Indonesia ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Indonesia ATM Market Overview:

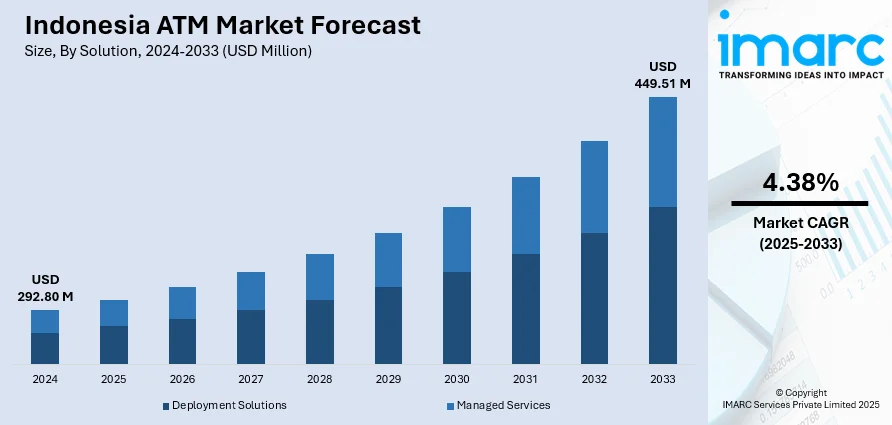

The Indonesia ATM market size reached USD 292.80 Million in 2024. The market is projected to reach USD 449.51 Million by 2033 exhibiting a growth rate (CAGR) of 4.38% during 2025-2033. The market is evolving with increased demand for cashless transactions and digital banking integration. Urbanization, expanding bank networks, and government financial inclusion efforts are driving ATM installations across both urban and rural areas. Technological advancements such as biometric authentication and multi-functional kiosks are enhancing user experience and security. Meanwhile, the shift toward mobile banking is prompting banks to optimize ATM operations rather than expand networks. These trends are reshaping the competitive landscape of the Indonesia ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 292.80 Million |

| Market Forecast in 2033 | USD 449.51 Million |

| Market Growth Rate 2025-2033 | 4.38% |

Indonesia ATM Market Trends:

QRIS Tap Integration into ATMs and Digital Payments

ATMs in Indonesia are evolving into versatile digital hubs that bridge the cash and electronic payment ecosystems. In March 2025, Bank Indonesia launched QRIS Tap at select ATM stations, enabling contactless withdrawals using NFC-enabled phones part of the national QRIS payment integration initiative. This move aligns with the government’s financial inclusion policies, aiming to modernize ATM infrastructure while supporting the Indonesia Payment System Blueprint 2030. Transitioning from cash-centric machines to versatile kiosks, these updated ATMs now support instant cash withdrawals, QRID-based transactions, and digital wallet top-ups. Rural and suburban communities benefit from enhanced accessibility, as the integration reduces dependency on physical bank visits. Supported by local regulatory frameworks, this digital-physical convergence is boosting convenience across urban and remote areas. As a result, these developments are shaping the Indonesia ATM market trends, modernizing infrastructure and elevating service standards nationwide.

To get more information on this market, Request Sample

Expansion of ATM Network Through Managed Infrastructure Services

Indonesia’s ATM infrastructure is expanding as part of national efforts to deepen financial access. In 2025, Indonesia's ATM network surpassed 113,000 machines, with further growth anticipated through managed-service partnerships backed by Bank Indonesia and the Financial Services Authority (OJK). These partnerships enable specialist providers to manage deployment, maintenance, and cash operations—especially in underbanked and remote regions—supporting broader financial inclusion goals. Outsourcing these functions allows banks to focus on digital solutions while ensuring ATMs remain consistently operational. Enhanced performance is driven by real-time monitoring tools and remote maintenance protocols, significantly reducing downtime. Additionally, managed services cover cash replenishment and reconciliation, improving the reliability of everyday transactions. Consumers benefit from more dependable access to cash services in both urban and rural areas a critical step in bridging service gaps. These developments are shaping Indonesia ATM market growth, delivering more equitable access to cash infrastructure and reinforcing confidence in the country’s banking ecosystem.

