India Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Authentication, Component, End-User, and Region, 2026-2034

India Biometrics Market Summary:

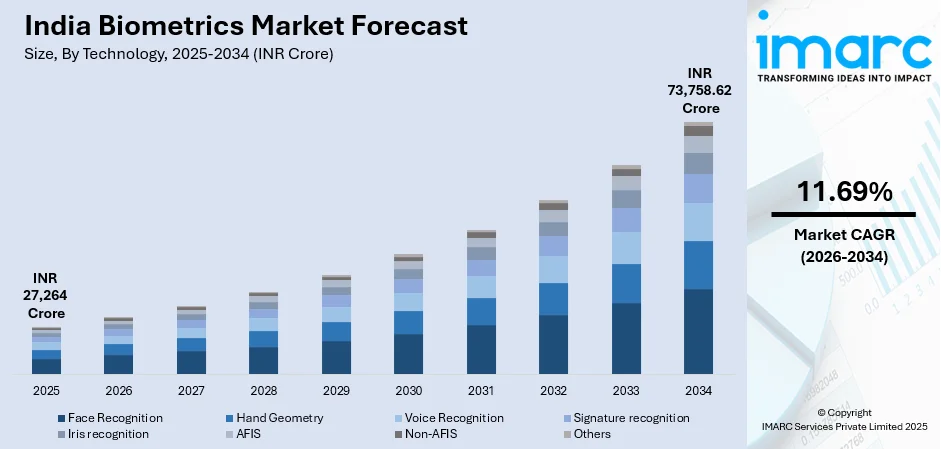

The India biometrics market size was valued at INR 27,264 Crore in 2025 and is projected to reach INR 73,758.62 Crore by 2034, growing at a compound annual growth rate of 11.69% from 2026-2034.

The India biometrics market represents one of the fastest-growing biometric ecosystems globally, driven by the nation's ambitious digital transformation initiatives and the world's largest biometric identification program, Aadhaar. The market benefits from increasing adoption across government and private sectors, with consumers and organizations utilizing fingerprint, facial, iris, and voice recognition technologies for identity verification, access control, and secure payment authentication across diverse applications.

Key Takeaways and Insights:

-

By Technology: Non-AFIS dominates the market with a share of 35.65% in 2025, driven by widespread deployment of fingerprint scanners, facial recognition systems, and iris scanners across diverse applications beyond automated fingerprint identification.

-

By Functionality: Contact leads the market with a share of 54.26% in 2025, reflecting the established infrastructure of touch-based fingerprint authentication systems deployed across government services, banking, and enterprise applications.

-

By Authentication: Single-factor authentication dominates the market with a share of 67.45% in 2025, supported by cost-effective implementation and widespread consumer familiarity with single biometric verification methods

-

By Component: Hardware leads the market with a share of 84.04% in 2025, attributable to the extensive deployment of biometric capture devices, scanners, readers, and authentication terminals across sectors.

-

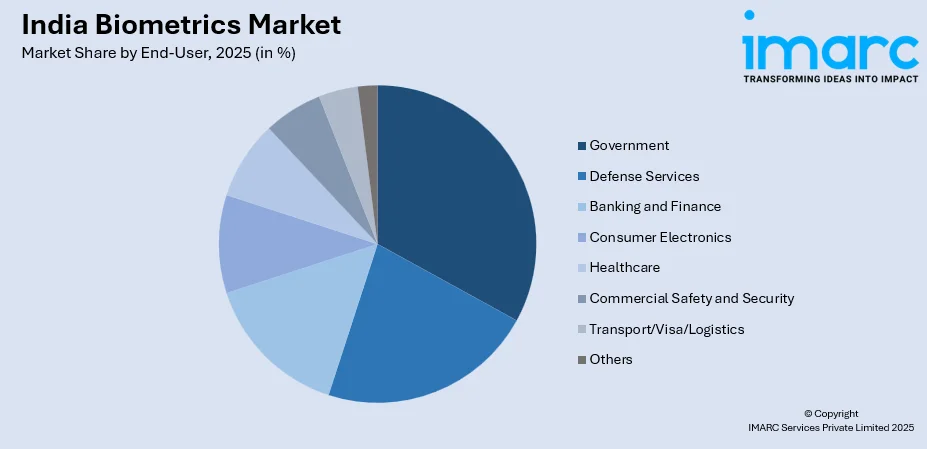

By End-User: Government dominates the market with a share of 21.44% in 2025, driven by large-scale e-governance initiatives including Aadhaar enrollment, e-passport issuance, and welfare scheme authentication.

