India Paper Cups Market Size, Share, Trends and Forecast by Cup Type, Wall Type, Cup Size, Application, End User, and States, 2025-2033

India Paper Cups Market Size and Share:

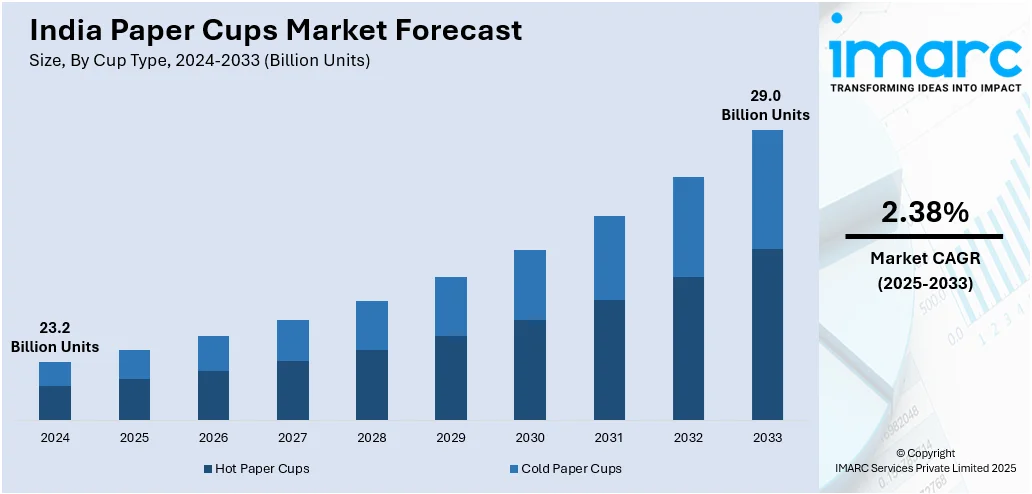

The India paper cups market size reached a volume of 23.2 Billion Units in 2024. The market is expected to reach a volume of 29.0 Billion Units by 2033, exhibiting a growth rate (CAGR) of 2.38% during 2025-2033. The market growth is attributed to the growing preference for eco-friendly products, rising awareness among consumers, supportive government regulations, increasing adoption in the foodservice sector, expanding quick-service restaurant chains, and heightened demand for on-the-go beverages.

Market Insights:

- On the basis of States, Maharashtra was the largest market for paper cups in India in 2024.

- Based on the cup type, hot paper cups represented the largest segment in 2024.

- On the basis of the wall type, single wall paper cups accounted for the largest market share in 2024.

- Based on the cup size, the market is categorized as small, medium, and large.

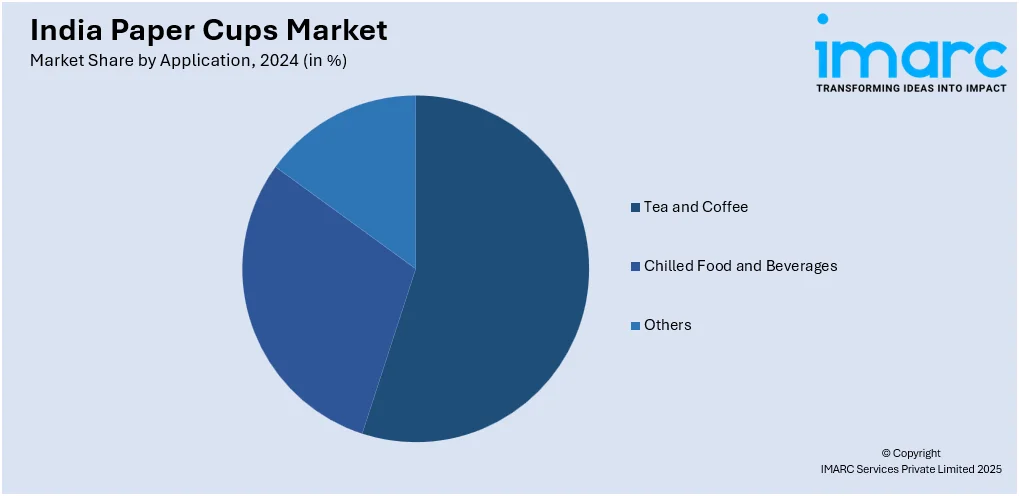

- On the basis of the application, tea and coffee accounted for the largest market share in 2024.

- Based on the end user, coffee/tea shops accounted for the largest market share in 2024.

Market Size and Forecast:

- 2024 Market Size: 23.2 Billion Units

- 2033 Projected Market Size: 29.0 Billion Units

- CAGR (2025-2033): 2.38%

Paper cups, also known as disposable cups, are made from bleached virgin paper pulp and coated with plastic and wax to prevent liquid from soaking through the paper and leaking. They are also coated with polyethylene, which aids in enhancing their durability and performance by controlling the condensed moisture from absorbing in and retaining the original flavor of the product. They are eco-friendly and biodegradable and help in saving time and effort as paper cups do not require cleaning and can be easily discarded after a single use. As a result, paper cups are widely used in India for consuming beverages like tea, coffee, soup, and soft drinks at social gatherings, celebrations, and special occasions. They are also used in hospitals, cafes, restaurants, hotels, and public buildings to prevent the spread of contagious diseases.

