Indonesia Animal Feed Market Size, Share, Trends and Forecast by Animal Type, Form, and Ingredient, 2025-2033

Market Overview:

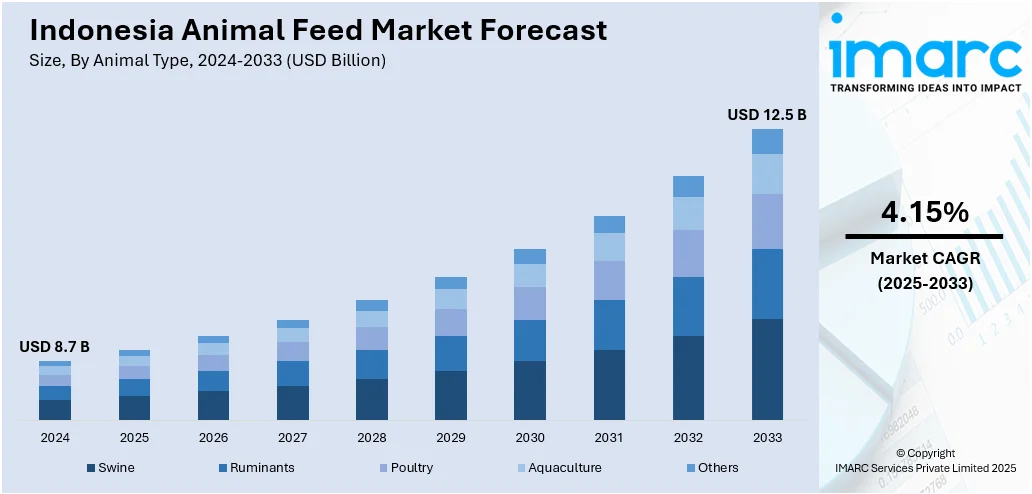

The Indonesia animal feed market size reached USD 8.7 Billion in 2024. Looking forward, the market is expected to reach USD 12.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The growth is primarily driven by rising demand for meat and dairy products, continual advancements in animal nutrition technologies, as well as initiatives promoting sustainable farming by the Indonesia government. The increasing adoption of alternative feed ingredients such as microalgae are further contributing to market expansion.

Market Insights:

- Poultry accounts for the majority of the animal type segment share in 2024.

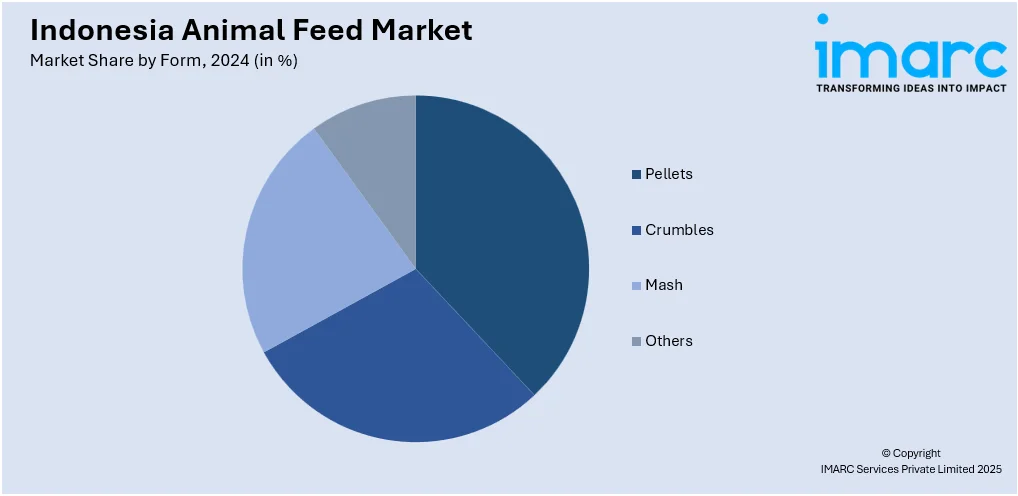

- Pellets hold the largest share in the form segment in 2024.

- Cereals represent the leading ingredient segment in 2024.

