Indian Pasta Market Size, Share, Trends and Forecast by Type, Raw Material, Distribution Channel, Cuisine, and Region, 2025-2033

Indian Pasta Market Size and Share:

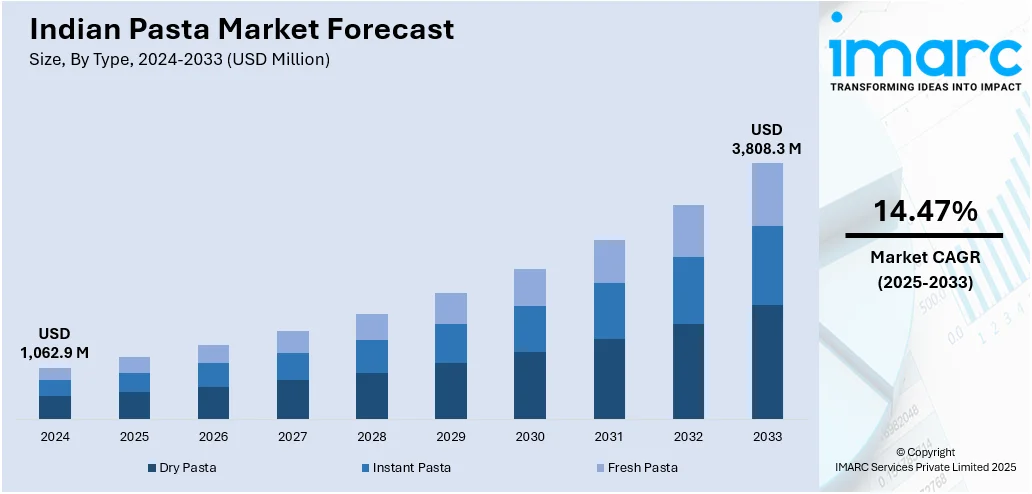

The Indian pasta market size reached USD 1,062.9 Million in 2024. The market is expected to reach USD 3,808.3 Million by 2033, exhibiting a growth rate (CAGR) of 14.47% during 2025-2033. The market growth is attributed to rising disposable incomes, changing food preferences, growing urbanization, increasing demand for convenient meals, western influence on diets, expanding retail and e-commerce channels, availability of diverse pasta varieties, aggressive marketing strategies, rising awareness of health-focused products, and the growing popularity of Italian cuisine.

Market Insights:

- On the basis of region, the market is divided into Uttar Pradesh, Delhi, Maharashtra, Gujarat, Karnataka, Tamil Nadu, and others.

- Based on the type, dry pasta dominates the market in 2024.

- On the basis of the raw material, semolina represents the largest segment in 2024.

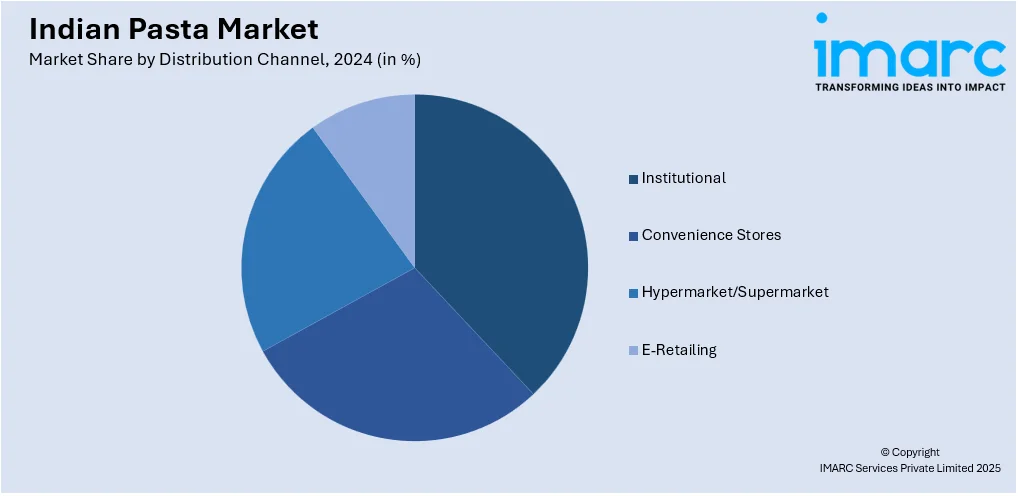

- Based on the distribution channel, institutional sales exhibit a clear dominance in 2024.

- On the basis of the cuisine, white sauce pasta represents the largest segment in 2024.

Market Size and Forecast:

- 2024 Market Size: USD 1,062.9 Million

- 2033 Projected Market Size: USD 3,808.3 Million

- CAGR (2025-2033): 14.47%

Pasta refers to the staple food of tradition Italian cuisine which is made using dough, water, eggs, vegetables, and oil. The dough is kneaded into various shapes some of which are known as penne, spaghetti, farfalle, fettuccine, barbine, etc. Pasta is associated with several health benefits owing to a high concentration of vitamins and minerals. Currently, the demand for pasta is gaining immense popularity in India, particularly amongst the younger population, due to expansion in food-service restaurants.

