India Vehicle Recycling Market Size, Share, Trends, and Forecast by Type, Material, Application, and Region, 2025-2033

India Vehicle Recycling Market Overview:

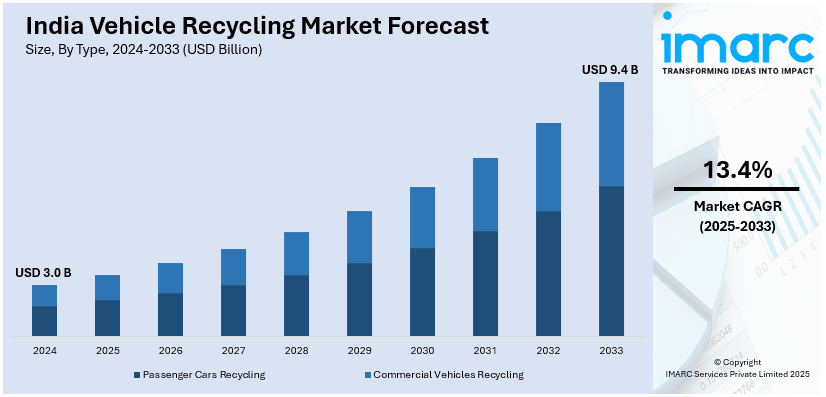

The India vehicle recycling market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.4 Billion by 2033, exhibiting a growth rate (CAGR) of 13.4% during 2025-2033. The market is expanding due to government regulations, increasing end-of-life vehicle (ELV) disposal, and the rising demand for recycled metals. Advancements in dismantling and shredding technologies enhance efficiency, while sustainability initiatives drive investments in organized recycling infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 9.4 Billion |

| Market Growth Rate 2025-2033 | 13.4% |

India Vehicle Recycling Market Trends:

Rising Adoption of Government-Led Vehicle Scrappage Policies

India’s vehicle recycling market is expanding due to the Vehicle Scrappage Policy introduced to phase out old, unfit vehicles. This initiative mandates deregistration and recycling of end-of-life vehicles (ELVs) to reduce pollution and promote eco-friendly disposal methods. For instance, as per industry reports, the government of India implemented scrapping rule with an aim to lower both carbon footprint and pollution. In line with this, from April 2023, HCV fitness testing was mandated at Automated Testing Stations and from June 2024, this extended to both private and commercial vehicles. Private ones over 20 years and commercial ones over 15 years were strictly advised to pass test or to be scrapped as ELVs. The policy offers incentives such as tax benefits and registration fee waivers for consumers scrapping older vehicles, encouraging participation in the formal recycling ecosystem. With the growing number of aging vehicles on Indian roads, the demand for organized vehicle dismantling and material recovery is increasing. Automakers and recyclers are investing in advanced shredding and separation technologies to extract valuable materials like steel, aluminum, and plastics, ensuring a circular economy. The push for sustainable automotive waste management is also aligning with India’s broader environmental goals, fostering increased collaboration between OEMs, recyclers, and policymakers to streamline the vehicle recycling process and promote responsible resource utilization.

To get more information of this market, Request Sample

Growth in Automated Dismantling and Material Recovery Technologies

The vehicle recycling industry in India is witnessing a shift towards automated dismantling and material recovery technologies to improve efficiency and sustainability. Traditional manual dismantling processes are being replaced with robotic and AI-driven systems that enhance precision in extracting reusable components, including engines, batteries, and catalytic converters. Advanced metal separation techniques, such as eddy current separators and laser-induced breakdown spectroscopy (LIBS), are being integrated into vehicle shredding facilities to improve the recovery rate of non-ferrous metals. Additionally, the increasing focus on electric vehicle (EV) battery recycling is driving investments in hydrometallurgical and pyrometallurgical processes for extracting lithium, cobalt, and nickel. For instance, as per industry reports, NITI Aayog estimates that by the year 2030, recycling volume for lithium-ion batteries will increase to 128 GWh, with 46% solely obtained from electric cars. Furthermore, the growing adoption of these technologies reduces environmental impact while optimizing resource recovery. As India advances in vehicle recycling infrastructure, automation is expected to enhance operational efficiency, reduce labor-intensive processes, and support the transition towards a more sustainable automotive supply chain.

India Vehicle Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, material, and application.

Type Insights:

- Passenger Cars Recycling

- Commercial Vehicles Recycling

The report has provided a detailed breakup and analysis of the market based on the type. This includes passenger cars recycling and commercial vehicles recycling.

Material Insights:

- Iron

- Aluminium

- Steel

- Rubber

- Copper

- Glass

- Plastic

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes iron, aluminium, steel, rubber, copper, glass, plastic, and others.

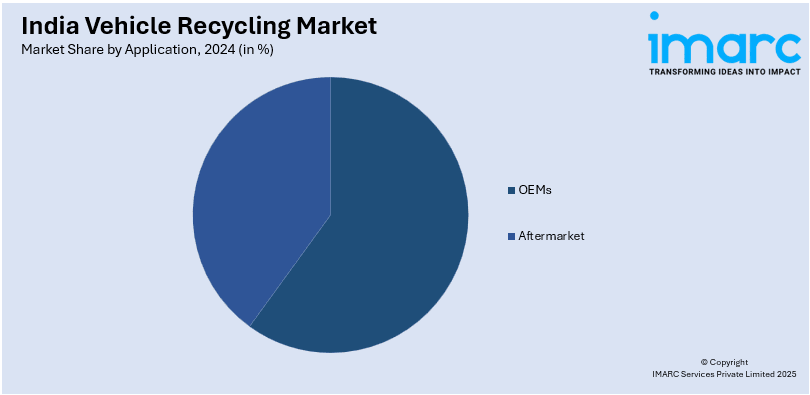

Application Insights:

- OEMs

- Aftermarket

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes OEMs and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vehicle Recycling Market News:

- In February 2025, TATA Motors announced the launch of its new recycling plant for advanced vehicles in Northeast India. This scrapping facility offers annual capacity of 15000 vehicles (end-of-life). The plant will serve as an extensive recycling zone for commercial as well as passenger vehicles of several brands.

- In December 2024, Kia India announced the launch of its new Scrappage Incentive Program that will enable consumers to scrap or trade their old cars of any brand and receive a new Kia in return. This program will also provide 1.5% discount on new purchase.

India Vehicle Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger Cars Recycling, Commercial Vehicles Recycling |

| Materials Covered | Iron, Aluminium, Steel, Rubber, Copper, Glass, Plastic, Others |

| Applications Covered | OEMs, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vehicle recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vehicle recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vehicle recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vehicle recycling market in India was valued at USD 3.0 Billion in 2024.

The India vehicle recycling market is projected to exhibit a CAGR of 13.4% during 2025-2033, reaching a value of USD 9.4 Billion by 2033.

Rising environmental regulations, stricter end-of-life vehicle policies, and growing awareness about sustainable practices are driving the India vehicle recycling market. Additionally, the economic value of recovered materials, expansion of formal dismantling infrastructure, and increased automotive sales contribute to greater demand for efficient and compliant recycling solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)