India Water Analytical Instruments Market Size, Share, Trends and Forecast by Type, Application, Measurement Parameter, End User, and Region, 2025-2033

India Water Analytical Instruments Market Overview:

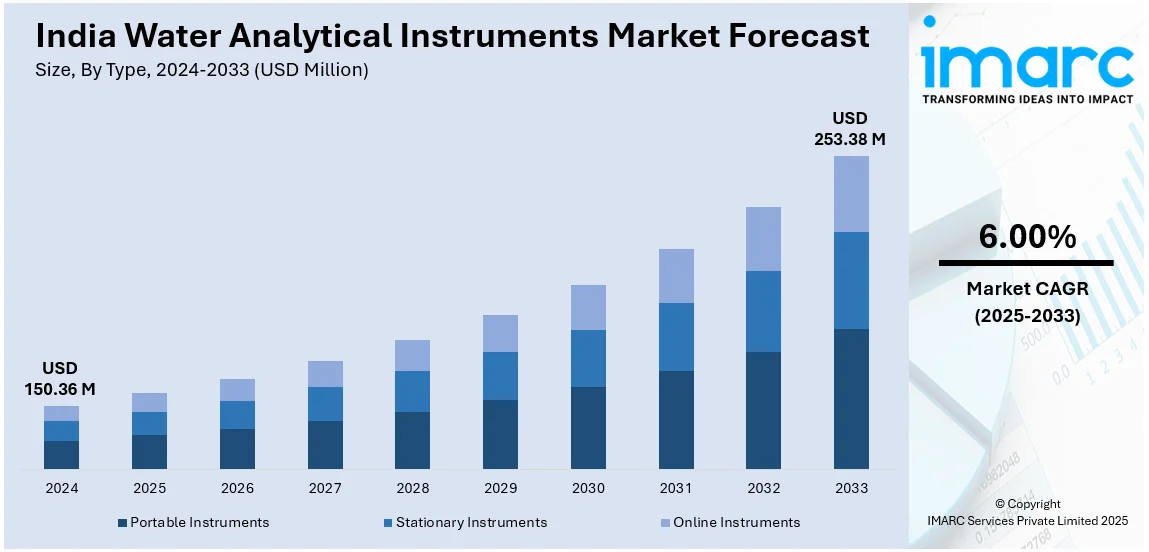

The India water analytical instruments market size reached USD 150.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 253.38 Million by 2033, exhibiting a growth rate (CAGR) of 6.00% during 2025-2033. The growing water pollution from industrial discharge, sewage, and agricultural runoff is driving the India water analytical instruments market share. Additionally, stringent regulations and rising public health concerns are compelling industries and municipalities toward real-time water quality monitoring.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.36 Million |

| Market Forecast in 2033 | USD 253.38 Million |

| Market Growth Rate (2025-2033) | 6.00% |

India Water Analytical Instruments Market Trends:

Expanding Number of Industries

Expansion of industries is significantly influencing the India water analytical instruments market outlook. The growing sectors like pharmaceuticals, food processing, and power generation require stringent water quality monitoring for compliance. Industrial processes depend on high-quality water to ensure operational efficiency and prevent equipment corrosion. Regulatory bodies mandate precise water testing to control effluent discharge and maintain environmental sustainability. Increasing industrialization is leading to higher wastewater generation, necessitating advanced analytical instruments for treatment monitoring. Companies are adopting real-time water analysis to enhance productivity and meet regulatory requirements effectively. The need for contamination-free water in manufacturing processes is attracting investments in sophisticated testing technologies. Industries are integrating automation and smart sensors to achieve higher accuracy in water quality assessments. Rapid urbanization is further expanding industrial clusters, increasing the demand for efficient water monitoring solutions. Rising foreign investments in Indian industries are accelerating infrastructure development and water management technology adoption. The launch of India’s first indigenous Automated Biomedical Waste Treatment Plant, Srjanam, at AIIMS New Delhi in February 2025 highlights this shift toward advanced waste treatment. Developed by CSIR-NIIST, it disinfects biomedical waste without incineration, eliminating odors. Such innovations are supporting industrial water reuse and recycling initiatives, further driving the demand for analytical instruments.

To get more information of this market, Request Sample

Rising Water Pollution

Industrial discharge, sewage, and agricultural runoff are severely contaminating water bodies, necessitating continuous quality monitoring. The Central Pollution Control Board (CPCB) is enforcing stricter norms to regulate pollutants in water sources. Municipalities and industries are adopting real-time water analysis to comply with stringent environmental regulations. Increasing cases of waterborne diseases, which cause $246 million in annual economic losses, are compelling authorities to invest in advanced testing technologies. Smart sensors and IoT-enabled instruments are helping detect contaminants and improve water quality management. Rapid urbanization is further stressing freshwater sources, increasing the need for efficient pollution control measures. Heavy metal contamination from industrial waste is driving investments in sophisticated analytical instruments. The rising demand for clean drinking water is prompting water treatment plants to upgrade technologies. Government initiatives like the Jal Jeevan Mission are encouraging widespread water quality monitoring and testing. The expansion of wastewater treatment plants is fueling the adoption of automated water testing solutions. Poor wastewater management is also impacting India's fisheries sector, causing over $2 billion in annual losses due to contamination, according to market reports. Public awareness about deteriorating water quality is encouraging industries to implement better monitoring systems. These factors are strengthening the India water analytical instruments market growth across multiple sectors.