To get more information on this market, Request Sample

The primary factors catalysing the growth of the Indian pasta industry include rising urbanisation, changing lifestyles and surging demand for ready-to-eat products. In addition to this, the market is also influenced by an increasing women's employment rate coupled with rising disposable incomes. Further, the health-conscious consumers are demanding food products with healthier ingredients, which has led to a rise in the demand for pasta made with whole-wheat and quinoa. Some of the other forces that have been proactive in maintaining the market growth are longer shelf-life and ease of preparation.

Indian Pasta Market Trends:

Rising Preference for Convenient and Ready-to-Eat Foods

The busy lifestyles of urban consumers in Indian have accelerated the demand for convenient food products, with pasta emerging as a popular option. Pasta is widely sought by many working professionals and students in search of rapid preparation yet satisfying meals. Increased penetration of instant and packaged versions of pasta has even encouraged this shift, as they can be prepared in a couple of minutes with less effort. This trend aligns with the rising number of women joining the workforce and the emergence of nuclear families, where cooking time at home is short. Besides this, firms are coming up with pre-cooked, microwave, and single-serving packs to address this need. As per the Indian pasta market analysis, the versatility of pasta with Indian taste palettes makes it even more desirable, and it becomes acceptable to a larger section of consumers. The ease factor is also magnified due to the increasing presence of modern retail formats and e-commerce portals, enabling easy access in cities as well as smaller towns.

Diversification Toward Health and Wellness Variants

A notable trend in the market is the shift toward healthier alternatives. Growing awareness of lifestyle-related health concerns such as obesity, diabetes, and high cholesterol has encouraged consumers to seek products that balance taste with nutrition. To meet this demand, manufacturers are introducing whole wheat, multigrain, quinoa, and millet-based pasta options. These variants appeal to health-conscious buyers who prefer products high in fiber, protein, and essential nutrients while being low in refined flour content. One of the emerging Indian pasta market trends is the expansion of gluten-free pasta among a niche segment of consumers with dietary restrictions. Marketing campaigns emphasize clean labels, natural ingredients, and added vitamins to strengthen brand positioning. This health-driven innovation reflects not only changing dietary preferences but also government and industry efforts to promote nutritious food consumption. The steady rise of premium pasta products in this segment highlights how health considerations are reshaping consumer choices in Indian.

Growing Popularity of International and Fusion Flavors

The market is witnessing strong demand for international flavors, driven by increased global exposure, rising travel, and the influence of social media. Consumers, particularly younger demographics, are eager to experiment with cuisines inspired by Italy and other Western cultures. At the same time, brands are innovating with fusion recipes that combine pasta with Indiann spices, sauces, and seasonings to cater to local palates. This dual approach ensures pasta’s acceptance across diverse consumer groups. Quick-service restaurants, cafés, and cloud kitchens are also playing a major role in popularizing such recipes, creating demand spillover into retail markets, thereby enhancing the Indian pasta market outlook. Premium flavored pasta, gourmet sauces, and recipe kits available through modern trade channels are further boosting experimentation at home. The trend highlights the interplay between global culinary exposure and domestic innovation, where pasta serves as a versatile base for creative flavor combinations, making it both aspirational and adaptable.

Growth, Opportunities, and Challenges in the Indian Pasta Market:

- Growth Drivers: The market is expanding due to rising disposable incomes and increasing urbanization, which encourage the adoption of convenient food options. Western food habits are becoming more mainstream, especially among younger consumers, creating a favorable environment for pasta consumption. The availability of diverse pasta formats, from instant to gourmet variants, further fuels demand. Growth in modern retail and e-commerce platforms has improved accessibility across urban and semi-urban areas, which is providing a boost to Indian pasta market growth. Aggressive marketing campaigns and flavor customization for Indian palates are strengthening the category’s acceptance.

- Market Opportunities: The growing health-conscious consumer base presents opportunities for whole wheat, multigrain, and gluten-free pasta. Increasing experimentation with international and fusion flavors allows brands to expand product portfolios. Rising demand in tier II and tier III cities provides scope for deeper penetration beyond metros. Partnerships with restaurants, cafés, and food delivery platforms can boost visibility and consumption. Innovation in ready-to-eat and recipe kit formats can create additional revenue streams.

- Market Challenges: According to Indian Pasta market forecast, high dependency on imported raw materials and premium ingredients can make pasta vulnerable to price fluctuations. Traditional Indiann staples like rice and wheat-based dishes remain strong competitors, limiting pasta’s everyday appeal. Lack of widespread cold-chain and logistics infrastructure restricts penetration in rural areas. Consumer perceptions of pasta as a “junk” or indulgent food can hinder adoption among health-focused households. Intense competition from established multinational brands creates barriers for smaller domestic players.

