Indian Sorbitol Market Report by Application (Pharmaceuticals, Cosmetics and Toiletries, Toothpaste, Food and Confectioneries, Industrial Surfactants, and Others), Feedstock (Corn, and Others), Type (Liquid Sorbitol, Crystal Sorbitol), Distribution Channel (Distributors, Manufacturers) 2025-2033

Market Outlook 2025-2033

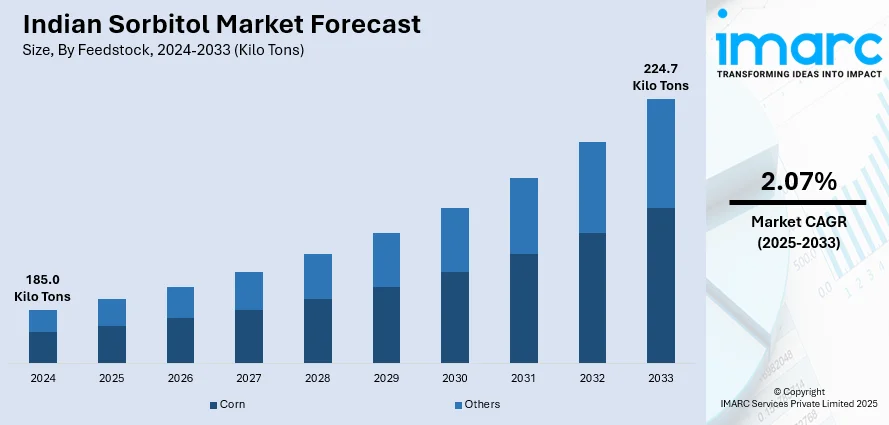

The sorbitol market in India size reached 185.0 Kilo Tons in 2024. Looking forward, IMARC Group expects the market to reach 224.7 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 2.07% during 2025-2033. The increasing adoption of diabetic and dietetic food and beverages, the rising product demand as a substitute for sugar, the growing product utilization in oral care products, and the escalating demand from the food and beverage industry for nutritive sweeteners are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

185.0 Kilo Tons |

|

Market Forecast in 2033

|

224.7 Kilo Tons |

| Market Growth Rate 2025-2033 | 2.07% |

Sorbitol is widely used as a sweetener, humectant, and thickening agent in various food and pharmaceutical products. It is derived from glucose and has a sweet taste with about 60% of the sweetness of sucrose (table sugar). One of the key characteristics of sorbitol is its ability to attract and retain moisture. It is commonly used as a humectant in food products to prevent them from drying out while maintaining their freshness. It also acts as a thickening agent in certain food formulations, enhancing their texture and mouthfeel. It is widely used in the pharmaceutical industry as an excipient in producing tablets, syrups, and other oral medications. It helps improve the taste, stability, and palatability of these products. It also finds extensive applications in oral care products, such as toothpaste and mouthwash. Sorbitol is known for its low-calorie content, making it a popular choice in sugar-free or reduced-sugar products. It provides sweetness without the same caloric impact as regular sugar, making it suitable for individuals with diabetes or those intending to reduce their caloric intake. Additionally, it is used to produce cosmetics, personal care products, and certain types of paper.

To get more information on this market, Request Sample

The market in India is majorly driven by the increasing awareness of sugar-related health issues. This can be attributed to the escalating demand for low-calorie alternatives. In line with this, India has a significant diabetic population, and sorbitol's low glycemic index makes it a suitable sweetener for diabetic-friendly products. Furthermore, the expanding food and beverage industry is significantly contributing to the demand for sorbitol as a sweetener and ingredient in various products. In addition to this, the confectionery industry is also witnessing considerable growth. Since sorbitol is utilized as a sugar substitute in sugar-free candies, gums, and chocolates, this is positively influencing the market. Moreover, the escalating product use in pharmaceutical formulations, dietary supplements, and oral care products is stimulating the market. Rapid advancements in sorbitol production technologies, such as improved extraction and purification methods, contribute to the market growth. Some of the other factors driving the market include the rising disposable incomes of the consumers, export potential of sorbitol-based products from India, growing demand for functional foods and wellness-oriented products, rapid expansion of organized retail and e-commerce platforms, and ongoing research and development activities focusing on sorbitol applications and production techniques.

