India Veterinary Pharmaceuticals Market Size, Share, Trends and Forecast by Product Type, Indication, Animal Type, Route of Administration, Distribution Channel, and Region, 2025-2033

India Veterinary Pharmaceuticals Market Overview:

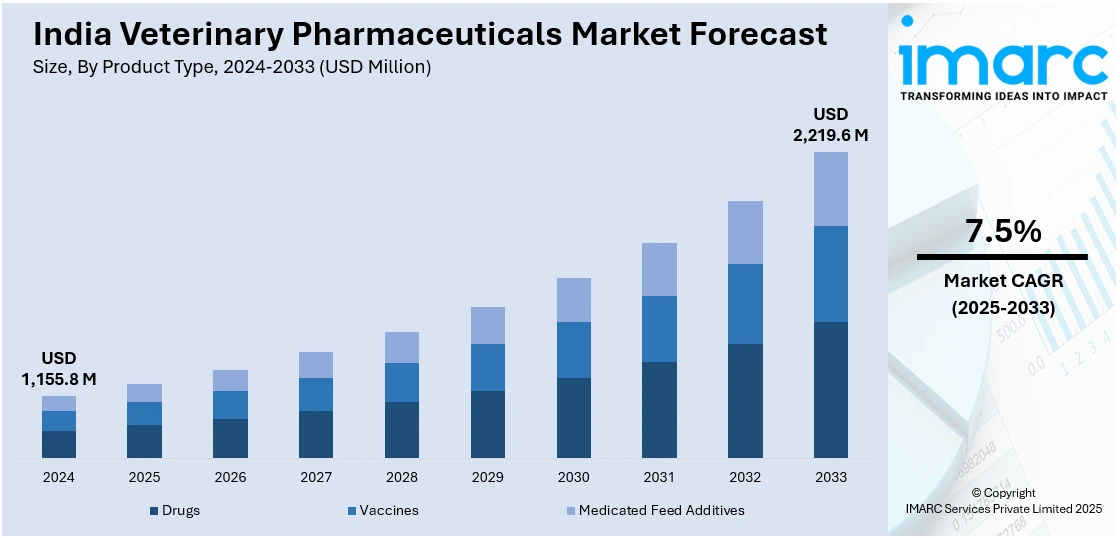

The India veterinary pharmaceuticals market size reached USD 1,155.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,219.6 Million by 2033, exhibiting a growth rate (CAGR) of 7.5% during 2025-2033. The market is growing due to rising livestock production, pet ownership, and disease management needs. Furthermore, the increased demand for drugs, vaccines, and medicated feed additives across livestock and companion animals, supported by evolving veterinary healthcare infrastructure is impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,155.8 Million |

| Market Forecast in 2033 | USD 2,219.6 Million |

| Market Growth Rate (2025-2033) | 7.5% |

India Veterinary Pharmaceuticals Market Trends:

Rising Livestock Population

Rising livestock population in India is driving significant demand for veterinary pharmaceuticals. As dairy and poultry farming expand to meet the country’s nutritional needs, the India veterinary pharmaceuticals market growth is accelerating, fueled by the need for higher productivity, disease prevention, and better animal health outcomes. Farmers are increasingly investing in vaccines, antibiotics, and feed additives to reduce mortality rates and enhance milk and meat yields. Poultry producers, in particular, are relying on antiparasitics and gut health enhancers to maintain flock health in intensive farming setups. Regional government initiatives supporting breed improvement and animal health infrastructure are further boosting demand. This surge in livestock-based agriculture is also prompting pharmaceutical companies to expand rural distribution networks and tailor formulations to Indian conditions. These dynamics are expected to steadily improve India veterinary pharmaceuticals market share, especially among domestic manufacturers.

To get more information of this market, Request Sample

Rise in Government Support

Government support through targeted schemes is strengthening India’s veterinary healthcare infrastructure. A major recent development further reinforcing this trend is the government’s approval of an expanded livestock health initiative. For instance, in March 2025, the Union Cabinet, chaired by the Prime Minister, approved the Rs. 3,880 crore Revision of the Livestock Health and Disease Control Programme (LHDCP) for 2024-26. The scheme includes three components and focuses on disease prevention through immunization, enhancing veterinary healthcare, and promoting generic medicines, benefiting farmers and rural entrepreneurs. Programs such as the Rashtriya Gokul Mission and National Livestock Mission are improving breed quality, boosting animal productivity, and expanding access to veterinary services in rural areas. These initiatives are enabling timely disease diagnosis and treatment, increasing awareness of preventive care, and promoting scientific livestock management practices. As more states adopt mobile veterinary clinics and subsidized healthcare programs, the demand for quality veterinary pharmaceuticals is rising. Public-private partnerships are also encouraging local manufacturing of essential animal health products. In parallel, the government’s focus on doubling farmers’ income is pushing the adoption of productivity-enhancing veterinary drugs. These policy-level efforts are creating a more structured and accessible ecosystem for animal healthcare, supporting long-term sector expansion. These developments are shaping a positive India veterinary pharmaceuticals market outlook.

Focus on Disease Prevention

A growing focus on disease prevention is reshaping the veterinary pharmaceuticals market in India. Farmers are increasingly recognizing the economic impact of animal diseases, which can lead to reduced productivity, higher mortality, and significant financial losses. To mitigate these risks, there is a shift toward proactive healthcare approaches, including regular vaccination, deworming, and biosecurity practices. Preventive veterinary care not only improves animal welfare but also enhances milk, egg, and meat yields, supporting overall farm profitability. Government campaigns and awareness programs are also encouraging farmers to adopt preventive solutions rather than relying solely on treatment after illness occurs. This trend is boosting demand for vaccines, parasiticides, and diagnostic services, and is expected to play a vital role in sustaining livestock health and farm economics across India.