To get more information on this market, Request Sample

At present, the rising consumption of beverages among consumers represents one of the key factors supporting the growth of the market in India. Besides this, the growing demand for disposable packaging in quick service restaurants (QSRs) and fast-food chains to reduce leakage and spillage of beverages is offering a positive market outlook in the country. Additionally, there is a rise in the need for sustainable and environment friendly solutions among the masses. This, coupled with the increasing demand for paper cups as they easily decompose in the environment and do not add to landfill wastes or pollute water bodies, is augmenting the India paper cups market share. Apart from this, the wide availability of paper cups through various distribution channels, such as hypermarkets, supermarkets, and convenience, specialty and online stores, is offering lucrative growth opportunities to industry investors. Moreover, the increasing demand for fancy graphics, attractive designs, and customized paper cups among the masses is positively influencing the market in the country. In addition, the Government of India is encouraging the adoption of paper cups as they are sustainable and do not affect the environment, which is contributing to the market growth. Furthermore, the rising demand for paper cups in hospitals to prevent the spread of germs is strengthening the market growth in India.

India Paper Cups Market Trends:

Development of Organized Fast-Food and Food Delivery Channels

The growth of organized quick-service restaurants (QSRs) and the speedy development of food delivery platforms in India have significantly raised the demand for paper cups. Moreover, urban customers increasingly consume beverages like coffee, tea, and cold drinks bought from cafes, QSRs, and food delivery aggregators, who in turn prefer disposable paper cups for convenience and hygiene. Additionally, cloud kitchen penetration, which delivers food online only, has further supported the requirement for uniform packaging solutions, such as good-quality paper cups that sustain temperature and prevent leakage. Manufacturers are responding with a multitude of cup sizes, double-wall insulation configurations, and customizable options to support these structured channels. Apart from this, increased middle-class demographics and shifting consumption behaviors, especially among millennials and Gen Z, have further solidified this trend, making disposable paper cups a key part of the contemporary food and beverage landscape.

Technology Advances and Personalization Options

Technology advances in the production of paper cups are revolutionizing the market by creating opportunities for improved functionality, quality, and attractiveness. This, in turn, is supporting the India paper cups market growth. These include enhanced barrier coatings, heat-insulating double-wall cups, and leak-proof constructions that are becoming the norm to address changing consumer demands. In line with this, digital branding and printing technologies enable companies to personalize cups with logos, marketing messages, and bright designs, thus making disposable cups marketing devices. Furthermore, the roll-out of automated manufacturing lines has also brought down operational costs, improved efficiency, and provided consistent quality, enabling large manufacturers as well as regional players to cater to varying demands. With rising awareness regarding standards of hygiene and durability, these technological advancements have created wider acceptability for paper cups in institutional, commercial, and retail channels of India, driving the market towards its continued growth path.

Growth, Opportunities, and Barriers in the India Paper Cups Market:

- Growth Drivers: The market is primarily driven by increasing environmental awareness and a shift toward sustainable packaging solutions. Moreover, government regulations and state-level bans on single-use plastics have accelerated the adoption of biodegradable and compostable cups. Also, rapid urbanization and rising disposable incomes have fueled demand for on-the-go beverages, particularly coffee and cold drinks, in cafes, QSRs, and food delivery channels. The expansion of organized foodservice and quick-service restaurant networks is creating steady demand for standardized paper cup solutions, which is enhancing the India paper cups market outlook.

- Market Opportunities: The market presents lucrative opportunities due to the rising popularity of eco-friendly packaging, which propels manufacturers to introduce innovative biodegradable and compostable paper cups. Growth in online food delivery and cloud kitchen models creates demand for customized, high-quality cups suitable for takeaway and delivery. Further, digital printing and branding technologies offer businesses the chance to use cups as marketing tools, increasing visibility and brand recall. Expansion into tier-2 and tier-3 cities, where coffee culture and beverage consumption are rising, provides untapped market potential.

- Market Challenges: The market faces challenges such as the high production costs for biodegradable and compostable paper cups compared to conventional plastic-lined cups. Limited consumer awareness in smaller towns and rural areas restricts widespread adoption of eco-friendly alternatives. Inconsistent quality standards and a lack of uniform certifications can affect market credibility and consumer trust. Competition from low-cost, conventional disposable cups continues to pose pricing pressures on manufacturers. According to the India paper cups market forecast, supply chain constraints, particularly the availability of sustainable raw materials, can hinder scaling up production and meeting growing market demand.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India paper cups market report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on cup type, wall type, cup size, application, and end user.

Cup Type Insights:

- Hot Paper Cups

- Cold Paper Cups

The report has provided a detailed breakup and analysis of the India paper cups market based on the cup type. This includes hot paper cups and cold paper cups. According to the report, hot paper cups represented the largest segment.

Wall Type Insights:

- Single Wall Paper Cups

- Double Wall Paper Cups

- Triple Wall Paper Cups

A detailed breakup and analysis of the India paper cups market based on the wall type has also been provided in the report. This includes single wall paper cups, double wall paper cups, and triple wall paper cups. According to the India paper cups market analysis, single wall paper cups accounted for the largest market share.

