India Welding Equipment Market Size, Share, Trends and Forecast by Technology, Type, End Use, and Region, 2025-2033

India Welding Equipment Market Overview:

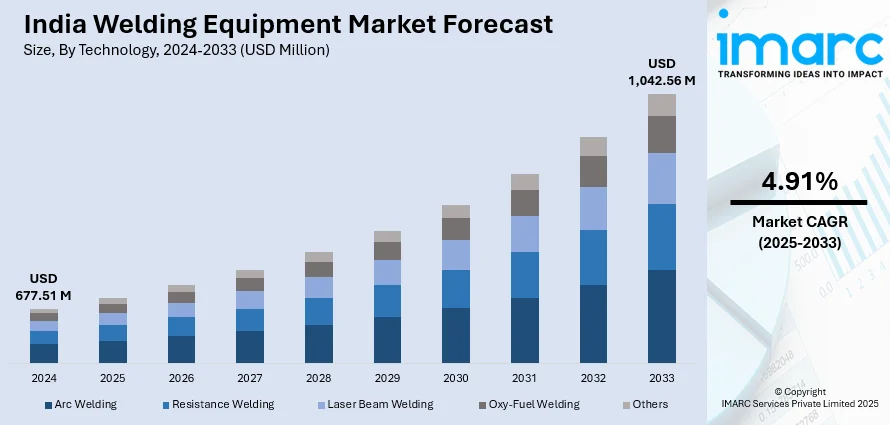

The India welding equipment market size reached USD 677.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,042.56 Million by 2033, exhibiting a growth rate (CAGR) of 4.91% during 2025-2033. The India welding equipment market is driven by rapid industrialization, infrastructure development, expanding automotive and aerospace sectors, renewable energy projects, railway modernization, advancements in automation and robotic welding, rising demand for high-precision welding in defence manufacturing, and extensive adoption of innovative welding technologies for enhanced efficiency and durability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 677.51 Million |

| Market Forecast in 2033 | USD 1,042.56 Million |

| Market Growth Rate 2025-2033 | 4.91% |

India Welding Equipment Market Trends:

Expansion of the Defense and Aerospace Industry

India's expanding defense and aviation sectors are among the key drivers propelling the demand for welding equipment. Moreover, the government drive for local production of defense gear under the "Atmanirbhar Bharat" program has boosted output of fighter planes, submarines, warships, and missile systems, all requiring precision welding techniques. Defense contracts to domestic firms for manufacturing armored vehicles, drones, and naval vessels have also boosted demand for specialized welding equipment. The aerospace sector, comprising commercial and defense aircraft manufacturing, is dependent on high-accuracy welding techniques like electron beam welding (EBW), tungsten inert gas (TIG) welding, and friction stir welding (FSW). These techniques are important in manufacturing lightweight high-strength components utilized in aircraft engines, fuselages, and fuel tanks. Moreover, the increasing space research investments by India, spearheaded by Indian Space Research Organization (ISRO), necessitate advanced welding solutions for satellite components, rocket shells, and cryogenic fuel storage tanks. Defect-free welds with high precision in applications to space have pushed investments into sophisticated welding technology such as robot-based and automatic welding systems.

To get more information of this market, Request Sample

Growth of the Indian Railways and Metro Expansion

The rapid expansion of Indian Railways and metro networks in major cities is another unique factor fueling the welding equipment market. The metro systems in India cover over 1,000 km across 11 states and 23 cities, making it the third largest metro system in the world. The Indian government is making major investments in upgrading railway infrastructures, bringing in high-speed trains, and increasing metro connectivity in urban zones. Welding is a critical activity in the production of railway tracks, coaches, locomotives, and metro, necessitating both conventional and state-of-the-art welding technologies. One of the major areas of application of welding technology in railways is track production and repair. Indian Railways has been making a switch toward replacing traditional bolted rail tracks with continuously welded rails (CWR), which provide more strength, safety, and durability. This trend has augmented the need for flash butt welding, thermite welding, and automatic track welding machines. Moreover, large-scale welding is needed in metro projects in Delhi, Mumbai, Bengaluru, and Chennai for tunnel construction, stations, and manufacturing of rolling stock. With the launch of semi-high-speed and bullet trains, including the Vande Bharat Express and Mumbai-Ahmedabad bullet train project, there is a growing need for lightweight and high-strength welded parts. Sophisticated welding processes, such as laser welding, friction stir welding (FSW), and robotic welding, are being used to produce energy-efficient, aerodynamic train coaches.