Market Size and Forecast:

- 2024 Market Size: USD 8.7 Billion

- 2033 Projected Market Size: USD 12.5 Billion

- CAGR (2025-2033): 4.15%

Animal feed is crucial in sustaining livestock's health, growth, and productivity, playing a pivotal role in the global food supply chain. Crafted from diverse ingredients, ranging from grains and oilseeds to vitamins and minerals, animal feed is formulated to meet the specific nutritional requirements of different species. This specialized nutrition ensures optimal development, efficient reproduction, and disease resistance in livestock, enhancing the quality and quantity of meat, dairy, and other animal-derived products for human consumption. Technological advancements in feed formulation have enabled the creation of balanced diets that cater to the unique needs of various animals, fostering improved overall well-being. The demand for high-quality animal feed is rising as the world grapples with a growing population and increasing meat consumption. Additionally, heightened concerns about animal welfare and sustainable farming practices underscore the importance of innovative feed solutions. Government regulations further contribute to the evolution of the animal feed industry, emphasizing safety standards and promoting responsible production practices. Animal feed is a linchpin in agriculture, nutrition, and global food security.

To get more information on this market, Request Sample

The market in Indonesia is majorly driven by the increasing population and rising middle class. In line with this, the growing demand for meat and dairy products is significantly contributing to the market growth. As dietary preferences evolve with changing lifestyles, there is a notable rise in meat consumption, necessitating a parallel expansion of the livestock industry and an augmented need for animal feed. Besides, technological advancements in feed formulation and production are pivotal in the market's growth. Innovations in nutrient optimization, feed efficiency, and disease prevention contribute to livestock's overall health and productivity, aligning with the industry's modernization. Furthermore, Indonesia's commitment to sustainable agricultural practices influences the market. There is a growing awareness of the environmental impact of livestock farming, prompting a shift towards sustainable and eco-friendly feed solutions. Government initiatives and regulations to ensure the quality and safety of animal feed are also propelling market expansion, fostering a competitive landscape that prioritizes responsible production practices. The expansion of Indonesia's livestock farming sector, driven by domestic and international demand, is another crucial factor. Large-scale farming operations seek efficient and high-quality feeds to maintain the health and productivity of their animals.

Indonesia Animal Feed Market Trends/Drivers:

Increasing Consumption of Animal-Based Products

The escalating consumption of animal-based products is a prominent driver fueling the market's growth. As the nation's population experiences a rise in affluence and urbanization, there is a corresponding surge in the demand for meat, eggs, and dairy products. This increased consumption places significant pressure on the livestock industry, necessitating a proportional increase in producing high-quality animal feed. With changing dietary patterns and an inclination towards protein-rich diets, particularly in urban centers, the livestock sector is compelled to meet the elevated demand for animal-based products. Farmers increasingly rely on specialized and nutritionally enhanced animal feeds to achieve this. These feeds are formulated to ensure that livestock receive the essential nutrients required for optimal growth, health, and reproductive efficiency. Moreover, the heightened consumer awareness regarding the quality and safety of animal-derived products has spurred investments in advanced feed formulations. Farmers are seeking feeds that promote the rapid growth of livestock and contribute to the production of meat, eggs, and dairy with enhanced nutritional profiles. Consequently, the symbiotic relationship between the increasing consumption of animal-based products and the demand for quality animal feed is propelling the market's growth.

Changing Consumer Inclination Toward Organic Variants

The shifting consumer preference from conventional poultry products to organic alternatives drives the expanding market. With an increasing awareness of health and environmental sustainability, consumers opt for organic and naturally produced meat and eggs. This evolving preference necessitates a transformation in how livestock is raised, emphasizing the use of organic animal feed. The demand for organic poultry products has led farmers to adopt organic farming practices, requiring specialized animal feed that adheres to stringent organic standards. This demand for organic feed, free from synthetic pesticides and genetically modified organisms, is steering the growth of the animal feed market. Producers invest in innovative formulations, prioritizing natural and organic ingredients, aligning with the consumers' desire for chemical-free and ethically produced animal products. As per the Indonesia animal feed market research report, the demand for organic poultry products also reflects a broader trend towards sustainable and eco-friendly practices. Farmers and feed manufacturers are responding to this demand by developing feeds that contribute to the animal's health and well-being and resonate with the values of environmentally conscious consumers. This consumer-driven shift towards organic poultry products is, therefore, a significant catalyst propelling the expansion and diversification of the market.

