Indonesia Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

Indonesia Air Freight Market Overview:

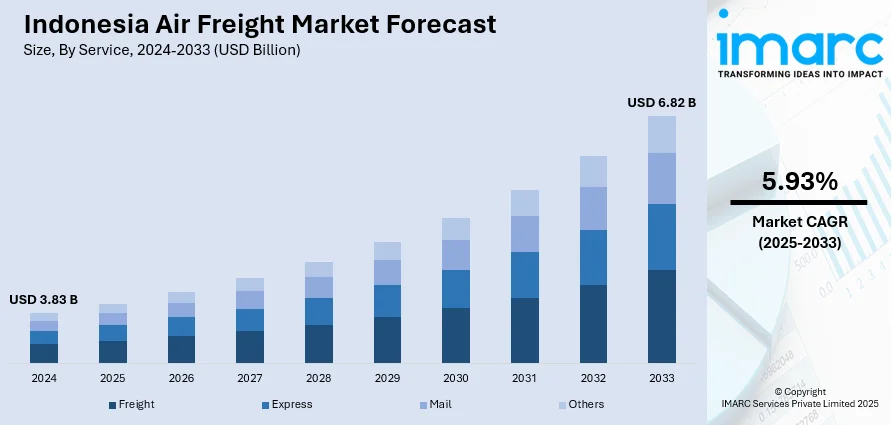

The Indonesia air freight market size reached USD 3.83 Billion in 2024. The market is projected to reach USD 6.82 Billion by 2033, exhibiting a growth rate (CAGR) of 5.93% during 2025-2033. The market is propelled by growing volumes of e-commerce, resulting in an increasing need for rapid and dependable delivery options throughout Indonesia's archipelago. Efforts by the government to improve air cargo infrastructure and the rising integration of international trade routes are also playing a major role in market growth. Furthermore, higher requirement from major industries like electronics, pharmaceuticals, and automobile parts is also augmenting the Indonesia air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.83 Billion |

| Market Forecast in 2033 | USD 6.82 Billion |

| Market Growth Rate 2025-2033 | 5.93% |

Indonesia Air Freight Market Trends:

E-Commerce Expansion and Its Influence on Air Freight Demand

Indonesia’s e-commerce sector has seen rapid growth, driven by increased internet penetration, mobile commerce adoption, and digital payment infrastructure. Platforms such as Tokopedia, Shopee, and Lazada have scaled their operations across urban and semi-urban regions, intensifying the need for fast, efficient delivery networks. This has translated into growing demand for air freight services, especially for high-value, time-sensitive goods and for meeting customer expectations around short delivery windows. Furthermore, the geographic layout of Indonesia makes air transport a critical enabler of nationwide distribution. Retailers and logistics providers are increasingly relying on air freight to maintain competitive delivery timelines across Java, Sumatra, Kalimantan, and eastern regions. According to industry reports, from January to June 2024, Indonesia’s air transport sector handled approximately 312,500 tonnes of freight, marking a year-on-year growth of 7.31%. This growth reflects the sector’s role in meeting e-commerce demands for speed, reliability, and reach in both dense and remote areas. Apart from this, domestic cargo carriers are expanding fleet capacities, while international air cargo operators are forming partnerships with local distributors to meet regional delivery timelines. Moreover, the rising popularity of same-day and next-day delivery offerings has placed pressure on logistics companies to develop more reliable air corridors between major islands, particularly Java, Sumatra, Kalimantan, and Sulawesi. This shift is encouraging investment in air cargo handling infrastructure, which is positively impacting the Indonesia air freight market growth.

To get more information of this market, Request Sample

Infrastructure Modernization and Airport Cargo Upgrades

The Indonesian government has prioritized infrastructure upgrades as part of its long-term logistics reform strategy. Air cargo infrastructure has been targeted to reduce dependency on inefficient seaport-based transport for time-sensitive goods. Furthermore, key international and regional airports, including Soekarno-Hatta in Jakarta, Kualanamu in Medan, and Sultan Hasanuddin in Makassar, are undergoing modernization initiatives aimed at expanding cargo terminals, automating handling processes, and enhancing integration with multimodal logistics networks. Notably, on 14 May 2025, Çelebi Aviation officially commenced operations at the newly established cargo terminal at Kualanamu International Airport in Medan, North Sumatra. As the latest phase in its Southeast Asia expansion, the Turkish ground-handling specialist builds upon its 2024 entry into the Indonesian market with ground services. The facility spans 8,000 m², supports a broad spectrum of cargo categories, including perishables, pharmaceuticals, and dangerous goods, and features advanced technology and cold‑chain capabilities to enhance logistics efficiency in the region. These developments have increased cargo throughput capacity, shortened processing times, and enabled better compliance with international security and documentation standards. Apart from this, improved infrastructure supports not only increased domestic connectivity but also enhances Indonesia’s role as a potential regional transshipment hub. Airlines now have greater incentive to schedule dedicated cargo flights, including overnight express routes, which improves efficiency for both inbound and outbound freight.

Indonesia Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

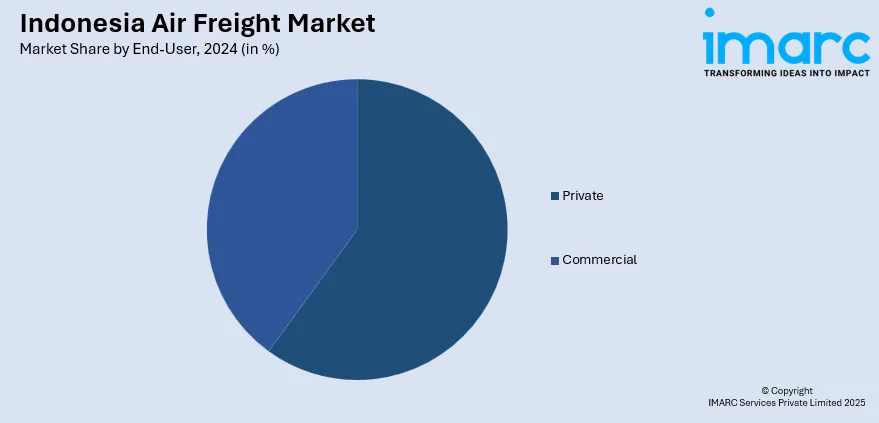

End-User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end- user. This includes private and commercial.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Air Freight Market News:

- On 14 November 2024, BBN Airlines Indonesia expanded its cargo capabilities by integrating a Boeing 737‑400F freighter into its fleet, marking a strategic enhancement of its Asia‑Pacific logistics operations. This is in addition to its existing fleet of six Boeing 737s, including two other cargo-configured aircraft, underscoring the airline's commitment to strengthening air freight services in Indonesia. The move aligns with the carrier's broader strategy to support both domestic and international cargo demand through fleet optimization and expansion.

Indonesia Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia air freight market on the basis of service?

- What is the breakup of the Indonesia air freight market on the basis of destination?

- What is the breakup of the Indonesia air freight market on the basis of end-user?

- What is the breakup of the Indonesia air freight market on the basis of region?

- What are the various stages in the value chain of the Indonesia air freight market?

- What are the key driving factors and challenges in the Indonesia air freight market?

- What is the structure of the Indonesia air freight market and who are the key players?

- What is the degree of competition in the Indonesia air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)