India Welding Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology, type, and end use.

Technology Insights:

- Arc Welding

- Shielded Metal/Stick Arc Welding

- MIG

- TIG

- Plasma Arc Welding

- Others

- Resistance Welding

- Laser Beam Welding

- Oxy-Fuel Welding

- Others

The report has provided a detailed breakup and analysis of the market based on technology. This includes arc welding (shielded metal/stick arc welding, MIG, TIG, plasma arc welding, and others), resistance welding, laser beam welding, oxy-fuel welding, and others.

Type Insights:

- Automatic

- Semi-Automatic

- Manual

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes automatic, semi-automatic, and manual.

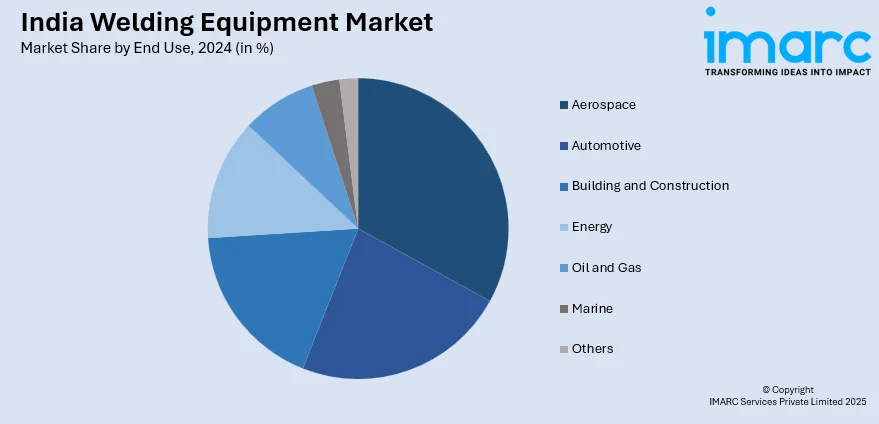

End Use Insights:

- Aerospace

- Automotive

- Building and Construction

- Energy

- Oil and Gas

- Marine

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes aerospace, automotive, building and construction, energy, oil and gas, marine, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Welding Equipment Market News:

- May 2024: Mehta’s Galaxy 3 kW Fiber Laser Welding Machine launched with high-speed, precision welding capabilities and minimal heat distortion. Its adoption has increased in industries like automotive, aerospace, and metal fabrication, boosting demand for advanced welding technology in India. This innovation has driven the Indian welding equipment market by promoting automation, efficiency, and high-quality welding solutions across various sectors.

- February 2024: Polymak introduced the ARC Welding Machine 260A, designed for high-performance welding applications. This addition enhances the range of advanced welding solutions available in India, meeting the propelling demand for efficient welding equipment. Such innovations contribute to the expansion of the Indian welding equipment market by offering improved technology to various industries.

India Welding Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Types Covered | Automatic, Semi-Automatic, Manual |

| End Uses Covered | Aerospace, Automotive, Building and Construction, Energy, Oil and Gas, Marine, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India welding equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India welding equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The welding equipment market in India was valued at USD 677.51 Million in 2024.

The India welding equipment market is projected to exhibit a CAGR of 4.91% during 2025-2033, reaching a value of USD 1,042.56 Million by 2033.

India welding equipment market is experiencing steady growth, driven by expanding industrial activity, infrastructure development, and rising automotive and construction manufacturing. Continuous technological improvements, such as advanced power sources, portable systems, and operator-friendly interfaces, are further shaping the evolving dynamics of the sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)