Pasta Market Size, Share, Trends, and Forecast by Product Type, Raw Material, Distribution Channel, and Region, 2025-2033

Pasta Market 2024, Size and Share:

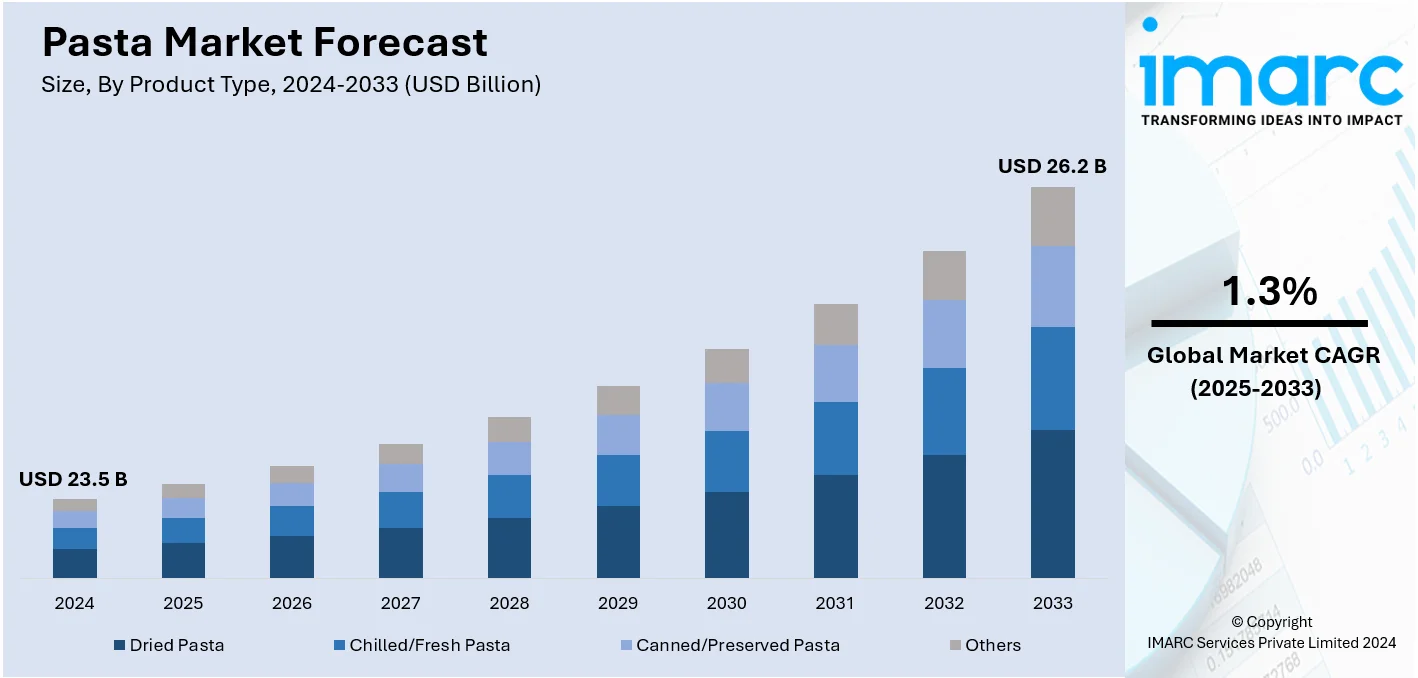

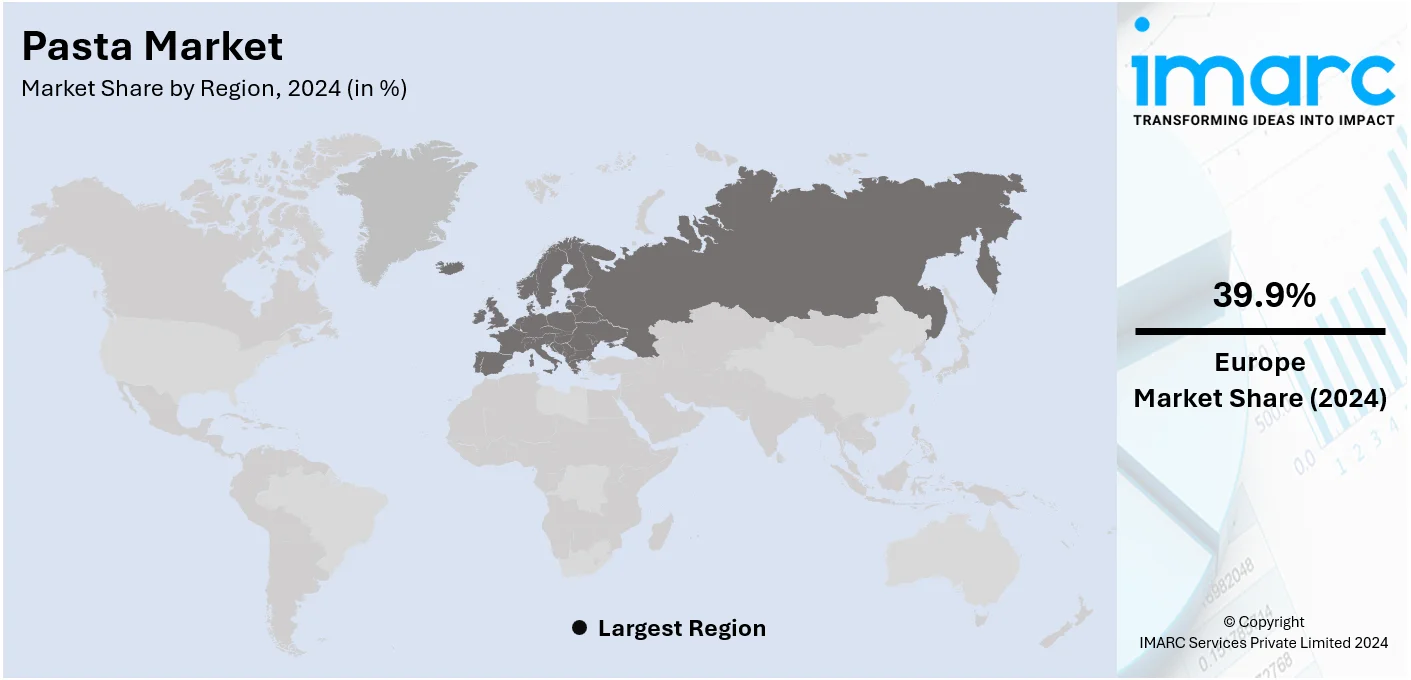

The global pasta market size was valued at USD 23.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.2 Billion by 2033, exhibiting a CAGR of 1.3% from 2025-2033. Europe currently dominates the pasta market share, by holding 39.9% in 2024. The growth of the European region is driven by strong pasta consumption traditions, rising demand for premium products, and increasing adoption of healthier and organic pasta options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.5 Billion |

| Market Forecast in 2033 | USD 26.2 Billion |

| Market Growth Rate 2025-2033 | 1.3% |

Modern lifestyles are becoming fast-paced, leaving little time for elaborate meal preparation. This trend is pushing consumers toward convenience foods that are quick to prepare and need little cooking time. Pasta, due to its fast cooking time and adaptability, is increasingly favored by families, busy professionals, and students. Its versatility in different recipes and alignment with easily accessible ingredients further boosts its attractiveness as a convenient dining choice. Furthermore, the increasing desire for healthy and nutritious food choices is leading to the creation of whole-grain, gluten-free, organic, and fortified pasta types. Shoppers are looking for choices that match their dietary needs, such as low-carb and protein-rich selections. In addition, brands are utilizing eco-friendly packaging, incorporating organic and sustainably sourced materials, and promoting their ethical practices in marketing initiatives. These initiatives appeal to consumers who are socially and environmentally aware, increasing demand even more.