Indian Sorbitol Market Trends/Drivers:

Increasing government initiatives and subsidies

The Indian government plays a significant role in driving the growth of the sorbitol market through various initiatives and subsidies. The government's focus on promoting the food processing industry and encouraging investments in the sector benefits the sorbitol market. Numerous initiatives such as the Food Processing Fund, support and incentivize companies involved in producing food ingredients like sorbitol and processing sorbitol-based food products. These initiatives help attract investments, foster innovation, and create a favorable business environment for sorbitol manufacturers across the country. The availability of government subsidies, tax incentives, and infrastructure support further drive the growth of the sorbitol market in India.

Rising awareness regarding oral health among the consumers

Growing awareness regarding oral health and hygiene among consumers in India is contributing to the demand for sorbitol-based oral care products. Sorbitol's ability to act as a humectant and enhance the mouthfeel of oral care products makes it a preferred ingredient in toothpaste, mouthwash, and other dental formulations. Consumers are becoming more conscious of the benefits of using oral care products that contain sorbitol, such as improved plaque control, fresh breath, and reduced risk of dental caries. The dental industry's emphasis on preventive oral care and the recommendation of sorbitol-based products by dental professionals drive the growth of the sorbitol market in India.

Expansion of the personal care and cosmetics industry

India's personal care and cosmetics industry is experiencing significant growth, driven by increasing disposable income, changing consumer lifestyles, and a focus on personal grooming. Sorbitol has applications in various personal care and cosmetic products due to its moisturizing and skin-conditioning properties. It is used in lotions, creams, moisturizers, and hair care formulations. As the need for personal care and cosmetic products continues to rise, the demand for sorbitol as an ingredient in these formulations also increases. The expansion of the personal care and cosmetics industry and the introduction of new and innovative sorbitol-based products contribute to the growth of the sorbitol market in India.

Indian Sorbitol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian sorbitol market report, along with forecasts for the period of 2025-2033. Our report has categorized the market based on application, feedstock, type, and distribution channel.

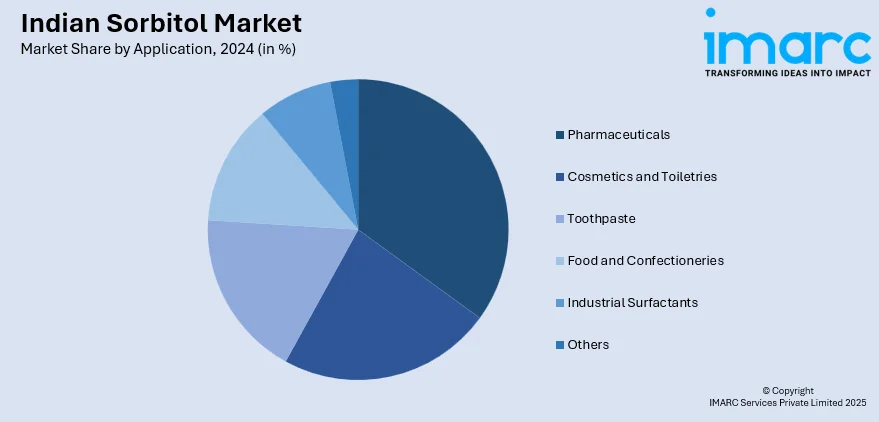

Breakup by Application:

- Pharmaceuticals

- Cosmetics and Toiletries

- Toothpaste

- Food and Confectioneries

- Industrial Surfactants

- Others

Pharmaceuticals dominate the Indian sorbitol market

The report has provided a detailed breakup and analysis of the Indian sorbitol market based on the application. This includes pharmaceuticals, cosmetics and toiletries, toothpaste, food and confectioneries, industrial surfactants, and others. According to the report, pharmaceuticals represented the largest segment.

