and Region, 2025-2033

India Vegan Chocolate Market Size and Share:

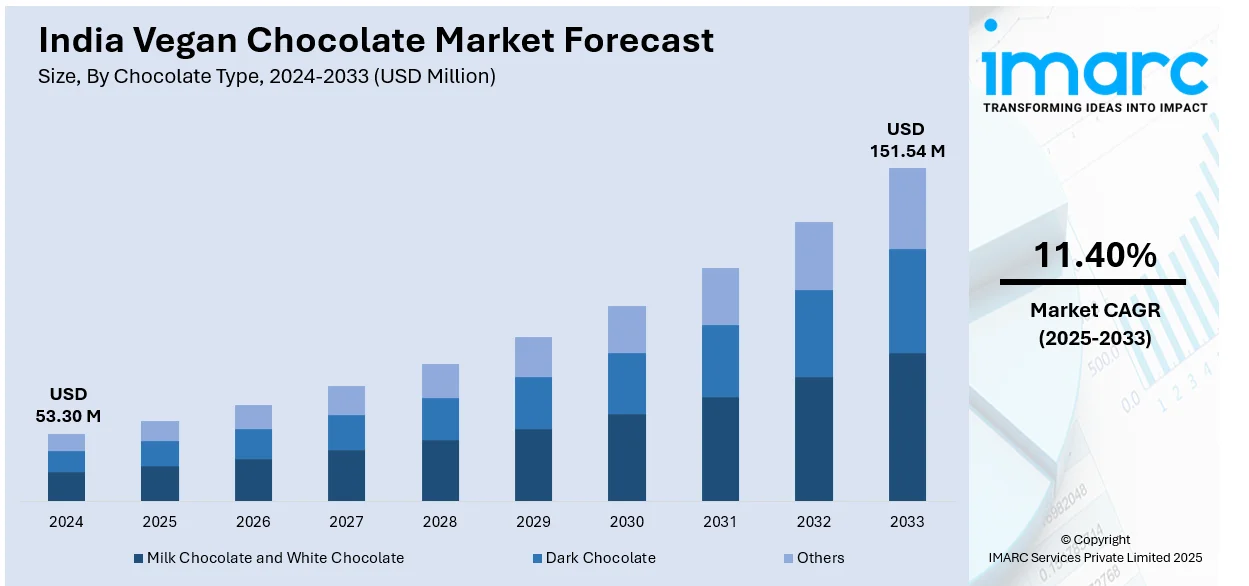

The India vegan chocolate market size reached USD 53.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 151.54 Million by 2033, exhibiting a growth rate (CAGR) of 11.40% during 2025-2033. The market is growing due to rising health consciousness, lactose intolerance awareness, ethical consumerism, plant-based diet adoption, premiumization, and e-commerce expansion. Moreover, the increasing disposable incomes, sustainability concerns, celebrity endorsements, and innovation in dairy-free alternatives like oat, almond, and coconut-based chocolates are some of the major factors driving the India vegan chocolate market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 53.30 Million |

| Market Forecast in 2033 | USD 151.54 Million |

| Market Growth Rate (2025-2033) | 11.40% |

India Vegan Chocolate Market Trends:

Rising Health Consciousness and Lactose Intolerance Awareness

Indian consumers are gradually prioritizing health and wellness, leading to a rise in demand for dairy-free, plant-based chocolates. Growing concerns over lactose intolerance, cholesterol levels, and digestive health are pushing consumers toward vegan alternatives. According to industry reports, lactose intolerance is a widespread digestive ailment in India, affecting around one-third of the population. Similarly, according to a recent survey, a diagnostics firm, indicated that 31% of Indians suffer from excessive cholesterol, with the 35-54 age group being the most affected, accounting for 34.5% of all instances. Many are opting for chocolates made from natural sweeteners, organic ingredients, and high-cocoa content to reduce sugar intake. Additionally, the rise of functional chocolates enriched with proteins, antioxidants, and vitamins is further creating a positive India vegan chocolate market outlook. The increasing awareness about clean-label products and preference for non-GMO, preservative-free chocolates are fueling the expansion of the vegan chocolate segment in both urban and semi-urban markets.

To get more information on this market, Request Sample

Plant-Based Diet Adoption and Celebrity Endorsements

The rise in vegan and flexitarian diets is significantly contributing to the demand for dairy-free chocolates. With celebrities, athletes, and influencers endorsing plant-based lifestyles, vegan chocolates are becoming a mainstream choice for health-conscious consumers. Social media campaigns promoting the benefits of plant-based diets and endorsements from Bollywood actors and fitness influencers are further accelerating India vegan chocolate market share. Additionally, international brands and homegrown startups are leveraging this trend by launching vegan chocolate variants infused with superfoods like quinoa, nuts, and seeds, catering to those wanting guilt-free enjoyment without sacrificing flavor. For instance, in March 2023, Hershey Co. announced that Reese's Plant-Based Peanut Butter Cups, which was in sale that month, was the company's first vegan candies distributed nationwide. A second plant-based option, Hershey’s Plant-Based Extra Creamy with Sea Salt and Almonds was available in April. Hershey stated the chocolates are produced with oats rather than milk.