To get more information on this market, Request Sample

In the United States, the pasta market demand is driven by the growing preference for premium, organic, and artisanal pasta, which appeals to consumers seeking high-quality and authentic products. In addition, widespread availability in supermarkets, specialty food stores, and online platforms is improving accessibility, especially as e-commerce gains prominence. For instance, in 2024, Etto Pasta revealed its debut on Amazon USA, providing small-batch, artisan organic pasta crafted in Paso Robles, California, available for nationwide delivery via Amazon Prime. Employing classic techniques and high-quality USDA-certified organic semolina durum wheat, Etto Pasta intends to deliver its genuine Italian-inspired flavors to households across America. The introduction offers an easy method to obtain their handcrafted items while showcasing their local heritage in Tin City.

Pasta Market Trends:

Changing consumer preferences for convenience

A key factor influencing the global pasta market trends is the changing consumer trend toward convenient and simple-to-make food choices. With hectic routines becoming commonplace, shoppers are looking for fast and easy meal options. There is a tendency towards meal convenience because of the growing pace of life and the presence of more single households, for example, in the case of the Japanese population. Consumers are very selective about convenience, which makes ready-to-cook products a popular option when it comes to cooking. As per EY, India is projected to reach 1 Billion working-age individuals by 2030, indicating a notable rise in its professional labor force. Pasta, due to its quick cooking time and adaptability, fits seamlessly with this trend. People are more and more attracted to the simplicity and versatility of pasta, enabling them to prepare fulfilling dishes with little effort. This preference change has prompted producers to create an extensive variety of ready-to-cook pasta items, including pre-packaged pasta dishes and microwaveable choices. By addressing the desire for convenient meal options, the pasta market takes advantage of the necessity for quick and nutritious food selections.

Growing global population and urbanization

The growing global population, along with swift urbanization, greatly increases the need for pasta products. As per the United Nations, the world’s population is expected to increase by almost 2 Billion individuals, hitting 9.7 Billion by 2050 and possibly reaching a peak of 10.4 Billion around the mid-2080s. The use of ready-to-cook foods has been occasioned by an increase in urbanization and population density as well as the busy working population. Exporting countries mentioned a 30% increase in demand during the pandemic, indicating their growing popularity. As an increasing number of individuals move to cities seeking economic prospects, their eating patterns frequently change towards food choices that are convenient and budget-friendly. Pasta, being a fundamental food, meets this requirement ideally. Its extended shelf life, along with its affordability, makes it an appealing option for both individuals and families. Additionally, city life frequently results in more hectic routines, driving consumers to choose meals that are quick to prepare while still being nutritious. The pasta market gains from this trend by offering a flexible and affordable food essential that aligns with the urban way of life.

Rising trend of adopting diverse cuisines and flavors

The worldwide pasta market growth is driven by the rising appeal of various cuisines and flavors. The pasta market in the Asia Pacific region is also experiencing high growth because of increasing urbanization, and convenience of the Western cuisine. Recent shifts in creative cooking and recipe innovation also provide added impetus to consumption, which has boosted the region’s higher (CAGR) in the global market after the pandemic. With globalization linking cultures and broadening culinary landscapes, consumers are increasingly willing to try diverse pasta dishes influenced by different traditions. This trend is boosting the need for diverse pasta shapes, sizes, and flavors that appeal to various tastes and preferences. Producers are reacting by launching creative pasta varieties enriched with distinctive ingredients and spices, appealing to both conventional and adventurous palates. This transition to incorporating global tastes not only maintains enthusiasm for pasta but also establishes it as a platform for culinary innovation, rendering it a vibrant and changing market segment. For example, in 2024, comedian Nigel Ng, also known as Uncle Roger, collaborated with MìLà to introduce the limited-edition Creamy Chili Crab Pasta Kit, drawing inspiration from Malaysian chili crab flavors. The package contains bucatini noodles, two chili crab sauces with medium and spicy heat levels, and oil infused with Carolina Reaper, accommodating adjustable spice tastes. This partnership merges adventurous cultural tastes with ease and creative food promotion.

Pasta Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pasta market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, raw material, and distribution channel.