Growing Emphasis on Sustainable and Eco-Friendly Feed Practices

Another significant trend fueling the Indonesia animal feed market share is the increasing focus on sustainability and eco-friendly practices in livestock farming. As concerns for the environment mounts, farmers and producers are gravitating towards sustainable feed solutions to minimize their carbon footprint. This encompasses incorporating alternative protein sources like insects, algae, and plant material to produce feed that is cost-efficient and environmentally friendly. The implementation of organic waste materials such as food waste and agricultural by-products in feed formulation is also increasingly used. This shift towards being sustainable comes in reaction to consumer pressures to produce greener products as well as government policies encouraging more environmentally friendly approaches. The implementation of such sustainable practices ensures that livestock rearing becomes increasingly compatible with international standards of sustainability, driving the Indonesia animal feed market growth.

Growth, Opportunities, and Barriers in the Indonesia Animal Feed Market:

- Growth Drivers: The animal feed market in Indonesia is primarily grown due to increasing demand for meat, dairy, and eggs as Indonesia's middle class continues to grow. Increased disposable incomes are also making consumers choose protein-based diets, increasing demand for quality animal products further. Moreover, urbanization is increasing the intensity and efficiency of livestock farming, which needs special animal feed to grow well and remain healthy, as indicated by the Indonesia animal feed market forecast.

- Market Opportunities: The organic farming trend offers tremendous opportunities for the Indonesia animal feed market. As consumers increasingly demand organic animal products, there is a drive for feed manufacturers to find means of manufacturing organic animal feed that is free from chemicals and pesticides. There is also the potential in the creation of specialized feeds across different animal species such as poultry, livestock, and aquaculture. Technological innovation in animal nutrition and feed additives also opens up new opportunities to enhance feed efficiency, improving the Indonesia animal feed market outlook.

- Market Challenges: One of the major challenges for the Indonesia animal feed market is the unpredictability of raw material prices, especially grains and protein sources, directly affecting the cost of feed formulation. Moreover, feed production requires competent experts and sophisticated technology to address the increasing demand for quality animal nutrition. Environmental issues related to intensive livestock production also pose regulatory challenges, propelling feed manufacturers to adopt environmentally friendly practices while maintaining competitiveness.

Indonesia Animal Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on animal type, form and ingredient.

Breakup by Animal Type:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

Poultry accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, grower), ruminants (calves, dairy cattle, beef cattle, others), poultry (broilers, layers, turkeys, others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, others), and others. According to the report, poultry represented the largest segment.

Poultry farming has emerged as a dominant sector within the Indonesian livestock industry, responding to the escalating demand for poultry products. Broilers, raised for meat production, layers for egg-laying, and turkeys for meat and eggs, collectively represent a substantial portion of the livestock market. The growth in poultry is intricately tied to changing dietary habits, urbanization, and the affordability of poultry products. As the population continues to expand and urbanize, there is a notable increase in the consumption of poultry products, creating a robust demand for specialized feeds catering to the distinct nutritional needs of broilers, layers, and turkeys.

Feed manufacturers respond to this demand by developing formulations that enhance growth rates, reproductive efficiency, and overall poultry health. Innovations in feed technology, incorporating essential nutrients and supplements, contribute to the efficiency and sustainability of poultry farming practices. Consequently, the poultry segment's growth is driving substantial expansion in the market, reflecting the dynamic interplay between consumer preferences, market segmentation, and the evolving landscape of the livestock industry.

Breakup by Form:

- Pellets

- Crumbles

- Mash

- Others

Pellets holds the largest share in the industry

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes pellets, crumbles, mash, and others. According to the report, pellets accounted for the largest market share.

Pellets represent a popular and efficient form of feed delivery, characterized by its convenience, nutritional density, and ease of handling. They are manufactured by compressing raw materials such as grains, oilseeds, and other essential nutrients into compact, uniform particles. This form offers improved digestibility, reduced waste, and enhanced animal nutrient absorption. The pelletization process ensures a balanced nutritional profile and facilitates easier storage and transportation, contributing to overall operational efficiency for farmers.

The increasing adoption of pellets can be attributed to the desire for precision in feeding practices. Its uniformity allows for precise control over the nutritional content, promoting optimal growth and health in livestock. Moreover, the pelleting process can enhance feed hygiene by reducing contamination and spoilage. As the livestock industry in Indonesia continues to evolve, driven by factors such as rising consumer demand and advancements in feed technology, the preference for pellets is likely to persist.

Breakup by Ingredient:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

Cereals represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the ingredients. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, others), and others. According to the report, cereals represented the largest segment.

Cereals, such as corn, wheat, barley, and sorghum, constitute a substantial portion of animal feed formulations due to their rich nutritional profile and energy content. Corn, in particular, is a prevalent cereal ingredient in animal feed, serving as a primary energy source for livestock. Its inclusion in feed formulations supports growth, reproduction, and overall animal performance. Wheat and barley, on the other hand, contribute protein and fiber, enhancing the nutritional diversity of the feed. Sorghum is valued for its drought-resistant properties, making it suitable for varied climatic conditions.

