India Wi-Fi Market Size, Share, Trends and Forecast by Component, Density, Location Type, Organization Size, Industry Vertical and Region, 2025-2033

India Wi-Fi Market Size and Share:

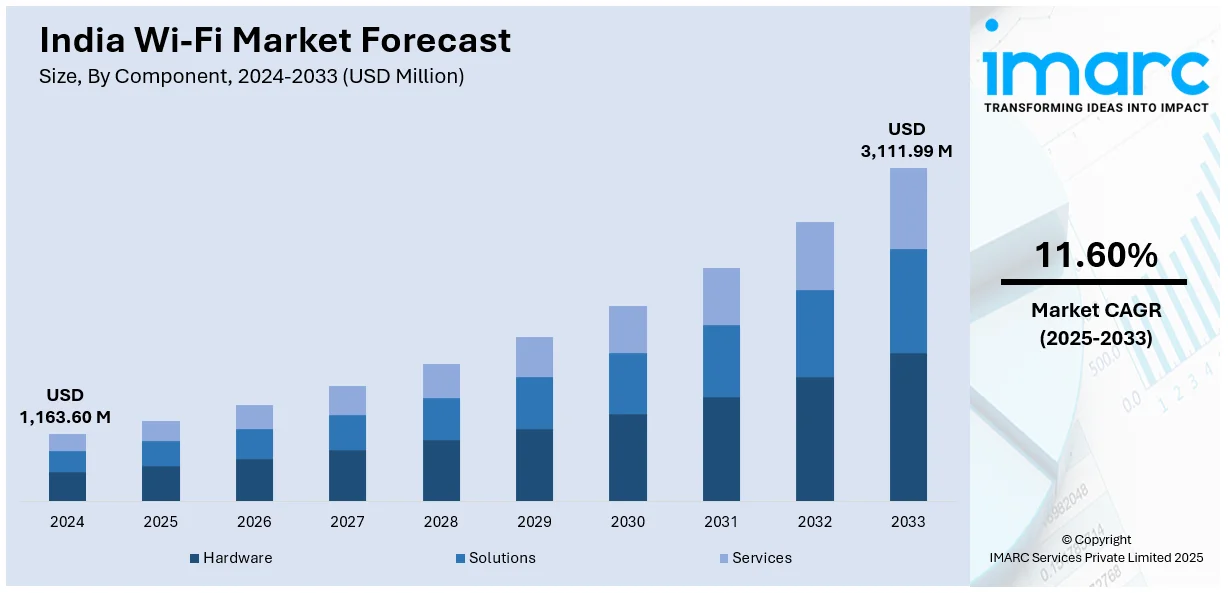

The India Wi-Fi market size reached USD 1,163.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,111.99 Million by 2033, exhibiting a growth rate (CAGR) of 11.60% during 2025-2033. The India Wi-Fi market share is being fueled by increasing smartphone penetration, growth in digital consumption, government initiatives such as Digital India, and escalating demand for high-speed internet. The growth in e-commerce, online learning, and remote working further propels the demand for secure Wi-Fi connectivity in urban and rural geographies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,163.60 Million |

| Market Forecast in 2033 | USD 3,111.99 Million |

| Market Growth Rate (2025-2033) | 11.60% |

India Wi-Fi Market Trends:

Growing Adoption of Public Wi-Fi Networks

Public Wi-Fi hotspots are now becoming a norm in India's connectivity infrastructure. With the initiatives of the government under the Digital India campaign, there has been rapid expansion of free or inexpensive Wi-Fi at public places like railway stations, airports, and bazaars. The launch of public Wi-Fi networks intends to narrow down the digital gap, particularly at rural and backward regions. Telecom firms, private operators, and the government are collaborating to develop such networks, widening access to the internet. Increasing usage of mobile internet and increasing usage of online services such as e-commerce, banking, and governmental services are further propelling the demand for such networks. Further, public Wi-Fi is an affordable solution for citizens of low-income areas, helping towards digital inclusion. This trend is likely to persist as the need for internet connectivity continues to grow, especially in emerging urban and rural communities, further propelling the India Wi-Fi market growth.

To get more information of this market, Request Sample

Increased Integration of Wi-Fi with 5G Networks

While India progresses toward the implementation of 5G technology, the combination of Wi-Fi with 5G networks is emerging as a major trend influencing the India Wi-Fi market outlook. The merger of Wi-Fi and 5G is intended to bring uniform connectivity, with increased speeds, lower latencies, and greater network efficiency. Telecom operators are seeking to rollout Wi-Fi 6, the new Wi-Fi standard, along with 5G to increase the user experience, particularly for data-hungry applications such as HD video streaming, online gaming, and IoT devices. Enterprises and customers are seeking a solution that pairs the broad reach of 5G with local connectivity features of Wi-Fi. This hybrid model is best suited for cities with heavy use of the internet, which shifts 5G traffic from clogged networks and provides a smoother connection. Second, the trend is in sync with India's initiative to develop digital infrastructure and cater to the needs of upcoming technologies like smart cities and industrial automation. Recently, in January 2025, the Government of India has recently implemented steps to enhance the PM-WANI public Wi-Fi initiative by lowering broadband prices for Public Data Offices (PDOs) and has required telecom operators to show caller IDs on all outgoing calls beginning in January to reduce spam and improve consumer safety. This initiative aims to foster a more sustainable and fair setting for public Wi-Fi accessibility, aligning with the government’s larger goals to enhance connectivity, as detailed in the National Digital Communications Policy of 2018 and the Bharat 6G Vision. These initiatives seek to establish 50 million public Wi-Fi hotspots by 2030, enhancing digital access for marginalized communities. This policy change aims to lessen the financial strain on PDOs and promote a competitive, clear pricing framework, thereby encouraging widespread adoption of public Wi-Fi, regarded as essential for closing India’s digital divide.