Analysis by Product Type:

- Dried Pasta

- Chilled/Fresh Pasta

- Canned/Preserved Pasta

- Others

The dried pasta segment holds 79.5% of the pasta market share. This segment is driven by several key factors, which include its long shelf life and easy storage. Moreover, the affordability of dried pasta compared to its fresh counterparts appeals to a wide range of consumers, including budget-conscious households. Furthermore, the global trend of increasing urbanization and busy lifestyles has amplified the need for quick and convenient meal solutions. Dried pasta's minimal preparation time and versatility in pairing with various sauces and ingredients address this demand effectively. Additionally, its non-perishable nature makes it a reliable choice for emergency food supplies. In line with this, the expanding market for international cuisines has spurred interest in dried pasta as it serves as a base for a variety of dishes from around the world. Lastly, the extensive distribution networks and shelf space in retail outlets contribute to the accessibility and visibility of dried pasta products, further propelling its market growth.

Analysis by Raw Material:

- Durum Wheat Semolina

- Wheat

- Mix

- Barley

- Rice

- Maize

- Others

Durum wheat semolina accounts for the majority of the market, holding a share of 54.8%. The demand in this segment is rising, owing to the superior quality and unique characteristics it offers, making it a preferred choice for pasta production. Its high protein content and gluten strength contribute to the desirable texture and firmness of pasta, enhancing its overall quality. Furthermore, the increasing consumer awareness about the nutritional benefits of durum wheat semolina-based products is driving its demand. Durum wheat semolina pasta is often considered a healthier option due to its higher protein and nutrient content compared to regular wheat pasta. In line with this, the rising global consumption of pasta and pasta-related products fuels the demand for durum wheat semolina, as it remains a crucial ingredient in pasta manufacturing. Additionally, the versatility of durum wheat semolina extends its applications beyond pasta, including in the production of couscous and some baked goods, further enhancing the pasta market outlook.