-

By Region: North India leads the market with a share of 29% in 2025, reflecting the concentration of government institutions, corporate headquarters, and IT infrastructure in the National Capital Region and surrounding states.

-

Key Players: The India biometrics market is highly competitive, driven by rising demand for identity verification, access control, and security solutions across government, BFSI, and enterprise sectors. Some of the key players include, IDEMIA, Secugen India Pvt. Ltd., NEC Technologies India Pvt. Ltd, 4G Identity Solutions Pvt. Ltd, HID Corporation, eSSL Security, 3M India Ltd, Honeywell International Inc., Zicom Saas Pvt. Ltd., and Matrix Comsec Pvt. Ltd.

To get more information on this market Request Sample

The biometrics industry in India is evolving rapidly, driven by digitalization, rising security needs, and the demand for reliable identity verification. For example, in September 2025, the Reserve Bank of India (RBI) formally approved biometric authentication technology, including fingerprint-based methods, for digital payment transactions, enabling firms like IDEX Biometrics to position their solutions for mainstream use in India’s financial ecosystem. Government initiatives have accelerated the adoption of biometric technologies across sectors such as financial services, telecommunications, healthcare, and public services. Innovations like artificial intelligence and machine learning are enhancing system accuracy, while multimodal biometric solutions are gaining traction. Additionally, there is a growing preference for contactless and user-friendly authentication methods, reflecting changing consumer expectations and heightened awareness of hygiene and convenience in the post-pandemic era.

India Biometrics Market Trends:

Rising Adoption of Contactless Biometric Solutions

The market is witnessing rapid adoption of contactless biometric technologies such as facial recognition, iris scanning, and voice authentication, driven by hygiene concerns and demand for frictionless user experiences. In November 2025, Kempegowda International Airport became India’s first to implement a fully biometric end-to-end passenger journey via the DigiYatra platform, earning a national innovation award. Meanwhile, banking, healthcare, and enterprises are steadily shifting from touch-based fingerprint systems to secure, touchless solutions, especially in high-throughput environments.

Integration of Artificial Intelligence and Machine Learning

Biometric solution providers are increasingly integrating AI and machine learning algorithms to enhance recognition accuracy, reduce false acceptance and rejection rates, and enable real-time threat detection. For example, in 2025 Aware, Inc. launched its Intelligent Liveness solution that uses advanced machine learning to cut error rates by 50% and achieve sub-second capture speeds, significantly boosting fraud resistance and system accuracy. Advanced deep learning models are improving facial recognition capabilities even under challenging conditions including low lighting, partial occlusion, and varied angles.

Growth of Multimodal Biometric Systems

Organizations are increasingly deploying multimodal biometric systems that combine multiple authentication modalities including fingerprint, facial, iris, and voice recognition for enhanced security and accuracy. For example, Iris ID unveiled its IrisAccess iA1000 multimodal access control reader in 2025, which integrates both iris and facial recognition for secure entry across enterprises and high-security facilities. These integrated systems are gaining traction in high-security environments including defense installations, banking infrastructure, and border control applications. The combination of multiple biometric factors significantly reduces authentication errors while providing fallback options when individual modalities encounter challenges.

Market Outlook 2026-2034:

The India biometrics market is positioned for robust double-digit growth through the forecast period, underpinned by continued government digitalization initiatives, expanding private sector adoption, and technological advancements in biometric recognition systems. The market's expansion trajectory is supported by mandatory Aadhaar-based authentication requirements, growing cybersecurity concerns, and increasing smartphone penetration enabling mobile biometrics. The market generated a revenue of INR 27,264 Crore in 2025 and is projected to reach a revenue of INR 73,758.62 Crore by 2034, growing at a compound annual growth rate of 11.69% from 2026-2034.

