Indian Pre-School/Childcare Market Size, Share, Trends and Forecast by Facility, Ownership, Age Group, Location, Major Cities, and Region, 2025-2033

Indian Pre-School/Childcare Market Size:

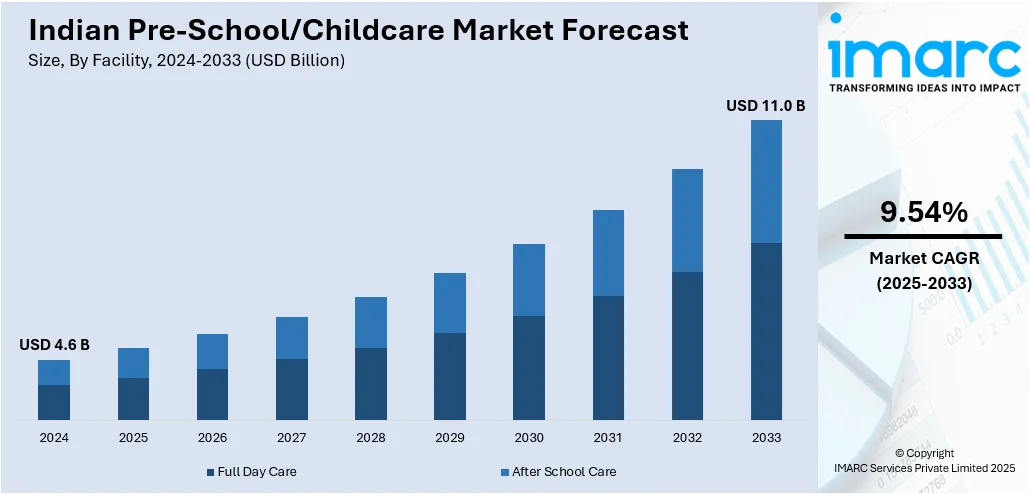

The Indian pre-school/childcare market size reached USD 4.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2033, exhibiting a growth rate (CAGR) of 9.54% during 2025-2033. The rising number of nuclear families and working women in the country, the growing demand for preschool and childcare services, rapid urbanization, and the increasing disposable income are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.6 Billion |

|

Market Forecast in 2033

|

USD 11.0 Billion |

| Market Growth Rate (2025-2033) | 9.54% |

Indian Pre-School/Childcare Market Analysis:

- Major Market Drivers: The rising parental awareness of early childhood education, the rising number of nuclear families, and the increasing disposable income are some of the major drivers of the market. Rapid urbanization and the rising working women population are further fueling the market demand. Government initiatives supporting early education and the entry of organized players offering standardized services are further contributing to the growth of the market.

- Key Market Trends: The increase of franchise-based models and the rising integration of technology in early education including learning tools, and digital classrooms are some of the key trends of the Indian pre-school/childcare market growth. The rising focus on holistic child development, emphasizing physical, cognitive, and emotional growth, along with increasing demand for bilingual education and international curricula is influencing the market trends.

- Competitive Landscape: Some of the major market players in the Indian pre-school/childcare industry include Kidzee, Bachpan Global, EuroKids, Tree House Education and Accessories Ltd., Shemrock Play School, Kangaroo Kids, Hello Kids, Little Millennium, Podar Jumbo Kids, and T.I.M.E. Kids, among many others.

- Challenges and Opportunities: The market faces several challenges including maintaining quality standards, lack of trained educators, and high operational costs. However, the market also faces various opportunities such as ripe for innovation with tech-driven learning solutions and personalized education approaches, along with government support and initiatives to enhance early education infrastructure.

To get more information on this market, Request Sample

Indian Pre-School/Childcare Market Trends:

Rising Dual-Income Families and Urbanization

Rapid urbanization and the rising dual-income households are creating a need for reliable childcare solutions, as more parents seek professional care and early education for their children. For instance, in India, the urban population amounts to 461 million people. This number is growing by 2.3% each year. By 2031, 75% of India's national income is estimated to come from urban settings. Providing the necessary urban infrastructure is a big challenge: 70 to 80% of the infrastructure that will be needed by 2050 has not been built yet, and the estimated investment gap amounts to approximately 827 billion U.S. dollars. The seven largest cities in India will become even bigger until 2030. Prospects suggest that the population growth of India's capital Delhi will increase by about 1/3 within the next decade up to 38.9 million people. This is expected to boost the Indian pre-school/childcare market forecast over the coming years.

