Indonesia Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Indonesia Craft Beer Market Overview:

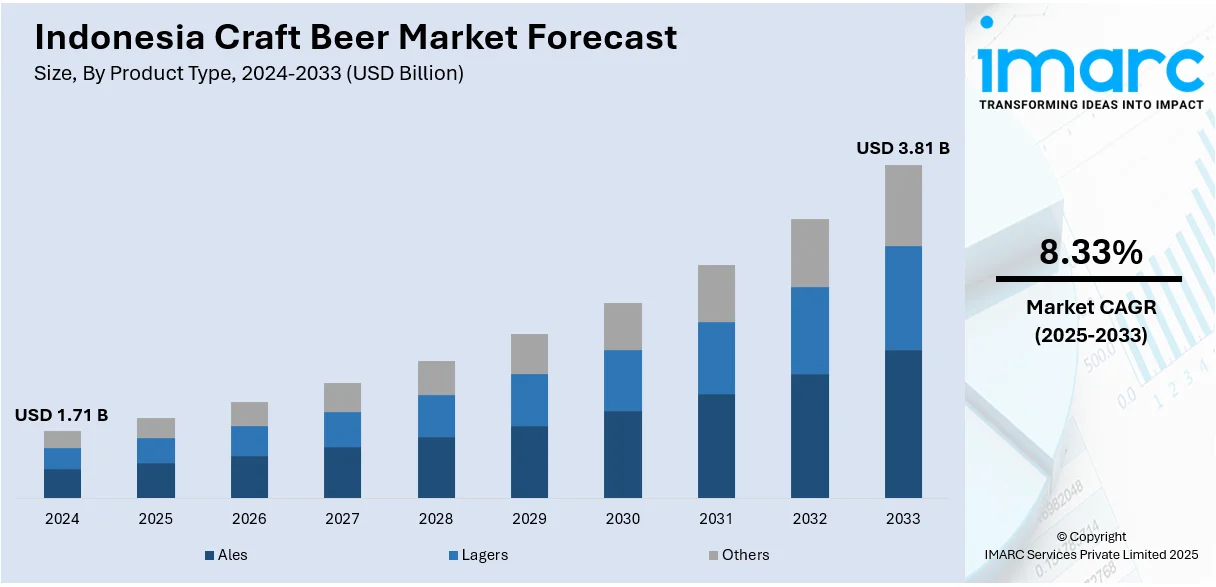

The Indonesia craft beer market size reached USD 1.71 Billion in 2024. The market is projected to reach USD 3.81 Billion by 2033, exhibiting a growth rate (CAGR) of 8.33% during 2025-2033. The market is gaining momentum, driven by rising interest in unique flavors and locally produced brews. Urban youth and expatriate communities are fostering demand for artisanal offerings. Despite regulatory constraints, niche breweries are innovating with tropical ingredients and creative branding. Enhanced presence in hospitality venues and boutique retail outlets further supports visibility. With increasing consumer awareness and product experimentation, these dynamics are gradually strengthening the Indonesia craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.71 Billion |

| Market Forecast in 2033 | USD 3.81 Billion |

| Market Growth Rate 2025-2033 | 8.33% |

Indonesia Craft Beer Market Trends:

Local Flavor Innovation Strengthens Regional Identity

Indonesia’s craft beer scene is flourishing as brewers increasingly incorporate native ingredients such as tropical fruits, spices, and local grains into their recipes. In late 2024, a well-known Bali brewery introduced a mango‑infused ale tailored to the Southeast Asian palate, blending sweetness and complexity with tropical authenticity. Beyond Bali, microbrewers on Java and Sumatra have begun experimenting with indigenous botanicals like tamarind, lemongrass, and kopi luwak coffee, showcasing a growing cultural expression via beer. These initiatives reflect how craft brewers are speaking to local roots and heritage, helping stimulate awareness and connection to community traditions. Taproom events and local festivals provide critical platforms to introduce these flavors, as well as educate consumers about the brewing process and ingredient origin. These efforts support Indonesia craft beer market trends, linking authenticity, regional pride, and flavor exploration in emerging markets. The focus on flavor innovation within local contexts strengthens community engagement, supports agricultural producers, and shapes a unique identity within Southeast Asia’s craft beer ecosystem.

To get more information on this market, Request Sample

Festival Dynamics Fuel Market Expansion Across Java

In 2024, Java hosted a resurgence of craft beer festivals and tasting events, signaling strong public engagement with artisanal beverages. Prominent events featured in travel guides have spotlighted local breweries introducing creative styles like fruit-infused ales, sour brews, and specialty lagers to broad audiences. Often held in Jakarta’s beer gardens and cultural venues, these festivals play a vital role in brand exposure, giving microbrewers the opportunity to engage directly with consumers. Increased festival attendance aligns with the expansion of taprooms and craft bars in urban centres, fostering a pipeline for new product launches and immediate feedback. This environment supports Indonesia craft beer market growth, as producers leverage event exposure to build brand loyalty and scale operations. Participating brewers also collaborate with food artisans for pairing events, enriching the cultural narrative of Indonesian craft beer. As the festival circuit extends to regions like Bandung and Yogyakarta, it is generating momentum that positively influences production, distribution, and consumer education signalling long-term structural growth in the market.