India Biometrics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Non-AFIS |

35.65% |

|

Functionality |

Contact |

54.26% |

|

Component |

Hardware |

84.04% |

|

Authentication |

Single-Factor Authentication |

67.45% |

|

End-User |

Government |

21.44% |

|

Region |

North India |

29% |

Technology Insights:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature recognition

- Iris recognition

- AFIS

- Non-AFIS

- Others

The non-AFIS dominates with a market share of 35.65% of the total India biometrics market in 2025.

The leading position of non-AFIS technologies reflects the widespread deployment of diverse biometric modalities beyond automated fingerprint identification systems across commercial and government applications. For example, in October 2025 India Post Payments Bank rolled out a facial and iris recognition-based banking service for individuals unable to provide traditional fingerprint biometrics, helping nearly 300 leprosy-affected citizens and many others access financial services with dignity and ease.

The segment’s growth is driven by increasing adoption across banking and financial services for secure customer authentication, corporate environments for workforce attendance and access management, and consumer electronics such as smartphones equipped with fingerprint sensors and facial recognition features. Additionally, the widespread rollout of Aadhaar-enabled payment systems and the growing use of e-KYC verification in financial services continue to expand the deployment footprint of non-AFIS biometric solutions across India.

Functionality Insights:

- Contact

- Non-contact

- Combined

The contact leads with a share of 54.26% of the total India biometrics market in 2025.

The dominant position of contact-based biometric systems reflects the well-established infrastructure of touch-based fingerprint authentication deployed extensively across Aadhaar enrollment centers, banking touchpoints, government service outlets, and enterprise access control systems. Contact biometrics, including capacitive and optical fingerprint scanners, represent a mature technology with proven reliability, high accuracy, and cost-effectiveness. Moreover, the extensive network of Aadhaar-authenticated welfare, financial, and identity services continues to rely predominantly on fingerprint-based verification that requires physical contact.

The segment remains dominant due to the extensive installed base of fingerprint readers across government, banking, and corporate facilities. Organizations favor contact-based systems for their reliability, lower costs, and user familiarity. Nevertheless, rising hygiene concerns, evolving security needs, and demand for seamless experiences are gradually shifting adoption toward touchless biometric technologies, leading to a slow erosion of the segment’s market share.

Authentication Insights:

- Single-Factor Authentication

- Multifactor Authentication

The single-factor authentication dominates with a market share of 67.45% of the total India biometrics market in 2025.

The leading position of single-factor authentication reflects the prevalence of standalone biometric verification methods including fingerprint-only or facial recognition-only authentication deployed across mass-scale applications. Single-factor systems offer simplified user experience, faster authentication speed, and lower implementation costs compared to multifactor alternatives. According to the Unique Identification Authority of India (UIDAI), Aadhaar authentication transactions surpassed 2,707 crore in the 2024–25 fiscal year, driven in large part by widespread use of single‑factor biometric verification such as fingerprint and face authentication across government and private services.

The segment benefits from widespread consumer familiarity and acceptance of single biometric authentication, particularly fingerprint verification that has become normalized through smartphone adoption and banking services. However, growing security concerns and regulatory requirements are driving gradual adoption of multifactor authentication combining biometrics with PINs, OTPs, or multiple biometric modalities in high-security applications including financial transactions and sensitive data access.

Component Insights:

- Hardware

- Software

The hardware leads with a share of 84.04% of the total India biometrics market in 2025.

The commanding share of hardware components reflects the capital-intensive nature of biometric infrastructure deployment requiring substantial investment in physical devices including fingerprint scanners, facial recognition cameras, iris scanners, and integrated authentication terminals. The extensive rollout of biometric capture devices across Aadhaar enrollment ecosystem, banking infrastructure, and enterprise facilities has generated significant hardware demand. Manufacturing innovations are improving device accuracy while reducing form factors and costs.