Rise of Advanced Cash-Recycling and Multi‑Functional ATMs

Indonesia is accelerating efforts to upgrade its ATM network with advanced cash-recycling and multifunctional features. In late 2024, trials began across major cities for ATMs equipped with cash recycler modules that automatically validate, accept, and dispense the same bills—significantly reducing cash transport costs and simplifying vault logistics. These next-generation machines also support deposits, withdrawals, mobile wallet top-ups, and contactless QRIS-based transactions, aligning with the Indonesia Payment System Blueprint (BSPI) 2030 launched in August 2024 by Bank Indonesia to modernize infrastructure and enhance service efficiency especially in underserved regions. By integrating multiple banking services into a single kiosk, these intelligent ATMs streamline the user experience while lowering operational costs. Backed by BSPI regulatory support, deployment of these smart machines is expanding nationwide, including both urban centers and remote hubs. This transition toward multifunctional, resource-efficient ATM infrastructure is a strategic shift and a core component of Indonesia ATM market trends, highlighting the sector’s move toward higher service levels and technological maturity.

Indonesia ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

Application Insights:

- Withdrawals

- Transfers

- Deposits

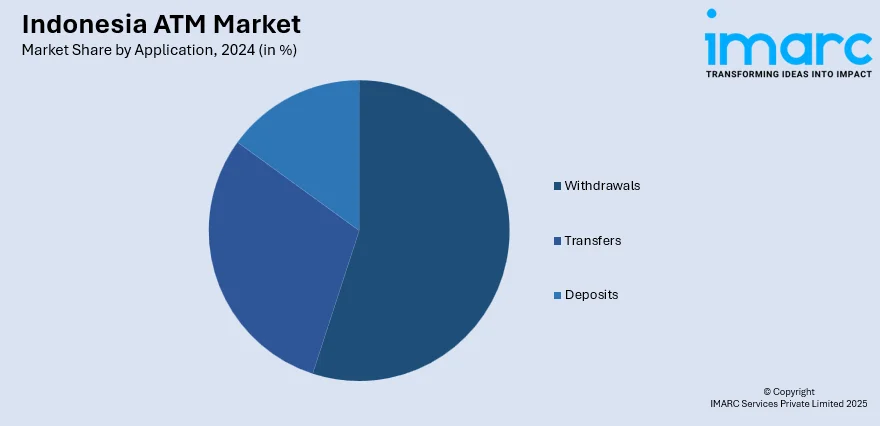

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia ATM Market News:

- August 2024: Indonesia’s leading ATM network servicer, Jalin Pembayaran Nusantara, has entered a strategic collaboration with DigiAsia Corp. to drive financial inclusion across the country. Leveraging Jalin’s extensive infrastructure of over 52,000 ATMs, the partnership will enable innovative services such as cardless cash withdrawals, expanded cash deposit machines, and branded “white‑label” ATMs. Jalin will also deploy merchant kiosks through DigiAsia’s network of one million merchants, significantly enhancing access to digital financial services. This collaboration strengthens Jalin’s role in modernizing Indonesia’s banking ecosystem.

Indonesia ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia ATM market on the basis of solution?

- What is the breakup of the Indonesia ATM market on the basis of screen size?

- What is the breakup of the Indonesia ATM market on the basis of application?

- What is the breakup of the Indonesia ATM market on the basis of ATM type?

- What is the breakup of the Indonesia ATM market on the basis of region?

- What are the various stages in the value chain of the Indonesia ATM market?

- What are the key driving factors and challenges in the Indonesia ATM?

- What is the structure of the Indonesia ATM market and who are the key players?

- What is the degree of competition in the Indonesia ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)