India Water Analytical Instruments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, measurement parameter, and end user.

Type Insights:

- Portable Instruments

- Stationary Instruments

- Online Instruments

The report has provided a detailed breakup and analysis of the market based on the type. This includes portable instruments, stationary instruments, and online instruments.

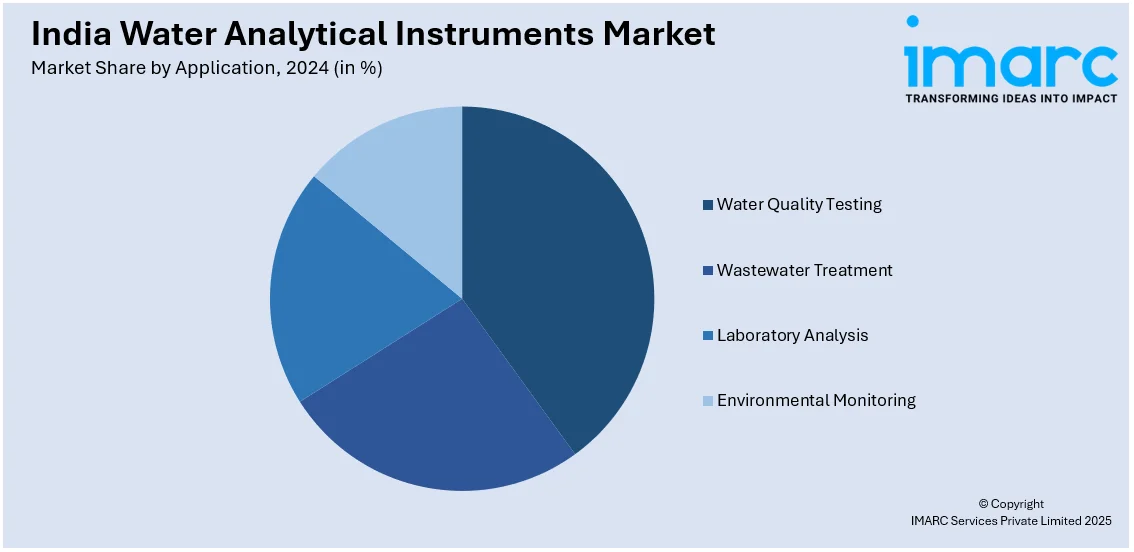

Application Insights:

- Water Quality Testing

- Wastewater Treatment

- Laboratory Analysis

- Environmental Monitoring

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water quality testing, wastewater treatment, laboratory analysis, and environmental monitoring.

Measurement Parameter Insights:

- pH Level

- Dissolved Oxygen

- Turbidity

- Conductivity

The report has provided a detailed breakup and analysis of the market based on the measurement parameter. This includes pH level, dissolved oxygen, turbidity, and conductivity.

End User Insights:

- Municipal Water Treatment

- Industrial Water Treatment

- Laboratories

- Environmental Agencies

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes municipal water treatment, industrial water treatment, laboratories, and environmental agencies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Analytical Instruments Market News:

- In November 2024, researchers at IIT Guwahati developed a unique method to remove ammonium from wastewater using microalgae and bacteria in a photo-sequencing batch reactor (PSBR). This energy-efficient process eliminates the need for external aeration, reducing costs. Supported by DST-FIST, the study, published in the Chemical Engineering Journal, advances sustainable wastewater treatment technologies in India.

- In October 2024, Atlas Copco, a leading industrial solutions provider, presented its advanced wastewater treatment technologies at IFAT India 2024. The company unveiled energy-efficient blowers and compressors aimed at lowering CO₂ emissions and reducing operational costs.

India Water Analytical Instruments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable Instruments, Stationary Instruments, Online Instruments |

| Applications Covered | Water Quality Testing, Wastewater Treatment, Laboratory Analysis, Environmental Monitoring |

| Measurement Parameters Covered | pH Level, Dissolved Oxygen, Turbidity, Conductivity |

| End Users Covered | Municipal Water Treatment, Industrial Water Treatment, Laboratories, Environmental Agencies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India water analytical instruments market performed so far and how will it perform in the coming years?

- What is the breakup of the India water analytical instruments market on the basis of type?

- What is the breakup of the India water analytical instruments market on the basis of application?

- What is the breakup of the India water analytical instruments market on the basis of measurement parameter?

- What is the breakup of the India water analytical instruments market on the basis of end user?

- What are the various stages in the value chain of the India water analytical instruments market?

- What are the key driving factors and challenges in the India water analytical instruments?

- What is the structure of the India water analytical instruments market and who are the key players?

- What is the degree of competition in the India water analytical instruments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water analytical instruments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water analytical instruments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water analytical instruments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)