India Wind Energy Storage Devices Market Size, Share, Trends and Forecast by Storage, and Region, 2025-2033

India Wind Energy Storage Devices Market Overview:

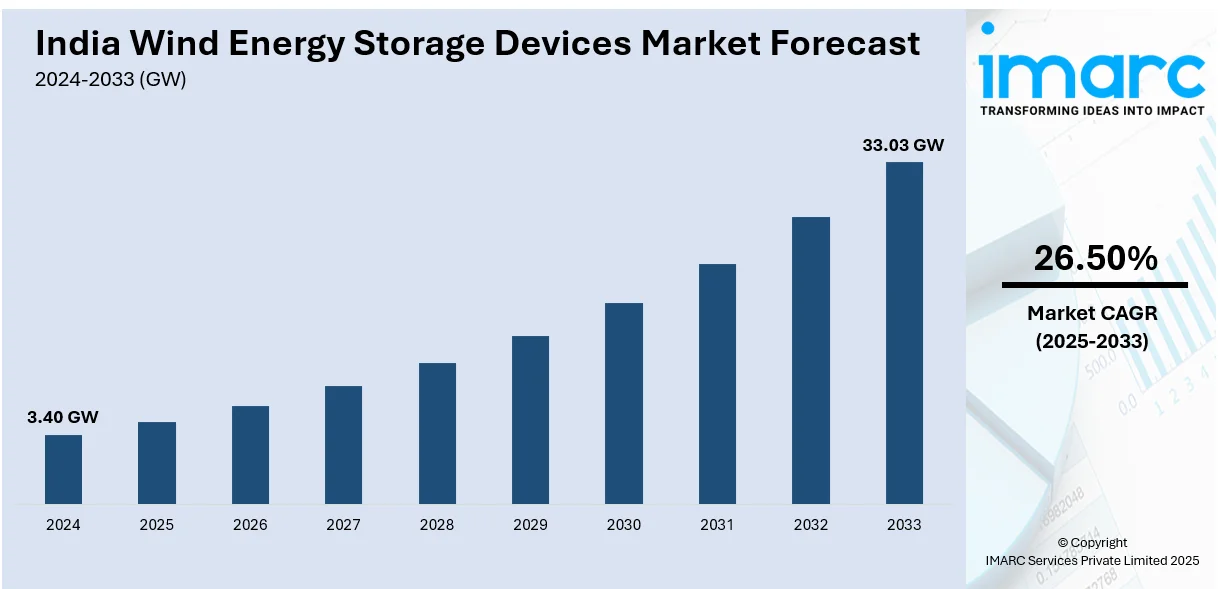

The India wind energy storage devices market size reached 3.40 GW in 2024. Looking forward, IMARC Group expects the market to reach 33.03 GW by 2033, exhibiting a growth rate (CAGR) of 26.50% during 2025-2033. The market is driven by the increasing integration of renewable energy sources, necessitating efficient storage solutions to manage variability and ensure grid stability. Government initiatives promoting clean energy adoption further bolster this growth, while technological advancements enhance storage efficiency and cost-effectiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3.40 GW |

| Market Forecast in 2033 | 33.03 GW |

| Market Growth Rate 2025-2033 | 26.50% |

India Wind Energy Storage Devices Market Trends:

Emergence of Hybrid Energy Systems

A notable trend in the Indian wind energy storage sector is the development of hybrid energy systems that integrate wind power with other renewable sources, such as solar photovoltaic (PV) energy. These systems often incorporate energy storage solutions to ensure a stable and reliable power supply. By combining multiple energy sources, hybrid systems can mitigate the intermittent nature of individual renewables, optimize resource utilization, and enhance overall energy output. This approach aligns with India's broader renewable energy goals and addresses the growing demand for consistent and sustainable power. For instance, in March 2025, Adani Renewable Energy Holding Twelve, Sprng Vayu Vidyut, Illuminate Hybren, and Avaada Energy secured capacities in NHPC's 1,200 MW ISTS-connected wind-solar hybrid power project auction (Tranche-X). Adani won 600 MW, Sprng 150 MW, and Illuminate 240 MW at a tariff of ₹3.41 ($0.0392)/kWh. The tender included a 1,200 MW greenshoe option. Projects require both solar and wind components, each constituting at least 33% of the contracted capacity.

To get more information of this market, Request Sample

Advancements in Energy Storage Technologies

Technological innovations are significantly impacting the wind energy storage market in India. The development of advanced storage technologies, such as battery energy storage systems (BESS), is crucial for managing the variability of wind energy and ensuring grid stability. These advancements not only improve the efficiency and lifespan of storage systems but also contribute to reducing costs, making renewable energy more competitive with traditional power sources. As a result, there is an increasing adoption of these technologies to support the integration of wind energy into the grid. For instance, in January 2025, Envision Energy India partnered with Juniper Green Energy to supply 1 GW of EN 182|5MW wind turbines and 320 MWh battery energy storage systems (BESS) for renewable projects across wind-rich states. The turbines offer a 40% higher annual energy output than previous models. Envision's AIoT-based Energy Management System will optimize BESS performance. The collaboration supports Juniper's goal to achieve 10 GW of renewable capacity by 2030, contributing to India's clean energy transition and sustainability goals.

