India Waste Electrical & Electronic Equipment Recycling Market Size, Share, Trends and Forecast by Waste Source, Recycling Process, Material Recycled, End-Use, and Region, 2025-2033

India Waste Electrical & Electronic Equipment Recycling Market Size and Share:

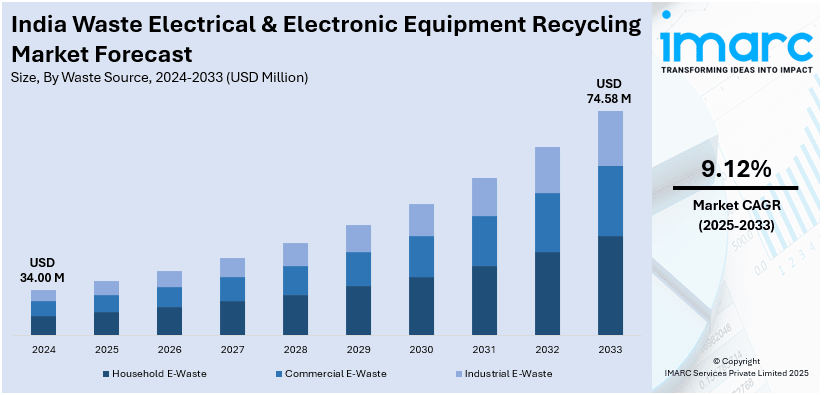

The India waste electrical & electronic equipment recycling market size reached USD 34.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 74.58 Million by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033. The India waste electrical & electronic equipment recycling market share is expanding, driven by the rising awareness about sustainable disposal methods to minimize environmental impact, along with the growing execution of stringent regulations by government agencies to promote the adoption of structured recycling processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.00 Million |

| Market Forecast in 2033 | USD 74.58 Million |

| Market Growth Rate 2025-2033 | 9.12% |

India Waste Electrical & Electronic Equipment Recycling Market Trends:

Rising electronic waste (e-waste) generation

The increasing amount of e-waste, also called waste electrical & electronic equipment, is fueling the market growth. According to industry reports, India became the third-largest producer of e-waste worldwide, following China and the USA, generating 3.8 Million Metric Tons in FY24, equating to a doubling compared to the last ten years. With rapid technological advancements, people frequently replace gadgets like smartphones, laptops, and home appliances, leading to a surge in discarded electronics. As e-waste piles up, concerns over its environmental impact are on the rise since these products contain hazardous materials, such as lead, mercury, and cadmium, which can harm soil and water if not disposed of properly. Environmental agencies are taking initiatives to ensure responsible debris management, which is offering a favorable India waste electrical & electronic equipment recycling market outlook. Companies are also recognizing the value of recovering precious metals like gold, silver, and copper from old electronics, making recycling an economically viable option. More individuals are becoming aware about sustainable disposal methods, driving the demand for efficient waste electrical & electronic equipment recycling facilities. As a result, the recycling market is expanding to meet the growing need for sustainable waste management solutions.

To get more information of this market, Request Sample

Growing execution of strict government regulations

The Indian Government is executing stringent regulations on waste electrical & electronic equipment management. With rising concerns about health hazards caused by improper disposal of e-waste, authorities are implementing policies that require companies to take responsibility for recycling their products. In August 2024, the Central Pollution Control Board (CPCB) declared an initiative to evaluate various companies over the coming six weeks to verify adherence to standard operating procedures and the recycling of electronic items, imposing fines on those who do not comply. The Extended Producer Responsibility (EPR) framework mandates manufacturers and importers to ensure proper recycling of waste electrical & electronic equipment, motivating businesses to team up with recycling firms. Heavy fines and penalties for non-adherence are also encouraging firms to employ structured recycling processes. Additionally, increased monitoring and licensing requirements for companies are fueling the India waste electrical & electronic equipment recycling market growth. The ongoing adoption of sustainable practices and the presence of certified plants are making waste electrical & electronic equipment recycling more efficient and widespread.

India Waste Electrical & Electronic Equipment Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on waste source, recycling process, material recycled, and end-use.

