Indonesia Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033

Indonesia Business Process Management Market Overview:

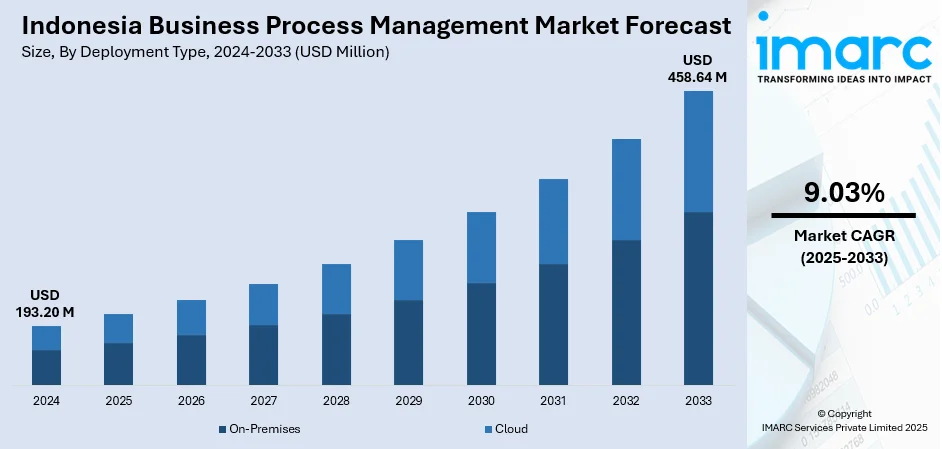

The Indonesia business process management market size reached USD 193.20 Million in 2024. The market is projected to reach USD 458.64 Million by 2033, exhibiting a growth rate (CAGR) of 9.03% during 2025-2033. The market is experiencing steady growth, fueled by increasing digital transformation activities in different industries. Companies are increasingly implementing BPM solutions to automate processes, improve operating efficiency, and facilitate agile decision-making. Cloud deployments and AI-based platforms are gaining popularity, particularly with large enterprises and government agencies. Demand is also rising in banking, retail, and manufacturing segments because of the necessity for process automation and compliance management. These trends are strongly impacting the Indonesia business process management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 193.20 Million |

| Market Forecast in 2033 | USD 458.64 Million |

| Market Growth Rate 2025-2033 | 9.03% |

Indonesia Business Process Management Market Trends:

Automation Drives BPM Growth in Indonesia

In 2025, Indonesia's growing demand for cloud-based Business Process Management (BPM) and Business Process as a Service (BPaaS) is a strong indicator of market opportunity and growth potential. According to Statista, the country’s BPaaS revenue is projected to reach approximately in millions in 2025, fueled by digital transformation efforts across public agencies and private sectors. As organizations seek flexible, scalable, and cost-effective process automation, BPM systems are being adopted to digitize workflows, enhance monitoring, and reduce manual overhead. Low-code/no-code platforms are gaining traction, empowering non-technical staff to model and deploy processes efficiently. Integration with mobile BPM solutions is also growing, reflecting a need for remote management and on-the-go oversight. Enterprise adoption across finance, supply chain, and HR functions is enhancing operational visibility and supporting data-driven decision-making. With increasing regulatory demands, BPM workflows are increasingly used for compliance and audit trails. These combined developments underscore how Indonesia business process management market growth is being shaped by technology advancements, evolving business needs, and rising digital maturity throughout the country.

To get more information on this market, Request Sample

Digital Transformation Accelerates BPM Adoption

In 2024, Indonesian enterprises across industries like finance, manufacturing, and telecommunications significantly increased their adoption of cloud-based business process management (BPM) platforms, enhancing operational efficiency and resilience. According to sources, demand for BPM-as-a-service (BPMaaS) is rising rapidly as companies use these platforms to automate invoice handling, customer onboarding, and HR operations. These solutions often feature advanced analytics and low-code design, enabling agile workflow redesign and real-time performance monitoring capabilities essential for enterprises adapting to hybrid and remote work models. Government digitalization initiatives, including smart city and public service modernization programs, are further incentivizing BPM adoption across public-sector organizations. The movement toward end-to-end process automation is improving customer experiences and accelerating service delivery. This evolution captures key Indonesia business process management market trends, as organizations increasingly focus on reducing manual labor, improving compliance, and enhancing time-to-market. Overall, this digital-first strategy signals a strategic alignment between industry needs and BPM implementation, setting the stage for sustained growth in Indonesia's BPM ecosystem.

