India X-ray Imaging System Market Size, Share, Trends and Forecast by Modality, Mobility, Type, Application, End User, and Region, 2025-2033

India X-ray Imaging System Market Overview:

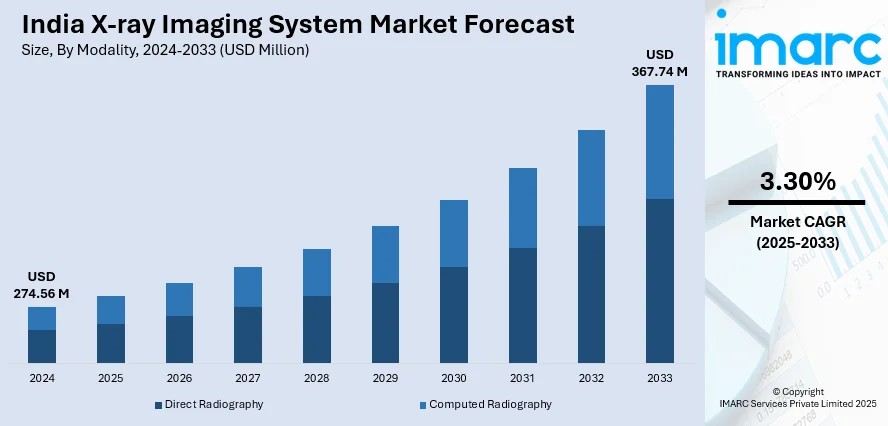

The India X-ray imaging system market size reached USD 274.56 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 367.74 Million by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The rising healthcare investments, increasing prevalence of chronic diseases, growing demand for early diagnostics, technological advancements like AI-powered imaging, expanding tele-radiology services, and government initiatives supporting healthcare infrastructure are fueling the market for X-ray imaging systems in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 274.56 Million |

| Market Forecast in 2033 | USD 367.74 Million |

| Market Growth Rate 2025-2033 | 3.30% |

India X-ray Imaging System Market Trends:

Growing Adoption of Digital and AI-Powered X-ray Systems

India's medical imaging landscape is undergoing a major transformation with the shift from conventional film-based X-ray systems to digital radiography (DR). Offering superior image quality, faster processing times, and enhanced storage capabilities, digital X-ray systems have seen a 20% rise in adoption between 2023 and 2025. AI-driven image analysis is further revolutionizing diagnostics, enabling early disease detection with greater accuracy. By 2025, AI-enabled X-ray imaging solutions are expected to account for 30% of all radiology diagnostics in India. The growing digital healthcare market, projected to reach $9 billion by 2025, is fueling demand for AI-integrated imaging solutions. Furthermore, government programs like the Ayushman Bharat Digital Mission (ABDM) are speeding up the use of digital technology and guaranteeing the smooth integration of AI-powered X-ray devices in diagnostic and medical facilities. With these developments, the radiology industry in India is expected to grow significantly, increasing medical imaging's accessibility and effectiveness.

To get more information on this market, Request Sample

Expansion of Tele-Radiology and Portable X-ray Solutions

India's expanding rural population and the shortage of radiologists are accelerating the adoption of tele-radiology services and portable X-ray machines, significantly enhancing accessibility to diagnostic imaging in remote areas. The rising demand for point-of-care diagnostics is fueling the portable X-ray segment, which is projected to grow at a CAGR of 15% from 2023 to 2025. Simultaneously, the Indian tele-radiology market is expected to expand by 25% annually, enabling remote interpretation of X-ray images and addressing the scarcity of trained radiologists in Tier 2 and Tier 3 cities. Additionally, technological advancements, including AI-driven image analysis and cloud-based storage solutions, are further optimizing diagnostic accuracy and efficiency. Government healthcare initiatives, such as Ayushman Bharat, are playing a crucial role in driving the widespread adoption of advanced X-ray imaging systems. These developments are not only bridging healthcare gaps but also ensuring timely and accurate diagnoses, ultimately improving patient outcomes and strengthening the country's medical infrastructure.

India X-ray Imaging System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on modality, mobility, type, application, and end user.

Modality Insights:

- Direct Radiography

- Computed Radiography

The report has provided a detailed breakup and analysis of the market based on the modality. This includes direct radiography and computed radiography.

Mobility Insights:

- Stationary

- Mobile

The report has provided a detailed breakup and analysis of the market based on the mobility. This includes stationary and mobile.

Type Insights:

- Digital

- Analog

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes digital and analog.

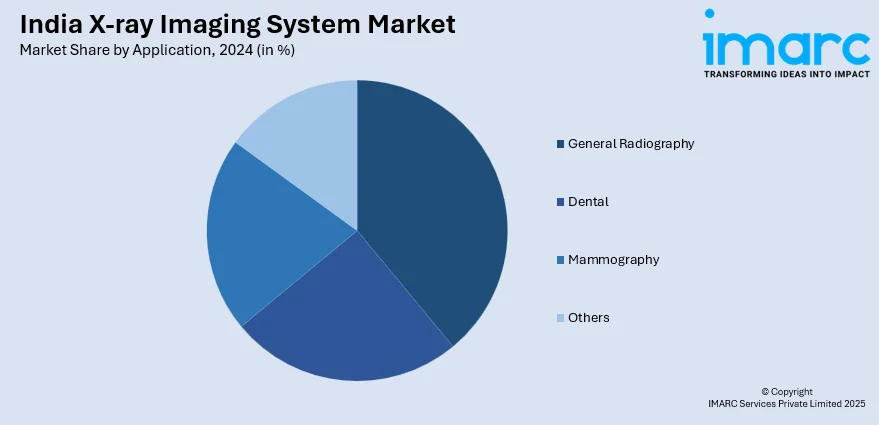

Application Insights:

- General Radiography

- Dental

- Mammography

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes general radiography, dental, mammography, and others.

End User Insights:

- Hospitals and Clinics

- Diagnostic Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, diagnostic centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India X-ray Imaging System Market News:

- October 2024: India developed an indigenous hand-held X-ray gadget for tuberculosis (TB) diagnostics, which would improve early detection and treatment efforts. The equipment, created by IIT Kanpur in collaboration with ICMR, costs less than half the price of imported portable X-rays.

- March 2024: DeepTek.ai unveiled its US FDA-cleared Augmento X-Ray AI system at the HIMSS 2024 conference. Deep learning techniques are used in the sophisticated AI solution to analyze chest X-rays and automatically detect dangerous spots. The company's goal is to modernize X-ray reporting and solve the rising worldwide burden of chest X-ray interpretation.

India X-ray Imaging System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modalities Covered | Direct Radiography, Computed Radiography |

| Mobilities Covered | Stationary, Mobile |

| Types Covered | Digital, Analog |

| Applications Covered | General Radiography, Dental, Mammography, Others |

| End Users Covered | Hospitals and Clinics, Diagnostic Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India X-ray imaging system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India X-ray imaging system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India X-ray imaging system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The X-ray imaging system market in India was valued at USD 274.56 Million in 2024.

The India X-ray imaging system market is projected to exhibit a CAGR of 3.30% during 2025-2033, reaching a value of USD 367.74 Million by 2033.

The India X-ray imaging system market is growing attributed to rising healthcare spending, better diagnostic awareness, and an increasing patient population. Hospitals upgrade equipment to offer faster, more accurate results. Demand rises with higher chronic disease cases and accident rates. Technological improvements and affordable digital systems help facilities modernize, boosting the use of X-ray imaging across urban and rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)