E-commerce Expansion and Premiumization

The rise of online retail and direct-to-consumer (D2C) brands is making vegan chocolates more accessible across India. E-commerce platforms, quick commerce, and specialty health food stores are helping brands reach a broader audience. According to IBEF, India's e-commerce platforms reached a historic milestone, with a GMV of $60 billion in fiscal year 2023, a 22% rise over the previous year. Consumers are willing to pay a premium for artisan, organic, and high-quality vegan chocolates that offer unique flavors and nutritional benefits. Premiumization is evident with brands introducing single-origin, bean-to-bar, and handcrafted vegan chocolates catering to an elite consumer base. The availability of international vegan chocolate brands through e-commerce is also contributing to the market’s expansion, enhancing competition and driving innovation in the segment.

India Vegan Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on chocolate type, nature, and sales channel.

Chocolate Type Insights:

- Milk Chocolate and White Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the chocolate type. This includes milk chocolate and white chocolate, dark chocolate, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and conventional.

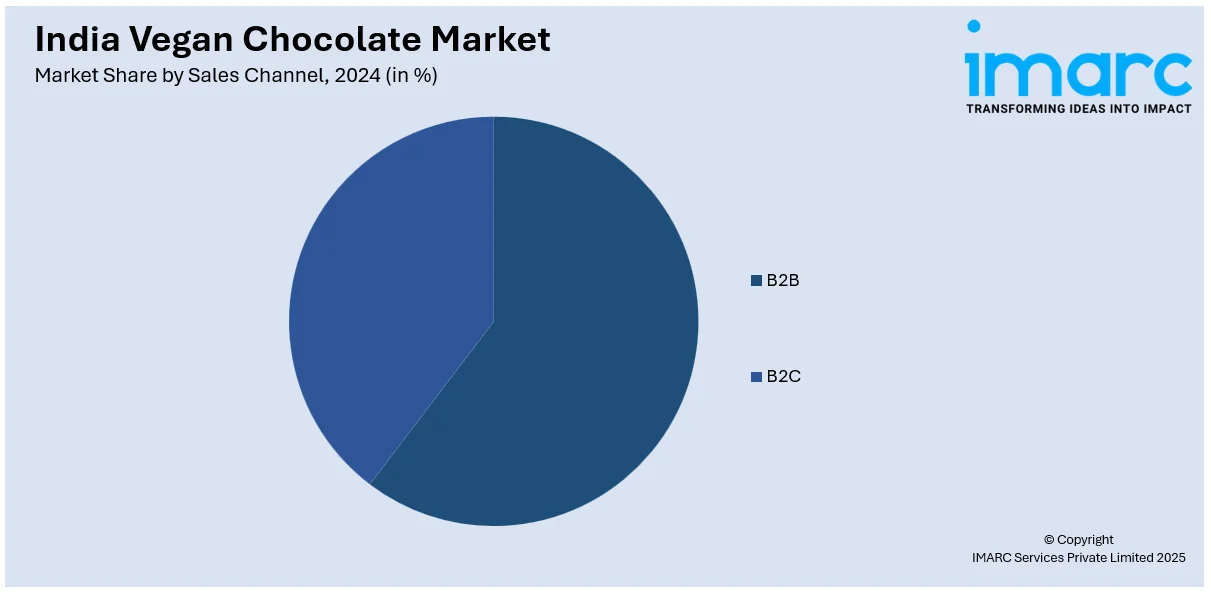

Sales Channel Insights:

- B2B

- B2C

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes B2B and B2C (supermarkets and hypermarkets, convenience stores, online stores, and others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vegan Chocolate Market News:

- In February 2023, Keventers, a renowned Indian dairy brand with a 97-year tradition best known for its milkshakes and ice creams, intends to expand its product portfolio across India with the debut of its first line of vegan delicacies on February 20, 2023. The two delicious flavors, Vegan Dark Chocolate and Vegan Strawberry are accessible in consumer packs of 450 ml and 100 ml, priced at Rs.349 and Rs.109, respectively.

India Vegan Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chocolate Types Covered | Milk Chocolate and White Chocolate, Dark Chocolate, Others |

| Natures Covered | Organic, Conventional |

| Sales Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India vegan chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the India vegan chocolate market on the basis of chocolate type?

- What is the breakup of the India vegan chocolate market on the basis of nature?

- What is the breakup of the India vegan chocolate market on the basis of sales channel?

- What is the breakup of the India vegan chocolate market on the basis of region?

- What are the various stages in the value chain of the India vegan chocolate market?

- What are the key driving factors and challenges in the India vegan chocolate market?

- What is the structure of the India vegan chocolate market and who are the key players?

- What is the degree of competition in the India vegan chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vegan chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vegan chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vegan chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)