India Water Softener Market Size, Share, Trends and Forecast by Type, Product Type, Application, and Region, 2025-2033

India Water Softener Market Overview:

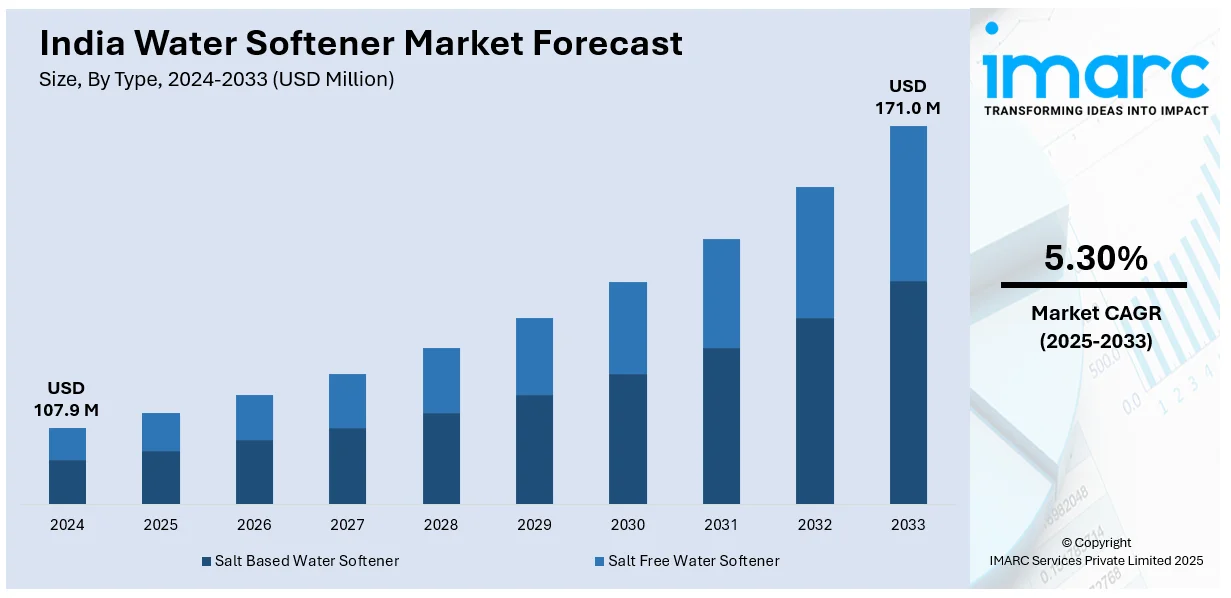

The India water softener market size reached USD 107.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 171.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market share is expanding, driven by rapid urbanization activities, which are creating the need for better water quality, along with the rising execution of government initiatives that aim to ensure a safe and adequate water supply.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.9 Million |

| Market Forecast in 2033 | USD 171.0 Million |

| Market Growth Rate (2025-2033) | 5.30% |

India Water Softener Market Trends:

Rising expenditure on urbanization projects

Increasing investments in urbanization projects are fueling the India water softener market growth. The Union Budget 2024-2025 revealed funding for building 3 Crore extra homes under the PM Awas Yojana. This encompassed PM Awas Yojana Urban 2.0, designed to meet the housing requirements of 1 Crore urban poor and middle-class households with an expenditure of INR 10 Lakh Crore. A central support of INR 2.2 Lakh Crore was to be allocated over the coming five years to aid this initiative. With rapid urban expansion, the demand for better water quality is rising since many areas still receive hard water that affects plumbing, appliances, and skin and hair health. Builders and developers are incorporating water softeners in new projects to enhance water quality, making them a common feature in modern housing societies and office buildings. As more people move to urban areas, the need for efficient water treatment solutions is becoming a priority for households and businesses. Additionally, industries like healthcare and manufacturing require soft water to maintain equipment efficiency and reduce maintenance costs. With urban lifestyles becoming more demanding, people are looking for convenient solutions to refine their daily water usage, making water softeners an essential part of modern urban living. The increasing number of real estate developments, combined with rising awareness about the benefits of soft water, is further impelling the market growth.

To get more information of this market, Request Sample

Growing implementation of clean water initiatives

The rising execution of government initiatives that enhance the availability of clean water is offering a favorable India water softener market outlook. According to the PIB, as of August 14, 2024, more than 2.35 Crore households (79.21%) in areas impacted by Japanese Encephalitis (JE)-Acute Encephalitis Syndrome (AES) were receiving clean tap water. With schemes like the Jal Jeevan Mission, the government is working to ensure a safe and adequate water supply, which is increasing consciousness about water purification and treatment solutions, including water softeners. Many areas in India receive hard water, which leads to scaling in pipes, damage to appliances, and health concerns, motivating both households and industries to look for solutions. Government programs emphasize better water infrastructure, which is catalyzing the demand for water softeners. Additionally, industries like food processing and hospitality, which rely on clean and soft water, are expanding their adoption due to the growing regulatory focus on water quality standards. The encouragement for wastewater recycling and sustainable water management is also enabling commercial establishments to invest in water softening technologies. With government-supported subsidies and incentives for water treatment solutions, more people are considering softeners for long-term cost savings and improved quality of life.

