India Vodka Market Size, Share, Trends and Forecast by Type, Quality, Distribution Channel, and Region, 2026-2034

India Vodka Market Overview:

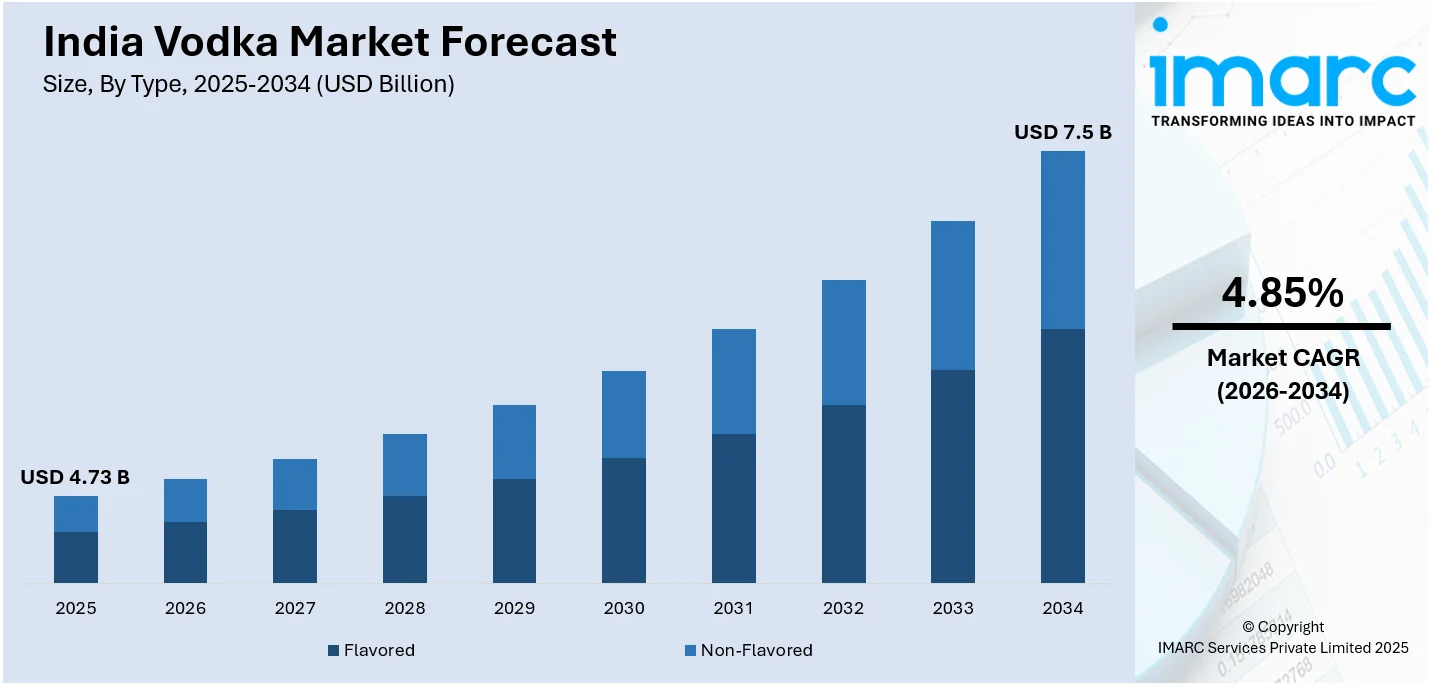

The India vodka market size reached USD 4.73 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.85% during 2026-2034. The India vodka market is primarily driven by the rising premiumization trends, increasing consumer preference for craft and flavored vodkas, and expanding cocktail culture. Besides this, the shift towards organic and sustainable vodka production, innovative packaging, and marketing strategies targeting younger demographics are fueling the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.73 Billion |

| Market Forecast in 2034 | USD 7.5 Billion |

| Market Growth Rate 2026-2034 | 4.85% |

India Vodka Market Trends:

Rising Demand for Premium Vodka

India’s growing economy and rising disposable incomes, particularly in urban areas, are driving a shift in consumer preferences toward premium alcoholic beverages, including vodka. Consumers are increasingly willing to spend on high-quality spirits that offer superior taste and brand prestige. Radico Khaitan, a leading Indian alcohol manufacturer known for "Magic Moments" vodka, reported a 24% rise in second-quarter profit for the period ending September 2024. The company’s consolidated net profit reached ₹806.6 million, with revenue from operations growing by 9.5% to ₹39.07 billion. The increasing demand for premium alcohol has fueled this growth. The company anticipated a 20% revenue growth for the fiscal year ending March 2025, reflecting the strong demand for premium alcoholic beverages. This trend extends beyond Radico Khaitan, as both domestic and international brands are expanding their premium vodka offerings. The focus on quality, unique flavors, and brand heritage is now crucial for capturing market share in India’s evolving spirits industry.

To get more information of this market Request Sample

Increasing Popularity of Flavored Vodka Among Younger Consumers

The rising popularity of flavored vodka is a key trend driving the growth of India’s vodka market, especially among younger consumers who seek variety and experimentation in their drinks. Flavored vodkas offer a diverse taste experience, from fruity and sweet to spicy and exotic, enhancing their appeal in cocktails. The market is witnessing an influx of innovative flavors from both established and emerging brands. In September 2024, McDowell’s & Co. launched the X Series, featuring unique recipes, honest ingredients, and vibrant packaging. Inspired by evolving consumer preferences, the X Series caters to those prioritizing quality drinking experiences and experimentation. Each variant is crafted to match different occasions and taste profiles. Additionally, Simba beer makers have entered the liquor market with ZigZag vodka, investing ₹45 lakh in a Chhattisgarh carbonation plant capable of producing 1 lakh cases per month. ZigZag vodka is available in four flavors, including original, lime, orange, and green apple—and in 750ml, 375ml, and 180ml sizes. These developments underscore the growing demand for flavored vodka in India, as brands innovate to meet the evolving tastes of a younger, more adventurous consumer base.