The segment benefits from UIDAI's transition from L0 to L1 certified biometric devices offering enhanced encryption and tamper resistance, creating replacement demand across the existing device network. The continuous rise in security threats drives demand for advanced hardware incorporating liveness detection and anti-spoofing capabilities. Growing smartphone penetration with embedded biometric sensors expands the hardware ecosystem beyond dedicated authentication devices into consumer electronics integration.

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

The government dominates with a market share of 21.44% of the total India biometrics market in 2025.

The leading position of government end users reflects the transformative impact of e-governance initiatives requiring biometric authentication for citizen services, welfare distribution, and administrative functions. The Aadhaar ecosystem represents the world's largest biometric identification program enabling identity verification across public services including subsidized food distribution, pension disbursement, and scholarship payments. Government deployment extends to e-passport issuance, voter verification, and employee attendance management.

The segment benefits from continued government investment in Digital India infrastructure, expansion of Aadhaar-enabled services to additional welfare schemes, and modernization of legacy identification systems. For example, in 2025 Aadhaar’s AI‑driven face authentication recorded a record 19.36 crore transactions in July alone, underscoring rapid adoption of contactless biometric modalities across government and private services. The National Crime Records Bureau and state governments are expanding biometric use from identity verification to public safety and service management.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 29% share of the total India biometrics market in 2025.

The leading position of North India reflects the concentration of central government institutions, corporate headquarters, and IT infrastructure in the National Capital Region encompassing Delhi, Gurugram, and Noida. The region hosts major government departments and ministries driving substantial biometric deployment for employee management and citizen services. High urbanization rates and developed commercial infrastructure in states including Delhi, Haryana, and Uttar Pradesh support advanced biometric adoption.

The region benefits from proximity to policy decision-making centers enabling early adoption of government-mandated biometric initiatives. Strong banking and financial services presence in northern metropolitan centers drives private sector biometric investment. The concentration of educational institutions, healthcare facilities, and commercial establishments requiring access control and attendance management systems supplements regional demand. Continued infrastructure development and economic activity in tier-2 cities across North India is expanding the biometric market footprint.

Market Dynamics:

Growth Drivers:

Why is the India Biometrics Market Growing?

Government Digitalization and E-Governance Initiatives

The Digital India program and associated e-governance initiatives are driving large-scale biometric deployment across government services requiring citizen identity verification. Mandatory Aadhaar authentication for welfare schemes, subsidy distribution, and public services creates sustained demand for biometric infrastructure. For example, in December 2025 NEXT Biometrics received a new order from an Indian device maker for its advanced FAP20 fingerprint sensors, set to be integrated into access control tablets and other identity verification devices, highlighting growing commercial adoption of high‑security biometric hardware in the Indian market. The expansion of biometric-enabled services to additional government programs and the modernization of existing systems with upgraded L1 certified devices continues propelling market growth.

Rising Security Concerns and Fraud Prevention Requirements

Escalating cyber threats, identity theft incidents, and financial fraud are compelling organizations across sectors to adopt biometric authentication as a secure alternative to passwords and PINs. Banks, financial institutions, and enterprises are implementing biometric verification to protect against unauthorized access and fraudulent transactions. In December 2025, JP Morgan‑backed fintech In‑Solutions Global launched ISG Authify, a biometric authentication solution replacing passwords and OTPs, targeting the sharp rise in digital fraud in India, which nearly tripled year over year. The inadequacy of traditional security measures against sophisticated attacks is accelerating biometric adoption in high-risk applications.

Smartphone Penetration and Mobile Biometrics Growth

India's booming smartphone market, which reached 153.3 million units in 2024 and is expected to grow to 277.1 million units by 2033 at a CAGR of 6.6% during 2025-2033, is featuring devices with integrated fingerprint sensors and facial recognition capabilities, normalizing biometric authentication among consumers. The widespread use of mobile biometrics for device unlocking, payment authorization, and app security creates foundation for biometric acceptance across enterprise and institutional applications. Smartphone-based biometric authentication enables cost-effective deployment without dedicated hardware infrastructure.

