India Women Reproductive Health Market Size, Share, Trends and Forecast by Treatment Type, Route of Administration, End User and Region, 2025-2033

India Women Reproductive Health Market Overview:

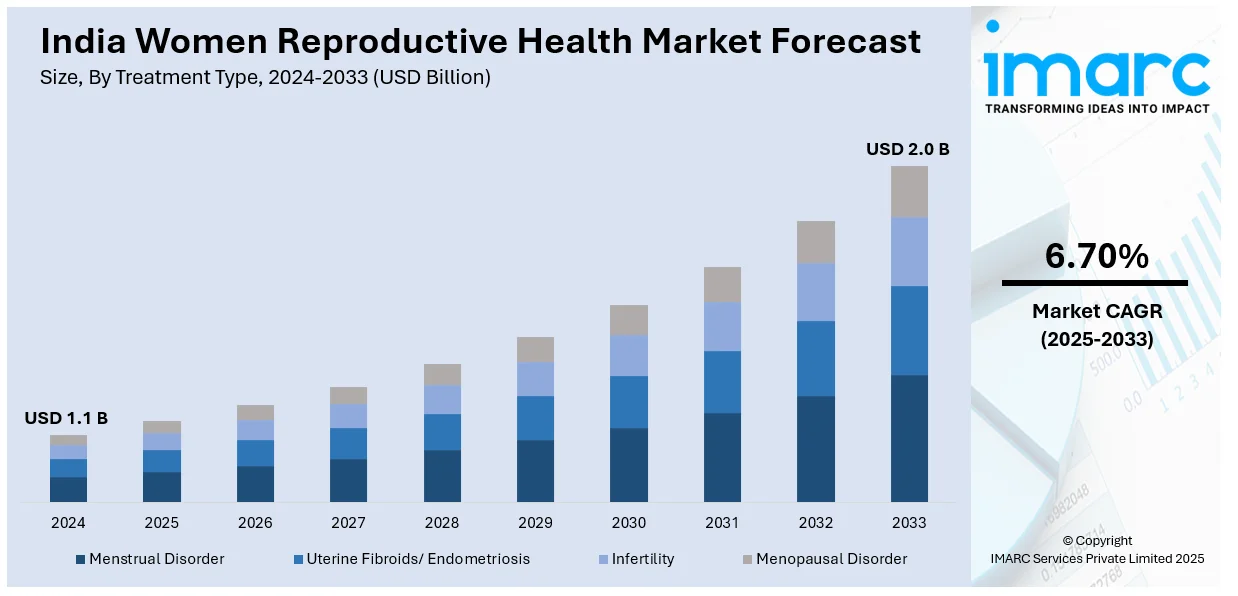

The India women reproductive health market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market share is fueled by heightened awareness about reproductive rights, rising demand for fertility and pregnancy care, and increasing adoption of health-tech solutions. Changing social beliefs, emergence of online channels of education, and government efforts in favor of women's health also drive the market forward.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 6.70% |

India Women Reproductive Health Market Trends:

Rising Awareness and Demand for Reproductive Health Education

India is experiencing a rising trend in increasing awareness and educating people concerning women's reproductive health. This is due to the extensive use of social media and online platforms, which have promoted reproductive rights information, menstrual health, and fertility. With empowered and enlightened women, they now demand improved access to healthcare services, preventive health, and proper information on reproductive health. As per the National Family Health Survey-5, over 23% of women aged 20-24 got married before turning 18. Although advancements have been made in different areas of development, there remains significant work to be done regarding sexual and reproductive health rights in India. The increasing focus on education has led to increased demand for items like menstrual products, fertility pills, and contraceptives. Additionally, NGOs and health campaigns are also significantly contributing to shattering social taboos and advocating for women's health, leading to better access to resources. This consciousness is driving a more direct discussion about reproductive health and ultimately fueling growth in India's women's reproductive health market.

To get more information of this market, Request Sample

Adoption of Fertility and Pregnancy Care Solutions

The use of fertility and pregnancy care solutions is another key trend influencing the India women reproductive health market outlook. As awareness improves and social circumstances change, greater numbers of women are prioritizing their fertility and reproductive health, particularly in cities. Increased rates of infertility, late marriages, and the rising popularity of assisted reproductive technologies (ART) are fueling the demand for fertility treatments, ovulation monitoring products, and pregnancy care solutions. Fertility centers and IVF are experiencing increased demand, with more women seeking personalized treatment to handle reproductive health. According to a recent study by the Indian Society of Assisted Reproduction, around 27.5 million couples in India are currently facing infertility challenges. Factors like urban growth, postponed marriages, and shifts in lifestyle have contributed to a rise in infertility rates, affecting 15% of couples now. Diagnostic advancements like preconception genetic testing and AI-assisted fertility technologies are facilitating earlier and more precise evaluations. AI is having a groundbreaking impact, especially in In Vitro Fertilisation (IVF). A recent McKinsey report regarding health-tech advancements in India emphasizes the growing use of AI in reproductive healthcare, where it helps in choosing top-quality embryos, enhancing IVF success rates by as much as 20-30%. Apart from this, there is also an increasing practice of employing natural and holistic fertility methods, like herbal supplements and acupuncture, that are increasingly being used in combination with traditional medical interventions. This trend has fueled the creation of a broad array of products, services, and digital health solutions that assist women in their fertility journey, greatly growing the market.