Growing Government Support and Initiatives

Government initiatives and policies aimed at promoting early childhood education and improving childcare infrastructure encouraging marketing growth and attracting investments. According to UNICEF, in July 2020, the Ministry of Education released a new educational policy, where schooling begins with the inclusion of ECCE from age 3. The policies state “universal provisioning of quality early childhood development, care, and education must thus be achieved as soon as possible, and no later than 2030, to ensure that all students entire Grade 1are school ready.” The three years of ECCE and early primary grades (classes one and two are proposed as a continuum of learning and referred to as the foundational stage of school. The UNEP 2020 recommends 2 models for the implementation of quality ECE, these are Anganwadi centers in communities, Anganwadi centers located within school premises, pre-primary sections in schools, and standalone preschools. This is influencing the Indian pre-school/childcare market statistics significantly.

Rising Integration of Technological

The widespread adoption of technology in education, including digital classrooms and e-learning tools, attracts tech-savvy parents seeking innovative learning experiences for their children. According to an article by the Times of India, in 2022, the size of the Indian preschool and childcare market was 3.8 billion U.S. dollars. The demand for childcare has increased significantly in recent years possibly due to nuclear setups in urban centers, which lead to a projected market value of over seven billion U.S. dollars by 2028. Technology can be a powerful asset in early childhood education. This includes the large touch screens which are helpful for several tasks, such as project collaboration, instructive gameplay, and presentation shows. This is further fueling the Indian pre-school/childcare market revenue.

Indian Pre-School/Childcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on facility, ownership, age group, location, and major cities.

Breakup by Facility:

- Full Day Care

- After School Care

The report has provided a detailed breakup and analysis of the market based on the facility. This includes full day care and after school care.

With the increasing number of dual-income families, there is a growing demand for comprehensive care for children throughout the entire day. Full Day Care centers offer a holistic approach to childcare, catering to the developmental needs of young children from morning till evening. These facilities provide a structured daily routine that includes educational activities, playtime, meals, and rest periods.

On the other hand, the after-school care segment has also witnessed substantial growth and is a significant facility in the Indian pre-school/childcare market. This segment caters to the needs of children who require supervision and engagement during the after-school hours when parents may still be at work.

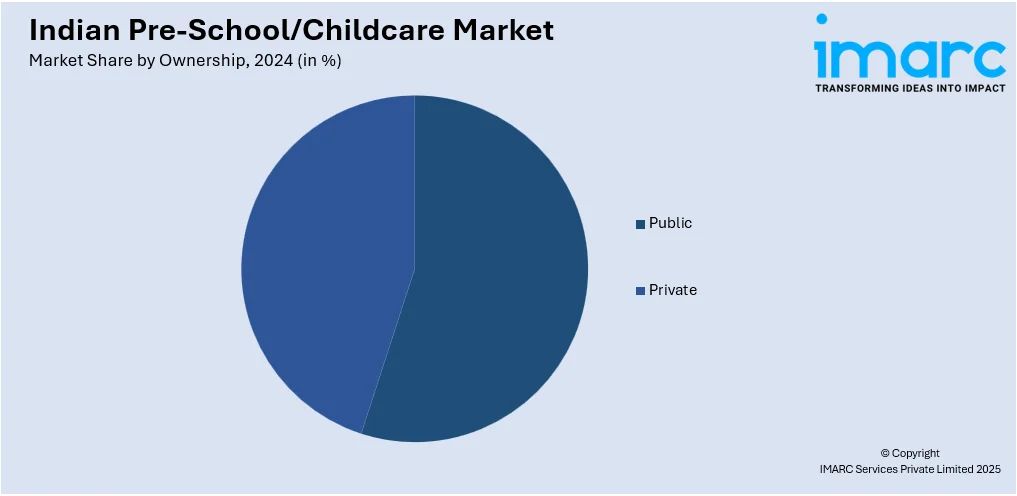

Breakup by Ownership:

- Public

- Private

A detailed breakup and analysis of the market based on the ownership has also been provided in the report. This includes public and private.

Publicly-owned pre-schools and childcare centers are typically operated and funded by the government or local authorities. These institutions play a critical role in promoting access to early childhood education and childcare services, especially in poor areas. Public ownership ensures that a portion of the facilities is made available at subsidized rates or even free of charge to cater to families with limited financial means. These centers often follow government-prescribed curricula and guidelines, focusing on providing a basic yet essential educational foundation to young children.

On the contrary, privately-owned pre-schools and childcare centers are operated by individuals, educational institutions, or corporate entities. These centers often emphasize innovative teaching methods, modern facilities, and personalized care for children. Additionally, private ownership encourages healthy competition, driving continuous improvement in the quality of services offered.

Breakup by Age Group:

- Less Than 2 Years

- 2-4 Years

- 4-6 Years

- Above 6 Years

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes less than 2 years, 2-4 years, 4-6 years, and above 6 years.