Waste Source Insights:

- Household E-Waste

- Commercial E-Waste

- Industrial E-Waste

The report has provided a detailed breakup and analysis of the market based on the waste sources. This includes household e-waste, commercial e-waste, and industrial e-waste.

Recycling Process Insights:

- Manual Processing

- Mechanical Processing

- Hydrometallurgical and Pyrometallurgical Processing

A detailed breakup and analysis of the market based on the recycling processes have also been provided in the report. This includes manual processing, mechanical processing, and hydrometallurgical and pyrometallurgical processing.

Material Recycled Insights:

- Metals

- Plastics

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the materials recycled. This includes metals, plastics, glass, and others.

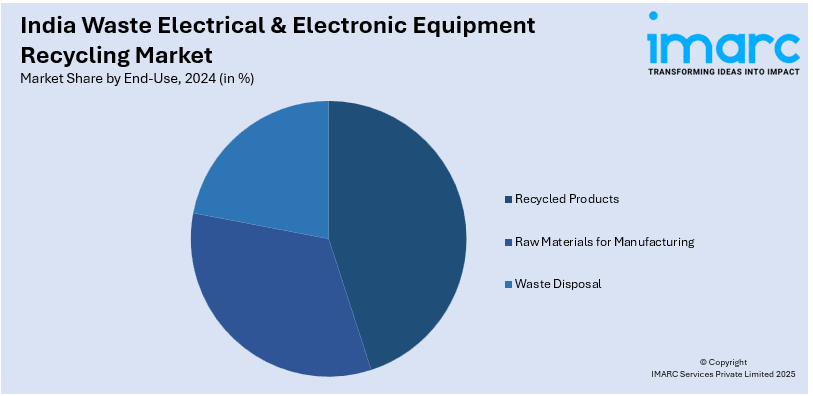

End-Use Insights:

- Recycled Products

- Raw Materials for Manufacturing

- Waste Disposal

A detailed breakup and analysis of the market based on the end-uses have also been provided in the report. This includes recycled products, raw materials for manufacturing, and waste disposal.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Waste Electrical & Electronic Equipment Recycling Market News:

- In March 2025, the government of Goa formulated a new policy requiring e-waste owners and generators to channel this waste solely through recyclers and dismantlers accredited by the Goa State Pollution Control Board (GSPCB). The initiative sought to monitor dismantlers asserting they possessed licenses, as well as scrapyard operators, to prevent them from recklessly dismantling e-waste and exporting it out of Goa.

- In January 2025, MKS PAMP GROUP teamed up with Karo Sambhav to enhance e-waste recycling and the extraction of precious metals and essential raw materials in India. By merging MKS PAMP GROUP’s technical knowledge and operational strength in precious metals refining and production with Karo Sambhav’s extensive e-waste collection systems and recycling solutions, the firms strived to establish new standards for material circularity and aid the country’s shift towards a sustainable future.

India Waste Electrical & Electronic Equipment Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Waste Sources Covered | Household E-Waste, Commercial E-Waste, Industrial E-Waste |

| Recycling Processes Covered | Manual Processing, Mechanical Processing, Hydrometallurgical and Pyrometallurgical Processing |

| Materials Recycled Covered | Metals, Plastics, Glass, Others |

| End-Uses Covered | Recycled Products, Raw Materials for Manufacturing, Waste Disposal |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India waste electrical & electronic equipment recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India waste electrical & electronic equipment recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India waste electrical & electronic equipment recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India waste electrical & electronic equipment recycling market was valued at USD 34.00 Million in 2024.

The India waste electrical & electronic equipment recycling market is projected to exhibit a CAGR of 9.12% during 2025-2033, reaching a value of USD 74.58 Million by 2033.

The India waste electrical & electronic equipment (WEEE) recycling market is driven by rising e-waste generation, government regulations, and growing environmental awareness. Rapid urbanization, increased electronic consumption, and extended producer responsibility (EPR) policies also boost demand. Technological advancements and formalization of the recycling sector further support market growth across major cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)