Growth of Health-Tech Solutions for Women's Reproductive Health

The ascendance of health-tech offerings specific to women's reproductive well-being is a revolutionary movement in India. Given the growing adoption of smartphones and digital platforms, women are increasingly using apps and wearable technology for tracking menstrual cycles, recording ovulation, and maintaining overall reproductive wellness. These technology-driven solutions offer personalized advice and enable women to own their reproductive health by presenting real-time information, reminders, and consultations with experts. Additionally, health-tech companies targeting women's wellness are using artificial intelligence and machine learning to provide more precise fertility predictions and enhance diagnostic equipment. The ease of these online platforms, along with increased attention to women's health, is propelling the use of health-tech solutions in India. With an increasing number of women adopting technology to track and maintain their reproductive well-being, the India women reproductive health market growth is poised to continue further. Recently, Arva Health, a rising leader in fertility care, obtained USD 1 Million in pre-seed funding to further its mission of enhancing the accessibility, affordability, and stigma-free nature of reproductive healthcare in India. The funding round was spearheaded by All in Capital, who was joined by iSeed, Bharath Founders Fund, and Galaxy. This achievement will allow the startup to expand its technology-driven fertility clinics, starting with its main site in Whitefield, Bangalore.

India Women Reproductive Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on treatment type, route of administration and end user.

Treatment Type Insights:

- Menstrual Disorder

- Uterine Fibroids/ Endometriosis

- Infertility

- Menopausal Disorder

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes menstrual disorder, uterine fibroids/endometriosis, infertility, and menopausal disorder.

Route of Administration Insights:

- Oral

- Parenteral

The report has provided a detailed breakup and analysis of the market based on the route of administration. This includes oral, and parenteral.

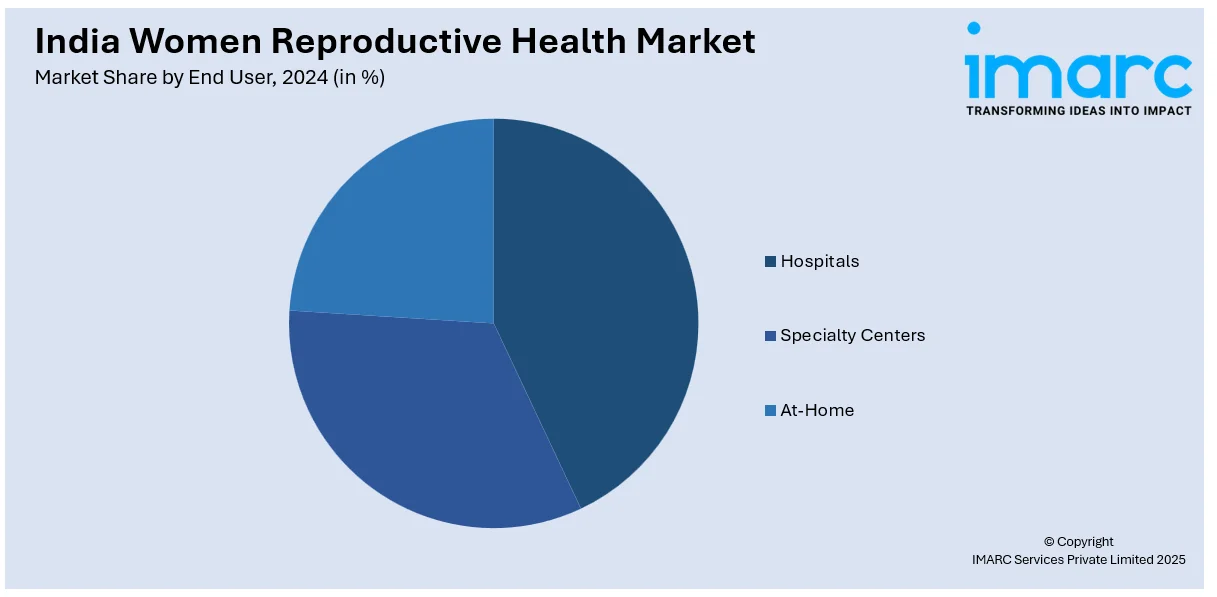

End User Insights:

- Hospitals

- Specialty Centers

- At-Home

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, specialty centers, and at-home.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Women Reproductive Health Market News:

- In September 2024, Apollo Hospitals, Ahmedabad launched its Apollo Female Aesthetic Studio, presenting FemRejuvenate Therapy—an advanced treatment aimed at boosting vaginal health while enhancing intimacy, wellness, and women's confidence. In a press release, the healthcare provider announced that this represents a pioneering service in the state, providing innovative Radio Frequency Energy and Laser Technology via the state-of-the-art ThermiVa and LYRA systems.

- In February 2024, Max Healthcare Institute, an Indian healthcare provider, established a strategic alliance with the Royal College of Obstetricians and Gynaecologists (RCOG) from the UK to improve specialty training programs in Obstetrics and Gynaecology throughout North India. The partnership seeks to leverage the advantages of both entities to enhance training, evaluation, and certification in obstetrics and gynaecology across India.

India Women Reproductive Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatment Types Covered | Menstrual Disorder, Uterine Fibroids/ Endometriosis, Infertility, Menopausal Disorder |

| Routes of Administration Covered | Oral, Parenteral |

| End Users Covered | Hospitals, Specialty Centers, At-Home |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India women reproductive health market performed so far and how will it perform in the coming years?

- What is the breakup of the India women reproductive health market on the basis of treatment type?

- What is the breakup of the India women reproductive health market on the basis of route of administration?

- What is the breakup of the India women reproductive health market on the basis of end user?

- What is the breakup of the India women reproductive health market on the basis of region?

- What are the various stages in the value chain of the India women reproductive health market?

- What are the key driving factors and challenges in the India women reproductive health market?

- What is the structure of the India women reproductive health market and who are the key players?

- What is the degree of competition in the India women reproductive health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India women reproductive health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India women reproductive health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India women reproductive health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)