Less than 2 years segment caters to infants and very young toddlers, typically from around 6 weeks to 2 years of age. Pre-schools and childcare centers catering to this age group focus on providing a safe, hygienic, and stimulating atmosphere where infants can explore their surroundings, engage in sensory activities, and receive personalized attention. Trained caregivers play a crucial role in meeting the unique needs of infants, including feeding, diaper changes, and ensuring proper rest.

On the other hand, 2-4 Years age group segment caters to young toddlers and preschoolers, a crucial phase where children's cognitive, social, and emotional skills develop rapidly. Pre-schools and childcare centers for this age group focus on providing a structured learning environment that encourages exploration, creativity, and social interaction.

The demand for preschool/childcare for children aged four to six years in India is driven by increasing urbanization and dual-income families, rising parental focus on early education, and growing awareness of the importance of holistic development and structured learning environment in preparing children for formal schooling, along with increasing disposable income.

The increasing demand for childcare for children above 6 years in India is driven by the need for after-school care due to working parents, the emphasis on extracurricular activities for holistic development, safety concerns, and structured environments that offer academic support and enrichment programs, aligning with parent’s educational aspirations for their children.

Breakup by Location:

- Standalone

- School Premises

- Office Premises

A detailed breakup and analysis of the market based on the location has also been provided in the report. This includes standalone, school premises, and office premises.

Standalone pre-schools and childcare centers are independent facilities that operate separately from other educational institutions or organizations. The standalone approach allows for greater flexibility in designing the infrastructure and curriculum according to the specific needs of young children. These centers often boast child-friendly layouts, vibrant classrooms, outdoor play areas, and age-appropriate learning resources.

On the other hand, school premises often allow schools to extend their services to younger age groups and offer a continuum of education from pre-school to higher grades. Additionally, school-based pre-schools often benefit from the existing infrastructure, resources, and expertise of the parent school, enabling them to provide a well-rounded educational experience. Collaborating with an established school can also drive the reputation and credibility of the preschool or childcare center.

Within office premises, the demand for free school/childcare is thriving due to the convenience of working parents, enhanced work-life balance, increased productivity because of the reduced commuting time, employer initiatives to attract and retain talent, and a growing perfect focus on employee well-being and family-friendly policies.

Breakup by Major Cities:

- Delhi-NCR

- Bengaluru

- Hyderabad

- Chennai

- Mumbai

- Kolkata

- Rest of India

A detailed breakup and analysis of the market based on the cities has also been provided in the report. This includes Delhi-NCR, Bengaluru, Hyderabad, Chennai, Mumbai, Kolkata, and rest of India.

Delhi-NCR is a hub for job opportunities, attracting people from various parts of the country, and this migration has led to an increased need for professional childcare services. The region's fast-paced lifestyle and hectic work schedules necessitate reliable and safe facilities where parents can entrust their children's care. Additionally, the awareness of the significance of early childhood education has grown among parents in Delhi-NCR, prompting them to seek quality pre-schools that offer comprehensive learning experiences for their children's overall development.

Bengaluru is another prominent city segment in the Indian pre-school/childcare market. The city's tech-savvy and progressive population emphasizes the importance of early education and quality childcare. As a result, Bengaluru has witnessed a surge in the establishment of pre-schools and childcare centers that offer modern facilities, innovative teaching methods, and a child-centric approach to education.

In Hyderabad, the market is driven by the growing ID sector with dual-income families, rapid urbanization, increasing parental awareness of early education, rising disposable income, and increasing demand for high-quality, safe, and holistic childcare solutions aligned with global standards.

In Chennai, the city's expanding urban population, increasing number of working parents, rising disposable income, and a strong emphasis on early tradition are driving the market growth. In addition to this, the growing demand for quality, safety-focused, and holistic childcare solutions is contributing to the growth of the market across the city.

In Mumbai, the state government is altering the age to enter school. A child now, for admission to nursery in 2024/25 will need to be at least three years old by the time he or she enters the school. While admissions have begun, the state is drawing up a policy to ensure that admission norms are in line with NEP 2022, according to an article by the Times of India. This is further driving the market growth across the city.

In Kolkata, government initiatives toward pre-school/Tricare focus on enhancing early childhood education through programs such as the integrated child development services (ICDS) and national early childhood care and education (ECCE) policy. These initiatives aim to improve access to quality preschool education, provide nutritional support, and promote holistic development which is further driving the market growth in the city.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India.

North India has experienced rapid urbanization and an increase in the number of working parents. This has led to a higher demand for pre-schools and childcare centers that can cater to the needs of young children while their parents are at work. The region's focus on quality education and a growing awareness of the importance of early childhood development have further fueled the market's growth.

In western central India, pre-school/childcare is crucial for fostering early childhood development, providing a strong educational foundation, and promoting social skills. It's about working parents by offering reliable care and contributing to higher female workforce participation. Access to quality early education programs in these regions helps bridge educational disparities, ensuring children from diverse backgrounds receive essential cognitive and emotional support.