India Vodka Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, quality, distribution channel.

Type Insights:

- Flavored

- Non-Flavored

The report has provided a detailed breakup and analysis of the market based on the type. This includes flavored and non-flavored.

Quality Insights:

- Standard

- Premium

- Ultra-Premium

A detailed breakup and analysis of the market based on the quality have also been provided in the report. This includes standard, premium, and ultra-premium.

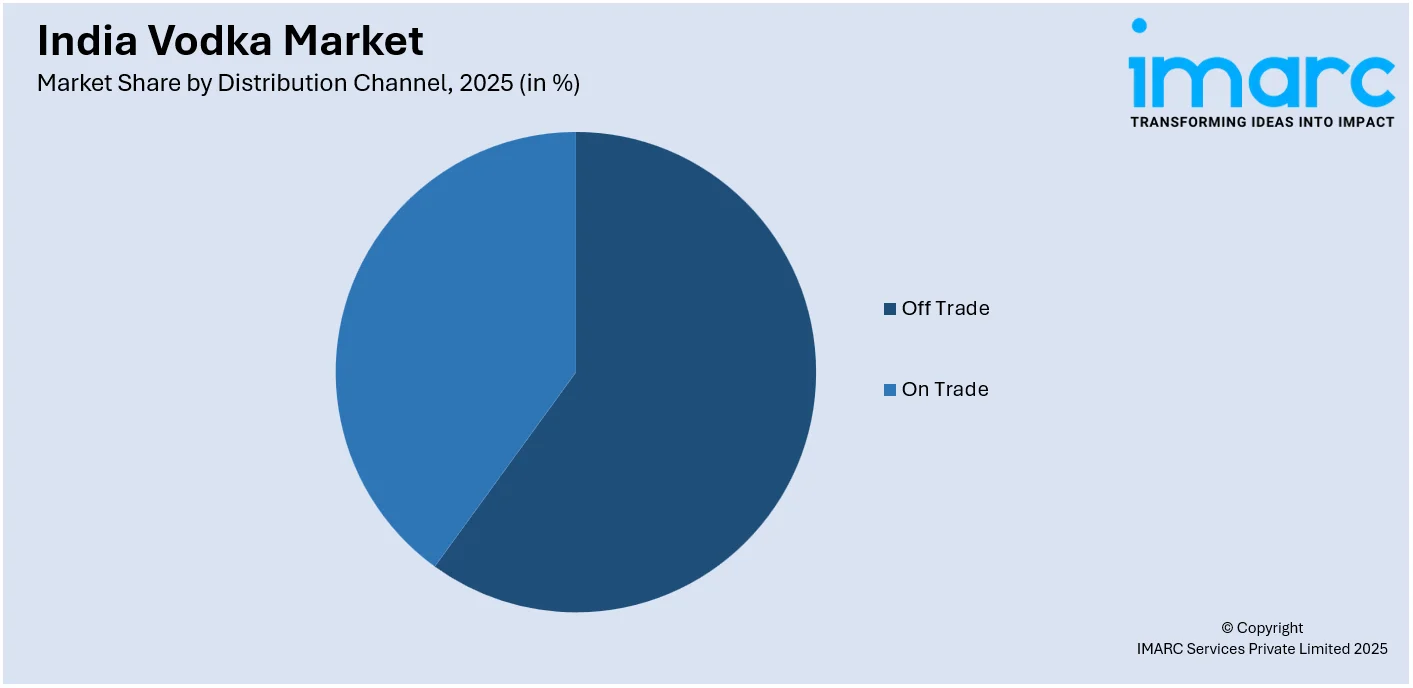

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Off Trade

- On Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes off trade and on trade.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vodka Market News:

- March 2025: Samsara, an Indian vodka brand, released its latest product, Amara Pink Vodka.The vodka is delicately distilled in five steps and infused with rose petals, lotus flowers, cherry blossoms, strawberries, peaches, and citrus, yielding a vivid taste profile and gentle pink tint.

- February 2025: Smirnoff Vodka introduced three new vodka tastes - Minty Jamun, Mirchi Mango, and Zesty Lime - to appeal to the Indian palate. The new vodka tastes are created in India, triple-distilled, and devoid of artificial flavors.

India Vodka Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flavored, Non-Flavored |

| Qualities Covered | Standard, Premium, Ultra-Premium |

| Distribution Channels Covered | Off Trade, On Trade |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vodka market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vodka market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vodka industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India vodka market was valued at USD 4.73 Billion in 2025.

The India vodka market is projected to exhibit a CAGR of 4.85% during 2026-2034, reaching a value of USD 7.5 Billion by 2034.

The India vodka market is driven by rising urbanization, changing lifestyles, and increasing acceptance of Western drinking culture. Growing young adult population, premium product offerings, and flavored variants also boost demand. Expanding nightlife, social drinking trends, and aggressive marketing by global and local brands further fuel market growth across cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)