India Wood Processing Equipment Market Size, Share, Trends and Forecast by Operating Principal, Product Type, End User, and Region, 2025-2033

India Wood Processing Equipment Market Overview:

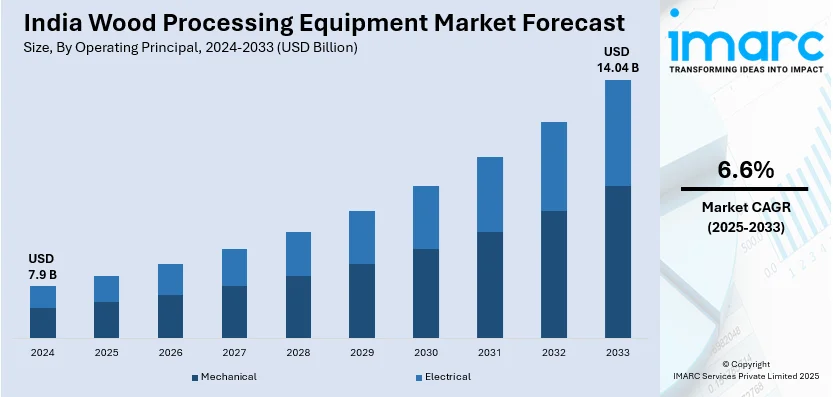

The India wood processing equipment market size reached USD 7.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.04 Billion by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033. Rapid urbanization, increasing construction and infrastructure projects, rising demand for modular and aesthetic furniture, technological advancements in automation and CNC machinery, and the growing adoption of engineered wood products are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.9 Billion |

| Market Forecast in 2033 | USD 14.04 Billion |

| Market Growth Rate (2025-2033) | 6.6% |

India Wood Processing Equipment Market Trends:

Advancing Skill Development and Sustainability in Wood Processing

The wood processing sector is increasingly focusing on skill development and sustainability through specialized learning hubs. These dedicated facilities integrate cutting-edge woodworking machinery with educational programs, equipping industry professionals, students, and artisans with hands-on expertise in advanced manufacturing techniques. By fostering knowledge-sharing and promoting eco-friendly wood products, such initiatives strengthen local industries and encourage responsible sourcing. Such centers act as catalysts for technological adoption, ensuring a skilled workforce capable of meeting evolving market demands. With a growing emphasis on precision engineering and sustainable materials, these spaces bridge the gap between innovation and real-world application, reinforcing India’s role as a competitive player in global wood manufacturing while aligning with environmentally conscious production standards. For example, in August 2023, Canadian Wood and Caple Industrial Solutions inaugurated a 13,000-square-foot Centre of Excellence (CoE) in Mumbai. This state-of-the-art facility serves as a showroom and training center, showcasing advanced woodworking machinery and sustainable wood products from British Columbia. The CoE aims to educate industry professionals, students, and enthusiasts on the latest technologies and best practices in wood manufacturing, thereby enhancing skill development and promoting sustainable practices within India's wood industry.

To get more information of this market, Request Sample

Growing Emphasis on Sustainable Certification in the Wood Industry

The increasing focus on sustainability in the wood industry is driving the adoption of standardized certification systems. With growing global demand for eco-friendly and responsibly sourced wood products, national frameworks are being established to ensure compliance with environmental and social standards. These initiatives help in streamlining regulations, enhancing market credibility, and supporting responsible forest management. As industries align with sustainable practices, there is a greater emphasis on self-reliance in certification, reducing dependence on external agencies. This shift not only strengthens domestic forestry practices but also improves market access for certified products. The move toward structured certification processes ensures long-term ecological balance, promotes conservation efforts, and enhances international acceptance of responsibly sourced wood, ultimately benefiting both businesses and consumers. For instance, in December 2023, the Indian government introduced the Indian Forest and Wood Certification Scheme (IFWCS) to promote sustainable forest management and counter foreign certification agencies. The IFWCS aims to provide a national standard for certifying forests and wood products, ensuring adherence to environmental and social standards. This initiative seeks to enhance the credibility of Indian wood products in domestic and international markets, supporting forest conservation and sustainable utilization.

India Wood Processing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on operating principal, product type, and end user.

Operating Principal Insights:

- Mechanical

- Electrical

The report has provided a detailed breakup and analysis of the market based on the operating principal. This includes mechanical and electrical.

Product Type Insights:

- Thickness Planer

- Grinding Machines

- Chain/Chisel Mortise

- Routers

- Wood Lathes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes thickness planer, grinding machines, chain/chisel mortise, routers, wood lathes, and others.

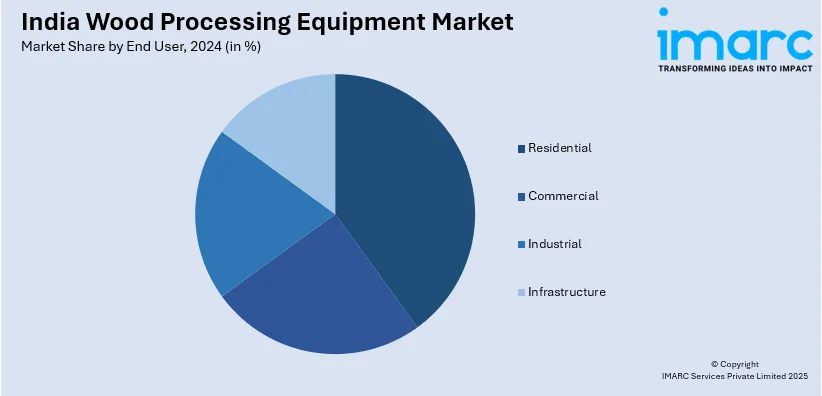

End User Insights:

- Residential

- Commercial

- Industrial

- Infrastructure

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, industrial, and infrastructure.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wood Processing Equipment Market News:

- In March 2025, INDIAWOOD 2025, held from March 6-9 at India Expo Mart, Greater Noida, marked its 25th anniversary, attracting over 600 brands from 30+ countries. The event showcased India's growing prominence in the global woodworking sector, featuring automation, sustainable practices, and AI-driven technologies. This milestone reinforced India’s position as a key player in furniture manufacturing and wood processing equipment.

- In September 2024, Kamdhenu Paints expanded its premium product line by launching a new wood coatings range that meets international quality standards. This strategic move positions the company as a leader in innovative coatings solutions. To meet rising demand, Kamdhenu Paints increased production capacity from 36,000 to 49,000 kiloliters per year and is enhancing dealer networks with additional tinting machines.

India Wood Processing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operating Principals Covered | Mechanical, Electrical |

| Product Types Covered | Thickness Planer, Grinding Machines, Chain/Chisel Mortise, Routers, Wood Lathes, Others |

| End Users Covered | Residential, Commercial, Industrial, Infrastructure |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India wood processing equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India wood processing equipment market on the basis of operating principal?

- What is the breakup of the India wood processing equipment market on the basis of product type?

- What is the breakup of the India wood processing equipment market on the basis of end user?

- What are the various stages in the value chain of the India wood processing equipment market?

- What are the key driving factors and challenges in the India wood processing equipment?

- What is the structure of the India wood processing equipment market and who are the key players?

- What is the degree of competition in the India wood processing equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wood processing equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wood processing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wood processing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)