South India has emerged as a robust market for pre-schools and childcare services. The region is known for its emphasis on education and a strong educational infrastructure. South Indian parents are increasingly investing in early education for their children, driving the growth of the pre-school market. Additionally, the presence of multinational companies and the IT sector has led to a higher number of nuclear families and a greater demand for professional childcare services in the region.

In East India, pre-school education is vital for early childhood development, offering a strong foundation for future learning. It supports social, emotional, and cognitive growth, preparing children for formal schooling. Quality pre-school programs help bridge educational gaps in diverse socioeconomic settings, promoting inclusivity. They provide essential support for working parents, particularly in urban areas, contributing to higher workforce participation. Investing in early education in East India fosters a more equitable and prosperous society by nurturing young minds from the outset.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the Indian pre-school/childcare industry include Kidzee, Bachpan Global, EuroKids, Tree House Education and Accessories Ltd., Shemrock Play School, Kangaroo Kids, Hello Kids, Little Millennium, Podar Jumbo Kids, and T.I.M.E. Kids, among many others.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The competitive landscape of the Indian pre-school/childcare market is highly competitive with key players including EuroKids, Bachpan, and Kidzee leading the sector. These grants offer franchise models, standardized curricula, and comprehensive child development programs. Local and regional players also contribute significantly, catering to diverse needs and preferences. For instance, In March 2023, EuroKids, India's leading preschool network, announced the launch of multiple shifts for the new academic year 23-24. With this launch, EuroKids, aims to provide parents with greater flexibility and choices when it comes to their child's education. This initiative offers convenience and a big relief to all the parents and kids who prefer late morning or afternoon batches for their pre-schooling needs.

Indian Pre-School/Childcare Market News:

- In March 2023, SRH announced recently that Bachpan Play School is its Official School Education Partner for the upcoming season. This partnership comes as a breath of fresh air in the world of education and cricket. This is the first time in India that a prominent play school brand and appending franchise have joined hands to transform the country's education segment.

- In January 2022, Childhood education brand Kangaroo Kids planned to launch its new iCan learning system, an initiative that aims to impact future learning lessons and problem-solving skills for children.

- In March 2024, Kangaroo Kids Preschool announced the launch of its highly anticipated summer camp, “KanKamp: Unleash the Adventure Within” across 130+ centers in 36+ cities.

Indian Pre-School/Childcare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Facilities Covered | Full Day Care, After School Care |

| Ownerships Covered | Public, Private |

| Age Groups Covered | Less Than 2 Years, 2-4 Years, 4-6 Years, Above 6 Years |

| Locations Covered | Standalone, School Premises, Office Premises |

| Major Cities Covered | Delhi-NCR, Bengaluru, Hyderabad, Chennai, Mumbai, Kolkata, Rest of India |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Kidzee, Bachpan Global, EuroKids, Tree House Education and Accessories Ltd., Shemrock Play School, Kangaroo Kids, Hello Kids, Little Millennium, Podar Jumbo Kids, T.I.M.E. Kids etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian pre-school/childcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indian pre-school/childcare market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian pre-school/childcare industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the Indian pre-school/childcare market to grow at a CAGR of 9.54% during 2025-2033.

Rising number of nuclear families and increase in the women employment rates in the country, are some of the key factors catalyzing the Indian pre-school/childcare market.

Sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations in the country resulting in temporary closure of schools, preschools, and childcare homes to mitigate the risk of coronavirus infection.

Based on the facility, the Indian pre-school/childcare market can be bifurcated into full day care and after school care.

Based on the ownership, the Indian pre-school/childcare market has been categorized into public and private. Currently, private childcare exhibits a clear dominance in the market.

Based on the age group, the Indian pre-school/childcare market can be segmented into less than 2 years, 2-4 years, 4-6 years, and above 6 years. Among these, 2-4 years age group currently holds the majority of the total market share.

Based on the location, the Indian pre-school/childcare market has been divided into standalone, school premises, and office premises. Currently, standalone pre-schools exhibit a clear dominance in the market.

Based on the major cities, the Indian pre-school/childcare market can be categorized into Delhi-NCR, Bengaluru, Hyderabad, Chennai, Mumbai, Kolkata, and Rest of India. Among these, Mumbai represents the largest segment.

On a regional level, the market has been classified into North India, East India, West and Central India, and South India, where North India currently dominates the Indian pre-school/childcare market.

Some of the major players in the Indian pre-school/childcare market include Kidzee, Bachpan Global, EuroKids, Tree House Education and Accessories Ltd., Shemrock Play School, Kangaroo Kids, Hello Kids, Little Millennium, Podar Jumbo Kids, and T.I.M.E. Kids. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)