Market Restraints:

What Challenges the India Biometrics Market is Facing?

Privacy and Data Security Concerns

Growing concerns regarding collection, storage, and potential misuse of sensitive biometric data present adoption challenges. The introduction of data protection legislation including requirements for consent, data localization, and transparency in biometric data handling creates compliance complexities for organizations. Public skepticism regarding government surveillance capabilities and data breach risks may constrain voluntary biometric adoption.

High Implementation and Infrastructure Costs

High capital requirements for biometric infrastructure, including hardware, software licensing, and system integration, pose significant barriers, especially for small and medium enterprises. These costs can limit adoption, slow implementation, and create challenges in scaling operations. SMEs often struggle to justify the upfront investment despite potential long-term efficiency, security, and operational benefits of biometric systems.

Technical Challenges and Accuracy Limitations

Biometric systems face accuracy challenges in diverse environmental conditions and across heterogeneous population characteristics. Fingerprint recognition may struggle with worn or damaged fingerprints common among manual laborers, while facial recognition accuracy varies with lighting conditions and demographic factors. The technology gap between international and domestic solutions and shortage of skilled personnel for system management present implementation challenges.

Competitive Landscape:

The India biometrics market features a competitive landscape comprising international technology leaders and domestic specialists serving diverse market segments. Global players leverage advanced technology capabilities and extensive product portfolios while regional companies offer cost-effective solutions tailored to local requirements and price sensitivities. Competition intensifies around UIDAI certification compliance, technology innovation, and service capabilities. The market structure reflects consolidation among major players commanding significant shares through government contracts and enterprise deployments. Strategic partnerships between international technology providers and local system integrators enable market penetration while domestic players compete through manufacturing localization and responsive customer service.

Some of the key players include:

- IDEMIA

- SecuGen India Pvt. Ltd

- NEC Technologies India Pvt. Ltd

- 4G Identity Solutions Pvt. Ltd

- HID Corporation

- eSSL Security

- 3M India Ltd

- Honeywell International Inc.

- Zicom Saas Pvt. Ltd.

- Matrix Comsec Pvt. Ltd

Recent Developments:

-

In November 2025, M-Tech Innovations Ltd. became the first Indian company to receive Visa certification for a locally manufactured biometric payment card using fingerprint sensor technology. The milestone strengthens secure, PIN-free digital payments and supports the Make in India initiative by promoting indigenous fintech hardware innovation.

India Biometrics Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crores |

| Segment Coverage |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technology Covered | Face Recognition, Hand Geometry, Voice Recognition Signature recognition, Iris recognition, AFIS, Non-AFIS, Others |

| Functionality Covered | Contact, Non-contact, Combined |

| Authentication Covered | Single-Factor Authentication, Multifactor Authentication |

| Component Covered | Hardware, Software |

| End-User Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | IDEMIA, Secugen India Pvt. Ltd., NEC Technologies India Pvt. Ltd, 4G Identity Solutions, HID Corporation, eSSL Security, 3M India Ltd, Honeywell International Inc., Zicom Saas Pvt. Ltd., and Matrix Comsec Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India biometrics market size was valued at INR 27,264 Crore in 2025.

The India biometrics market is expected to grow at a compound annual growth rate of 11.69% from 2026-2034 to reach INR 73,758.62 Crore by 2034.

Non-AFIS dominated the market with a 35.65% share, driven by widespread deployment of fingerprint scanners, facial recognition systems, and diverse biometric modalities across commercial and government applications beyond automated fingerprint identification systems.

Key factors driving the India biometrics market include government digitalization and e-governance initiatives, rising security concerns and fraud prevention requirements, increasing smartphone penetration enabling mobile biometrics, and expanding Aadhaar-based authentication requirements across sectors.

Major challenges include privacy and data security concerns, high implementation and infrastructure costs, technical challenges and accuracy limitations in diverse conditions, evolving regulatory requirements, and shortage of skilled personnel for system management and maintenance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)