India Vials Market Size, Share, Trends and Forecast by Preparation, Application, Material, End User, and Region, 2025-2033

India Vials Market Overview:

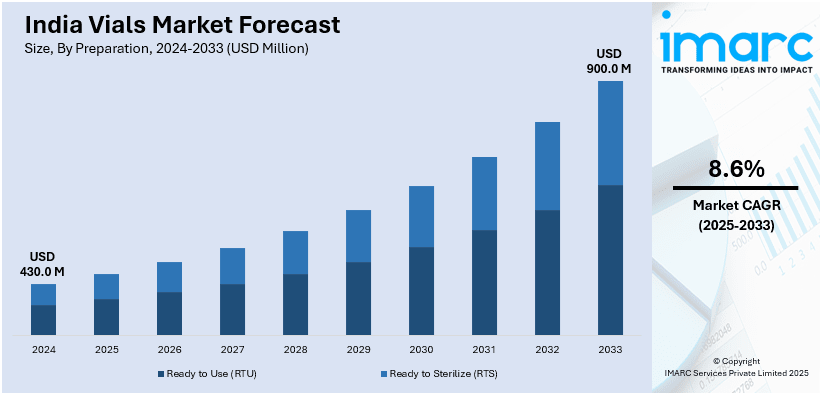

The India vials market size reached USD 430.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 900.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.6% during 2025-2033. The market is driven by expanding pharmaceutical production, growing vaccine manufacturing, rising demand for injectable drugs, government initiatives like the PLI scheme, advancements in counterfeit drug detection, and the booming biotechnology sector, all of which contribute to the need for high-quality, sterile, and secure vial packaging solutions across healthcare and research industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 430.0 Million |

| Market Forecast in 2033 | USD 900.0 Million |

| Market Growth Rate (2025-2033) | 8.6% |

India Vials Market Trends:

Expansion of the Pharmaceutical Industry

India's pharmaceutical sector stands as the world's third-largest by volume and fourteenth by value, underscoring its pivotal role in global healthcare. This robust development is a testament to India's extensive manufacturing capabilities, which produce a diverse range of generic medicines and active pharmaceutical ingredients (APIs). The government's encouraging policies have also accelerated this progress. Schemes, such as the Production Linked Incentive (PLI) scheme, are intended to boost local manufacturing of key starting materials (KSMs), drug intermediates, and APIs. With a budgetary expenditure of INR 6,940 crore, the PLI scheme is intended to minimize import dependence and build the local production base. This growing pharmaceutical sector has a direct impact on the vials market. With higher production of injectable medications, vaccines, and biologics, the demand for efficient and reliable packaging options like vials surges. Vials play a crucial role in preserving the sterility and effectiveness of these drugs to ensure safe administration to patients. Therefore, the vials market is expected to grow at a CAGR of 4.60% during 2030.

To get more information of this market, Request Sample

Surge in Demand for Injectable Drugs

The widespread occurrence of chronic conditions, such as cancer, diabetes, and autoimmune diseases, has contributed to the greater importance of injectable drugs. The drugs tend to have immediate and localized therapeutic actions, which makes them a critical component of contemporary medical practice. The higher attention on injectable drugs has consequently impacted the demand for vials. During the COVID-19 pandemic, India's massive drive for vaccination created the need to manufacture and deliver billions of vaccine doses, with each dose needing sterile vial packaging. The record demand brought out the industry's strength and capability. The indigenous manufacture of Liposomal Amphotericin B during the period from May 1 to June 30, 2021, stood at 4,53,555 vials, testifying to the responsiveness of the industry. Briefly, the expansion of India's pharmaceutical sector and the increase in demand for injectable drugs are critical drivers driving the market for vials. These, combined with the support of government policies and an efficient manufacturing base, have placed the vials industry on a path of long-term growth, ensuring the ability of the healthcare sector to address both present and future needs.

India Vials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on preparation, application, material, and end user.

Preparation Insights:

- Ready to Use (RTU)

- Ready to Sterilize (RTS)

The report has provided a detailed breakup and analysis of the market based on the preparation. This includes ready to use (RTU) and ready to sterilize (RTS).

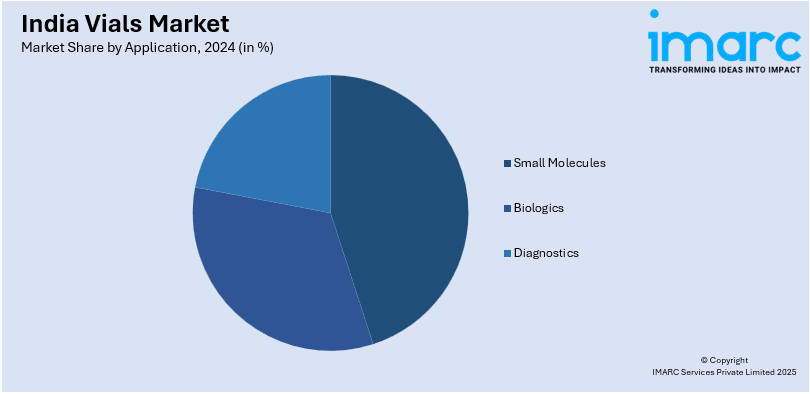

Application Insights:

- Small Molecules

- Biologics

- Diagnostics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes small molecules, biologics, and diagnostics.

Material Insights:

- Glass

- Polymer

- Hybrid

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes glass, polymer, and hybrid.

End User Insights:

- Hospitals and Clinics

- Pharma and Biotech Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Diagnostic Laboratories

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, pharma and biotech companies, contract development and manufacturing organizations (CDMOs), diagnostic laboratories, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vials Market News:

- January 2025: Researchers at the University of Oxford, together with the Serum Institute of India, created a process to identify fake COVID-19 vaccines by scanning vial labels and adhesives with MALDI-ToF mass spectrometry without having to open the vials. This innovation enhances the quality of vaccine distribution, thus driving the need for genuine vials in India. The Indian market for vials is thus expanding as manufacturers implement this technology to verify product authenticity and safety.

- October 2024: The Indian government suggested making QR codes compulsory on anti-cancer drug vials to fight fake drugs and guarantee authenticity. This legislation is building demand for secure, traceable vial packaging, and it is forcing manufacturers to invest in upgrading technology. The move is making the pharmaceutical supply chain stronger and improving the reliability of vials in India.

India Vials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Preparations Covered | Ready to Use (RTU), Ready to sterilize (RTS) |

| Applications Covered | Small Molecules, Biologics, Diagnostics |

| Materials Covered | Glass, Polymer, Hybrid |

| End User Covered | Hospitals and Clinics, Pharma and Biotech Companies, Contract Development and Manufacturing Organizations (CDMOs), Diagnostic Laboratories, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vials market in India was valued at USD 430.0 Million in 2024.

The vials market in India is projected to exhibit a CAGR of 8.6% during 2025-2033, reaching a value of USD 900.0 Million by 2033.

The India vials market is driven by growing pharmaceutical and biotechnology industries, rising demand for injectable medicines, and the need for safe, sterile packaging. Innovations in vial materials, along with increased focus on quality, export readiness, and regulatory compliance, are encouraging widespread use across healthcare and laboratory applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)