In the pharmaceutical sector, sorbitol's properties as a humectant, sweetener, and excipient make it an essential ingredient in the formulation of various medicines and syrups, thus fueling its demand in the market. This is providing a boost to the market in this segment.

On the other hand, the cosmetics and toiletries industry benefits from sorbitol's ability to moisturize and enhance product stability, leading to increased adoption in skincare, haircare, and personal care products. The toothpaste segment is also experiencing a significant increase in the demand for sorbitol for offering a sweet taste and acting as a binder and texturizer.

In the food and confectionery sector, sorbitol’s low-calorie content and sweetening properties drive its usage in sugar-free and low-calorie food products, thereby contributing to the market growth. Industrial surfactants utilize sorbitol as a key component, benefiting from its solubility, stability, and surface-active properties. The expanding manufacturing and industrial sectors propel this segment's growth.

Breakup by Feedstock:

- Corn

- Others

A detailed breakup and analysis of the Indian sorbitol market based on the feedstock have also been provided in the report. This includes corn and others.

Corn-based sorbitol production has gained momentum in India due to the abundant availability of corn as a raw material. Corn starch is processed to derive sorbitol, making it a key driver in the market. The corn segment has witnessed increased demand for sorbitol in various industries. Sorbitol derived from corn is utilized as a sugar substitute in dietetic products and low-calorie foods in the food and beverage sector. Besides this, the pharmaceutical industry further utilizes corn-based sorbitol as a pharmaceutical excipient in tablets, syrups, and suspensions.

Numerous other feedstocks such as wheat, rice, and cassava are also used in sorbitol production for specific applications. The market in this segment is expected to be driven by the adoption of alternative feedstocks by numerous companies and manufacturers as a means of diversifying their supply chains.

Breakup by Type:

- Liquid Sorbitol

- Crystal Sorbitol

A detailed breakup and analysis of the Indian sorbitol market based on the type have also been provided in the report. This includes liquid sorbitol and crystal sorbitol.

Liquid sorbitol is vital in various sectors, including pharmaceuticals, cosmetics, and food and beverage. In the pharmaceutical industry, liquid sorbitol is commonly used as a non-cariogenic sweetener and an excipient in syrups, suspensions, and oral medications. Its ability to act as a humectant and binder makes it a preferred ingredient in cosmetics and personal care products. Furthermore, liquid sorbitol finds application as a sweetening agent and moisture-retaining additive in food and beverages, particularly in sugar-free and low-calorie products.

On the other hand, crystal sorbitol is predominantly utilized in the confectionery industry. It is valued for its sugar-like crystalline structure, making it an ideal sweetener in sugar-free candies, gums, and mints. Crystal sorbitol provides the desired texture, taste, and sweetness while being lower in calories than traditional sugars.

Breakup by Distribution Channel:

- Distributors

- Manufacturers

Distributors holds the largest share of the Indian sorbitol market

A detailed breakup and analysis of the Indian sorbitol market based on the distribution channel have also been provided in the report. This includes distributors and manufacturers. According to the report, distributors accounted for the largest market share.

Distributors and manufacturers play a crucial role in driving the growth of the Indian sorbitol market. Distributors serve as a vital link between sorbitol manufacturers and the market. They facilitate the distribution and supply chain processes, ensuring sorbitol reaches different regions and industries across India. These distributors have established networks and relationships with retailers, wholesalers, and end-users, enabling them to promptly meet other sectors’ demands. Their efficient distribution channels and logistics capabilities help expand the overall market reach.

On the other hand, manufacturers are expected to drive the market growth by producing sorbitol in large quantities and maintaining product quality. They invest in research and development to improve production processes, enhance product properties, and meet the evolving demands of various industries. Manufacturers play a pivotal role in ensuring a consistent supply of sorbitol, enabling industries such as pharmaceuticals, cosmetics, food and beverage, and others to meet their production requirements.