India Veterinary Pharmaceuticals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, indication, animal type, route of administration, and distribution channel.

Product Type Insights:

- Drugs

- Anti-Infective

- Anti-Inflammatory

- Parasiticide

- Vaccines

- Inactivated Vaccines

- Attenuated Vaccines

- Recombinant Vaccines

- Others

- Medicated Feed Additives

- Amino Acids

- Antibiotics and Antimicrobials

The report has provided a detailed breakup and analysis of the market based on the product type. This includes drugs (anti-infective, anti-inflammatory and parasiticide), vaccines (inactivated vaccines, attenuated vaccines, recombinant vaccines and others) and medicated feed additives (amino acids, and antibiotics and antimicrobials).

Indication Insights:

- Infectious Diseases

- Dermatologic Diseases

- Pain

- Orthopedic Diseases

- Behavioral Diseases

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes infectious diseases, dermatologic diseases, pain, orthopedic diseases, behavioral diseases and others.

Animal Type Insights:

- Production Animals/Livestock

- Poultry

- Swine

- Cattle

- Sheep and Goats

- Others

- Companion Animals

- Dogs

- Cats

- Horses

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes production animals/livestock (poultry, swine, cattle, sheep and goats and others) and companion animals (dogs, cats, horses and others).

Route of Administration Insights:

- Oral Route

- Parenteral Route

- Topical Route

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral route, parenteral route and topical route.

Distribution Channel Insights:

- Veterinary Hospitals

- Veterinary Clinics

- Retail Pharmacies

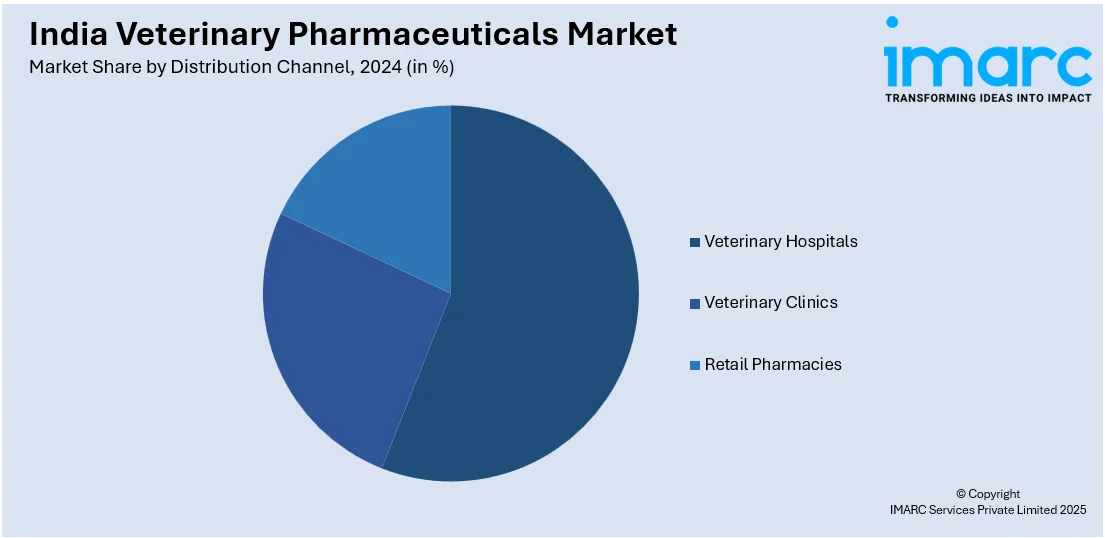

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes veterinary hospitals, veterinary clinics and retail pharmacies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Veterinary Pharmaceuticals Market News:

- In March 2025, Fredun Pharmaceuticals entered the large animal veterinary market with the launch of Freossi Tone+ and Freossi Power, designed to tackle health challenges in livestock. This strategic move builds on their trusted reputation in companion animal care, reinforcing their commitment to innovation in veterinary healthcare.

- In January 2024, ENTOD Pharmaceuticals launched its new veterinary division, "FUR by ENTOD," specializing in innovative eye and ear care solutions for pets. The product range includes lubricating drops, anti-glaucoma medications, and antibiotics aimed at improving pet health globally, reinforcing ENTOD's commitment to pharmaceutical excellence.

India Veterinary Pharmaceuticals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Indications Covered | Infectious Diseases, Dermatologic Diseases, Pain, Orthopedic Diseases, Behavioral Diseases, Others |

| Animal Types Covered |

|

| Route of Administrations Covered | Oral Route, Parenteral Route, Topical Route |

| Distribution Channels Covered | Veterinary Hospitals, Veterinary Clinics, Retail Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India veterinary pharmaceuticals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India veterinary pharmaceuticals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India veterinary pharmaceuticals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The veterinary pharmaceuticals market in India was valued at USD 1,155.8 Million in 2024.

The India veterinary pharmaceuticals market is projected to exhibit a CAGR of 7.5% during 2025-2033, reaching a value of USD 2,219.6 Million by 2033.

Key drivers include the rising livestock population, increasing pet ownership, greater demand for disease management solutions, government support through initiatives like the Livestock Health and Disease Control Programme, and the growing veterinary healthcare infrastructure, all contributing to sector growth and development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)