Sustainability & Smart Efficiency Define BPM Evolution

By 2024, Indonesia's BPM landscape began shifting toward sustainable, intelligent process management, driven by demands for environmental responsibility and operational efficiency. This evolution includes the integration of AI, machine learning, and robotic process automation (RPA) into BPM platforms enhancing predictive capabilities and intelligent task routing, according to sources. Organizations are deploying systems that monitor energy usage, reduce paper-based operations, and optimize resource allocation in real time. Cloud-native BPM solutions support remote work and collaboration, lowering the IT infrastructure footprint while enabling scalable deployment. The government’s digital push, including the Digital Technology Bilateral Dialogue with the U.S., has strengthened policy support for digital innovation and BPM adoption. As transparency and traceability become more critical, BPM systems are being employed for compliance, risk management, and secure data flows. These shifts highlight how Indonesia business process management market align with a broader drive for intelligent, eco-efficient business operations, laying the groundwork for more resilient and agile enterprises ahead.

Indonesia Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes IT solutions (process improvement, automation, content and document management, integration, and monitoring and optimization) and IT services (system integration, consulting, and training and education)

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes human resources, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMEs and large enterprises.

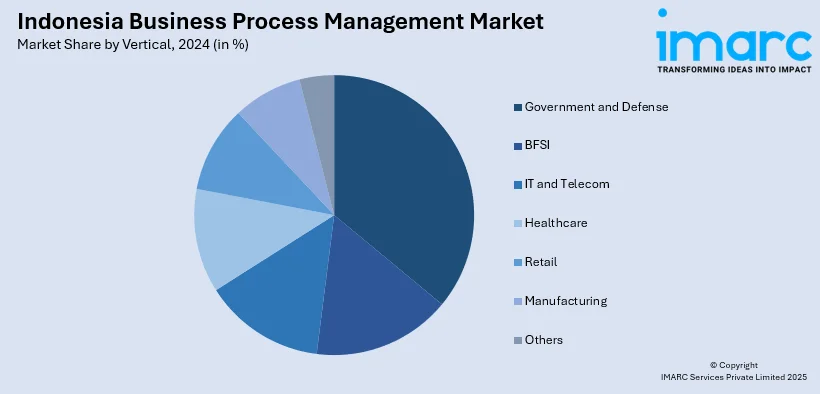

Vertical Insights:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Business Process Management Market News:

- July 2024: Crest Infosolutions has announced its expansion into Indonesia, launching operations in Jakarta to deliver Alfresco-based ECM and BPM solutions. Targeting sectors like banking, insurance, manufacturing, and public services, the company aims to support digital transformation with advanced document management and workflow tools. The move marks a strategic push to strengthen its Southeast Asian presence, positioning Crest as a key player in Indonesia’s growing enterprise technology landscape.

Indonesia Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia business process management market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia business process management market on the basis of deployment type?

- What is the breakup of the Indonesia business process management market on the basis of component?

- What is the breakup of the Indonesia business process management market on the basis of business function?

- What is the breakup of the Indonesia business process management market on the basis of organization size?

- What is the breakup of the Indonesia business process management market on the basis of vertical?

- What is the breakup of the Indonesia business process management market on the basis of region?

- What are the various stages in the value chain of the Indonesia business process management market?

- What are the key driving factors and challenges in the Indonesia business process management?

- What is the structure of the Indonesia business process management market and who are the key players?

- What is the degree of competition in the Indonesia business process management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia business process management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia business process management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)