India Women’s Cosmetics Market Size, Share, Trends and Forecast by Category, Pricing, Distribution Channel, and Region, 2025-2033

India Women’s Cosmetics Market Overview:

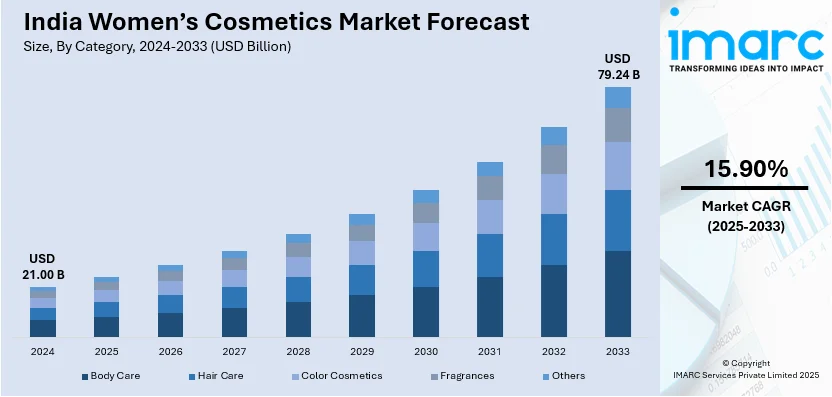

The India women’s cosmetics market size reached USD 21.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 79.24 Billion by 2033, exhibiting a growth rate (CAGR) of 15.90% during 2025-2033. The Indian women's cosmetics market is fueled by rising beauty consciousness, greater disposable incomes, increased social media influence, rapid expansion in e-commerce, demand for natural and organic products, celebrity endorsements, advances in skincare technology, premiumization of beauty products, and government policies promoting women's economic empowerment and entrepreneurship in the beauty industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.00 Billion |

| Market Forecast in 2033 | USD 79.24 Billion |

| Market Growth Rate 2025-2033 | 15.90% |

India Women’s Cosmetics Market Trends:

Rising Beauty Consciousness Among Indian Women

There has been a major transformation in the attitude of beauty and personal care among women in India in the last decade. This higher beauty awareness is triggered by various factors like the influence of social media sites, exposure to international beauty culture, and the urge to express self through physical form. Social media platforms such as Instagram, YouTube, and TikTok have been crucial in spreading beauty trends and tutorials, opening up beauty routines, and making them accessible and entertaining. Beauty bloggers and influencers post on a regular basis content that educates and encourages women to play around with makeup, thus enhancing the popularity and acceptance of cosmetics and skincare products. This digital exposure has brought about democratization of beauty such that women of different backgrounds have been able to explore and incorporate new beauty regimes. In addition, the popularity of beauty pageants, fashion shows, and reality TV shows revolving around makeovers and modeling has promoted the aspirational value of beauty. These mediums present makeover journeys of beauty, motivating women to spend on cosmetics to uplift their features and gain self-confidence. The popularity of personal grooming is no longer limited to cities; it has reached semi-urban and rural areas as well, representing a countrywide trend. The social acceptance of makeup as a means of self-expression has also resulted in a wider consumer base. Women are extremely open to trying out new colors, varied makeup techniques, and new products. This has caused beauty companies to launch a greater variety of products suiting different skin tones, tastes, and occasions, hence creating a positive market influence.

To get more information of this market, Request Sample

Growing Disposable Incomes and Economic Empowerment

The Indian economy has been greatly transformed, with higher disposable incomes, especially among women. Economic empowerment has directly affected the spending behavior of consumers, with a significant proportion going to beauty and personal care products. Expansion in the middle-class segment has resulted in high demand for luxury and premium cosmetics. As women become increasingly employed and acquire economic independence, there is a higher likelihood to indulge in self-grooming and self-care products. This behavior has been seen in urban areas and is now slowly moving into smaller cities and towns, reflecting a general change in consumption patterns. Government policies to encourage women's education and employment have supported this trend further. As per the Ministry of Statistics and Programme Implementation, the share of female employees in urban India working in trade, hotel, and restaurant industries was 14.8% during 2021-22, indicating their involvement in working. This working has enabled women to make independent consumer decisions, such as investments in beauty goods. Furthermore, the rise of e-commerce sites has led to higher availability of cosmetics for a wider group of consumers. Online shopping sites provide extensive collections of products at affordable prices, along with convenient delivery services, allowing consumers to browse and buy cosmetics more easily. Online shopping convenience has especially attracted working women looking for quality products without the limitations of time and place.

India Women’s Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on category, pricing, and distribution channel.

Category Insights:

- Body Care

- Hair Care

- Color Cosmetics

- Fragrances

- Others

The report has provided a detailed breakup and analysis of the market based on the category. This includes body care, hair care, color cosmetics, fragrances, and others.

Pricing Insights:

- Mass

- Premium

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes mass and premium.

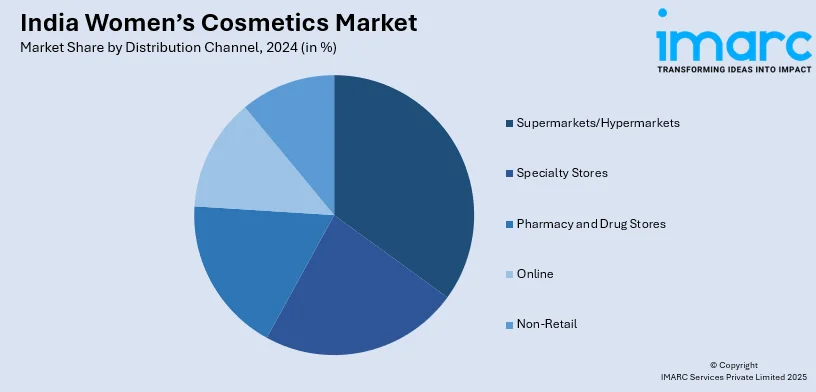

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacy and Drug Stores

- Online

- Non-Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty stores, pharmacy and drug stores, online, and non-retail.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Women’s Cosmetics Market News:

- October 2024: Kylie Cosmetics extended its reach in India by introducing the 'Cosmic' perfume, making a foray into the fragrance business. This move helped diversify the offerings of the brand, meeting the changing tastes of Indian consumers. These forays by global brands have made the Indian women's cosmetics industry richer in terms of offerings and more vibrant in terms of growth.

- August 2024: Reliance Retail's beauty platform Tira launched Mixsoon, a high-end Korean beauty brand, in India. The move expands the product range for Tira, answering the propelling consumer demand for Korean beauty products. Such offerings expand the availability and diversity of foreign beauty products, positively affecting the development of India's women's cosmetics market.

India Women’s Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Body Care, Hair Care, Color Cosmetics, Fragrances, Others |

| Pricings Covered | Mass, Premium |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Pharmacy and Drug Stores, Online, Non-Retail |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India women’s cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India women’s cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India women’s cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The women’s cosmetics market in India was valued at USD 21.00 Billion in 2024.

The India women’s cosmetics market is projected to exhibit a CAGR of 15.90% during 2025-2033, reaching a value of USD 79.24 Billion by 2033.

The women's cosmetics market in India is led by increasing disposable income, increasing awareness of beauty and personal care, urban lifestyle changes, and rising social media impact. Demand is also supported by the presence of organic, herbal, and personalized products, regular product offerings, and greater availability through both e-commerce and organized retailing, increasing consumer interaction and brand visibility in urban and semi-urban cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)