Competitive Landscape:

The top sorbitol companies in India are investing in expanding their production capacities to meet the rising demand for sorbitol in India. By increasing production capabilities, these companies ensure a consistent and reliable supply of sorbitol to meet market requirements. Furthermore, these companies prioritize research and development activities to improve sorbitol's quality, functionality, and applications. They invest in developing new manufacturing processes, exploring innovative applications, and enhancing the efficiency of sorbitol production. Such advancements help augment the market growth by offering improved and value-added sorbitol products. Moreover, these top companies focus on diversifying their product portfolios to cater to a wide range of industries and applications. They offer different grades and formulations of sorbitol tailored to specific needs in sectors such as food and beverages, pharmaceuticals, and personal care. This diversification expands the potential market for sorbitol and drives its adoption across multiple industries. Top sorbitol companies also engage in strategic marketing and promotion activities to create awareness about the benefits and applications of sorbitol. They educate consumers, industry professionals, and key stakeholders about the advantages of using sorbitol as a sugar substitute, humectant, or ingredient in various products. Additionally, the leading companies collaborate with other industry players, including manufacturers, suppliers, distributors, and research institutions. These collaborations foster knowledge sharing, promote technological advancements, and enhance the distribution network of sorbitol products. By establishing strong partnerships, these companies expand their market reach and contribute to the growth of the sorbitol market in India.

The report has provided a comprehensive analysis of the competitive landscape in the Indian sorbitol market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Kasyap Sweeteners

- Gulshan Polyols

- Gayatri Bio-organics

- Sukhjit Starch & Chemicals Ltd.

Recent Developments:

- In 2015, Kasyap Sweeteners increased the production capacity of its Badnawar Plant to 200 metric tons per day. This resulted in augmenting the overall daily production capacity of the company to 300 metric tons per day.

- In December 2022, Gulshan Polyols Limited announced its collaboration with Amplus RJ Solar Private Limited. It collaborated to buy electricity in the form of solar energy for its Muzaffarnagar plant in Uttar Pradesh, which focuses on grain processing and mineral processing business.

- In May 2023, Sukhjit Starch & Chemicals Ltd increased its presence across the geographies to strengthen its market share and gain a competitive advantage.

Indian Sorbitol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | '000 Metric Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Pharmaceuticals, Cosmetics and Toiletries, Toothpaste, Food and Confectioneries, Industrial Surfactants, Others |

| Feedstocks Covered | Corn, Others |

| Types Covered | Liquid Sorbitol, Crystal Sorbitol |

| Distribution Channels Covered | Distributors, Manufacturers |

| Companies Covered | Kasyap Sweeteners, Gulshan Polyols, Gayatri Bio-organics, Sukhjit Starch & Chemicals Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian sorbitol market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian sorbitol market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian sorbitol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sorbitol market in India reached 185.0 Kilo Tons in 2024.

The Indian sorbitol market is projected to exhibit a CAGR of 2.07% during 2025-2033, reaching 224.7 Kilo Tons by 2033.

The Indian sorbitol market is propelled by the growing demand from the pharmaceutical and personal care sectors, increasing use in diabetic-friendly food products, and its functional properties as a sweetener, humectant, and stabilizer. Growth in health-conscious consumers and industrial applications further supports market expansion.

Pharmaceuticals account for the largest share in the Indian sorbitol market, driven by the widespread use of sorbitol as a stabilizer, sweetener, and humectant in various medicinal formulations such as syrups, tablets, and tonics. Its non-cariogenic and diabetic-friendly properties make it a preferred ingredient in pharmaceutical applications across the country.

Some of the major players in the Indian sorbitol market include Kasyap Sweeteners, Gulshan Polyols, Gayatri Bio-organics, Sukhjit Starch & Chemicals Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)