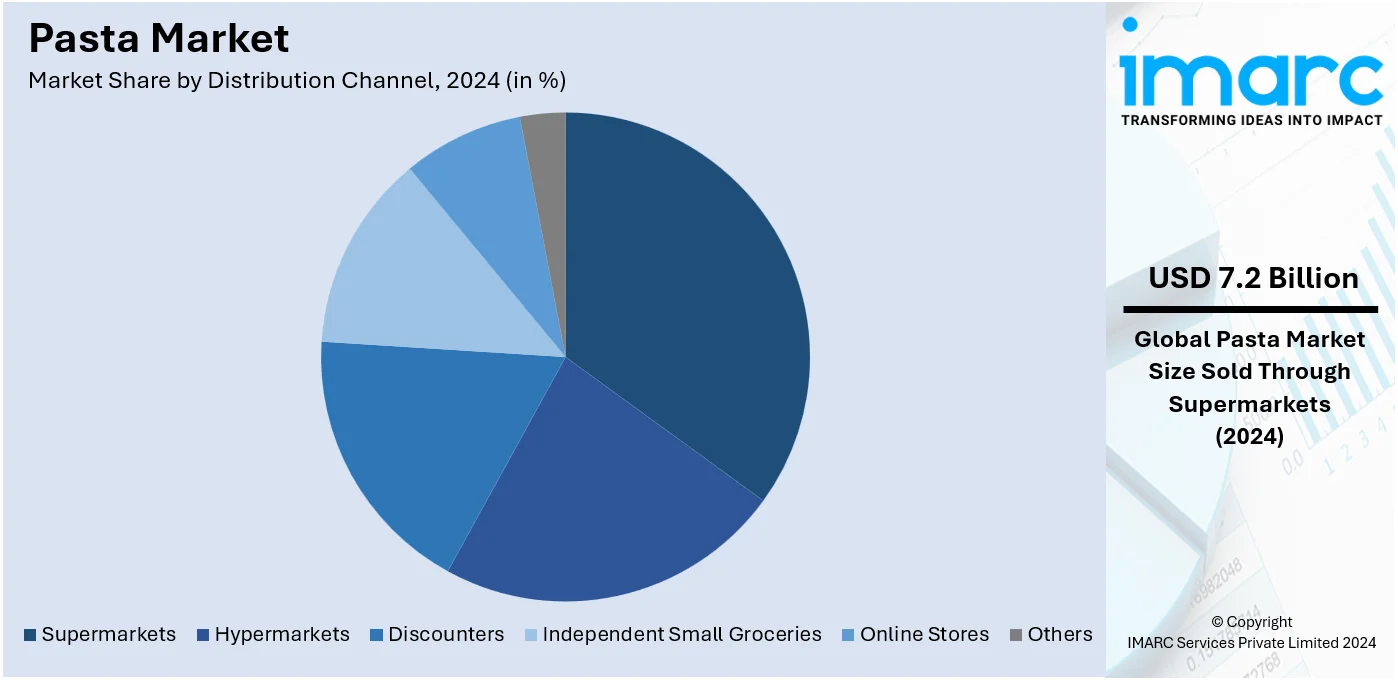

Analysis by Distribution Channel:

- Supermarkets

- Hypermarkets

- Discounters

- Independent Small Groceries

- Online Stores

- Others

Supermarkets exhibit a clear dominance in the market attributed to several key factors that shape its growth and prominence in the retail landscape. It offers a one-stop shopping experience, providing buyes with a diverse array of products, ranging from groceries to household items, all under a single roof. This convenience appeals to busy individuals seeking efficiency in their shopping routines. Moreover, the emphasis on variety and choice contributes to the supermarkets segment's appeal. These stores stock a wide assortment of products, catering to different tastes, preferences, and dietary requirements. This diversity attracts a broad customer base and positions supermarkets as go-to destinations for comprehensive shopping needs. Furthermore, competitive pricing strategies are a driving force behind the segment's success. Supermarkets often leverage their purchasing power to negotiate favorable deals with suppliers, allowing them to offer competitive prices to consumers.

Regional Analysis:

- Europe

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

Europe leads the market owing to its deep-rooted culinary traditions, where pasta is a staple in many households. The area enjoys a robust food processing sector and sophisticated manufacturing abilities, guaranteeing reliable quality and creativity in pasta manufacturing. Furthermore, strong retail infrastructure and extensive presence in supermarkets, specialty shops, and online platforms bolster market leadership. In addition to this, there is a rise in the number of industry events and trade shows that foster innovation, highlight emerging trends, and offer opportunities for collaboration among manufacturers, suppliers, and culinary experts. For example, in 2024, HRC revealed the introduction of a specialized pizza and pasta section for its 2025 trade exhibition, set to occur from March 17-19 at Excel London. This fresh segment will highlight tools, components, and trends within the pizza and pasta sector, as well as live demonstrations and chances for networking. It seeks to promote innovation and cooperation within the worldwide culinary industry.

Key Regional Takeaways:

United States Pasta Market Analysis

The rising demand for convenience foods in the United States has significantly contributed to the increased popularity of pasta. With a growing number of working professionals prioritizing convenience in their meals because of time limitations, the demand for quick and easy-to-make dishes such as pasta has increased. As per the Bureau of Labor Statistics, in 2023, 64.2% of the American population was employed, an increase from 63.8% in 2022, indicating growth in the number of working professionals. The growing workforce boosts the need for easy ready-to-eat meals such as pasta, providing a fast option for those with hectic schedules. Convenient pasta products are designed for busy individuals who want home-cooked dishes without extensive preparation times. This trend is additionally reinforced by a wider selection of pasta options, including pre-cooked or microwaveable varieties, which are perfect for busy professionals. Moreover, the increase in health awareness has resulted in pasta types crafted from whole grains, protein-enriched substitutes, and gluten-free choices, attracting a wider array of dietary preferences. As the number of working professionals rises and the need for quick meal options grows, pasta has become a vital component in numerous households across the United States, leading to increased consumption.

Europe Pasta Market Analysis

In Europe, the growing adoption of pasta can be attributed to the rise of the food and beverage sector. According to reports, the food & drink wholesaling industry in Europe, with approximately 445k businesses, is witnessing significant growth, driven by increasing demand for diverse food and beverage products. The sector continues to expand as consumer preferences evolve and businesses adapt to new market trends. As the demand for diverse culinary experiences expands, pasta has become an increasingly popular staple in restaurants, cafés, and other foodservice establishments. The rise in eating out and the preference for international cuisines have helped boost pasta consumption across Europe. Additionally, consumer interest in convenience foods has further driven pasta's popularity, with ready-to-eat pasta dishes and meal kits gaining traction. Innovations in flavors, ingredients, and pasta types have made pasta an attractive option for consumers looking for easy, yet diverse meal choices. With Europe’s rich culinary tradition of pasta, coupled with modern trends toward convenience and variety, pasta adoption continues to grow, reinforcing its status as a key ingredient in the region’s food culture.

