India Wall Cladding Market Size, Share, Trends and Forecast by Construction Type, Type, End User, and Region, 2025-2033

India Wall Cladding Market Overview:

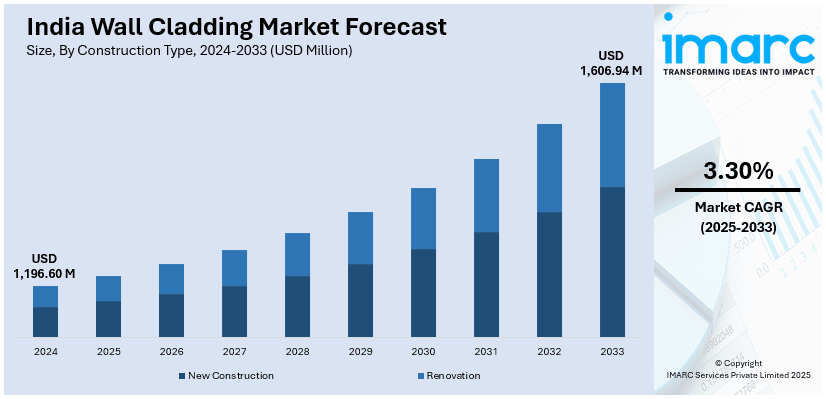

The India wall cladding market size reached USD 1,196.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,606.94 Million by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The India wall cladding market share is growing due to rapid urbanization and expanding infrastructure projects. Rising construction activities, including residential and commercial developments, are driving the overall demand. Moreover, increasing preference for energy-efficient and sustainable materials is further influencing the adoption of eco-friendly cladding solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,196.60 Million |

| Market Forecast in 2033 | USD 1,606.94 Million |

| Market Growth Rate 2025-2033 | 3.30% |

India Wall Cladding Market Trends:

Rapid Urbanization and Infrastructure Development

Growing rural-urban migration is propelling residential and commercial building work across different cities and towns. By 2030, more than 40% of India's population will be urban dwellers, propelling infrastructure growth significantly. The Government's Smart Cities Mission is promoting contemporary building, creating demand for long-lasting and visually appealing cladding solutions. Widening metro rail networks, highways, and airports are creating a surge in demand for high-performance wall cladding solutions. Fast urban real estate development is driving developers to opt for stylish, weather-resistant, and energy-efficient facades. Soaring high-rise structures and business complexes necessitate high-end cladding solutions for insulation, security, and aesthetics. Increasing investments in shopping malls, IT campuses, and hotels are also fueling the India wall cladding market growth. Contractors are increasingly going for high-end materials such as metal, fiber cement, and terracotta for endurance and beauty. Fast development of schools and hospitals is driving the need for fire-resistant and water-proof cladding. Sustainable urban infrastructure focus is catalyzing the demand for green and energy-efficient cladding materials. Prefabricated construction methods are gaining traction, favoring the use of lightweight and simple-to-install cladding solutions. Government initiatives focusing on energy efficiency and sustainable development are driving the use of high-performance cladding solutions.

To get more information of this market, Request Sample

Rising Construction Activities

With the fast expansion of residential constructions, contemporary homes need wall cladding solutions that are both visually pleasing and long-lasting. The India wall cladding market outlook is being favorably impacted by commercial construction, which includes office buildings and retail complexes. The need for weatherproof and fire-resistant cladding solutions is being driven by the growth of industrial infrastructure. The need for economical and long-lasting wall cladding is growing as a result of government programs like affordable housing projects. The use of high-performance cladding materials is growing as a result of the expansion of urban infrastructure, such as roads, airports, and metros. In order to increase productivity, builders are choosing lightweight, simple-to-install cladding, since the Indian modular building industry is expected to reach USD 3.0 billion by 2024. High-rise residences and rising skyscrapers need sophisticated covering for structural protection, energy efficiency, and insulation. The need for contemporary cladding solutions is being further stimulated by an increase in the rehabilitation of older structures. Low-maintenance and aesthetically pleasing cladding materials are being used by hotels, hospitals, and educational institutions. The usage of insulated and environmentally friendly wall cladding is being driven by growing awareness of energy-efficient building.

India Wall Cladding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on construction type, type, and end user.

Construction Type Insights:

- New Construction

- Renovation

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes new construction and renovation.

Type Insights:

- Fiber Cement and Concrete

- Ceramics

- Metal

- Wood

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes fiber cement and concrete, ceramics, metal, wood, and others.

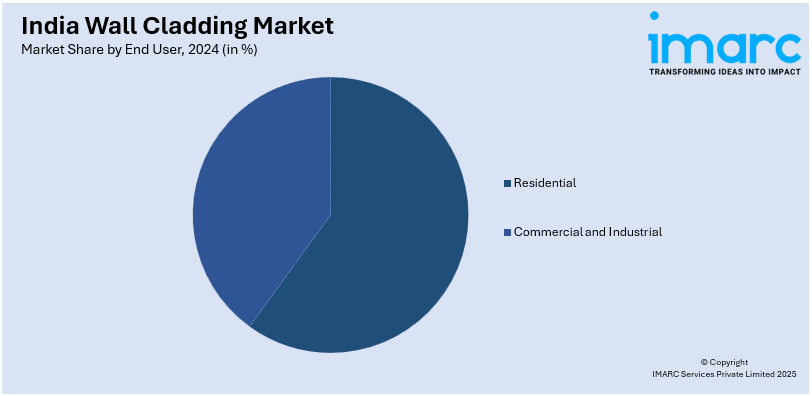

End User Insights:

- Residential

- Commercial and Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wall Cladding Market News:

- In November 2024, VOX India expanded its product range with stylish and durable ceiling and wall panels, including Infratop SV26, Fronto SV24, and Welo SV22. Designed for residential and commercial spaces, these panels provide versatile solutions for modern interiors, enhancing aesthetic appeal and functionality while catering to India’s growing demand for premium wall cladding materials.

- In April 2024, Alumil India introduced SMARTIA M7000 Barcode Cladding, which offers a modern wall cladding solution for interior and exterior applications. Featuring customizable profiles, diverse colors, LED integration, perforated panels, and synthetic wood, it enables unique designs. Made from durable, corrosion-resistant aluminum, it seamlessly integrates with curtain walls, windows, and doors, suiting commercial, office, and residential projects.

India Wall Cladding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Construction Types Covered | New Construction, Renovation |

| Types Covered | Fiber Cement and Concrete, Ceramics, Metal, Wood, Others |

| End Users Covered | Residential, Commercial and Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India wall cladding market performed so far and how will it perform in the coming years?

- What is the breakup of the India wall cladding market on the basis of construction type?

- What is the breakup of the India wall cladding market on the basis of type?

- What is the breakup of the India wall cladding market on the basis of end user?

- What are the various stages in the value chain of the India wall cladding market?

- What are the key driving factors and challenges in the India wall cladding market?

- What is the structure of the India wall cladding market and who are the key players?

- What is the degree of competition in the India wall cladding market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wall cladding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wall cladding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wall cladding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)