Indonesia Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Indonesia Cement Market Overview:

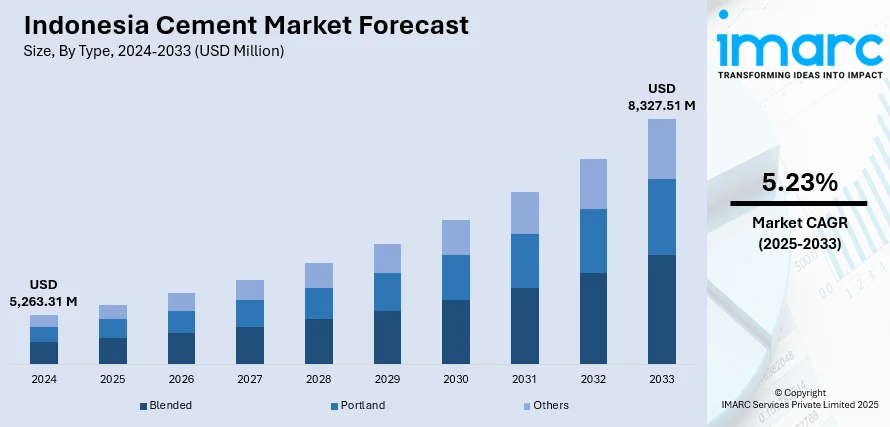

The Indonesia cement market size reached USD 5,263.31 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,327.51 Million by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The market is driven by robust infrastructure development, including the Nusantara capital city project and toll road expansions under the National Strategic Projects (PSN) program, accelerating cement demand. Government-led sustainability initiatives, such as the Low Carbon Development Initiative (LCDI), are pushing manufacturers to adopt green cement solutions, supported by rising demand for EDGE-certified construction. Post-pandemic economic recovery and housing sector growth further bolster consumption, further augmenting the Indonesia cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,263.31 Million |

| Market Forecast in 2033 | USD 8,327.51 Million |

| Market Growth Rate 2025-2033 | 5.23% |

Indonesia Cement Market Trends:

Rising Demand for Green and Sustainable Cement

The demand for sustainable and environmentally friendly cement is increasing in the market, driven by stricter environmental regulations and growing awareness of carbon emissions. Government efforts to encourage green construction through the introduction of the Low Carbon Development Initiative (LCDI) have encouraged cement producers to adopt sustainable production practices. Cement producers, such as PT Semen Indonesia and PT Indocement, are employing substitute raw materials to reduce the volume of clinker consumed in cement production, which is a significant contributor to CO₂ emissions, including fly ash and slag. In the first quarter of 2024, PT Semen Jawa, a subsidiary of Siam Cement Group (SCG), employed 24,000 tons of alternative raw materials such as bottom ash, fly ash, and slag, representing 3% of its overall raw material usage. Furthermore, the company co-processed 15,000 tons of alternative fuel (AF) with a substitution rate of 20%. These efforts complement SCG's commitment to reducing CO2 emissions and supporting Indonesia in meeting its climate targets. In addition, the application of waste heat recovery systems in factories is increasing efficiency. The expansion of green building certifications, such as EDGE (Excellence in Design for Greater Efficiencies), also contributes to this movement as developers seek sustainable materials. Combined with Indonesia's goal to achieve a net-zero emissions target by 2060, demand for low-carbon cement products is expected to continue rising, thereby reshaping the competitive dynamics of the industry.

To get more information on this market, Request Sample

Infrastructure Development Boosts Cement Consumption

The emergence of large-scale infrastructure projects under the government’s National Strategic Projects (PSN) program is also propelling the Indonesia cement market growth. Key initiatives such as the new capital city Nusantara in East Kalimantan, toll road expansions, and dam constructions are driving cement demand. The annual increase in cement consumption, supported by both public and private sector investments is impacting the market. In December 2024, Indonesia experienced a year-on-year decline of 11.5% in cement demand, reaching 5.619 million tons, with significant drops observed in all areas except Sumatra. For the year as a whole, cement sales totaled 64.887 million tons, representing a slight 0.9% decrease from 2023, with Java contributing 52% of total sales. Despite a tough market, cement production rose by 1% year-over-year to 67.570 million tons, while clinker exports increased by 14.6% to 10.9 million tons, driven mainly by interest from Bangladesh and Australia. Additionally, post-pandemic economic recovery has accelerated housing projects, further fueling market growth. To meet rising demand, major players are expanding production capacities PT Semen Padang, for instance, has increased its output to 8 million tons annually. However, challenges such as rising energy costs and logistics disruptions could impact pricing. Despite these hurdles, the infrastructure-driven demand is expected to sustain market expansion, making Indonesia one of Southeast Asia’s fastest-growing cement markets.

Indonesia Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, portland, and others.

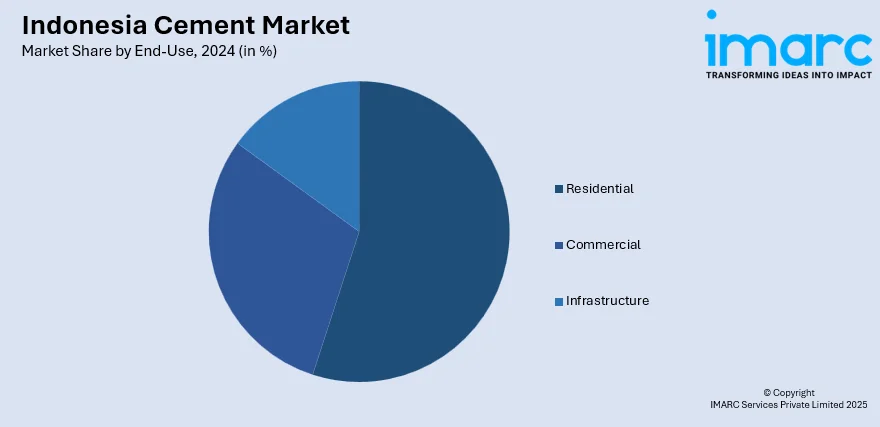

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Cement Market News:

- February 18, 2025: PT Cemindo Gemilang, the producer of Semen Merah Putih, announced the upgrade of its cement plants in Indonesia by adopting carbon injection technology from its Canadian business partner, CarbonCure Technologies. This move reduces CO2 emissions while also strengthening concrete, making it more durable and reducing cement use by up to 4%. The company is expanding the use of this environmentally friendly technology across all of its plants, thus driving sustainability in the refurbished cement industry.

Indonesia Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement market in Indonesia was valued at USD 5,263.31 Million in 2024.

The Indonesia cement market is projected to exhibit a CAGR of 5.23% during 2025-2033, reaching a value of USD 8,327.51 Million by 2033.

The Indonesia cement market is driven by rapid infrastructure development, including government-backed projects like the new capital city, highways, and industrial zones. Urbanization and rising residential construction demand, fueled by a growing middle class, also contribute significantly. Increased foreign investment and supportive government policies further accelerate market growth and capacity expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)