Asia Pacific Pasta Market Analysis

In the Asia-Pacific region, the popularity of pasta has experienced significant growth, primarily because of the increase in online food delivery options. As per the India Brand Equity Foundation, India's online food ordering and delivery sector, valued at USD 28.3 Billion in 2022, is expected to expand at a CAGR of roughly 27%, hitting approximately USD 117 Billion by 2028. This swift growth mirrors the rising need for convenience and digital solutions within the food industry. The expansion is driven by increasing internet access and changing consumer preferences. Due to hectic city living and shifting dietary choices, consumers are increasingly opting for delivery services that offer convenient and diverse food selections. Pasta, due to its simple preparation and versatility, has turned into a favored option for numerous consumers looking for fast, fulfilling meals. These services enable customers to enjoy a variety of pasta dishes from diverse cuisines without stepping outside their homes. This growing trend has been especially significant in major cities across the region, where people value both convenience and variety in their meals. Additionally, the expansion of delivery platforms has made pasta more accessible to a broader audience, driving its increased consumption.

Latin America Pasta Market Analysis

In Latin America, increasing disposable income has played a major role in the expanding trend of plant-based diets, which includes the uptake of wheat and gluten-free pasta. Reports indicate that total disposable income in Latin America is expected to rise by almost 60% in real terms between 2021 and 2040, boosting the demand for healthier food choices as consumers acquire greater purchasing power. This increase is anticipated to notably affect food consumption trends in the area. With the rise in consumers’ purchasing power, there is a heightened demand for healthier, specialty food choices, including gluten-free and plant-based pasta substitutes. This change in food choices is influenced by increased awareness of health and well-being, coupled with the rising availability of these items in supermarkets and specialty shops. With an increasing number of individuals choosing gluten-free or plant-based diets for health or moral reasons, pasta producers have reacted by offering a wider variety of choices. These changes are additionally reinforced by increasing income levels, which facilitate consumer investment in these alternatives, fostering the consistent rise of pasta consumption in the area.

Middle East and Africa Pasta Market Analysis

The growing tourism sector in the Middle East and Africa has positively impacted the consumption of pasta. For instance, Dubai welcomed 5.18 Million overnight visitors in January-March 2024, marking an 11% increase compared to the same period in 2023. The city's growing tourism sector is driving the demand for instant meals like pasta, contributing to the sector's expansion. As the region attracts more international visitors, the demand for diverse and familiar foods, such as pasta, has surged. Tourism drives a need for a variety of food options, especially in urban centers and tourist hotspots, where international cuisine is highly sought after. Pasta, with its global appeal and versatility, has found a place on menus across restaurants and hotels catering to tourists. Additionally, local food industries are expanding their offerings to accommodate both tourists and the growing local appetite for global foods, further enhancing the popularity of pasta. This tourism-driven demand for varied cuisines has helped increase pasta consumption in the region.

Competitive Landscape:

Major participants in the market are putting funds into innovative manufacturing methods to improve production efficiency and uphold quality benchmarks. Efforts in strategic marketing, such as partnerships with retail chains and online platforms, are being amplified to enhance visibility and expand reach. To match evolving consumer tastes, numerous businesses are implementing sustainable sourcing methods and environmentally friendly packaging options. Furthermore, top companies are emphasizing product innovation, broadening their ranges to feature healthier choices such as whole-grain, organic, and gluten-free pasta. In May 2024, Monte’s Fine Foods, recognized for its award-winning clean-label sauces, is branching out into the pasta sector with a new range of dried pasta. The launch showcases two distinct shapes, 3 Buchi and Rotolini, crafted from 100% organic durum wheat semolina and water. The pasta is non-GMO, slow-dried, and bronze-die extruded, adhering to traditional Italian techniques to improve sauce absorption.