The growth of the cereal segment in the animal feed market is closely linked to the availability, cost, and nutritional benefits of these grains. As the demand for meat and dairy products rises in Indonesia, there is a parallel increase in the need for cereal-based animal feed to sustain the growing livestock industry. Moreover, ongoing research and technological advancements in feed formulations are driving innovations in maximizing the nutritional efficiency of cereals within animal diets.

Competitive Landscape:

Top companies are instrumental drivers in propelling the growth of the market. These companies, leveraging their market influence, technical expertise, and extensive distribution networks, play a pivotal role in meeting the accelerating demand for high-quality animal feed. They invest significantly in research and development, innovating feed formulations to optimize nutritional content and improve feed efficiency. By incorporating advanced technologies, they contribute to livestock's overall health and productivity, aligning with the evolving needs of the modern farming industry. Furthermore, their commitment to sustainability and responsible production practices sets a benchmark for the industry. They often emphasize eco-friendly approaches, ensuring their feed production meets environmental and ethical standards. This resonates with consumers and farmers alike, fostering trust and loyalty in the market. Moreover, these companies actively engage in strategic collaborations with farmers, providing technical support, training, and access to the latest advancements in animal nutrition. This collaborative approach strengthens the entire livestock supply chain, from feed production to farming practices, contributing to increased productivity and improved animal welfare. Besides, the leading companies contribute to the internationalization of Indonesia's animal feed industry by expanding their operations beyond domestic borders. This global presence enhances market competitiveness and exposes the industry to global best practices and innovations.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players are:

- ADM

- BASF SE

- PT Cargill Indonesia

- IT CJ INDONESIA

- Louis Dreyfus Company

- PT Central Proteina Prima Tbk (CP Prima)

- PT Charoen Pokphand Indonesia Tbk

- PT Japfa Comfeed Indonesia Tbk

- PT Malindo Feedmill Tbk

- PT Sreeya Sewu Indonesia Tbk

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- In July 2025, Indonesia's National Research and Innovation Agency (BRIN) reported using spirulina, a type of microalgae, to enhance livestock productivity. Spirulina is high in omega-3 and provides an inexpensive and environmentally sustainable feed alternative that boosts the growth of animals and improves meat, egg, and milk quality. The move is expected to curb reliance on costly traditional feed and encourage sustainable livestock production in Indonesia.

- In October 2024, De Heus Animal Nutrition inaugurated its fifth production facility in Purwodadi, Central Java, demonstrating its support for sustainable agriculture and local livestock farming in Indonesia. The new plant, with a monthly production capacity of 15,000 tons, will address the increasing need for quality animal feed in Central Java and the surrounding regions. This move further solidifies De Heus' leadership in the Indonesian market.

- In January 2024, food processing behemoth of the world Archer Daniels Midland (ADM) announced its acquisition of PT Trouw Nutrition Indonesia, a top animal nutrition solutions provider for livestock farming. The acquisition covers such strategic premix manufacturing facilities in Pasuruan (Surabaya) and Cibitung (Jakarta), and it sees ADM poised to broaden its presence in the Indonesian animal feed industry. The acquisition is aimed at addressing rising demand for protein in the country.

Indonesia Animal Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook. Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered |

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Ingredients Covered |

|

| Companies Covered | ADM, BASF SE, PT Cargill Indonesia, IT CJ INDONESIA, Louis Dreyfus Company, PT Central Proteina Prima Tbk (CP Prima), PT Charoen Pokphand Indonesia, Tbk, PT Japfa Comfeed Indonesia Tbk, PT Malindo Feedmill Tbk, PT Sreeya Sewu Indonesia Tbk, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia animal feed market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the Indonesia animal feed market?

- What is the impact of each driver, restraint, and opportunity on the Indonesia animal feed market?

- What is the breakup of the market based on the animal type?

- Which is the most attractive animal type in the Indonesia animal feed market?

- What is the breakup of the market based on the form?

- Which is the most attractive form in the Indonesia animal feed market?

- What is the breakup of the market based on the ingredient?

- Which is the most attractive ingredient in the Indonesia animal feed market?

- What is the competitive structure of the Indonesia animal feed market?

- Who are the key players/companies in the Indonesia animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia animal feed market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)