India Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

India Vegetable Oil Market Overview:

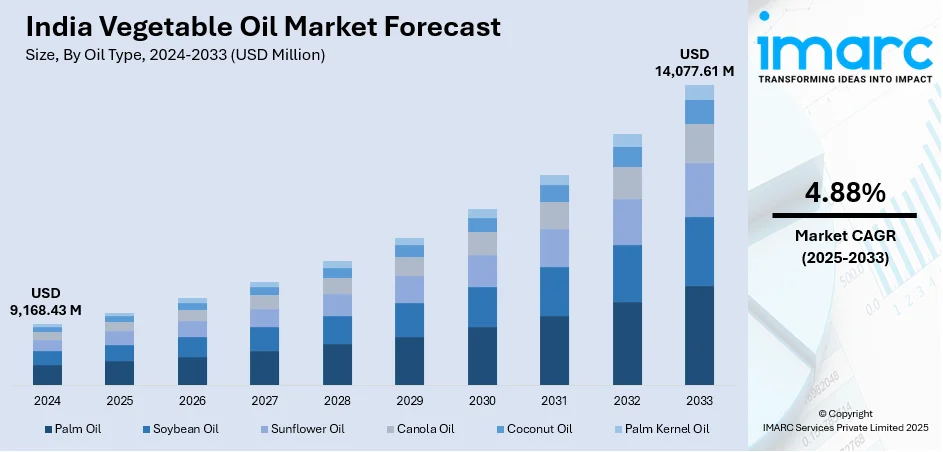

The India vegetable oil market size reached USD 9,168.43 Million in 2024. Looking forward, the market is projected to reach USD 14,077.61 Million by 2033, exhibiting a growth rate (CAGR) of 4.88% during 2025-2033. The market is driven by India’s high edible oil consumption and import dependence across household and industrial segments. Government efforts to enhance domestic oilseed production and refine trade policies are reshaping long-term supply structures. Rising health awareness and fortified, branded oil adoption are further augmenting the India vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9,168.43 Million |

| Market Forecast in 2033 | USD 14,077.61 Million |

| Market Growth Rate 2025-2033 | 4.88% |

India Vegetable Oil Market Trends:

High Consumption Demand and Edible Oil Dependency

India is among the world’s largest consumers of vegetable oil, with demand primarily driven by population growth, urbanization, and dietary habits centered around fried and oil-rich foods. However, domestic production falls significantly short of meeting national needs, with the majority of edible oil demand met through imports—especially of palm, soybean, and sunflower oil. Urban households and the foodservice sector rely on refined oils for large-scale cooking and processing, while rural consumption remains steady through unbranded or loose oil sales. Consumption growth is also supported by the increasing popularity of packaged and processed foods, especially in Tier II and Tier III cities. Brands are investing in blending technologies to reduce reliance on single-source imports and offer healthier options aligned with consumer preferences. On July 22, 2024, the Roundtable on Sustainable Palm Oil (RSPO) and the Indian Vegetable Oil Producers’ Association (IVPA) signed a Memorandum of Understanding to promote sustainable palm oil cultivation and imports in India. The agreement, announced during IVPA’s flagship event in New Delhi, aims to raise awareness, advocate supportive policies, and integrate best practices under the National Mission on Edible Oils – Oil Palm (NMEO-OP). As the world’s largest palm oil importer, India seeks to reduce import dependence by producing up to 3 million tons of palm oil domestically by 2030 while enhancing sustainability in the vegetable oil sector. As price volatility in global oil markets impacts India’s inflation, both public and private stakeholders are emphasizing storage infrastructure and import diversification. This consistently high and diversified consumption across regions and income levels continues to drive India vegetable oil market growth and positions the sector as critical to food security and inflation management.

To get more information on this market, Request Sample

Government Policy Interventions and Domestic Oilseed Initiatives

To reduce import dependency, the Indian government has launched multiple policy measures under oilseed development programs. On October 3, 2024, the Indian Cabinet approved the National Mission on Edible Oils – Oilseeds (NMEO-Oilseeds), allocating INR 10,103 Crore (approx. USD 1.21 Billion) to enhance domestic oilseed production over 2024–31. The mission aims to raise oilseed output from 39 Million Tons in 2022–23 to 69.7 Million Tons by 2030–31, and edible oil production to 25.45 Million Tons, targeting 72% self-sufficiency. To support this, India will expand cultivation by 4 Million Hectares, establish 65 seed hubs and 600 value chain clusters, and launch a digital seed tracking system, directly impacting the India vegetable oil market. These include financial incentives for farmers cultivating oilseed crops such as mustard, soybean, groundnut, and oil palm, along with investments in oil extraction units and processing infrastructure. Import duties on refined versus crude oils are strategically adjusted to protect domestic refiners while keeping retail prices affordable. Additionally, the Food Corporation of India (FCI) collaborates with state governments for buffer stocking and subsidized oil distribution through the Public Distribution System (PDS). Public-private partnerships are also emerging to boost farm productivity through hybrid seed development and agri-tech integration. Furthermore, the emphasis on self-reliance (Atmanirbhar Bharat) has extended to agro-processing industries, encouraging investments in oil refineries and cold storage chains. These coordinated efforts—spanning farm-level interventions to trade regulation—have laid the foundation for enhancing India’s edible oil security and long-term supply-side resilience. By addressing both production bottlenecks and import risk, policy interventions remain a cornerstone of the sector’s structural growth.

India Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

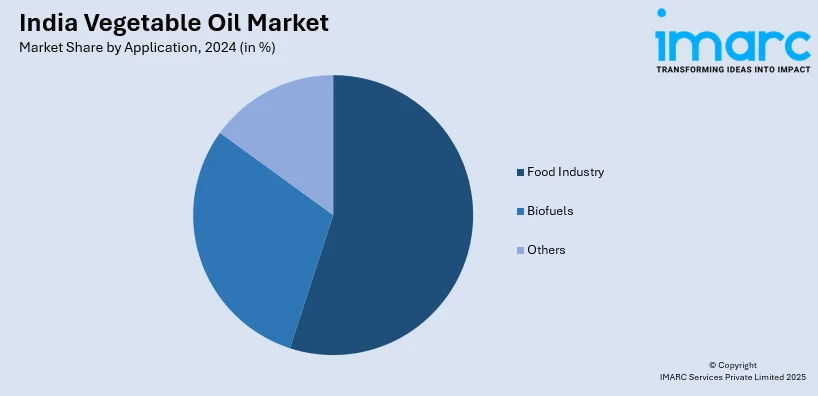

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all major regional markets. This includes North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vegetable Oil Market News:

- On July 10, 2024, Louis Dreyfus Company (LDC) relaunched its consumer-facing edible oil brand Vibhor in India as part of its downstream expansion strategy. The refreshed Vibhor line includes refined mustard oils, soybean, palm olein, cottonseed, and vanaspati, all fortified with vitamins A and D, to cater to India’s growing demand for nutritious and value-added edible oils.

India Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the India vegetable oil market on the basis of oil type?

- What is the breakup of the India vegetable oil market on the basis of application?

- What is the breakup of the India vegetable oil market on the basis of region?

- What are the various stages in the value chain of the India vegetable oil market?

- What are the key driving factors and challenges in the India vegetable oil market?

- What is the structure of the India vegetable oil market and who are the key players?

- What is the degree of competition in the India vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)