India Wi-Fi Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, density, location type, organization size, industry vertical and region.

Component Insights:

- Hardware

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, solutions, and services.

Density Insights:

- High Density Wi-Fi

- Enterprise Class Wi-Fi

The report has provided a detailed breakup and analysis of the market based on the density. This includes high density wi-fi, and enterprise class wi-fi.

Location Type Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the location type. This includes indoor, and outdoor.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises, and small and medium-sized enterprises.

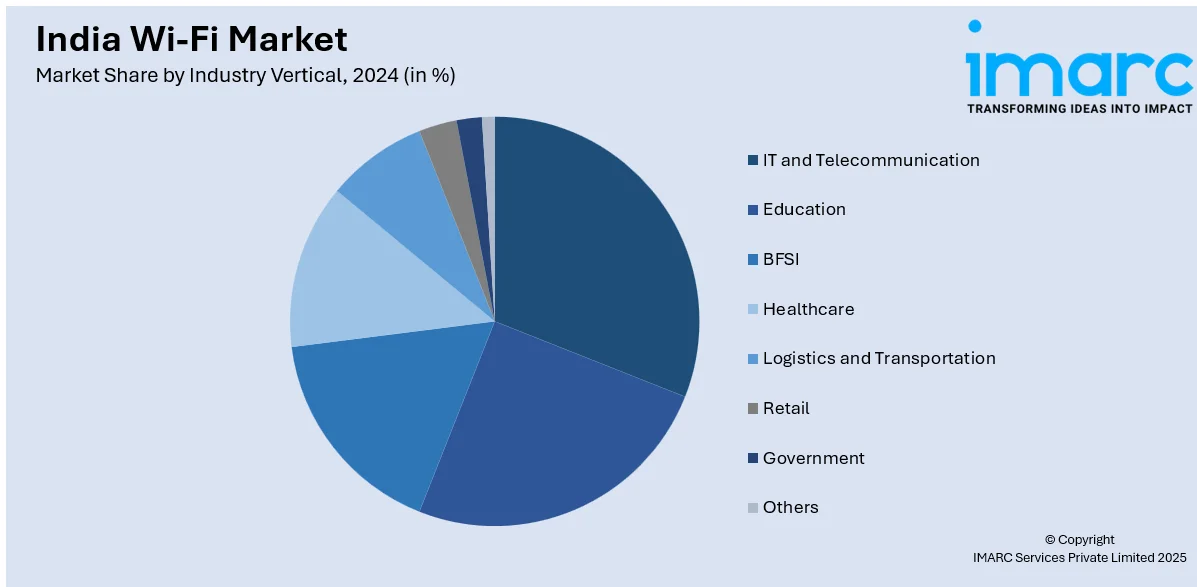

Industry Vertical Insights:

- IT and Telecommunication

- Education

- BFSI

- Healthcare

- Logistics and Transportation

- Retail

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes IT and telecommunication, education, BFSI, healthcare, logistics and transportation, retail, government, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wi-Fi Market News:

- In November 2024, Cisco, a US telecommunications equipment manufacturer, introduced new Wi-Fi 7 access points (APs) along with a consolidated subscription licensing model for businesses. These Wi-Fi 7 APs feature AI-driven performance enhancements and effortless self-configuration, and with inclusion of access to the Cisco Spaces platform within the subscription license, users receive an operating system to transform their work environments into intelligent spaces.

- In November 2024, Huawei, the top contributor to global standards for Wi-Fi 7, revealed its acclaimed wireless technology as an easy solution for universities, hospitals, and businesses. The company's Wi-Fi 7 campus solution, presented at Dubai's GITEX tech show in October 2024, streamlines the connection of numerous devices — including security cameras and student laptops — while functioning at higher speeds and enhanced security compared to earlier networks.

- In January 2024, NETGEAR launched the enhanced Wi-Fi 6 mesh systems, Orbi RBK752 and RBK753, aimed at delivering reliable connections in every room consistently. These Wi-Fi 6 mesh solutions provide an excellent enhancement for retail consumers, optimally balancing Wi-Fi performance and coverage while supporting numerous devices at a competitive price.

India Wi-Fi Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Solutions, Services |

| Densities Covered | High Density Wi-Fi, Enterprise Class Wi-Fi |

| Location Types Covered | Indoor, Outdoor |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | IT and Telecommunication, Education, BFSI, Healthcare, Logistics and Transportation, Retail, Government, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India Wi-Fi market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India Wi-Fi market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India Wi-Fi industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India Wi-Fi market was valued at USD 1,163.60 Million in 2024.

The India Wi-Fi market is projected to exhibit a CAGR of 11.60% during 2025-2033, reaching a value of USD 3,111.99 Million by 2033.

The India Wi-Fi market is driven by government initiatives like PM-WANI and National Broadband Mission expanding public and rural connectivity, growing smartphone and IoT device adoption, and business demand for high-speed managed Wi-Fi in sectors like logistics and hospitality. Advances in Wi-Fi 6/6E and indoor 6 GHz spectrum unlock new capacity, thus further contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)