The report provides a comprehensive analysis of the competitive landscape in the pasta market with detailed profiles of all major companies, including:

- 8th Avenue Food & Provisions

- Banza

- Barilla Group

- Borges International Group, S.L.U

- Ebro Foods, S.A.

- F.lli De Cecco di Filippo - Fara San Martino S.p.A.

- Giovanni Rana USA

- La Molisana Spa

- Makfa JSC

- Nestle S.A

- Panzani Group

- The Campbell's Company

- Unilever Food Solutions

Latest News and Developments:

- December 2024: Parfetts has introduced a new pasta line under its Go Local brand, including Spaghetti, Fusilli, and Penne in 500g packages priced around USD 1.47. Spaghetti comes in 12-packs, while Fusilli and Penne are sold in six-packs. A YouGov poll carried out in 2020 showed that Fusilli is the most popular pasta shape in the UK. This is because 19% of the pasta enthusiasts liked it.

- December 2024: Realfoods Organico introduces a new line of seven organic pasta options just in time for National Spaghetti Day, with approximately 18 million tons of spaghetti eaten worldwide annually. Despite the rise of fancy pasta varieties, classic thin spaghetti remains the top choice worldwide, with strong sales in China, Canada, Japan, North America, and Germany. The new pasta, crafted by a small batch producer in Bari Puglia, focuses on slow-proofing and drying for superior quality.

- November 2024: Barilla is launching a festive new pasta shape, Barilla Snowfall, just in time for the holiday season. The company aims to bring cheer to family meals, continuing its tradition of unique seasonal pasta shapes like Barilla Love. US pasta marketing director Angie Cotter highlights Barilla's commitment to creating memorable dining experiences. The launch reflects Barilla's long-standing legacy of innovation in pasta shapes.

- August 2024: The food tech startup EQUII, focused on enriching the nutritional value of flour, is now extending its presence in the pasta category with its new Protein-Packed Mac & Cheese and Rigatoni. The products bring superior nutrition and complete protein, further aligning with the brand's mission of providing better-for-you pantry staples. The pasta lineup complements EQUII's existing Complete Protein Breads, including Power, Balance, and Thin varieties in Classic Wheat and Multigrain.

Pasta Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dried Pasta, Chilled/Fresh Pasta, Canned/Preserved Pasta, Others |

| Raw Materials Covered | Durum Wheat Semolina, Wheat, Mix, Barley, Rice, Maize, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discounters, Independent Small Groceries, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 8th Avenue Food & Provisions, Banza, Barilla Group, Borges International Group, S.L.U, Ebro Foods, S.A., F.lli De Cecco di Filippo - Fara San Martino S.p.A., Giovanni Rana USA, La Molisana Spa, Makfa JSC, Nestle S.A, Panzani Group, The Campbell's Company, Unilever Food Solutions, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pasta market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pasta market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pasta market was valued at USD 23.5 Billion in 2024.

IMARC estimates the pasta market to exhibit a CAGR of 1.3% during 2025-2033, expecting to reach USD 26.2 Billion by 2033.

The global pasta market is driven by rising demand for convenient, affordable meals, increased consumer interest in diverse cuisines, and the growing popularity of healthier options like whole-grain and gluten-free pasta. Innovations in flavors, packaging, and product variety also attract consumers, while expanding retail networks and online sales make pasta more accessible, boosting its appeal worldwide.

Europe currently dominates the pasta market, accounting for a share exceeding 39.9% in 2024. This dominance is fueled by a rich culinary tradition, high consumption in countries like Italy, growing demand for premium and organic varieties, and strong export activities supported by established manufacturing capabilities.

Some of the major players in the global pasta market include 8th Avenue Food & Provisions, Banza, Barilla Group, Borges International Group, S.L.U, Ebro Foods, S.A., F.lli De Cecco di Filippo - Fara San Martino S.p.A., Giovanni Rana USA, La Molisana Spa, Makfa JSC, Nestle S.A, Panzani Group, The Campbell's Company, Unilever Food Solutions, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)