India Vision Care Market Size, Share, Trends and Forecast by Product Type, Coating, Lens Material Distribution Channel, and Region, 2025-2033

India Vision Care Market Overview:

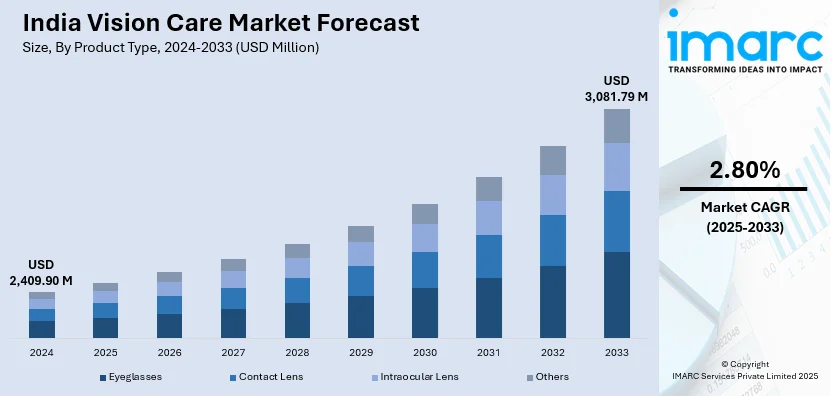

The India vision care market size reached USD 2,409.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,081.79 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The market is being driven by the rising screen exposure, increasing awareness of eye health, and growing demand for advanced eyewear solutions. Rapid urbanization, e-commerce penetration, and innovation in lenses, coatings, and smart eyewear technologies are also impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,409.90 Million |

| Market Forecast in 2033 | USD 3,081.79 Million |

| Market Growth Rate (2025-2033) | 2.80% |

India Vision Care Market Trends:

Technological Advancements in Lenses

Technological advancements in lenses are playing a crucial role in reshaping consumer preferences in India’s vision care segment. With increasing screen exposure due to digital lifestyles, blue light-blocking lenses are seeing strong uptake, especially among working professionals and students. The India vision care market growth is also being supported by innovations like photochromic lenses, which adjust to light conditions, and anti-glare coatings that enhance comfort during extended use. For instance, In March 2025, EssilorLuxottica India launched Transitions GEN S, an innovative adaptive eyewear product that quickly adjusts to light conditions. Featuring ultra-responsive darkening, eight unique color shades, and enhanced HD vision, these lenses provide superior comfort and protection, making them a significant advancement in modern vision care. These advancements are not only improving visual comfort and eye health but also influencing buying decisions, particularly in urban regions. Manufacturers are responding with enhanced R&D, launching customized solutions for different age groups and occupations. Additionally, premium lens technologies are becoming more affordable, leading to higher penetration in mid-income segments. As innovation continues to drive product differentiation, these smart lens solutions are expected to significantly shape the India vision care market outlook.

To get more information of this market, Request Sample

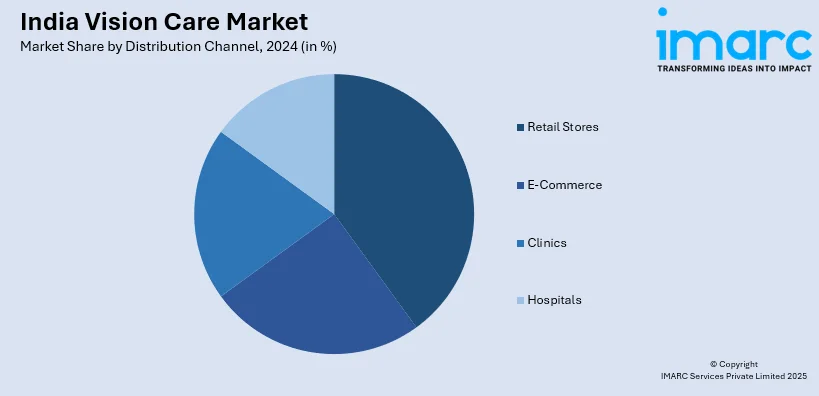

Expansion of Online Optical Retail

The expansion of online optical retail is reshaping access to vision care products across India, especially in Tier 2 and Tier 3 cities. Digital-first platforms like Lenskart, Titan Eyeplus, and GKB Opticals are offering a wide range of eyeglasses, contact lenses, and eye testing services through easy-to-navigate apps and websites. These platforms are integrating features such as virtual try-ons, AI-driven recommendations, and home eye check-ups to bridge the accessibility gap in underserved regions. Competitive pricing, quick delivery, and digital payment options are also encouraging adoption. Strategic warehousing and localized marketing efforts are enabling faster last-mile delivery and improved service experience. Innovative product offerings and strategic partnerships are helping online retailers differentiate and enhance the customer experience. For instance, in February 2025, Lenskart launched Phonic smart glasses, integrating Bluetooth audio into stylish eyewear for multitasking users. In collaboration with Zepto, customers can receive their glasses in just 10 minutes. Priced affordably, Phonic features up to 7 hours of battery life, compatible with both Android and iOS voice assistants. As internet penetration and smartphone usage continue to rise, e-commerce is expected to play a pivotal role in driving India vision care market share.

India Vision Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, coating, lens material, and distribution channel.

Product Type Insights:

- Eyeglasses

- Contact Lens

- Intraocular Lens

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes eyeglasses, contact lens, intraocular lens and others.

Coating Insights:

- Anti-Glare

- Anti-Reflecting

- Others

A detailed breakup and analysis of the market based on the coating have also been provided in the report. This includes anti-glare, anti-reflecting and others.

Lens Material Insights:

- Normal Glass

- Polycarbonate

- Trivex

- Others

A detailed breakup and analysis of the market based on the lens material have also been provided in the report. This includes normal glass, polycarbonate, trivex and others.

Distribution Channel Insights:

- Retail Stores

- E-Commerce

- Clinics

- Hospitals

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail stores, e-commerce, clinics and hospitals.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vision Care Market News:

- In February 2025, Johnson & Johnson announced the launch of the TECNIS PureSee intraocular lens (IOL) in India to enhance cataract treatment options for the aging population. Designed for presbyopia, the lens offers high contrast and low-light performance while minimizing visual disturbances, aiming to reduce reliance on spectacles post-surgery in a growing market.

- In February 2024, ZEISS announced the launch of the VISUCORE 500 in India, revolutionizing eye care with a combined refraction unit that enhances efficiency and patient experience. The device completes eye screenings in under 4:30 minutes, reducing chair time by 46%. This innovation underscores ZEISS's commitment to advancing technology in the optical industry.

India Vision Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Eyeglasses, Contact Lens, Intraocular Lens, Others |

| Coatings Covered | Anti-Glare, Anti-Reflecting, Others |

| Lens Materials Covered | Normal Glass, Polycarbonate, Trivex, Others |

| Distribution Channels Covered | Retail Stores, E-Commerce, Clinics, Hospitals |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vision care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vision care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vision care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vision care market in India was valued at USD 2,409.90 Million in 2024.

The India vision care market is projected to exhibit a CAGR of 2.80% during 2025-2033, reaching a value of USD 3,081.79 Million by 2033.

The vision care market in India is expanding owing to the growing prevalence of eye-related disorders, aging population, and higher awareness about eye health. Technological advancements in vision correction solutions, expanding healthcare access, and increasing disposable incomes, also strengthen the market growth, alongside an increasing focus on preventive eye care and improved diagnostic tools.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)