Cup Size Insights:

- Small

- Medium

- Large

A detailed breakup and analysis of the India paper cups market based on the cup size has also been provided in the report. This includes small, medium, and large.

Application Insights:

- Tea and Coffee

- Chilled Food and Beverages

- Others

A detailed breakup and analysis of the India paper cups market based on the application has also been provided in the report. This includes tea and coffee, chilled food and beverages, and others. According to the report, tea and coffee accounted for the largest market share.

End User Insights:

- Coffee/Tea Shops

- Fast Foods Shops/ QSRS

- Offices, Educational Institutes and Multiplexes

- Supermarket (Food Courts)

- Others

A detailed breakup and analysis of the India paper cups market based on the end-user has also been provided in the report. This includes coffee/tea shops, fast foods shops/ QSRS, offices, educational institutes and multiplexes, supermarket (food courts), and others. According to the report, coffee/tea shops accounted for the largest market share.

States Insights:

- Maharashtra

- Uttar Pradesh

- Tamil Nadu

- West Bengal

- Gujarat

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Maharashtra, Uttar Pradesh, Tamil Nadu, West Bengal, Gujarat, and Others. According to the report, Maharashtra was the largest market for paper cups in India. Some of the factors driving the Maharashtra paper cups market included government initiatives to promote paper cups, increasing demand in hotels, cafes, and restaurants, presence of various key players, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India paper cups market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Leetha Group, Sri Lakshmi Polypack, Octane Ecowares Private Limited, Plus Paper Foodpac Ltd., Neeyog Packaging, Swan International, Manohar International Private Limited (MIPL), Greenware Revolution, Vecchio Industries Private Limited, Hyper Pack Private Limited, Valpack Solutions Pvt. Ltd., Ashima Paper Products, World Star Packaging Industry, Paricott India Papercup Pvt. Ltd., etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Latest News and Developments:

- September 2024: Chuk, the leading brand from Pakka, rolled out a fresh line of fully compostable tableware products, aimed at reducing single-use plastic in the food service industry. The product range includes a beverage cup, a 4-inch dona, and a 3-compartment snack tray, all crafted from bagasse, the agri-residue of sugarcane. These eco-friendly alternatives are designed to meet the sustainability needs of quick-service restaurants (QSRs), caterers, and event planners.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Crore, Billion Units |

| Segment Coverage | Cup Type, Wall Type, Cup Size, Application, End User, States |

| States Covered | Maharashtra, Uttar Pradesh, Tamil Nadu, West Bengal, Gujarat, Others |

| Companies Covered | Leetha Group, Sri Lakshmi Polypack, Octane Ecowares Pvt Ltd, Plus Paper Foodpac Limited, Neeyog Packaging, Swan International, Manohar International Private Limited (MIPL), Greenware Revolution, Vecchio Industries, Hyper Pack Pvt. Ltd., Valpack Solutions Pvt. Ltd., Ashima Paper Products, World Star Packaging Industry and Paricott India Papercup Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India paper cups market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India paper cups market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India paper cups industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India paper cups market reached a volume of 23.2 Billion Units in 2024.

We expect the India paper cups market to exhibit a CAGR of 2.38% during 2025-2033.

The increasing consumer environmental concerns, along with the growing adoption of paper cups as a cleaner, safer, and hygienic option over plastic counterparts for food takeaway services, are primarily driving the India paper cups market.

The sudden outbreak of the COVID-19 pandemic has led to the rising food safety concerns among individuals, resulting in a gradual shift from non-disposable cutlery towards paper cups, for serving beverages across numerous restaurants, bakeries, cafes, etc., in India.

Based on the cup type, the India paper cups market has been divided into hot paper cups and cold paper cups, where hot paper cups currently exhibit a clear dominance in the market.

Based on the wall type, the India paper cups market can be categorized into single wall paper cups, double wall paper cups, and triple wall paper cups. Currently, single wall paper cups account for the majority of the market share.

Based on the application, the India paper cups market has been segregated into tea and coffee, chilled food and beverages, and others. Among these, tea and coffee holds the largest market share.

Based on the end user, the India paper cups market can be bifurcated into coffee/tea shops, fast foods shops/QSRs, offices, educational institutes and multiplexes, supermarket (food courts), and others. Currently, coffee/tea shops exhibit a clear dominance in the market.

On a regional level, the market has been classified into Maharashtra, Uttar Pradesh, Tamil Nadu, West Bengal, Gujarat, and others, where Maharashtra currently dominates the India paper cups market.

Some of the major players in the India paper cups market include Leetha Group, Sri Lakshmi Polypack, Octane Ecowares Private Limited, Plus Paper Foodpac Ltd., Neeyog Packaging, Swan International, Manohar International Private Limited (MIPL), Greenware Revolution, Vecchio Industries Private Limited, Hyper Pack Private Limited, Valpack Solutions Pvt. Ltd., Ashima Paper Products, World Star Packaging Industry, and Paricott India Papercup Pvt. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)