Government Policies and Financial Incentives

The Indian government's commitment to renewable energy is evident through various policies and financial incentives aimed at promoting the adoption of wind energy storage solutions. Initiatives such as the National Wind-Solar Hybrid Policy encourage the integration of different renewable energy sources, while financial mechanisms like accelerated depreciation benefits and generation-based incentives attract investment in storage technologies. These supportive measures create a conducive environment for the growth of the wind energy storage market, facilitating the country's transition towards a more sustainable energy landscape. For instance, Madhya Pradesh's Renewable Energy Policy 2025 aims to source 50% of its power from renewables by FY 2030, with interim targets of 20% by FY 2024 and 30% by FY 2027. The policy seeks investments of ₹15,000 crore in renewable generation by 2024 and ₹50,000 crore by 2027. It offers a 50% waiver on wheeling charges for five years and a ten-year electricity duty exemption for new projects. Plans include establishing 10 GW renewable energy parks by FY 2027.

India Wind Energy Storage Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on storage.

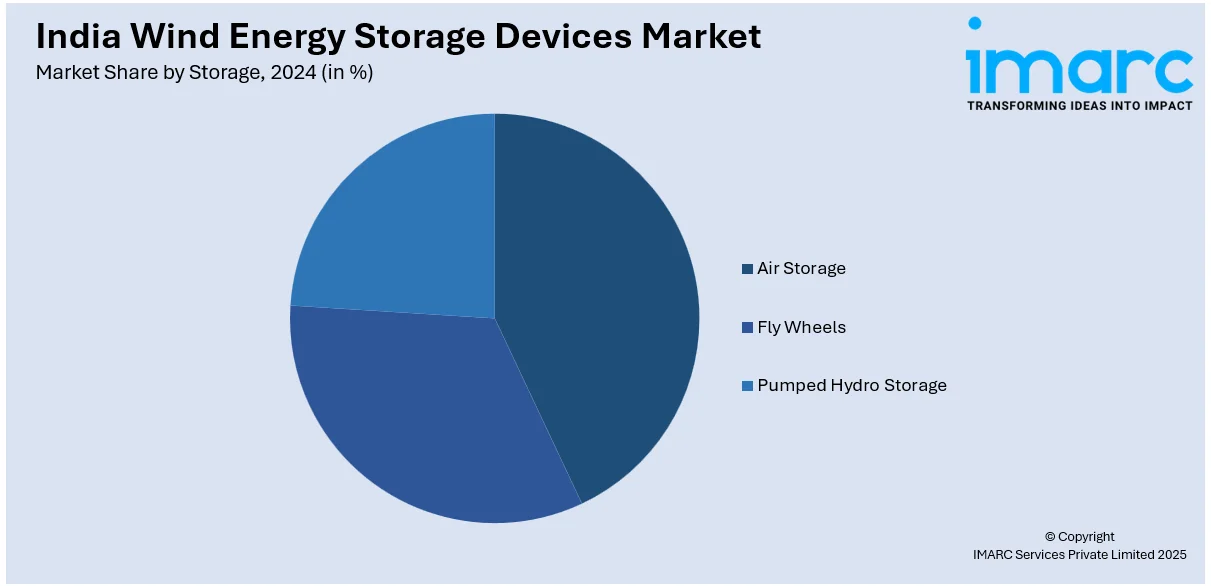

Storage Insights:

- Air Storage

- Fly Wheels

- Pumped Hydro Storage

The report has provided a detailed breakup and analysis of the market based on the storage. This includes air storage, fly wheels, and pumped hydro storage.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wind Energy Storage Devices Market News:

- In March 2025, TPG, through its climate investing platform TPG Rise Climate, acquired a majority stake in Siemens Gamesa’s onshore wind turbine generator manufacturing business in India and Sri Lanka. Siemens Gamesa retains a stake while providing technology and product development support. Approximately 1,000 employees and manufacturing infrastructure will transfer to the new entity. The acquisition aims to expand onshore wind operations in the region.

- In 2024, Envision Energy secured 30.6 GW of wind turbine orders, ranking among the top global turbine manufacturers. The company achieved over 10 GW in international orders and was second globally for new installations at 14.5 GW. Besides this, Envision introduced the Model T Pro and Model Z Pro platforms with AI-driven monitoring systems.

- In March 2025, AMPIN Energy Transition secured a USD 50 Million investment from Siemens Financial Services, the financing arm of Siemens AG. This funding will support the company's expansion in both Commercial & Industrial (C&I) and utility-scale renewable energy projects, as well as its energy transition value chain business.

- In March 2025, BluPine Energy secured ₹17.87 billion in structured financing from the National Bank for Financing Infrastructure and Development (NaBFID) to expand its renewable energy portfolio. The funds will optimize financial structuring, repower existing solar assets, and enhance operational performance. Established by Actis with an $800 million investment, BluPine aims to exceed 4,000 MW of renewable capacity across Punjab, Uttarakhand, and Karnataka.

- In March 2025, Zelestra signed a long-term Firm & Dispatchable Renewable Energy (FDRE) contract with SJVN to supply 24/7 clean energy using 250 MWdc solar, 180 MW wind, and a 90 MWh battery energy storage system (BESS) in Solapur, Maharashtra, starting in 2027. The project will generate over 815 GWh annually, reducing 0.7 million tonnes of CO2 emissions and powering 225,000 households. With 5.4 GW of clean energy projects across India, Zelestra continues its commitment to sustainable energy solutions.

India Wind Energy Storage Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GW |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Storages Covered | Air Storage, Fly Wheels, Pumped Hydro Storage |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India wind energy storage devices market performed so far and how will it perform in the coming years?

- What is the breakup of the India wind energy storage devices market on the basis of storage?

- What are the various stages in the value chain of the India wind energy storage devices market?

- What are the key driving factors and challenges in the India wind energy storage devices market?

- What is the structure of the India wind energy storage devices market and who are the key players?

- What is the degree of competition in the India wind energy storage devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wind energy storage devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wind energy storage devices market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wind energy storage devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)