Indian Pasta Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian pasta market report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on type, raw material, distribution channel and cuisine.

Breakup by Type:

- Dry Pasta

- Instant Pasta

- Fresh Pasta

On the basis of type, the market has been segmented as dry pasta, instant pasta and fresh pasta. Currently, dry pasta dominates the Indian pasta market, holding the majority of the market share.

Breakup by Raw Material:

- Semolina

- Refined Flour

- Durum Wheat

- Others

Based on raw materials, semolina represents the largest segment. This can be accredited to the high gluten content of semolina which helps in maintaining the shape of pasta.

Breakup by Distribution Channel:

- Institutional

- Convenience Stores

- Hypermarket/Supermarket

- E-Retailing

On the basis of distribution channels, the market is segregated as convenience stores, supermarkets/hypermarkets, institutional and e-retail. Amongst these, institutional sales exhibit a clear dominance in the pasta market in India.

Breakup by Cuisine:

- White Sauce Pasta

- Red Sauce Pasta

- Mix Sauce Pasta

Based on cuisines, white sauce pasta represents the largest segment.

Breakup by State:

- Uttar Pradesh

- Delhi

- Maharashtra

- Gujarat

- Karnataka

- Tamil Nadu

- Others

Region-wise, the market has been segmented into Uttar Pradesh, Delhi, Maharashtra, Gujarat, Karnataka, Tamil Nadu and others.

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being Nestlé, ITC, Bambino, MTR and Del Monte.

This report provides a deep insight into the Indian pasta market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indian pasta industry in any manner.

Latest News and Developments:

- July 2025: WickedGüd, the noodles and pasta-focused food brand, launched a new campaign film as part of a three-part digital series featuring actor, entrepreneur, and brand ambassador Shilpa Shetty. The brand's mission is to reinvent comfort food by making it both indulgent and health-conscious, offering consumers a guilt-free experience. The film is positioned to strengthen WickedGüd's broader narrative of redefining traditional comfort food by blending taste with innovation and wellness.

- December 2024: Pasta Street inaugurated its eighth Bengaluru location in Sahakara Nagar, adding to its existing outlets in Indiranagar, JP-Nagar, Koramangala, ITPL-Whitefield, Cunningham Road, Varthur Road, and Sarjapur. True to its ethos of blending Italian tradition with contemporary flair, the Sahakara Nagar outlet features spacious interiors, an open-kitchen design, alfresco seating, and a menu crafted from premium ingredients to evoke the warmth and elegance of Italian cuisine. This expansion is augmenting Indian pasta market share.

- September 2024: Oleev Kitchen, a brand under Modi Naturals Ltd., launched its new multigrain pasta line featuring a blend of chickpea, jowar, brown rice, and durum wheat—designed to offer a high-protein, fibre-rich, and healthier alternative to traditional pasta without compromising on taste. The company enlisted Bollywood actress Chitrangda Singh as the face of the digital campaign, leveraging her advocacy for balanced living to reinforce the brand's ethos of clean and healthy eating. The new range is available in two SKUs (400 g Multigrain Macaroni and 400 g Multigrain Penne) and is currently sold through Amazon and the brand's D2C website, complementing its existing "Zero Maida" pasta offerings.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, ‘000 Tons |

| Segment Coverage | Type, Raw Material, Distribution Channel, Cuisine, State |

| States Covered | Uttar Pradesh, Delhi, Maharashtra, Gujarat, Karnataka, Tamil Nadu, Others |

| Companies Covered | Nestlé, ITC, Bambino, MTR, Del Monte |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian pasta market was valued at USD 1,062.9 Million in 2024.

We expect the Indian pasta market to exhibit a CAGR of 14.47% during 2025-2033.

The increasing popularity of Italian cuisine, along with the growing demand for healthy product variants, such as pasta, prepared from wheat, quinoa, and gluten-free ingredients, is primarily driving the Indian pasta market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of pasta across the nation.

Based on the type, the Indian pasta market has been divided into dry pasta, instant pasta, and fresh pasta. Currently, dry pasta holds the largest market share.

Based on the raw material, the Indian pasta market can be segregated into semolina, refined flour, durum wheat, and others. Among these, semolina currently accounts for the majority of the total market share.

Based on the distribution channel, the Indian pasta market has been bifurcated into institutional, convenience stores, hypermarket/supermarket, and e-retailing. Currently, institutional exhibits a clear dominance in the market.

Based on the cuisine, the Indian pasta market can be categorized into white sauce pasta, red sauce pasta, and mix sauce pasta. Among these, white sauce pasta holds the largest market share.

On a regional level, the market has been classified into Uttar Pradesh, Delhi, Maharashtra, Gujarat, Karnataka, Tamil Nadu, and others, where Maharashtra currently dominates the Indian pasta market.

Some of the major players in the Indian pasta market include Nestlé, ITC, Bambino, MTR, and Del Monte.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)