India Water Softener Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, product type, and application.

Type Insights:

- Salt Based Water Softener

- Salt Free Water Softener

The report has provided a detailed breakup and analysis of the market based on the type. This includes salt based water softener and salt free water softener.

Product Type Insights:

- Catalytic Water Softeners

- Electro-Magnetic Water Softeners

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes catalytic water softeners and electro-magnetic water softeners.

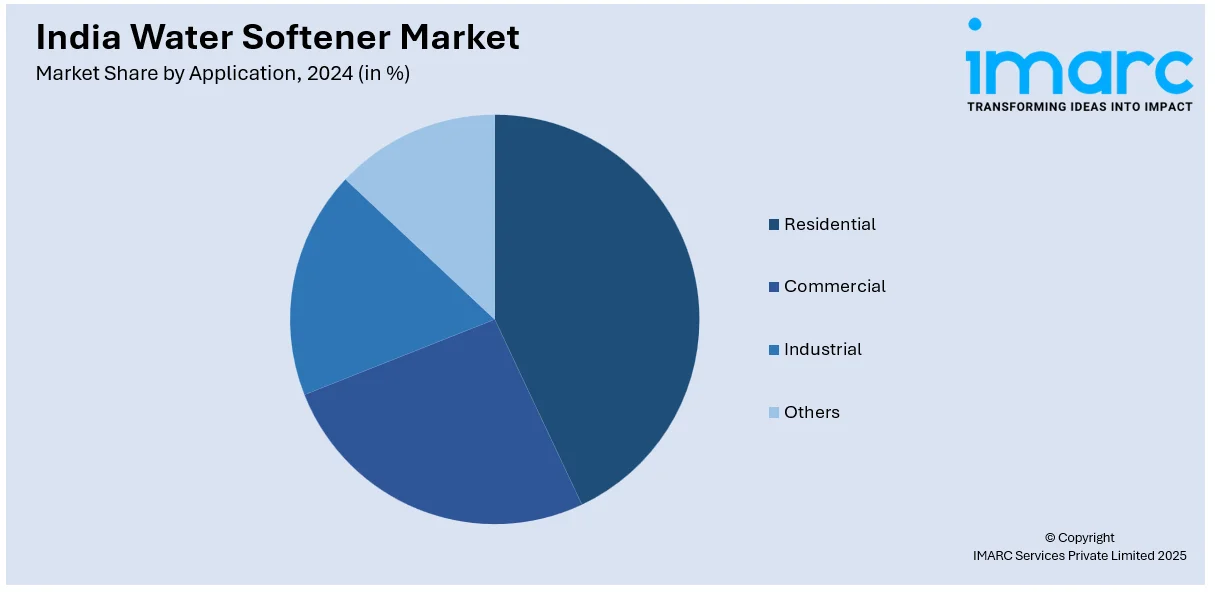

Application Insights:

- Residential

- Commercial

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Softener Market News:

- In October 2024, the governing agencies in Karnataka launched the 5th phase of the Cauvery Water Supply Scheme, which aimed to provide approximately 775 Million Liters of drinking water to 5 Million residents in the city's outskirts, including Whitefield. It also invested INR 4 Lakh in the borewell and another INR 60,000 on a water softener for domestic purposes, such as cooking.

- In April 2024, Thermax, a premier provider of energy and environmental solutions, revealed the inauguration of its advanced manufacturing facility in Pune, India. It was focused on water and wastewater treatment solutions. The plant was set to develop and supply the firm's innovative technologies to provide softener and filter vessels, Capacitive Deionisation (CDI) solutions, and tubular membrane modules.

India Water Softener Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Salt Based Water Softener, Salt Free Water Softener |

| Product Types Covered | Catalytic Water Softeners, Electro-Magnetic Water Softeners |

| Applications Covered | Residential, Commercial, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water softener market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water softener market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water softener industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India water softener market was valued at USD 107.9 Million in 2024.

The India water softener market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 171.0 Million by 2033.

The India water softener market is driven by widespread hard water issues across urban and rural regions, prompting consumers to address appliance scaling, skin irritation, and laundry inefficiencies. Rapid urbanization and investments in residential, commercial, and industrial infrastructure create ongoing demand. Heightened awareness about health and equipment longevity further fuels adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)