Sustainability & Digital Engagement Enhance Craft Appeal

In 2025, Indonesia’s craft breweries have intensified focus on sustainability and digital storytelling to align with contemporary consumer values. Many producers, especially in Bali, are introducing eco-conscious strategies such as spent grain repurposing, biodegradable packaging, and solar-energized brewing facilities. These efforts are being showcased through digital platforms and interactive campaigns, allowing brewers to transparently communicate green initiatives and strengthen brand trust. QR-coded labels and e-commerce avenues link cultural narratives to product craftsmanship, creating deeper consumer engagement. Virtual tastings and online brewer interactions further foster community, especially among younger, tech-savvy audiences. This combined emphasis on environmental responsibility and digital outreach reflects essential Indonesia craft beer market trends, reinforcing authenticity and resonance with modern urban consumers. By integrating sustainability into both operations and messaging, the craft beer sector is solidifying a reputation grounded in ethical production and narrative-driven connections, essential for future competitiveness and cultural relevance.

Indonesia Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

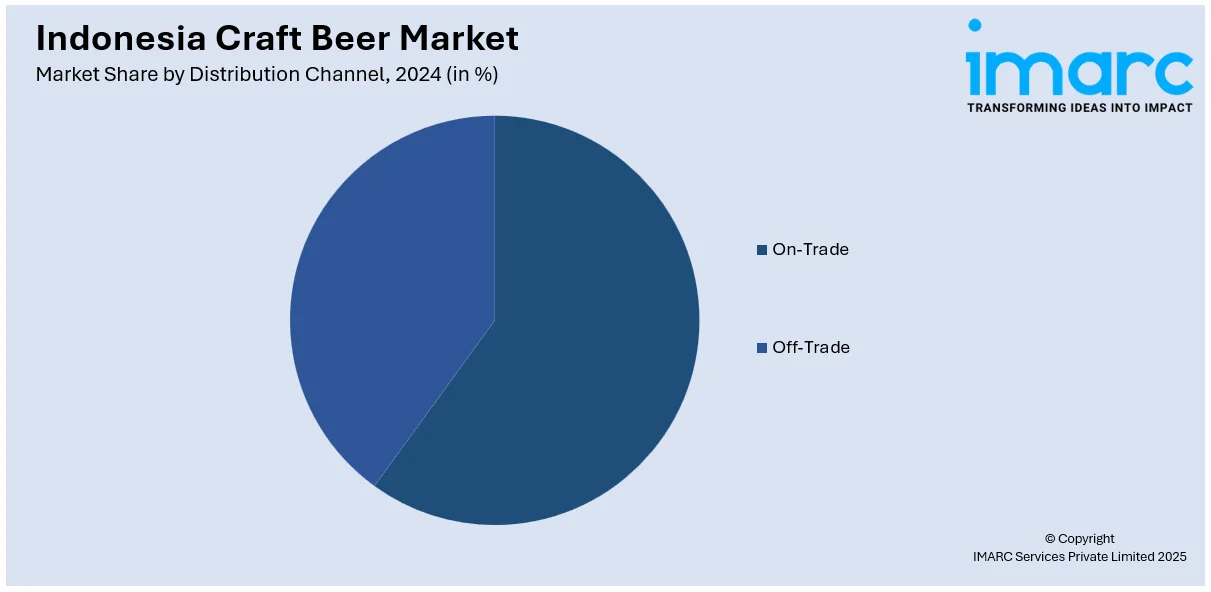

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Craft Beer Market News:

- April 2025 – Bali: Stark Craft Beer expanded its lineup with a 7% ABV rice pilsner and upgraded mango and lychee ales. The brewery also invested in advanced equipment to enhance flavor consistency and support its growing export ambitions across Southeast Asia.

- January 2025 – Bali: Multi Bintang Indonesia launched Bintang Arak Jeruk & Madu, a hybrid blend of Balinese arak, orange, and honey. Timed with Arak Day on January 29, the release marks a bold entry into locally inspired spirit-beer fusions, available exclusively in the Bali market.

Indonesia Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia craft beer market on the basis of product type?

- What is the breakup of the Indonesia craft beer market on the basis of age group?

- What is the breakup of the Indonesia craft beer market on the basis of distribution channel?

- What is the breakup of the Indonesia craft beer market on the basis of region?

- What are the various stages in the value chain of the Indonesia craft beer market?

- What are the key driving factors and challenges in the Indonesia craft beer?

- What is the structure of the Indonesia craft beer market and who are the key players?

- What is the degree of competition in the Indonesia craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)